Trigon Metals Announces Positive Feasibility for its Kombat Asis West Underground Mine

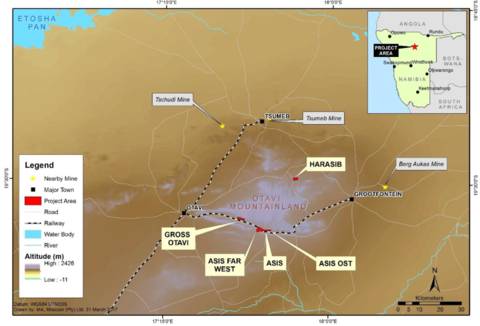

Figure 1: Location of Kombat Mine (Graphic: Business Wire)

The Feasibility Study incorporates both the currently operational open pit mine at Kombat as well as the restart of the historic Asis West underground mine. Please note that all financial figures in this press release are in

Highlights

- Significant Mineral Reserves and production,

- Strong financial metrics,

- Defined Project Capital requirement, and

- Derisked operational and production profile.

Jed Richardson, Chairman, commented “I am pleased with the efforts of our team and the collaboration with SRK on the completion of the study. The projected returns validate our efforts and expectations for the Kombat Mine. We look forward to even stronger valuations as we develop through the conversion of more of our Indicated Mineral Resources to Reserves, the development of Asis Far West and exploration of the Copper King Extension."

A summary of operating and financial metrics from the Feasibility Study are presented in Table 1 below.

Table 1: Kombat Mine – Operating and Financial Metrics

Description |

Unit |

Total/average over LoM |

Asis West underground |

Open pit |

Copper price |

USD/lb |

4.00 |

|

|

Silver price |

USD/oz |

25.00 |

|

|

Life of mine |

Years |

5.8 |

5.8 |

2.4 |

Run of mine |

kt |

2 385 |

1 635 |

750 |

RoM grade - Copper |

% |

|

|

|

RoM grade - Silver |

g/t |

17.5 |

22.9 |

5.7 |

Processing recovery - Copper |

% |

|

|

|

Processing recovery - Silver |

% |

|

|

|

Concentrate production |

kt |

195 |

171 |

24 |

Recovered product - Copper |

Mlb |

120 |

106 |

14 |

Recovered product - Silver |

kg |

35 451 |

32 143 |

3 308 |

C1 cash cost/lb |

USD/lb |

2.19 |

|

|

AISC/lb |

USD/lb |

2.59 |

|

|

Project capex |

USDm |

40.6 |

|

|

NPV |

USDm |

116.0 |

|

|

IRR |

% |

|

|

|

NPV |

USDm |

77.8 |

|

|

IRR |

% |

|

|

|

Note

Run of mine excludes 13.0 kt at

C1 cost: direct costs, which include costs incurred in mining and processing (labour, power, reagents, materials) plus local G&A, and freight, realization and selling costs, and mineral royalties.

ASIC: All In Sustaining Costs, including sustaining capital.

Certain project capital has already been incurred and this is included in the assessed loss/unredeemed capital reported by Trigon at February 2024.

Kombat Mine Overview

Trigon holds six active mineral licences related to the Kombat mine: the four mining licenses of Asis West, Asis Far West, Asis Ost and Gross Otavi and two exclusive prospecting licenses. The project areas are situated in the Otjozondjupa Region, Grootfontein Magisterial District of the Otjozondjupa Region,

Trigon commenced with open pit mining in early 2023, and dewatering of the historic Asis West underground complex (which comprises two vertical shafts, No. 1 shaft and No. 3 shaft, and a decline ramp) in August 2023. In February 2024, Trigon announced the commencement of operational training for the commencement of underground mining.

Mineral Resources and Mineral Reserve Estimates

Mineral Resources

The Mineral Resource Statement presented represents the third Mineral Resource evaluation prepared for the Kombat Mine project in accordance with NI 43-101 by Minxcon (Pty) Ltd (an independent consulting company) commissioned by Trigon to undertake this work. The Mineral Resources have been independently reviewed by SRK and reported using updated techno-economic factors.

Mineral Resources are shown in Tables 2 to 4 below. Mineral Resources are reported inclusive of any Mineral Reserves that may be derived from them.

Table 2: Open Pit Mineral Resource Statement for Kombat Mine as at 29 February 2024

Area |

Mineral Resource Category |

Tonnes (Mt) |

Density (t/m3) |

Grade |

Content |

||||

Cu (%) |

Pb (%) |

Ag (g/t) |

Cu (t) |

Pb (t) |

Ag (kg) |

||||

Kombat East |

Indicated |

2.26 |

2.79 |

0.92 |

0.36 |

6.01 |

20 760 |

8 064 |

1 593 |

Kombat Central |

0.87 |

2.78 |

1.07 |

0.13 |

9.32 |

9 294 |

1 167 |

148 |

|

Kombat West |

0.01 |

2.98 |

1.95 |

4.69 |

17.43 |

268 |

645 |

10 |

|

Total Indicated |

|

3.14 |

2.79 |

0.97 |

0.31 |

6.98 |

30 322 |

9 876 |

1 751 |

Gross Otavi |

Inferred |

0.54 |

2.85 |

0.74 |

2.27 |

1.15 |

3 943 |

12 186 |

615 |

Total Inferred |

|

0.54 |

2.85 |

0.74 |

2.27 |

1.15 |

3 943 |

12 186 |

615h |

Notes:

- A Mineral Resource is not a Mineral Reserve, and there is no guarantee that all or part of the Mineral Resource will be converted to a Mineral Reserve

- The Mineral Resources have been depleted with historical mining pit shells and underground voids

- The Mineral Resources are reported within an optimised pit shell, based on the techno-economic factors disclosed above

-

The Kombat Mineral Resources are reported above a

0.53% Cu cut-off, and the Gross Otavi Mineral Resources above a0.60% CuEq cut-off - Mineral Resources are reported as total Mineral Resources and not attributable to Trigon

- Mineral Resources are reported inclusive of any Mineral Reserves that may be derived from them

-

The Gross Otavi Mineral Resources include geological losses of

15% , depletion for unknown historical development of1% and reduced by a porosity factor by7.5%

Table 3: Underground Mineral Resource Statement for Kombat Mine at 29 February 2024

Area |

Mineral Resource Category |

Tonnes (Mt) |

Density (t/m3) |

Grade |

Content |

||||

Cu (%) |

Pb (%) |

Ag (g/t) |

Cu (t) |

Pb (t) |

Ag (kg ) |

||||

Kombat East |

Indicated |

0.36 |

2.81 |

1.44 |

1.23 |

9.23 |

5 219 |

4 443 |

3 346 |

Kombat Central |

0.85 |

2.81 |

1.55 |

0.86 |

12.55 |

13 173 |

7 299 |

10 664 |

|

Kombat West |

1.18 |

2.83 |

1.90 |

1.30 |

11.26 |

22 393 |

15 319 |

13 255 |

|

Asis West |

7.53 |

2.82 |

2.38 |

0.80 |

18.02 |

179 213 |

60 603 |

135 707 |

|

Gap |

0.50 |

2.79 |

1.89 |

0.16 |

9.90 |

9 529 |

822 |

4 990 |

|

Total Indicated |

|

10.42 |

2.82 |

2.20 |

2.20 |

16.11 |

229 527 |

88 486 |

167 962 |

Kombat East |

Inferred |

0.00 |

2.83 |

1.45 |

1.79 |

13.64 |

0 |

0 |

0 |

Kombat Central |

0.01 |

2.88 |

2.02 |

2.74 |

0.01 |

187 |

254 |

0 |

|

Kombat West |

0.13 |

3.68 |

5.00 |

10.50 |

0.08 |

6 377 |

13 399 |

11 |

|

Asis West |

0.12 |

2.82 |

2.49 |

0.71 |

13.74 |

2 946 |

846 |

1 628 |

|

Gap |

0.01 |

2.79 |

1.64 |

0.17 |

32.79 |

229 |

24 |

458 |

|

Asis Far West |

1.53 |

2.79 |

2.15 |

0.37 |

7.99 |

32 763 |

5 703 |

12 196 |

|

Total Inferred |

|

1.80 |

2.84 |

2.37 |

1.13 |

7.96 |

42 503 |

20 226 |

14 293 |

Notes:

- A Mineral Resource is not a Mineral Reserve, and there is no guarantee that all or part of the Mineral Resource will be converted to a Mineral Reserve

- The Mineral Resources have been depleted with historical mining underground voids

-

The Mineral Resources are reported above a

1.2% CuEq cut-off - Mineral Resources are reported as total Mineral Resources and not attributable to Trigon

- Mineral Resources are reported inclusive of any Mineral Reserves that may be derived from them

- No geological losses are applied

Table 4: Total Mineral Resource statement for Kombat Mine as at 29 February 2024

Source |

Mineral Resource Category |

Tonnes (Mt) |

Density (t/m3) |

Grade |

Content |

||||

Cu (%) |

Pb (%) |

Ag (g/t) |

Cu (t) |

Pb (t) |

Ag (kg) |

||||

Open Pit |

Indicated |

3.14 |

2.79 |

0.97 |

0.31 |

6.98 |

30 322 |

9 876 |

1 751 |

Underground |

10.42 |

2.82 |

2.20 |

2.20 |

16.11 |

229 527 |

88 486 |

167 962 |

|

Total Indicated |

|

13.56 |

2.81 |

1.92 |

1.76 |

14.00 |

259 849 |

98 362 |

169 713 |

Open Pit |

Inferred |

0.54 |

2.85 |

0.74 |

2.27 |

1.15 |

3 943 |

12 186 |

615 |

Underground |

1.80 |

2.84 |

2.37 |

1.13 |

7.96 |

42 503 |

20 226 |

14 293 |

|

Total Inferred |

|

2.33 |

2.85 |

1.99 |

1.39 |

6.39 |

46 446 |

32 412 |

14 908 |

Notes:

- A Mineral Resource is not a Mineral Reserve, and there is no guarantee that all or part of the Mineral Resource will be converted to a Mineral Reserve

- The Mineral Resources have been depleted with historical mining underground voids

-

The underground Mineral Resources are reported above a

1.2% CuEq cut-off. The Kombat open Pit Mineral Resources (All indicated) are reported above a0.53% Cu cut-off, and the Gross Otavi open Pit Mineral Resources (All Inferred) above a0.60% CuEq cut-off - Mineral Resources are reported as total Mineral Resources and not attributable to Trigon

- Mineral Resources are reported inclusive of any Mineral Reserves that may be derived from them

-

No geological losses are applied at Kombat. The Gross Otavi Mineral Resources include geological losses of

15% , depletion for unknown historical development of1% and reduced by a porosity factor by7.5%

Mineral Reserves

The open pit Mineral Reserves as set out in Table 5 are limited to the Ore Capping open pits, which are situated in the Kombat East and Central areas. The LoM pit has been excluded due to interference with current underground infrastructure. The open pit Mineral Reserve is declared at the RoM stockpile as a reference point.

Table 5: Open Pit Mineral Reserve Statement for Kombat Mine as at 29 February 2024

Area |

Mineral Reserve Category |

Tonnes (Mt) |

Grade |

Content |

||

Cu (%) |

Ag (g/t) |

Cu (t) |

Ag (kg) |

|||

Kombat East |

Probable |

0.75 |

|

5.7 |

6 953 |

4 299 |

Total Probable |

|

0.75 |

|

5.7 |

6 953 |

4 299 |

Notes:

- The Mineral Reserves have been depleted with historical mining pit shells and underground voids.

- The Mineral Reserves are reported within pit designs and scheduled.

-

The Kombat Mineral Reserves are reported above a

0.56% Cu cut off. - Mineral Reserves are reported as total Mineral Reserves and not attributable to Trigon.

-

The Mineral Reserve statement excludes 13.0 kt at

0.83% Cu sitting in stockpile.

The Mineral Reserves for the underground mining schedule are set out in Table 6 below. The Mineral Reserves are reported at the point where the ore is fed into the processing plant.

Table 6: Kombat Asis West Underground Mineral Reserve as at 29 February 2024

Area |

Mineral Reserve Category |

Tonnes (Mt) |

Grade |

Content |

||

Cu |

Ag |

Cu |

Ag |

|||

(%) |

(g/t) |

(t) |

(kg) |

|||

Asis West |

Probable |

1.64 |

|

22.8 |

51 643 |

37 393 |

Total Probable |

|

1.64 |

|

22.8 |

51 643 |

37 393 |

Notes:

- Applied a dilution factor 0.5 m envelope of ore below cut-off in the stopes.

-

Applied an overbreak of

5% in waste development. -

Lashing or mucking loss of blasted material in the stopes at

2% . -

Applied a cut-off of

1.5% Cu ore. - The Mineral Reserve estimates are declared at the shaft head.

-

Cu metallurgical recovery applied is

93% . - The declaration is according to CIM Standards.

The combined Mineral Reserves for the Kombat mine are set out in Table 7 below.

Table 7: Kombat Combined Mineral Reserve as at 29 February 2024

Area |

Mineral Resource Category |

Tonnes (Mt) |

Grade |

Content |

||

Cu |

Ag |

Cu |

Ag |

|||

(%) |

(g/t) |

(t) |

(kg) |

|||

Asis West Underground |

Probable |

1.64 |

|

22.8 |

51 643 |

37 393 |

Open pit |

Probable |

0.75 |

|

5.7 |

6 953 |

4 299 |

Stockpile |

Probable |

0.01 |

|

2.5 |

108 |

33 |

Total |

Probable |

2.40 |

|

17.4 |

58 704 |

41 726 |

Open Pit Mining Notes:

- The Mineral Reserves have been depleted with historical mining pit shells and underground voids.

- The Mineral Reserves are reported within pit designs and scheduled.

-

The Kombat Mineral Reserves are reported above a

0.56% Cu cut-off. - Mineral Reserves are reported as total Mineral Reserves and not attributable to Trigon

Underground Notes:

- Applied a dilution factor 0.5m envelope of ore below cut-off in the stopes.

-

Applied an overbreak of

5% in waste development. -

Lashing or mucking loss of blasted material in the stopes at

2% . -

Applied a cut-off of

1.5% Cu ore. - The Mineral Reserve estimates are declared at the point where the ore if fed into the plant.

-

Cu metallurgical recovery applied is

93% . - The declaration is according to CIM Standards.

- Mineral Reserves are reported as total Mineral Reserves and not attributable to Trigon

Qualified Person

The technical information presented in this press release has been reviewed and approved for disclosure by [Andrew McDonald CEng MIMMM FSAIMM, SRK Principal Engineer and Competent Valuator, Jaco van Graan, Pr Eng MSAIMM, SRK Associate Partner and Principal Mining Engineer, Mark Wanless Pr.Sci.Nat FGSSA MGASA, SRK Partner and Principal Geologist and Joseph Mainama PrEng MSAIMM, SRK Partner and Principal Mining Engineer] who are Qualified Persons as defined by NI 43-101.

Trigon Metals Inc.

Trigon is a publicly traded Canadian exploration and development company with its core business focused on copper and silver holdings in mine-friendly African jurisdictions. Currently, the company has operations in

The complete NI 43-101 technical report associated with the Feasibility Study and updated mineral resources and reserves estimates (the “Technical Report”) will be available on SEDAR+ at www.sedarplus.ca under the Company’s issuer profile, as well as the Company’s website at www.trigonmetals.com within 45 calendar days.

Cautionary Notes

This news release may contain forward-looking statements. These statements include statements regarding the Kombat Mine, the mineralization of the Kombat Mine, the timing and results of economic studies including the Feasibility Study, the economic viability of the Kombat Mine, mineral resources and mineral reserves estimates, ability to realize on projected economic estimates, timing of receipts of permits and approvals, future exploration and development plans and results and the Company’s future plans and objectives. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statements or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

Non-IFRS measures

The Company has included certain non-IFRS measures in this press release. The Company believes that these measures provide investors an improved ability to evaluate the underlying performance of the Company’s projects. The non-IFRS measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These measures do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240304321945/en/

Jed Richardson

+1 647 276 6002

jed.richardson@trigonmetals.com

Website: www.trigonmetals.com

Source: Trigon Metals Inc.