Ridgeline Minerals Provides Drill Program Updates for Its Three Partner Projects in Nevada

Rhea-AI Summary

Ridgeline Minerals (OTCQB: RDGMF) provided updates on drilling programs at its three partner projects in Nevada: Swift, Black Ridge, and Selena. The company has secured its largest exploration budget to date of US $9.5 million through partner funding, with assays pending through Q4 2025 and Q1 2026.

The Selena project, operated by Ridgeline under a US $20 million South32 earn-in agreement, is progressing with a US $3.45 million budget for up to three deep core holes. The Swift project, under a US $30 million NGM earn-in agreement, is testing high-grade gold intercepts with up to five planned holes. At Black Ridge, under a US $10 million NGM earn-in agreement, one deep core hole was completed in August with results expected in Q4 2025.

Positive

- Record exploration budget of US $9.5 million through partner funding

- Multiple strategic partnerships with major mining companies (NGM and South32)

- NGM has already invested US $10.87 million at Swift project, showing strong commitment

- Previous drilling at Swift yielded high-grade gold intercepts up to 10.4 g/t Au

Negative

- Significant remaining earn-in expenditures required from partners (US $20M for Swift, US $4.5M for Black Ridge)

- Limited progress on South32's earn-in at Selena with only US $573,758 spent of required US $10M

News Market Reaction – RDGMF

On the day this news was published, RDGMF gained 2.74%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

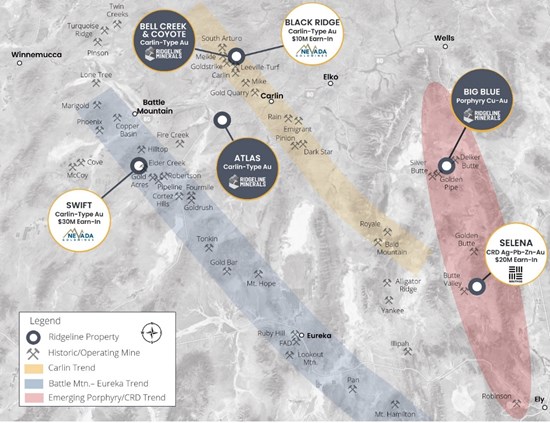

Vancouver, British Columbia--(Newsfile Corp. - September 9, 2025) - Ridgeline Minerals Corp. (TSXV: RDG) (OTCQB: RDGMF) (FSE: 0GC0) ("Ridgeline" or the "Company") is pleased to provide exploration updates for ongoing drill programs at the Swift, Black Ridge and Selena exploration projects located in north-central Nevada (Figure 1). The Swift and Black Ridge gold projects are operated by Nevada Gold Mines ("NGM") and are both in Phase 1 of separate exploration earn-in agreements totaling US

The combined partner-funded 2025 exploration budget of US

Chad Peters, Ridgeline's President, CEO & Director commented, "Drilling is progressing smoothly across our three partner projects with both Swift and Selena close to finishing up the first deep core tails of their respective programs. NGM has also recently completed a single framework drill hole at Black Ridge, which is on-trend of NGM's Leeville Mine and Fallon Deposit1 to the south. We expect drilling to continue at Swift and Selena through the end of 2025 with steady news flow and assay results throughout the end of the year."

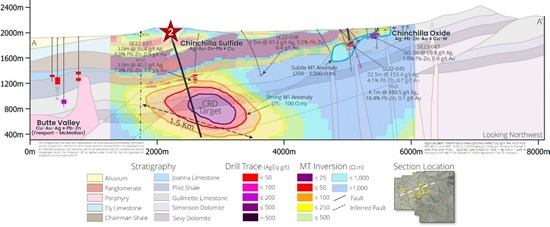

Selena Project (US

The drill program at Selena has been in progress since June with the first core tail commencing in late July. The US

South32 has incurred a total of US

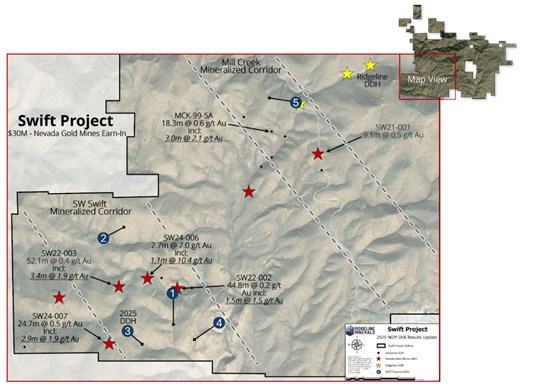

Swift Project (US

The first of up to five holes is in progress and testing along strike of previous high-grade gold intercepts (up to 1.1m grading 10.4 g/t Au in SW24-006) at the projected intersection of cross cutting fault zones (i.e., fluid conduits) where they intersect a modeled fold hinge (i.e., fluid trap), on the hanging wall side of the Mill Creek thrust (Figure 3). For a detailed summary of the drill program see the July 30, 2025 press release HERE.

NGM has incurred a total of US

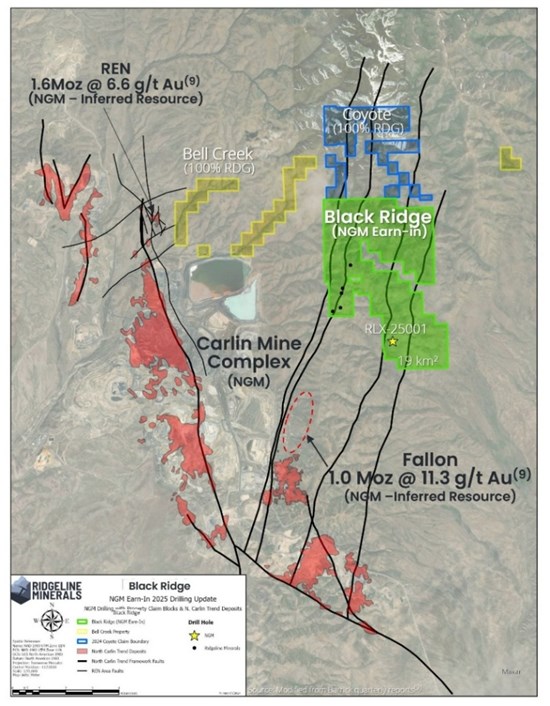

Black Ridge Project (US

One deep core hole was completed by NGM in August with the primary goal of testing the same lower-plate host rock section that hosts multiple past and currently producing gold deposits on the north Carlin Trend1 (Figure 4). Samples are being prepared for assay with results anticipated in Q4, 2025.

NGM has incurred a total of US

Figure 1: Ridgeline's 200-kilometer² exploration portfolio in Nevada with partner projects in white

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7298/265615_5ed2ffcfa47e5a35_003full.jpg

Figure 2: Simplified Long Section A-A' showing planned core hole #2 (1,600m) testing the highly conductive MT anomaly on both sides of the interpreted thrust faults, interpreted as key fluid conduits to the system

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7298/265615_5ed2ffcfa47e5a35_004full.jpg

Figure 3: Zoomed in plan view map of the Swift property showing proposed location of 2025 drillholes

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7298/265615_5ed2ffcfa47e5a35_005full.jpg

Figure 4: Plan view map of the Black Ridge property showing the location of 2025 drillhole RLX-25001

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7298/265615_5ed2ffcfa47e5a35_006full.jpg

Note 1: The QP has been unable to verify the Fallon and Ren resources and mineralization on nearby properties is not necessarily indicative to the mineralization potential on the Black Ridge property.

QAQC Procedures

Selena samples are submitted to American Assay Laboratories (AAL) of Sparks, Nevada, which is a certified and accredited laboratory, independent of the Company. Independent check samples are sent to Paragon Geochemical Labs (PAL) of Sparks, Nevada. Samples are prepared using industry-standard prep methods and analysed using FA-PB30-ICP (Au; 30g fire assay) and ICP-5AM48 (48 element Suite; 0.5g 5-acid digestion/ICP-MS) methods. AAL also undertakes its own internal coarse and pulp duplicate analysis to ensure proper sample preparation and equipment calibration. Ridgeline's QA/QC program includes regular insertion of CRM standards, duplicates, and blanks into the sample stream with a stringent review of all results completed by the Company's Qualified Person, Michael T. Harp, Vice President, Exploration.

Swift and Black Ridge samples are submitted to ALS Minerals, Elko Nevada, which is a certified and accredited laboratory, independent of Nevada Gold Mines. Samples are prepared using industry-standard prep methods and analysed using Au-AA23 (Au; 30 g fire assay) and ME-MS61 (48 element Suite; 0.25 g 4-acid digestion/ICP- MS) methods. ALS also undertakes its own internal coarse and pulp duplicate analysis to ensure proper sample preparation and equipment calibration. Nevada Gold Mines QAQC program includes regular insertion of CRM standards, duplicates, and blanks into the sample stream with a stringent review of all results completed internally by Nevada Gold Mines technical personnel.

Technical information contained in this news release has been prepared under the supervision of, and approved by, Michael T. Harp, CPG, the Company's Vice President, Exploration. Mr. Harp is a "qualified person" under National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Ridgeline Minerals Corp.

Ridgeline Minerals is a discovery focused precious and base metal explorer with a proven management team and a 200 km2 exploration portfolio across seven projects in Nevada, USA. The Company is a hybrid explorer with a mix of

On behalf of the Board

"Chad Peters"

President & CEO

Further Information:

Chad Peters, P.Geo.

President, CEO & Director Ridgeline Minerals Corp.

+1 775 304 9773

cpeters@ridgelineminerals.com

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Cautionary Note regarding Forward-Looking Statements

Statements contained in this press release that are not historical facts are "forward-looking information" or "forward-looking statements" (collectively, "Forward-Looking Information") within the meaning of applicable Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995. Forward-Looking Information includes, but is not limited to, the assay results for core hole SW24-004 and the potential significance thereof. The words "potential", "anticipate", "meaningful", "significant", "pending", "believe", "estimate", "expect", "may", "will", "project", "plan", "historical", "historic" and similar expressions are intended to be among the statements that identify Forward-Looking Information. Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from any future results expressed or implied by the Forward-Looking Information. In preparing the Forward-Looking Information in this news release, Ridgeline has applied several material assumptions, including, but not limited to, assumptions that the current objectives concerning the Swift project can be achieved and that its other corporate activities will proceed as expected; that general business and economic conditions will not change in a materially adverse manner; and that all requisite information will be available in a timely manner. Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of Ridgeline to be materially different from any future results, performance or achievements expressed or implied by the Forward-Looking Information. Such risks and other factors include, among others, risks related to dependence on key personnel; risks related to unforeseen delays; risks related to historical data that has not been verified by the Company; as well as those factors discussed in Ridgeline's public disclosure record. Although Ridgeline has attempted to identify important factors that could affect Ridgeline and may cause actual actions, events, or results to differ materially from those described in Forward-Looking Information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information. Except as required by law, Ridgeline does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/265615