REE Automotive Expected to Supply Cascadia Motion with Corner Technology Used in Electric Drive Units for Global OEM Market

Rhea-AI Summary

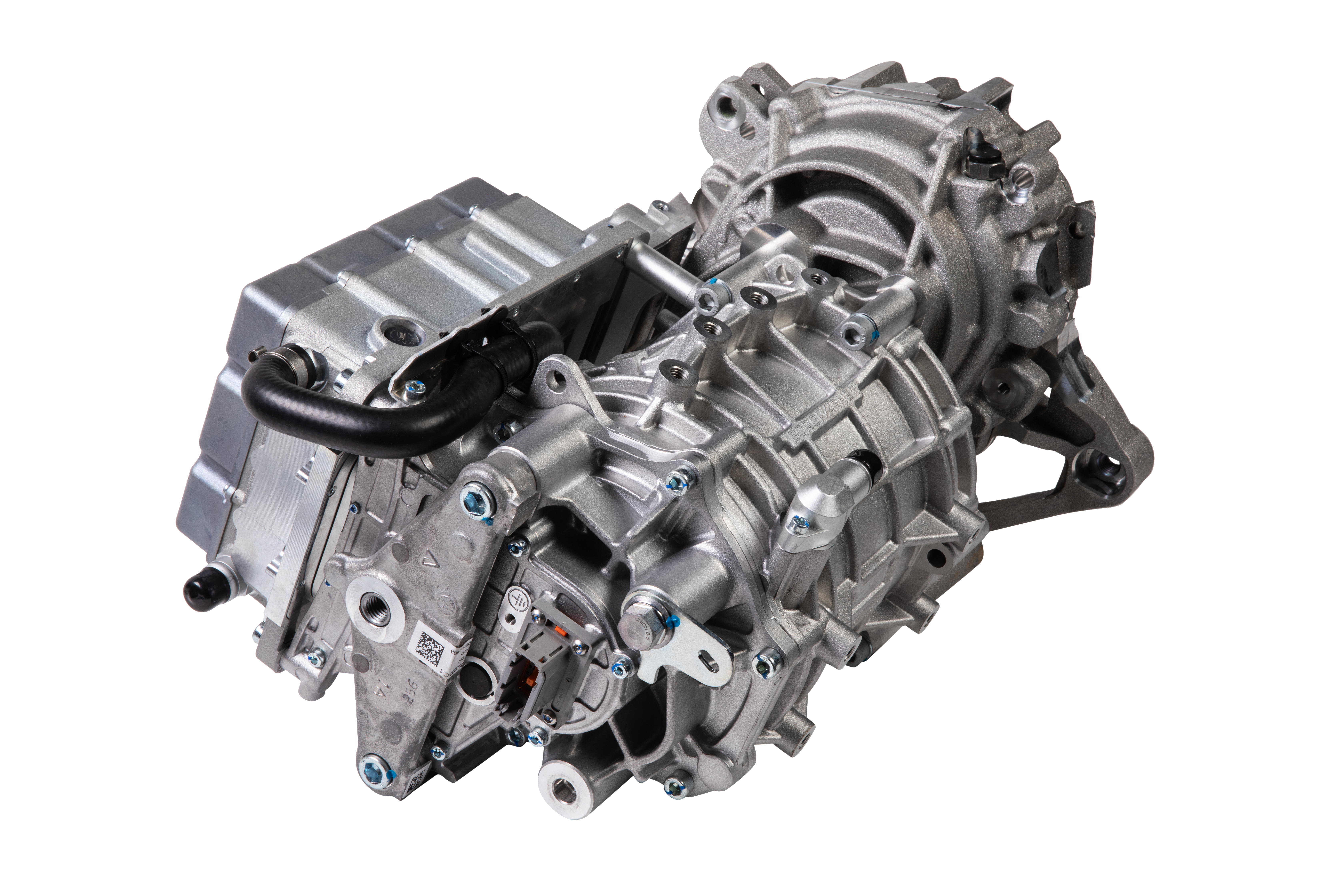

REE Automotive (Nasdaq: REE) announced a non-binding MOU with Cascadia Motion (a BorgWarner subsidiary) to jointly develop, manufacture, commercialize, and sell a next‑generation compact electric drive unit (EDU) that integrates REEcorner technology with Cascadia Motion’s iM-125 motor+inverter for global OEM programs.

The arrangement contemplates a phased commercial plan with a royalty-bearing agreement, a time‑limited exclusive distribution option for Cascadia Motion, access to REE’s EDU assembly line and tooling, and planned off‑the‑shelf availability via CascadiaMotion.com. Industry research cited projects ~9% CAGR in the global EDU market from 2025–2035 with the market roughly doubling by 2035.

Positive

- None.

Negative

- None.

News Market Reaction

On the day this news was published, REE gained 5.75%, reflecting a notable positive market reaction. Argus tracked a peak move of +26.4% during that session. Our momentum scanner triggered 13 alerts that day, indicating notable trading interest and price volatility. This price movement added approximately $2M to the company's valuation, bringing the market cap to $31M at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Momentum scanner shows only CREV in motion, down 7.51% without news. Other auto-parts peers in the static list had mixed to negative moves earlier, but no same-day news cluster or broad, confirmed sector-wide move tied to this announcement.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Nov 18 | SDV collaboration MOU | Positive | +15.8% | Non-binding MOU with Mitsubishi Fuso to evaluate REE as SDV supplier. |

| Nov 11 | Proxy supplement filing | Neutral | +0.5% | Supplement to proxy statement ahead of special shareholder meeting. |

| Jul 03 | Nasdaq bid-price notice | Negative | +4.9% | Nasdaq notification of non-compliance with $1.00 minimum bid requirement. |

Positive collaboration news previously coincided with upside moves, while negative compliance headlines showed a divergent, mildly positive reaction.

Over the last six months, REE has combined strategic collaborations with listing and governance milestones. On Jul 3, 2025, it disclosed a Nasdaq minimum bid-price deficiency with a 180-day cure period ending Dec 29, 2025, yet shares rose about 4.94%. In November, governance-related proxy materials produced a neutral price response. By Nov 18, 2025, a positive SDV-focused MOU with Mitsubishi Fuso aligned with a strong 15.8% gain. Today’s Cascadia Motion MOU extends that SDV and EDU collaboration theme with another global OEM-linked partner.

Market Pulse Summary

The stock moved +5.8% in the session following this news. A strong positive reaction aligns with prior moves where collaboration news, such as the Mitsubishi Fuso MOU that preceded a 15.8% gain, was rewarded by the market. The Cascadia Motion MOU adds another OEM-linked partner and leverages REE’s EDU and SDV architecture as the EDU market is projected to grow at 9% CAGR. However, shares remain far below the 200-day MA and 92.61% under the 52-week high, highlighting execution and listing-compliance risks.

Key Terms

electric drive unit technical

software-defined vehicle technical

over-the-air (ota) updates technical

asil-d technical

zonal architecture technical

ecu technical

AI-generated analysis. Not financial advice.

- Cascadia Motions (a wholly owned subsidiary of BorgWarner Inc.) to manufacture, commercialize, and sell a new generation of compact electric drive unit (EDU) integrating REEcorner technology with Cascadia Motion for inverter-motor modules OEM programs globally.

- Drive units expected to be available as off-the-shelf products at CascadiaMotion.com

- According to industry research estimates, the global EDU is projected to double by 2035, growing at a compound annual growth rate (CAGR) of approximately

9% from 2025 through 2035. - REE anticipates the distribution of its REEcorner-based EDUs under a phased commercial plan, including a royalty-bearing arrangement that enables BorgWarner to manufacture the EDU.

TEL AVIV, Israel, Dec. 29, 2025 (GLOBE NEWSWIRE) -- REE Automotive Ltd. (Nasdaq: REE) (“REE” or the “Company”), an automotive technology company that develops software-defined vehicle (SDV) technology solutions, today announced a strategic non-binding Memorandum of Understanding (“MOU”) with Cascadia Motion, LLC (a wholly owned subsidiary of BorgWarner Inc.) (“Cascadia Motions”). The MOU outlines cooperation across manufacturing, commercialization, and sale of a next-generation electric drive unit (EDU) based on REEcorner technology for global OEM electrification programs. The new EDU product will be jointly developed by Cascadia Motion and REE.

As part of an expected phased commercial plan, including a royalty-bearing agreement, REE would grant Cascadia Motion an exclusive, time-limited option to distribute a uniquely packaged EDU that integrates Cascadia Motion’s iM-125 drive unit (motor and inverter) with REEcorner technology. Together, the companies aim to offer a compact, cross-platform EDU that is designed to help OEMs accelerate EV development. The new EDU combined with REE’s vehicle control units is intended to support higher levels of functional safety, including ASIL-D, and to improve efficiency and time to market through secure, stable over-the-air (OTA) updates.

REE also plans to provide Cascadia Motion with access to its existing EDU assembly line, tooling, inventories, and supplier network to support manufacturing of the combined EDU Units, subject to negotiation of final terms and conditions.

“Integrating Cascadia Motion’s iM-125 drive unit with REEcorner technology bolsters our portfolio of off-the-shelf electric drive solutions, providing our customers with even more flexibility in their electrification programs,” said Joseph McHenry, General Manager of BorgWarner Portland and the Cascadia Motion brand. “This collaboration reflects our commitment to delivering innovative, ready-to-integrate drive units that help OEMs reduce development time and streamline vehicle launch.”

This arrives at a time when, according to certain industry research estimates and publications, the global EDU market is expected to grow by a compound annual growth rate (CAGR) of approximately

“We believe that this MOU with Cascadia Motions represents a natural progression of our three-year collaboration and reinforces our mission to accelerate the industry’s transition to software-defined, by-wire mobility,” said Daniel Barel, CEO and co-founder of REE Automotive. “We believe this collaboration positions us to meet global demand at scale while laying the groundwork for next-generation, fully by-wire solutions.”

In addition to the EDU-focused product offering, the parties plan to evaluate demand for complete SDV solutions, including standalone REEcorner units and REE’s software products, which can supplement this offering or present additional capabilities for OEMs. REE’s SDV technology is a purpose-built foundation that replaces legacy domain systems with centralized, zonal control that simplifies design, cuts wiring, and accelerates development of software-defined vehicles. REE’s zonal architecture combines the REEcenter ECU, REEzonal ECUs, and REEgateway into a high-performance network that unites software packages of advance vehicle dynamic, chassis control, body control, autonomy integration, safety systems, and connectivity. This integrated approach is designed to simplify complexity, accelerated development, and future-proof vehicle programs that aim to integrate seamlessly into diverse commercial OEM plans.

The MOU builds on REE’s momentum as OEMs increasingly seek modern, software-defined architectures that shorten development cycles and unlock new vehicle configurations, such as low and flat chassis design, improved functional safety, and on-going secure and stable OTA updates. REE’s advanced zonal SDV architecture integrates seamlessly with legacy systems to improve safety, performance, and reliability. By combining this architecture with Cascadia Motion’s propulsion systems, the companies believe they are positioned to support OEMs transitioning toward software-defined vehicles built for continuous improvement and long-term adaptability.

| REE EDU Performance @ Gearbox Output | |

| Motor Type | Permanent Magnet |

| Voltage | 400 V |

| Peak Torque, 30s | 3000 NM |

| Peak Power | 100 kW |

| Max Speed | 835 rpm |

| Max Cont. Torque | 2150 Nm |

| Max Cont. Power | 57 kW |

| Gear Ratio | 19.17 |

| Cooling | Water-Glycol (8LPM @65°C) |

| Weight | 54 kg |

About REE Automotive

REE Automotive (Nasdaq: REE) is an automotive technology company that develops and produces software-defined vehicle (SDV) technology designed to manage vehicle operations and features through proprietary software. REE’s advanced Zonal SDV Architecture is designed to integrate seamlessly with legacy systems to improve vehicle safety, performance, and reliability. By centralizing key vehicle functions, the architecture seeks to enhance modularity, redundancy, and stability, and to enable safer and more efficient vehicle platforms. Powered by secured AI and deep over-the-air upgradability, REE’s technology allows for continuous updates and improvements throughout a vehicle’s lifespan. This makes Powered by REE® vehicles adaptable to customer and market changes and designed with future autonomy and connectivity in mind. REE was the first company to FMVSS certify a full by-wire vehicle in the U.S. Its proprietary by-wire technology for drive, steer, and brake control removes the need for mechanical linkages, supporting flexible design and optimized performance. Through its approach of “complete not compete,” REE enables original equipment manufacturers and technology companies to license its SDV technology, allowing them to design and build vehicles tailored to their specific requirements using REE’s scalable, future-ready platform. www.REE.auto

About BorgWarner:

For more than 130 years, BorgWarner has been a transformative global product leader bringing successful mobility innovation to market. With a focus on sustainability, we’re helping to build a cleaner, healthier, safer future for all.

Media Contact

Keren Shemesh

Chief Marketing Officer for REE Automotive

Media@ree.auto

Investor Contact

Hai Aviv

Chief Finance Officer for REE Automotive

investors@ree.auto

BorgWarner Media Contact

Michelle Collins

Global Director, Marketing and Public Relations

mediacontact@borgwarner.com

Caution About Forward-Looking Statements

This press release includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These include, among others, statements regarding the performance of the terms of the MOU; the expected supply of REEcorner technology and REE-designed components for use in Cascadia Motion’s electric drive units; the anticipated development, manufacturing, commercialization, distribution, and sale of a next-generation EDU integrating REEcorner technology; the expected availability of drive units as off-the-shelf products; the anticipated phased commercial plan and royalty-bearing arrangement; the potential grant and exercise of any exclusive, time-limited option; the expected timing and scope of any supply, inventory utilization, tooling access, supplier network use, and manufacturing ramp; the parties’ evaluation of demand for complete software-defined vehicle solutions and additional product opportunities; the expected growth of the global EDU market; the belief that the arrangement positions both companies to offer OEMs a scalable, advanced EDU solution with near-term availability; the belief that the collaboration positions REE to meet global demand at scale while laying the groundwork for next-generation, fully by-wire solutions; and the anticipated benefits of the collaboration for OEM programs.

These forward-looking statements are based on current expectations and assumptions and involve risks and uncertainties that may cause actual results to differ materially from those expressed or implied. The memorandum of understanding is non-binding and does not create enforceable obligations to purchase, sell, manufacture, commercialize, distribute, or supply any products, and does not include firm purchase orders or guaranteed volumes, notwithstanding certain optional purchase mechanisms and conditional minimum purchase provisions. Any commercialization, product availability, supply volumes, exclusivity arrangements, royalties, manufacturing rights, or other economic terms will depend on the negotiation and execution of definitive agreements and the placement of purchase orders, customer demand, successful technical development, operational readiness, and the parties’ ability to obtain required supplier and commercial arrangements, and may not occur as currently contemplated or at all. Factors that could cause actual results to differ are discussed in the sections entitled “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors,” and “Operating and Financial Review and Prospects” in REE’s annual report filed with the U.S. Securities and Exchange Commission (the “SEC”) on May 15, 2025, as updated by REE’s subsequent filings with the SEC. The forward-looking statements in this press release speak only as of the date of this press release, and we undertake no obligation to update any forward-looking statements.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/e012b46f-cbee-47b1-8136-045f60e03f15