Q2 Metals Reports Multiple Wide, Mineralized Intercepts from Infill Drilling at the Cisco Lithium Project, Including 95.1 m and 81.9 m each Grading 1.56% Li₂O

Rhea-AI Summary

Q2 Metals (OTCQB:QUEXF) reported assay results from four infill drill holes at the Cisco Lithium Project on Dec 1, 2025, including multiple wide spodumene intercepts such as 95.1 m at 1.56% Li2O and 81.9 m at 1.56% Li2O. The results cover 2,211.7 m across four holes; the company has completed 27,295 m over 67 holes to date and is operating four drill rigs. An earlier Exploration Target estimated 215–329 Mt at 1.0–1.38% Li2O (based on 40 holes). Assays remain pending for >20 holes, including a notable 457.4 m continuous spodumene intercept in CS25-044. The infill program is intended to support an initial inferred Mineral Resource Estimate expected in Q1 2026.

Positive

- Intercept of 95.1 m at 1.56% Li2O

- Multiple long intercepts above 1.3% Li2O across holes

- 27,295 m completed over 67 holes

- Four drill rigs actively operating on site

Negative

- Exploration Target remains conceptual; not a mineral resource

- Assays pending for >20 holes including 457.4 m intercept

- Reported intervals are core widths and not true widths

News Market Reaction

On the day this news was published, QUEXF gained 15.96%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Peers in Other Industrial Metals & Mining showed mixed moves, with names like CANALASKA URANIUM up 4.53% and others such as ASIA BROADBAND down 4.65%, suggesting QUEXF’s modest gain of 0.63% was stock-specific rather than a broad sector surge.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 03 | Drill results update | Positive | +9.6% | Reported CS25-044 with 457.4 m at 1.65% Li2O, widest interval to date. |

| Dec 01 | Infill drilling results | Positive | +16.0% | Multiple wide mineralized intercepts from four infill holes at Cisco. |

| Nov 17 | Exploration drilling north | Positive | -1.1% | 179.2 m continuous pegmatite north of mineralized zone and new parallel zone. |

| Oct 27 | Board appointment | Neutral | -0.7% | Added director Keith Phillips and granted 1,300,000 stock options at $0.95. |

| Oct 02 | ESG and award update | Positive | -4.8% | Named VP ESG and Cisco nominated for Discovery of the Year by AEMQ. |

Positive Cisco drill and project updates often saw supportive or strong price reactions, but there were notable instances where upbeat exploration news coincided with short-term pullbacks.

Over the last few months, Q2 Metals has focused on advancing the Cisco Lithium Project through drilling and corporate developments. Multiple updates highlighted wide spodumene pegmatite intercepts, including continuous intervals of 179.2 m and later 457.4 m at 1.65% Li2O, and reiterated an Exploration Target of 215–329 Mt at 1.0–1.38% Li2O. Management appointments and ESG leadership were also emphasized. Today’s infill results fit this sequence of building towards an initial inferred Mineral Resource Estimate targeted for Q1 2026.

Market Pulse Summary

The stock surged +16.0% in the session following this news. A strong positive reaction aligns with the company’s pattern of outsized moves on major Cisco drill updates, such as the prior 15.96% gain on wide infill results and 9.61% move on the 457.4 m intercept. However, past pullbacks after good news highlight risks if expectations outpace future assays or the 2026 inferred Mineral Resource Estimate timeline, especially with the stock already trading above its 200-day MA.

Key Terms

li2o technical

spodumene pegmatite technical

exploration target technical

mineral resource estimate technical

ni 43-101 regulatory

qa/qc technical

sodium peroxide fusion technical

icp-aes/ms technical

AI-generated analysis. Not financial advice.

Highlights:

- Four (4) drill holes from the 2025 infill drill program with strong analytical results are reported herein:

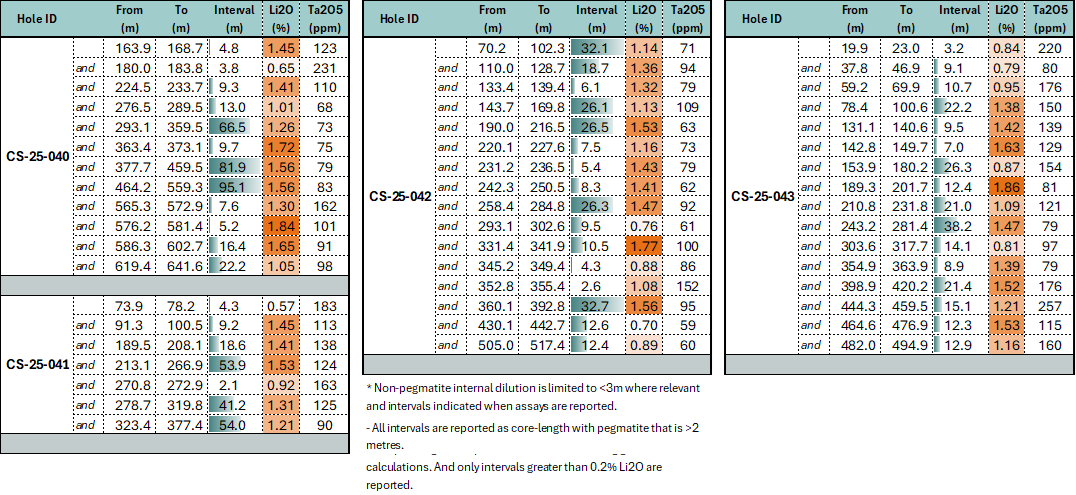

- CS25-040: 12 separate intervals, including 95.1 metres (“m”) at

1.56% Li2O, 81.9 m at1.56% Li2O and 66.5 m at1.26% Li2O; - CS25-041: seven (7) separate intervals, including 53 .9 m at

1.53% Li2O, 54.0 m at1.21% Li2O and 41.2 m at1.31% Li2O; - CS25-042: 16 separate intervals, including 32.7 m at

1.56% Li2O, 26.5 m at1.53% Li2O, 26.3 m at1.47% Li2O, 32.1 m at1.14% Li2O, and 26.1 m at1.13% Li2O; and - CS25-043: 16 separate intervals, including 38.2 m at

1.47% Li2O, 22.2 m at1.38% Li2O and 21.4 m at1.52% Li2O.

- CS25-040: 12 separate intervals, including 95.1 metres (“m”) at

- Assays are pending on more than 20 drill holes, including CS25-044 which intercepted 457.4 m of continuous spodumene pegmatite.

- Four (4) drill rigs continue to operate on the Cisco Project, primarily focused on infill-scale drilling within the main mineralized zone, supporting the Company’s efforts to deliver an initial inferred Mineral Resource Estimate in the first quarter of 2026.

VANCOUVER, British Columbia, Dec. 01, 2025 (GLOBE NEWSWIRE) -- Q2 Metals Corp. (TSX.V: QTWO | OTCQB: QUEXF | FSE: 458) (“Q2” or the “Company”) is pleased to report assay results from the ongoing 2025 drill program (the “2025 Drill Program”) at the Company’s Cisco Lithium Project (the “Project” or the “Cisco Project”), located within the greater Nemaska traditional territory of the Eeyou Istchee James Bay region of Quebec, Canada.

The primary focus of the fall and winter drilling campaign is on infill-scale drilling within the main mineralized zone defined by the Exploration Target (the “Mineralized Zone”), issued by the Company in July 2025. The Exploration Target estimated a range of potential lithium mineralization at the Mineralized Zone of 215 to 329 million tonnes at a grade ranging from 1.0 to

The drill campaign has been designed to support the Company’s objective of delivering an initial inferred Mineral Resource Estimate in the first quarter of 2026. Drilling at the Cisco Project is ongoing, with four (4) drill rigs currently operating on site.

“The recent infill drilling results further demonstrate the consistency and robustness of the Mineralized Zone at the Cisco Lithium Project. Since commencing our infill drill program, we have tightened our drill spacing to an average of 125 metres as we prepare our initial inferred Mineral Resource Estimate. To date, we have completed a total of 27,295 metres over 67 holes and continue to see encouraging results,” said Neil McCallum, Vice President of Exploration for Q2 Metals.

The analytical results reported herein represent 2,211.7 m of drilling over four (4) drill holes completed during the 2025 Drill Program. Pegmatite intervals and analytical results from the current program will be reported as they are received and reviewed.

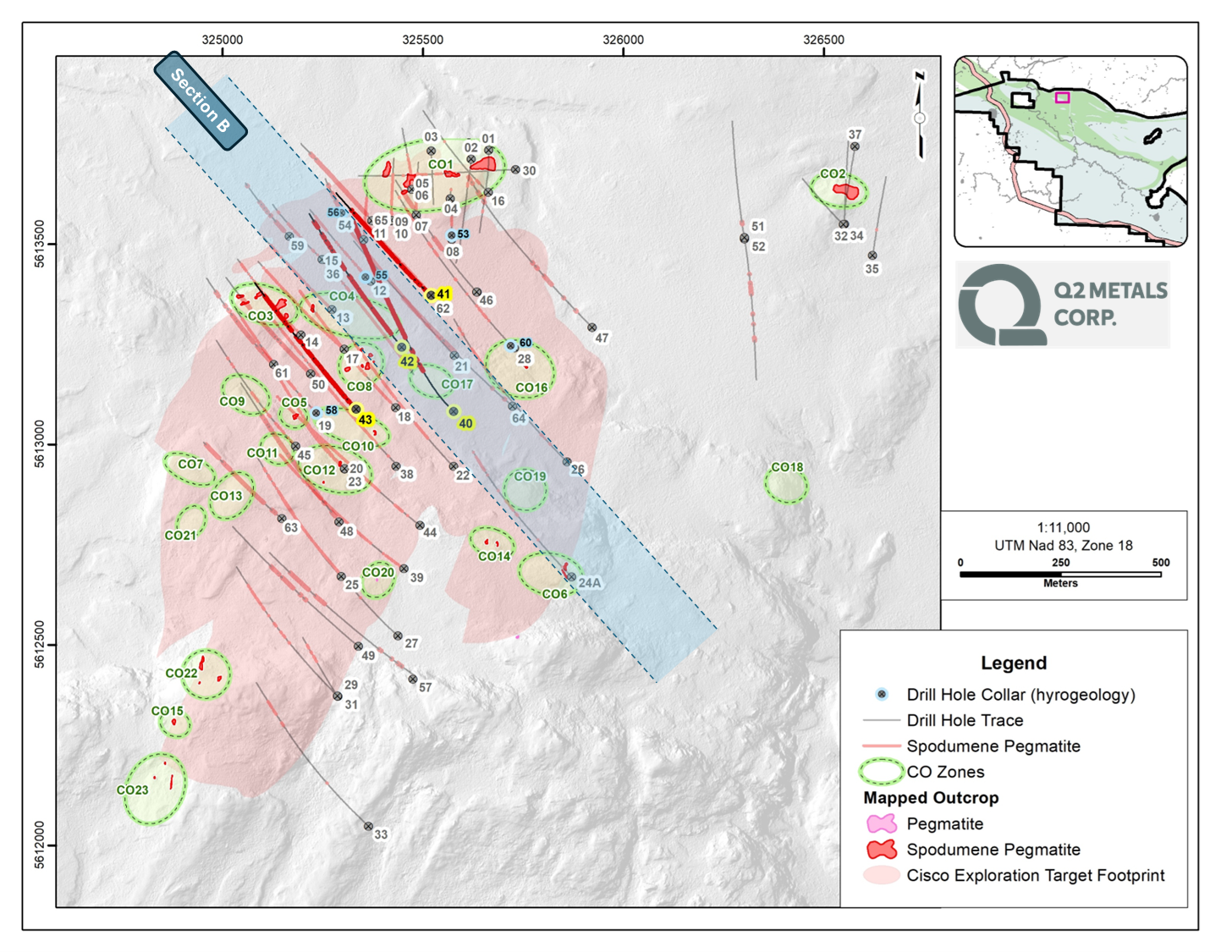

Figure 1. Map of Recent Drill Holes with Analytical Results at Cisco Property

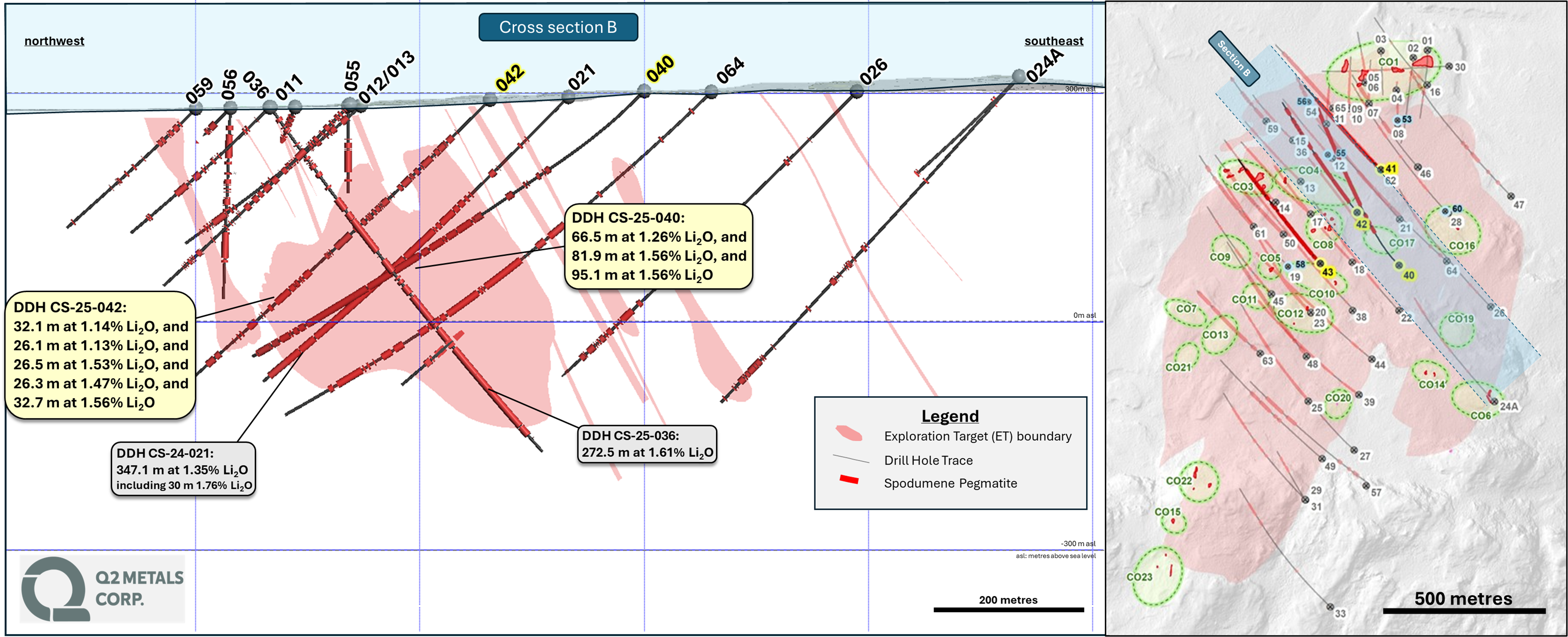

Figure 2. Cross-Section B

Table 1. Summary of Analytical Results of Drill Holes CS25-040, 041 and 042 at Cisco Project

All intervals of greater than 2 m of core-length and greater than

Drill Hole Collar Information

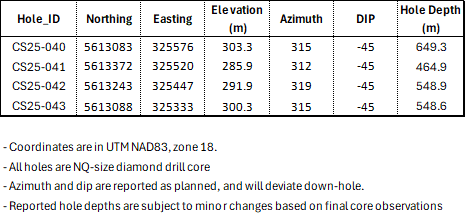

The summary of drill holes CS25-040, CS25-041 and CS25-042, including basic location and dip/azimuth, is detailed below (Table 2).

Table 2. Summary of Drill Hole Collar Information, Cisco Project (CS25-040, CS25-041 and CS25-042)

Sampling, Analytical Methods and QA/QC Protocols

All drilling was conducted using diamond drill rig with NQ sized core and all drill core samples are shipped to SGS Canada’s preparation facility in Val D’Or, Quebec, for standard sample preparation (code PRP92) which includes drying at 105°C, crushing to

A Quality Assurance / Quality Control (QA/QC) protocol following industry best practices was incorporated into the sampling program. Measures include the systematic insertion of quartz blanks and certified reference materials (CRMs) into sample batches at a rate of approximately

Qualified Person

Neil McCallum, B.Sc., P.Geol, is a Qualified Person as defined by NI 43-101, and a registered permit holder with the Ordre des Géologues du Québec and member in good standing with the Professional Geoscientists of Ontario. Mr. McCallum has reviewed and approved the technical information in this news release. Mr. McCallum is a director and the Vice President Exploration for Q2.

Upcoming Events

Members of the Q2 team will be attending the Mines & Money Resourcing Tomorrow conference being held in London, UK from December 2-4, 2025.

ABOUT Q2 METALS CORP.

Q2 Metals is a Canadian mineral exploration company focused on the Cisco Lithium Project which is located within the greater Nemaska traditional territory of the Eeyou Istchee, James Bay region of Quebec, Canada. The known mineralized zone at Cisco is just 6.5 km from the Billy Diamond Highway, which leads to the railhead in the Town of Matagami, approximately 150 km to the south.

The Cisco Project has district-scale potential with an initial Exploration Target estimating a range of potential lithium mineralization of 215 to 329 million tonnes at a grade ranging from 1.0 to

The 2025 Exploration Program is ongoing, prioritizing infill drilling towards an initial mineral resource estimate expected in Q1 2026. Expansion and exploration drilling continues at the main zone, which remains open at depth and along strike, as well as at high potential targets identified across the broader 41,253 hectare project area.

FOR FURTHER INFORMATION, PLEASE CONTACT:

| Alicia Milne President & CEO Alicia@Q2metals.com | Jason McBride Investor Relations Manager Jason@Q2metals.com | Chris Ackerman Corporate Development Chris@Q2metals.com |

Telephone: 1 (800) 482-7560

E-mail: info@Q2metals.com

www.Q2Metals.com

Social Media:

Follow the Company: Twitter, LinkedIn, Facebook, and Instagram

Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian legislation. Forward-looking statements are typically identified by words such as: “believes”, “expects”, “anticipates”, “intends”, “estimates”, “plans”, “may”, “should”, “would”, “will”, “potential”, “scheduled” or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. Accordingly, all statements in this news release that are not purely historical are forward-looking statements and include statements regarding beliefs, plans, expectations and orientations regarding the future including, without limitation, any statements or plans regard the geological prospects of the Company’s properties and the future exploration endeavors of the Company. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those anticipated in such forward-looking statements. The forward-looking statements in this news release speak only as of the date of this news release or as of the date specified in such statement. Forward looking statements in this news release include, but are not limited to, drilling results on the Cisco Project and inferences made therefrom, the conceptual nature of an exploration target on the Cisco Project, the potential scale of the Cisco Project, the focus of the Company’s current and future exploration and drill programs, the scale, scope and location of future exploration and drilling activities, the Company's expectations in connection with the projects and exploration programs being met, the Company’s objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, variations in ore grade or recovery rates, changes in project parameters as plans continue to be refined, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, reallocation of proposed use of funds, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same. Readers are cautioned that mineral exploration and development of mines is an inherently risky business and accordingly, the actual events may differ materially from those projected in the forward-looking statements. Additional risk factors are discussed in the section entitled “Risk Factors” in the Company’s Management Discussion and Analysis for its recently completed fiscal period, which is available under Company’s SEDAR profile at www.sedarplus.com.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update this forward-looking information except as otherwise required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/50bf8236-0ca7-48f4-aff3-88335f577046

https://www.globenewswire.com/NewsRoom/AttachmentNg/a2f51690-cda6-4b5e-8fcf-e0b119c0a400

Tables accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/0759195b-fadf-4b9d-97e1-54a61ab1132a

https://www.globenewswire.com/NewsRoom/AttachmentNg/acb1a99a-6ca6-4d33-8a15-08ce1962014f