PyroGenesis Signs $1.3 Million Energy Transition Contract

Rhea-AI Summary

PyroGenesis (OTCQX: PYRGF) signed a EUR 815,000 (CAD $1,324,000) contract to supply a plasma torch system for electrifying a calcination furnace in the cement industry.

Delivery is targeted for early Q3 2026 and the client will run a 9-month test as part of a multi-year initiative to demonstrate electric heating can replace fossil fuel combustion. The project plans to use captured CO2 in a closed-loop to power the plasma torch and moves PyroGenesis from low-kW trials toward megawatt-scale testing in industrial calcination.

Positive

- Contract value EUR 815,000 (CAD $1,324,000)

- Delivery target early Q3 2026

- 9-month pilot test within a multi-year decarbonization initiative

- Closed-loop CO2 concept for plasma torch heating (captured CO2 reuse)

Negative

- Pilot stage only: client will test system for 9 months (not immediate commercial roll-out)

- Client identity withheld for confidentiality, limiting public visibility on counterparty

News Market Reaction

On the day this news was published, PYRGF gained 0.07%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Peer moves are mixed: ASPZ is up 7.45% while NEWH is down 16.63%, and others are flat, suggesting PYRGF’s 32.66% move is stock-specific rather than sector-wide.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 08 | Commercial contract | Positive | +24.1% | Titanium powder supply contract to a global aerospace leader after certification. |

| Dec 03 | Commercial contract | Positive | +0.1% | EUR 815,000 plasma torch contract for cement calcination electrification. |

| Nov 28 | Financing | Negative | +4.5% | Completion of non-brokered private placement raising $5.23M with warrant coverage. |

| Nov 11 | Earnings update | Neutral | +8.7% | Q3 2025 results with lower revenue but a $51.6M backlog and multiple contracts. |

| Nov 05 | Conference call | Neutral | -1.6% | Scheduling of Q3 2025 results and business update conference call. |

Recent news, especially commercial contracts and operational milestones, has often coincided with positive price reactions, while even dilutive financing saw a price uptick, indicating a tendency to respond constructively to corporate developments.

Over the past month, PyroGenesis reported several notable developments. An earnings release on Nov 11, 2025 highlighted revenue pressure but a substantial $51.6M backlog and new contracts. A non-brokered private placement completed on Nov 28, 2025 raised gross proceeds of $5,226,083. The company then announced a EUR 815,000 (CAD $1,324,000) cement-sector contract and, later, a titanium powder order to a global aerospace leader. Today’s cement electrification contract fits this pattern of commercial traction in energy transition and advanced materials.

Market Pulse Summary

This announcement adds a EUR 815,000 (CAD $1,324,000) cement-sector contract, advancing plasma torch electrification of high-temperature calcination and moving from low-kilowatt toward megawatt-scale testing. It builds on a broader backlog referenced in prior updates and aligns with cement’s goal to cut emissions, where around 40% stem from fuel combustion. Investors may track execution milestones, such as the early Q3 2026 delivery target and the planned 9-month test period.

Key Terms

plasma torch technical

calcination furnace technical

greenhouse gas emissions technical

closed-loop system technical

rotary kiln technical

AI-generated analysis. Not financial advice.

Advances electrification of calcination furnaces in the cement industry using plasma torch technology

MONTREAL, Dec. 03, 2025 (GLOBE NEWSWIRE) -- PyroGenesis Inc. (“PyroGenesis”) (TSX: PYR) (OTCQX: PYRGF) (FRA: 8PY1), the leader in ultra-high temperature processes and engineering innovation, and a plasma-based technology provider to heavy industry & defense, announces that it has signed a EUR815,000 (CAD

PROJECT HIGHLIGHTS

Purpose: using an electric plasma torch for a more efficient and cleaner method for high-temperature calcination.

Scope: supply of proprietary plasma technology for integration into a calcination furnace, used as part of the cement production process.

Timeline: delivery to client is targeted for early Q3 2026.

Strategic Impact: supports cement industry goals to reduce emissions and produce cleaner, “greener” cement.

The contract announced today is with a global leader in mining and minerals within the cement industry. The goal is to effectively use a plasma torch in a calcination furnace, a key step in the cement production process. For this project, the client is evaluating the use of a CO2-powered plasma torch. Of particular note, the CO2 will be captured from other processes and, in a closed-loop system, redirected to the plasma torch to heat the calcination furnace. The client will test the plasma system for 9 months, as part of an existing multi-year initiative that aims to demonstrate that electric heating can substitute fossil fuel combustion in the cement industry. The construction and testing of a plasma-driven rotary kiln, for permanent use in calcination on an industrial scale, is a central goal of the initiative. The integration of PyroGenesis’ plasma torch represents the next step forward from previous low kilowatt-power tests toward megawatt power tests.

A calcination furnace (also known as a calciner), can be used for the high temperature processing of limestone, quicklime, and trona, to produce lime, clinker, and soda ash, all of which are key components of cement, and which contribute to its binding properties, as well as to its strength and durability. Fossil fuel combustion and CO2 released during calcination are major sources of emissions in the cement industry. Approximately

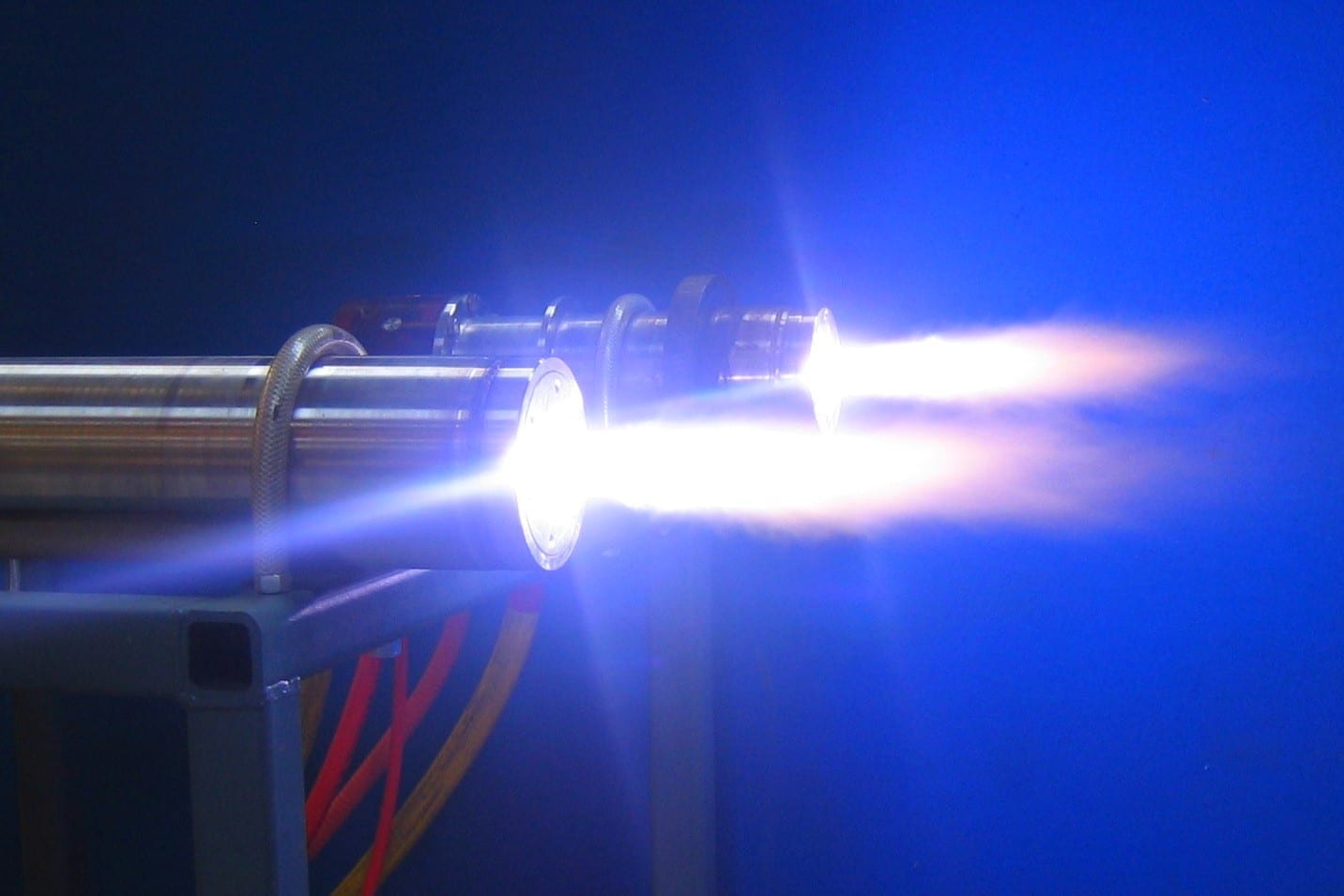

Image: PyroGenesis’ proprietary plasma torch technology.

“The cement industry is under mounting pressure to shift toward cleaner technology for their high temperature process steps,” said Mr. P. Peter Pascali, President and CEO of PyroGenesis. “Transitioning production methods, using plasma as a heating source, is not just a way to boost operational efficiency, but a vital way to achieve the sector’s long-standing net-zero emission reduction goals. Since fossil fuel combustion accounts for roughly

INDUSTRY AND MARKET CONTEXT

- Cement production is one of the most energy intensive of all manufacturing industries, accounting for nearly

5% of total global energy consumption. ii iii - Cement production accounts for

7% of total GHG emissions and up to9% of human-caused CO2 emissions. iv v 40% of cement industry emissions come from fossil-fuel combustion to power calcination. i- The Global Cement and Concrete Association targets

20% reduction of CO2 per metric ton of cement and25% reduction of CO2 per cubic meter of concrete by 2030 compared to 2020. The GCCA also calls for complete decarbonization by 2050. vi

About PyroGenesis Inc.

PyroGenesis leverages 34 years of plasma technology leadership to deliver advanced engineering solutions to energy, propulsion, destruction, process heating, emissions, and materials development challenges across heavy industry and defense. Its customers include global leaders in aluminum, aerospace, steel, iron ore, utilities, environmental services, military, and government. From its Montreal headquarters and local manufacturing facilities, PyroGenesis’ engineers, scientists, and technicians drive innovation and commercialization of energy transition and ultra-high temperature technology. PyroGenesis’ operations are ISO 9001:2015 and AS9100D certified, with ISO certification maintained since 1997. PyroGenesis’ shares trade on the TSX (PYR), OTCQX (PYRGF), and Frankfurt (8PY1) stock exchanges.

Cautionary and Forward-Looking Statements

This press release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of applicable securities laws. In some cases, but not necessarily in all cases, forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects” or “does not expect”, “is expected”, “an opportunity exists”, “is positioned”, “estimates”, “intends”, “assumes”, “anticipates” or “does not anticipate” or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, “will” or “will be taken”, “occur” or “be achieved”. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances contain forward-looking statements. Forward-looking statements are not historical facts, nor guarantees or assurances of future performance but instead represent management’s current beliefs, expectations, estimates and projections regarding future events and operating performance. Forward-looking statements are necessarily based on a number of opinions, assumptions and estimates that, while considered reasonable by PyroGenesis as of the date of this release, are subject to inherent uncertainties, risks and changes in circumstances that may differ materially from those contemplated by the forward-looking statements. Important factors that could cause actual results to differ, possibly materially, from those indicated by the forward-looking statements include, but are not limited to, the risk factors identified under “Risk Factors” in PyroGenesis’ latest annual information form, and in other periodic filings that it has made and may make in the future with the securities commissions or similar regulatory authorities, all of which are available under PyroGenesis’ profile on SEDAR+ at www.sedarplus.ca. These factors are not intended to represent a complete list of the factors that could affect PyroGenesis. However, such risk factors should be considered carefully. There can be no assurance that such estimates and assumptions will prove to be correct. You should not place undue reliance on forward-looking statements, which speak only as of the date of this release. PyroGenesis undertakes no obligation to publicly update or revise any forward-looking statement, except as required by applicable securities laws. Neither the Toronto Stock Exchange, its Regulation Services Provider (as that term is defined in the policies of the Toronto Stock Exchange) nor the OTCQX Best Market accepts responsibility for the adequacy or accuracy of this press release.

For further information contact ir@pyrogenesis.com or visit http://www.pyrogenesis.com

__________________________________

i https://link.springer.com/article/10.1007/s10098-023-02683-0

ii https://www.eia.gov/todayinenergy/detail.php?id=11911

iii https://www.sciencedirect.com/science/article/abs/pii/B9780323852104000102

v https://www.scientificamerican.com/article/solving-cements-massive-carbon-problem/

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9471926b-3a09-4680-a426-532da1c3523c