Ridgeline Minerals Provides Assay Results for the Black Ridge Gold Project, Nevada

Rhea-AI Summary

Ridgeline Minerals (OTCQB: RDGMF) provided assay results from the Black Ridge project and an exploration update for the Swift project in Nevada on December 11, 2025. NGM completed one deep core hole at Black Ridge to 1,109 m, intersecting Lower Plate Rodeo Creek at 773 m and a 6.7 m Popovich section with Carlin-Type alteration; highlight intercept was 0.8 m @ 0.113 g/t Au. At Swift, two deep core holes have assays pending and RC pre-collars to 730 m are in place for spring 2026 follow-up. NGM has recorded US$1.071M at Black Ridge and US$14.789M at Swift to date with earn-in spending commitments of US$4.5M by July 14, 2028 (Black Ridge) and US$20M by Dec 31, 2026 (Swift).

Positive

- Lower Plate target validated by RLX-25001 drill hole

- Previous SW24-006 intercept: 1.1 m @ 10.4 g/t Au

- NGM has invested US$14.789M at Swift through Sep 30, 2025

Negative

- Highlight intercept low grade: 0.8 m @ 0.113 g/t Au

- True widths unknown for reported intercepts

- Lab delays have postponed Swift assay releases

- Earn-in spending deadlines: US$4.5M by Jul 14, 2028 and US$20M by Dec 31, 2026

News Market Reaction – RDGMF

On the day this news was published, RDGMF declined 1.11%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

RDGMF slipped 0.75% with above-average volume, while gold exploration peers were mixed: one notable gainer at 14.29%, others down between roughly 3–9% or flat. Moves do not reflect a unified sector trend.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Nov 12 | CEO interview feature | Positive | +8.6% | Media interview spotlighting recent impressive drill results at Selena. |

| Nov 04 | Exploration results | Positive | -28.7% | High-grade CRD massive sulfide discovery at Selena’s Chinchilla target. |

| Sep 29 | Equity compensation | Negative | -6.3% | Grant of stock options, DSUs, and RSUs to insiders and employees. |

| Sep 09 | Drill program update | Positive | +2.7% | Updates on three Nevada partner projects with largest exploration budget. |

| Aug 08 | Maiden drill results | Neutral | -4.8% | Atlas maiden drilling intersecting low-grade halo with Carlin-Type features. |

News-linked moves have been mixed: strong positive and negative reactions to exploration results, with several instances of divergence between upbeat technical news and subsequent price performance.

Over the last few months, Ridgeline has repeatedly highlighted exploration progress in Nevada. On Aug 08, maiden Atlas drilling intersected up to 1.8 g/t oxide gold. A Sep 09 update outlined partner-funded programs at Swift, Black Ridge, and Selena with a US $9.5M budget. Early November brought a high-grade CRD discovery at Selena, followed by a CEO interview on Nov 12. Today’s Black Ridge assays and Swift drilling update extend this exploration-focused narrative with partner-funded work.

Market Pulse Summary

This announcement details early assay results at Black Ridge and progress at Swift under substantial NGM earn-in agreements totaling up to US $40,000,000. Spending milestones of US $20,000,000 at Swift and US $4,500,000 at Black Ridge frame near-term work. Historical news shows mixed share-price reactions to exploration results, so monitoring upcoming Swift assays and continued partner spend levels will be important for assessing how these projects evolve.

Key Terms

earn-in agreements financial

QAQC technical

fire assay technical

ICP- MS technical

National Instrument 43-101 regulatory

AI-generated analysis. Not financial advice.

Drill Program Update for the Swift Gold Project, Nevada

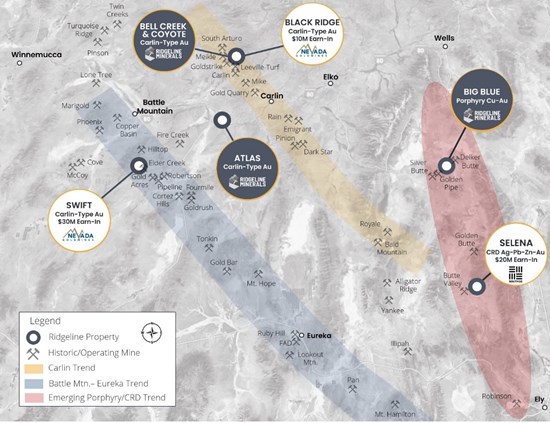

Vancouver, British Columbia--(Newsfile Corp. - December 11, 2025) - Ridgeline Minerals Corp. (TSXV: RDG) (OTCQB: RDGMF) (FSE: 0GC0) ("Ridgeline" or the "Company") is pleased to provide assay results for the Black Ridge Project ("Black Ridge") and an exploration update for the drill program at the Swift Project ("Swift") located on the Carlin and Cortez mine trends in north-central Nevada (Figure 1). Swift and Black Ridge are operated by Nevada Gold Mines ("NGM") and are both in Phase 1 of separate exploration earn-in agreements totaling US

Chad Peters, Ridgeline's President, CEO & Director commented, "We are very encouraged by the Nevada Gold Mines teams first drill hole at Black Ridge, which has validated our Lower Plate target concept and confirms that gold mineralization continues along the Leeville Trend and extends onto the Black Ridge property at shallower than modeled depths. The anomalous gold and Carlin-Type alteration was intersected within the same host rocks as NGM's neighbouring Leeville Mine and Fallon gold deposit, highlighting the exploration potential at Black Ridge. Further drilling is required to vector into higher-grade gold mineralization along this highly prospective fault corridor."

Mr. Peters continues, "Assays are pending for two deep core holes at our Swift project, with drilling following up on the success of last year's drill program, which delivered the first high-grade gold intercepts ever drilled at the SW Swift target. We originally anticipated results from our first hole in November; however, NGM is experiencing lab delays due to the high volume of samples from the Fourmile project. We have recently received confirmation that our samples are now being processed, and we look forward to releasing assay results as soon as they are available."

Black Ridge Project (US

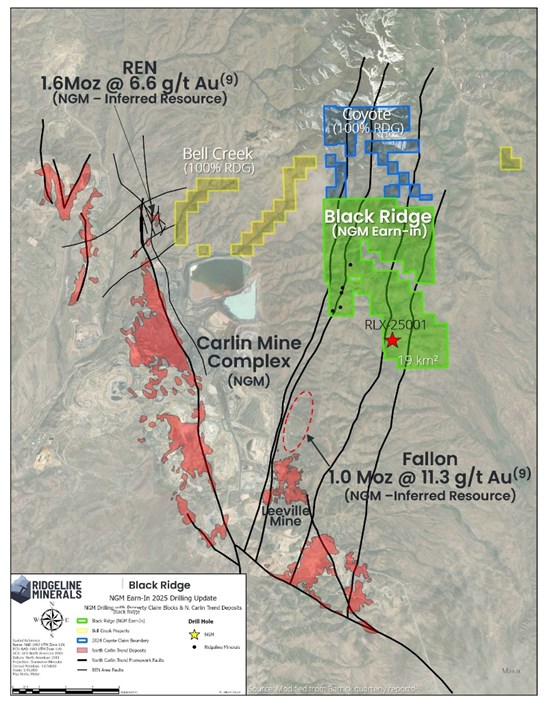

NGM completed one deep core hole to a depth of 1,109 meters ("m") in August with the primary goal of testing the same lower-plate host rock section that host NGM's currently producing Leeville Mine and high-grade Fallon discovery, both of which are located on-trend of and approximately 3.0 kilometers to the southwest of Black Ridge (Figure 2).

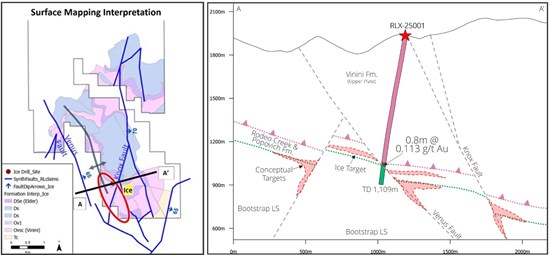

- Drilling intersected Lower Plate Rodeo Creek formation (Drc) host rocks at 773 m vertical depth, which is substantially shallower than anticipated based on Ridgeline's 2020 drill campaign.

- The hole transitioned from Rodeo Creek into a 6.7m thick section of Popovich formation (Dp), which is thinner than usual and interpreted as a potentially faulted off section of Dp (Figure 3).

- The entire section of Dp exhibited extensive silicification, crackle brecciation and sulfidation with elevated Carlin-Type pathfinders (As-Sb-Hg) throughout.

- Returned a highlight intercept of 0.8m grading 0.113 g/t gold starting at 972.8 m in sulfidized Popovich formation (Picture 1). True widths of the drilled intercept are unknown at this time.

- The entire section of Dp exhibited extensive silicification, crackle brecciation and sulfidation with elevated Carlin-Type pathfinders (As-Sb-Hg) throughout.

- The hole transitioned from Rodeo Creek into a 6.7m thick section of Popovich formation (Dp), which is thinner than usual and interpreted as a potentially faulted off section of Dp (Figure 3).

- The hole bottomed in variably altered and bleached Bootstrap Formation (SDb), which is the host to multiple past and currently producing gold deposits on the Carlin Trend .

NGM has incurred a total of US

Swift Project (US

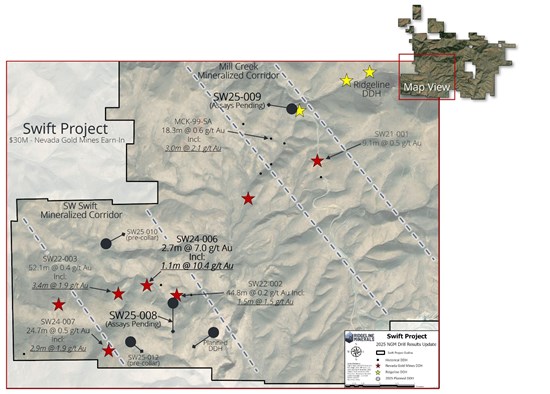

The second core tail out of the five proposed holes in 2025 is complete with assays pending on both. An additional RC pre-collar has been completed to depth of 730 m and drilling is in progress on a second. Both will be ready for re-entry in the spring of 2026 to continue drilling along strike of previous high-grade gold intercepts (up to 1.1m grading 10.4 g/t Au in SW24-006) at the SW Swift target (Figure 4).

NGM has incurred a total of US

Figure 1: Ridgeline's 200-kilometer² exploration portfolio in Nevada with partner projects in white

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7298/277706_edd31f35a4385800_003full.jpg

Figure 2: Map of the Black Ridge property showing the location of NGM drillhole RLX-25001 (red star)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7298/277706_edd31f35a4385800_004full.jpg

*The QP has been unable to verify the Fallon and Ren resources and mineralization on nearby properties is not necessarily indicative to the mineralization potential on the Black Ridge property

Figure 3: Plan view map and conceptual X-section of RLX-25001 testing the "Ice" gold target

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7298/277706_edd31f35a4385800_005full.jpg

Picture 1: Core photos of RLX-25001 showing sulfidized and crackle brecciated (Carlin-Type alteration & mineralization features) Rodeo Creek and Popovich limestone running 0.8m grading 0.113 g/t Au

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7298/277706_edd31f35a4385800_006full.jpg

Figure 4: Plan view map of the Swift property showing 2025 drill locations and previous drill intercepts

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7298/277706_edd31f35a4385800_007full.jpg

QAQC Procedures

Swift and Black Ridge samples are submitted to ALS Minerals, Elko Nevada, which is a certified and accredited laboratory, independent of Nevada Gold Mines. Drill core samples consist of both HQ and NQ size core which is split using a diamond core saw with 1/2 of the cut core sample submitted for assay and the remaining 1/2 core sample retained in the core box for future reference. Samples are prepared using industry-standard prep methods and analysed using Au-AA23 (Au; 30 g fire assay) and ME-MS61 (48 element Suite; 0.25 g 4-acid digestion/ICP- MS) methods. ALS also undertakes its own internal coarse and pulp duplicate analysis to ensure proper sample preparation and equipment calibration. Nevada Gold Mines QAQC program includes regular insertion of CRM standards, duplicates, and blanks into the sample stream with a stringent review of all results completed internally by Nevada Gold Mines technical personnel.

Technical information contained in this news release has been prepared under the supervision of, and approved by, Michael T. Harp, CPG, the Company's Vice President, Exploration. Mr. Harp has reviewed Nevada Gold Mines' internal QAQC program and has confirmed that it meets or exceeds best practice standards. Mr. Harp is a "qualified person" under National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Ridgeline Minerals Corp.

Ridgeline Minerals is a discovery focused precious and base metal explorer with a proven management team and a 200 km2 exploration portfolio across seven projects in Nevada, USA. The Company is a hybrid explorer with a mix of

On behalf of the Board

"Chad Peters"

President & CEO

Further Information:

Chad Peters, P.Geo.

President, CEO & Director Ridgeline Minerals Corp.

+1 775 304 9773

cpeters@ridgelineminerals.com

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release

Cautionary Note regarding Forward-Looking Statements

Statements contained in this press release that are not historical facts are "forward-looking information" or "forward-looking statements" (collectively, "Forward-Looking Information") within the meaning of applicable Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995. Forward-Looking Information includes, but is not limited to, the assay results for core hole SW24-004 and the potential significance thereof. The words "potential", "anticipate", "meaningful", "significant", "pending", "believe", "estimate", "expect", "may", "will", "project", "plan", "historical", "historic" and similar expressions are intended to be among the statements that identify Forward-Looking Information. Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from any future results expressed or implied by the Forward-Looking Information. In preparing the Forward-Looking Information in this news release, Ridgeline has applied several material assumptions, including, but not limited to, assumptions that the current objectives concerning the Swift project can be achieved and that its other corporate activities will proceed as expected; that general business and economic conditions will not change in a materially adverse manner; and that all requisite information will be available in a timely manner. Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of Ridgeline to be materially different from any future results, performance or achievements expressed or implied by the Forward-Looking Information. Such risks and other factors include, among others, risks related to dependence on key personnel; risks related to unforeseen delays; risks related to historical data that has not been verified by the Company; as well as those factors discussed in Ridgeline's public disclosure record. Although Ridgeline has attempted to identify important factors that could affect Ridgeline and may cause actual actions, events, or results to differ materially from those described in Forward-Looking Information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information. Except as required by law, Ridgeline does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/277706