ReelTime Slashes Potential Dilution by Over 74% with Historic Capital Reset

Rhea-AI Summary

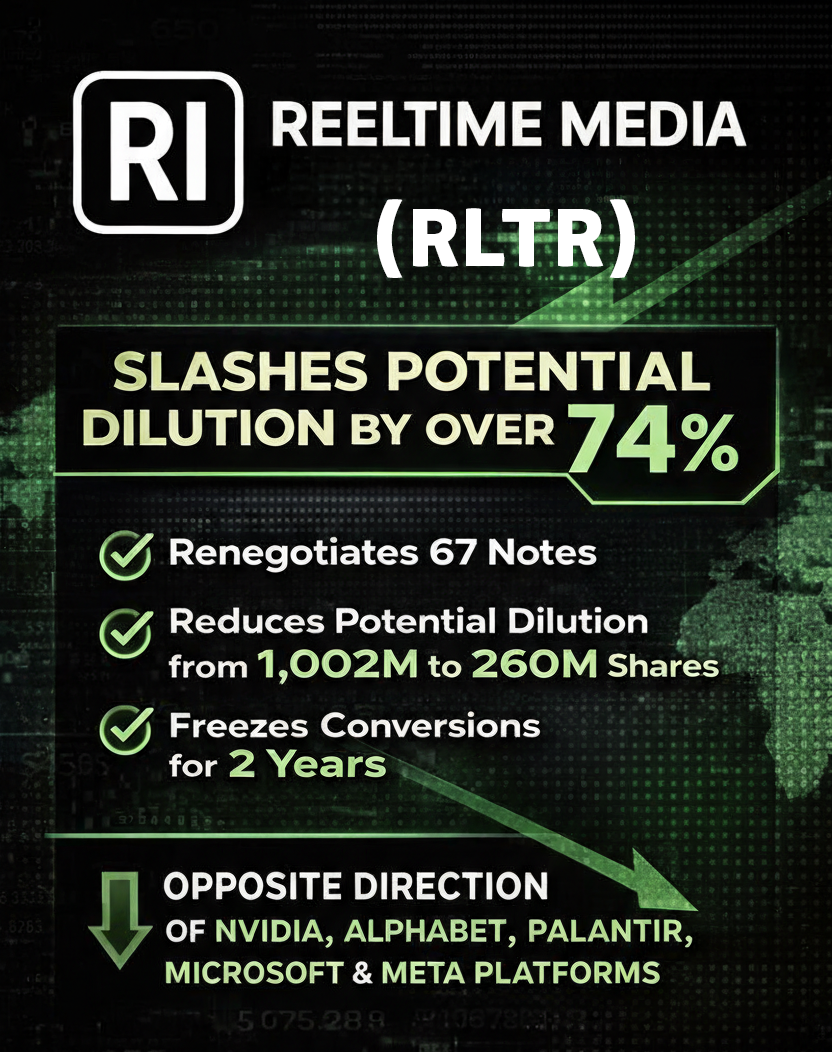

ReelTime Media (RLTR) reached definitive agreements with 18 noteholders to renegotiate 67 outstanding notes, reducing potential dilution by over 74% from ~1.002 billion to ~260 million shares. Notes restart on Feb 22, 2026, mature Feb 22, 2028, carry a 5% interest rate, and are non-convertible for at least two years. The company also reported total debt reduction of ~64% over the past year and a >50% decline in overall debt last week, which management says materially improves per-share value and capital structure.

Positive

- Potential dilution reduced by >74% from ~1.002B to ~260M shares

- Notes restart on 22 Feb 2026 and mature on 22 Feb 2028

- Interest rate reset to 5% across renegotiated notes

- Conversion rights precluded for at least two years

- Total debt reduced approximately 64% year-over-year

Negative

- Remaining potential dilution of approximately 260 million shares

- Legacy notes still outstanding until Feb 22, 2028 maturity

As NVIDIA (NVDA), Alphabet (GOOGL), Palantir (PLTR), Microsoft (MSFT), and Meta Platforms (META) Expand Share Counts to Fund Capital-Intensive AI, ReelTime Media (RLTR) Moves in the Opposite Direction, Strengthening Per-Share Value.

Bothell, WA, Feb. 03, 2026 (GLOBE NEWSWIRE) -- ReelTime Media (OTCID:RLTR) today announced that it has reached definitive agreements with 18 key noteholders to renegotiate 67 outstanding notes, delivering a reduction in potential dilution of more than

(RLTR) Slashes Dilution by

Under the new agreements, notes that had previously matured and were accruing substantially higher interest rates will restart as of February 22, 2026, coinciding with the one-year anniversary of ReelTime’s Reel Intelligence (“RI”) platform, and will mature on February 22, 2028. The revised terms preclude any conversions of the notes for at least two years and reset the interest rate across the notes to

“This restructuring represents a decisive break from legacy financing structures that no longer serve shareholders,” said Barry Henthorn, CEO of ReelTime Media. “We reduced potential dilution by more than

ReelTime’s actions stand in sharp contrast to the broader artificial intelligence sector. While major AI companies such as NVIDIA, Alphabet, Palantir, Microsoft, and Meta Platforms continue to expand share counts through stock-based compensation, equity issuance, and capital-intensive infrastructure investment, ReelTime Media is moving decisively in the opposite direction. By renegotiating legacy obligations, locking out conversions, and materially reducing its future share overhang, the Company is actively shrinking dilution risk. This shareholder-first strategy reflects the fundamentally different economics of ReelTime’s Reel Intelligence (“RI”) platform, which operates without the need for massive, centralized infrastructure, specialized chip dependency, or perpetual equity financing. As a result, value creation at ReelTime is structured to accrue on a per-share basis, rather than being offset by ongoing dilution.

This announcement comes one week after the Company disclosed that it had reduced overall debt by more than

“We believe this positions ReelTime uniquely in the AI and media landscape,” Henthorn added. “As others scale by adding infrastructure and issuing shares, we’re scaling by removing financial drag. That difference matters.”

The renegotiated notes are expected to be fully executed and included in the subsequent event section of the Company’s upcoming annual report.

About ReelTime Media: ReelTime Rentals, Inc. (OTCID:RLTR), doing business as ReelTime Media and ReelTime VR, is a Seattle area-based publicly traded company at the forefront of multimedia production and AI innovation. The company's flagship Reel Intelligence (RI) platform delivers an unprecedented suite of tools for creating images, audio, video, and more. ReelTime has also pioneered virtual reality content development and technology, providing end-to-end production, editing, and distribution services. The company continues to leverage its expertise to transform how content is produced, distributed, and experienced worldwide.

Media Contact

Barry Henthorn, CEO - ReelTime Media

Email: ceo@reeltime.com

Website: www.ReelTime.com

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of applicable securities laws. Actual results may differ materially due to risks and uncertainties, including market conditions, execution risks, and other factors described in the Company’s public filings.

Investor Relations

ReelTime Media

OTC: RLTR

Reel Intelligence

Press Inquiries

Barry B Henthorn

barry [at] baristas.tv

2065790222

https://reeltime.com

4203 223rd PL SE

Bothell, WA 98021

A video accompanying this announcement is available here: https://youtube.com/watch?v=-Pv5AHkQWo8