St. Augustine Announces Positive Results of the Kingking Copper-Gold Project Updated Preliminary Feasibility Study

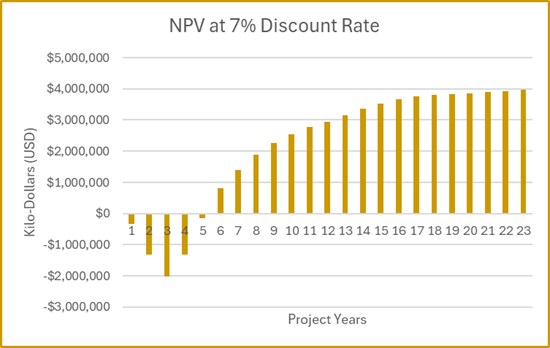

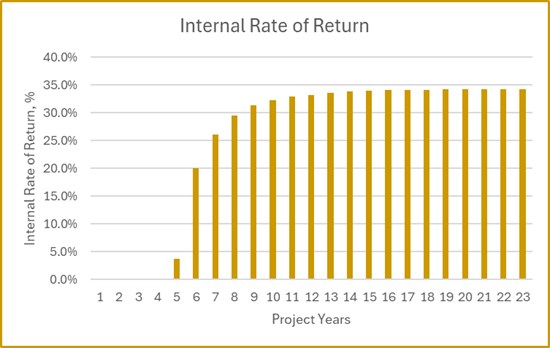

St. Augustine Gold and Copper Limited (TSX: RTLGF) announced positive results from the updated Preliminary Feasibility Study (PFS) for its Kingking Copper-Gold Project in the Philippines. The study reveals a robust post-tax NPV of $4.18 billion and an IRR of 34.2%, with a payback period of 1.9 years.

The project boasts 960 million tonnes of reserves, including 849 million tonnes for milling and 111 million tonnes for leaching. First five-year production estimates average 284 million pounds of copper and 333,000 ounces of gold annually. The initial capital cost is estimated at $2.37 billion, with low C1 cash costs of $0.32 per pound of copper net of gold credits.

The project has secured major regulatory approvals and expanded its development area from 1,656 to over 2,976 hectares. St. Augustine plans to advance to Definitive Feasibility Study and move toward production with optimization studies focusing on improved efficiency and production methods.

St. Augustine Gold and Copper Limited (TSX: RTLGF) ha annunciato risultati positivi dall'aggiornamento dello Studio di Fattibilità Preliminare (PFS) per il suo progetto Kingking Copper-Gold nelle Filippine. Lo studio evidenzia un NPV post-tasse di 4,18 miliardi di dollari e un IRR del 34,2%, con un periodo di ritorno dell'investimento di 1,9 anni.

Il progetto dispone di 960 milioni di tonnellate di riserve, di cui 849 milioni per la lavorazione e 111 milioni per il processo di lisciviazione. Le stime di produzione per i primi cinque anni prevedono in media 284 milioni di libbre di rame e 333.000 once d'oro all'anno. Il costo iniziale di capitale è stimato in 2,37 miliardi di dollari, con bassi costi operativi C1 di 0,32 dollari per libbra di rame al netto dei crediti d'oro.

Il progetto ha ottenuto le principali approvazioni regolatorie e ha ampliato l'area di sviluppo da 1.656 a oltre 2.976 ettari. St. Augustine prevede di procedere con lo Studio di Fattibilità Definitivo e avanzare verso la produzione, con studi di ottimizzazione focalizzati sul miglioramento dell'efficienza e dei metodi produttivi.

St. Augustine Gold and Copper Limited (TSX: RTLGF) anunció resultados positivos del Estudio de Factibilidad Preliminar (PFS) actualizado para su Proyecto Kingking Copper-Gold en Filipinas. El estudio revela un VPN post-impuestos de 4.18 mil millones de dólares y una TIR del 34.2%, con un período de recuperación de 1.9 años.

El proyecto cuenta con 960 millones de toneladas de reservas, incluyendo 849 millones para molienda y 111 millones para lixiviación. Las estimaciones de producción para los primeros cinco años promedian 284 millones de libras de cobre y 333,000 onzas de oro anuales. El costo inicial de capital se estima en 2.37 mil millones de dólares, con bajos costos en efectivo C1 de 0.32 dólares por libra de cobre neto de créditos de oro.

El proyecto ha asegurado las principales aprobaciones regulatorias y ha ampliado su área de desarrollo de 1,656 a más de 2,976 hectáreas. St. Augustine planea avanzar hacia un Estudio de Factibilidad Definitivo y avanzar hacia la producción con estudios de optimización centrados en mejorar la eficiencia y los métodos de producción.

St. Augustine Gold and Copper Limited (TSX: RTLGF)는 필리핀의 Kingking 구리-금 프로젝트에 대한 업데이트된 예비 타당성 조사(PFS)에서 긍정적인 결과를 발표했습니다. 연구 결과는 세후 순현재가치(NPV) 41억 8천만 달러와 내부수익률(IRR) 34.2%를 나타내며, 투자 회수 기간은 1.9년입니다.

이 프로젝트는 9억 6천만 톤의 매장량을 보유하고 있으며, 그 중 8억 4,900만 톤은 제분용, 1억 1,100만 톤은 침출용입니다. 최초 5년간 연평균 생산량은 2억 8,400만 파운드 구리와 33만 3천 온스 금입니다. 초기 자본 비용은 23억 7천만 달러로 추산되며, 금 크레딧을 제외한 구리 파운드당 C1 현금 비용은 0.32달러로 낮습니다.

프로젝트는 주요 규제 승인을 확보했으며 개발 면적을 1,656헥타르에서 2,976헥타르 이상으로 확장했습니다. St. Augustine은 확정 타당성 조사로 진행하고 최적화 연구를 통해 효율성과 생산 방법 개선에 중점을 두어 생산을 향해 나아갈 계획입니다.

St. Augustine Gold and Copper Limited (TSX : RTLGF) a annoncé des résultats positifs issus de l'étude de faisabilité préliminaire (PFS) mise à jour pour son projet Kingking Copper-Gold aux Philippines. L'étude révèle une VAN après impôts de 4,18 milliards de dollars et un TRI de 34,2%, avec une période de récupération de 1,9 an.

Le projet dispose de 960 millions de tonnes de réserves, dont 849 millions pour le broyage et 111 millions pour la lixiviation. Les estimations de production pour les cinq premières années s'élèvent en moyenne à 284 millions de livres de cuivre et 333 000 onces d'or par an. Le coût initial en capital est estimé à 2,37 milliards de dollars, avec des coûts en espèces C1 faibles de 0,32 dollar par livre de cuivre net des crédits d'or.

Le projet a obtenu les principales approbations réglementaires et a étendu sa zone de développement de 1 656 à plus de 2 976 hectares. St. Augustine prévoit de passer à l'étude de faisabilité définitive et d'avancer vers la production avec des études d'optimisation axées sur l'amélioration de l'efficacité et des méthodes de production.

St. Augustine Gold and Copper Limited (TSX: RTLGF) gab positive Ergebnisse der aktualisierten vorläufigen Machbarkeitsstudie (PFS) für sein Kingking Kupfer-Gold-Projekt auf den Philippinen bekannt. Die Studie zeigt einen robusten Nachsteuer-NPV von 4,18 Milliarden US-Dollar und eine IRR von 34,2% mit einer Amortisationszeit von 1,9 Jahren.

Das Projekt verfügt über 960 Millionen Tonnen Reserven, darunter 849 Millionen Tonnen für die Verarbeitung und 111 Millionen Tonnen für die Auslaugung. Die Produktion für die ersten fünf Jahre wird auf durchschnittlich 284 Millionen Pfund Kupfer und 333.000 Unzen Gold jährlich geschätzt. Die anfänglichen Investitionskosten werden auf 2,37 Milliarden US-Dollar geschätzt, mit niedrigen C1-Kosten von 0,32 US-Dollar pro Pfund Kupfer, netto Goldgutschriften.

Das Projekt hat wichtige behördliche Genehmigungen erhalten und die Entwicklungsfläche von 1.656 auf über 2.976 Hektar erweitert. St. Augustine plant, zur endgültigen Machbarkeitsstudie überzugehen und mit Optimierungsstudien zur Verbesserung der Effizienz und Produktionsmethoden die Produktion voranzutreiben.

- Post-tax NPV of $4.18 billion with strong IRR of 34.2%

- Rapid payback period of 1.9 years with benefit-cost ratio of 1.8

- Large reserve base of 960 million tonnes with high-grade copper equivalent of 0.83% in first five years

- Low C1 cash costs of $0.32 per pound of copper net of gold credits

- Major regulatory approvals already in place

- Expanded development area from 1,656 to 2,976 hectares

- Strategic location with direct ship access to largest copper market

- High initial capital cost requirement of $2.37 billion

- Lapsed Mineral Processing Permit requiring renewal

- Extended 38-year mine life may increase operational risks

- Declining ore grades after first five years of production

NPV

Reserve Estimate of 960 million Tonnes 849 million Tonnes of Proven and Probable Milling Reserves and 111 million Tonnes of Proven and Probable Leaching Reserves

Material Regulatory Approvals in Place

Equivalent Mill Copper Grade of

Payable Copper and Gold Production is Estimated to be 4.4 billion

Annual Production Average in the first 5 years will be 284 million

Total MPSA Tenement and Land Area St. Augustine Controls for Development has been increased from 1,656 Hectares to Greater than 2,976 Hectares.

Planned Tradeoff and Optimization Studies Focus on Chloride Leach to support Low Grade Sulfide Stockpile Copper production at the beginning of mine life / Improved Mill Recoveries / Improved Crushing and Grinding Circuit efficiency for levelized mill throughput at total plant capacity

St. Augustine plans to move the large scale open pit Kingking project through Definitive Feasibility and into production on an optimized schedule

Manila, Philippines--(Newsfile Corp. - July 31, 2025) - St. Augustine Gold and Copper Limited (TSX: SAU) ("St. Augustine" or the "Company") is pleased to announce the results of the updated Preliminary Feasibility Study ("PFS") of the Kingking Copper-Gold Project located in Pantukan, Davao de Oro, Philippines. The updated Pre-Feasibility Study allows the Company to initiate work on the Definitive Feasibility Study and expedite the start of construction. The results of the PFS demonstrate extremely robust economics, generating an estimated post-tax net present value ("NPV") of

The Company's senior management team led by Mr. Michael G. Regino, Chief Operating Officer, Mr. Andrew J. Russell, Project Director, and Mr. Nico Paraskevas, Executive Director, completed the effort over the last 14 months.

Mr. Regino commented: "The update to the Pre-Feasibility Study for Kingking is a long-awaited milestone for our shareholders, especially in the context of recent changes to the Philippine mining regulatory structure which have paved the way for a world class project development. The benefit of the project to the Philippine economy as well as the local communities cannot be overstated. The location in Southeast Asia is enviable with direct ship access to the largest copper market on earth. We look forward to participating in these critical metals supply chains."

Mr. Regino further stated: "The first 5 years of Kingking gold production will make it one of the top 25 worldwide gold producers at more than 333,000 oz per year, excluding its substantial copper production. The combined copper and gold production brings Kingking into the top 10 copper producing mines on a copper equivalent basis at more than 204,000 equivalent tonnes per year."

The Company believes that following completion of the update to the PFS, the opportunity to move the Kingking project through the Definitive Feasibility process and into production can soon be realized. Mr. Russell noted, "This project will produce copper net of by-product credits at one of the lowest rates of any operation worldwide. The tradeoff studies and recommendations provide a clear path to improved efficiencies, levelized production, and operational excellence. We have some of the world's best engineering firms supporting us in this endeavor."

Mr. Paraskevas further stated: "Open pit mining projects of the scale of Kingking are rare, and even more so considering that the Kingking project has substantially completed applicable permitting requirements and is essentially shovel ready. We are very pleased with the results of the Preliminary Feasibility Study, which confirm the strong technical and economic potential of our Kingking project. These results reinforce our confidence in delivering value to our stakeholders and further demonstrate the significant opportunity that Kingking represents for the region and our shareholders. We look forward to advancing the project towards a definitive feasibility study and continuing our engagement with stakeholders and partners as we progress."

Permitting Status

The Environmental Impact Statement (EIS) and Declaration of Mine Project Feasibility ("DMPF") were submitted to the Philippine Government in 2012. The Environmental Compliance Certificate (ECC) was granted in February 2015 (EIS approval) and Declaration of Mining Project Feasibility (DMPF) was approved in January 2016. The Company has confirmed with the Mines and Geosciences Bureau (MGB) and Environmental Management Bureau (EMB) that the DMPF and ECC are in good standing. Additionally, as required by the EMB, the Company has secured ISO 14001: 2015 Certification for Environmental Management System (EMS) in 2018, which remains valid. The Mineral Processing Permit (MPP) is currently lapsed because of the Company's inability to proceed to the development of the Kingking Project due to a combination of regulatory restrictions, including the 2017 open pit mining ban which was only lifted in late December 2021, and the operational disruptions caused by the COVID-19 pandemic. These unforeseen events significantly delayed the commencement of the Kingking Project. The Company is now actively working to complete the requirements to secure the renewal of its MPP.

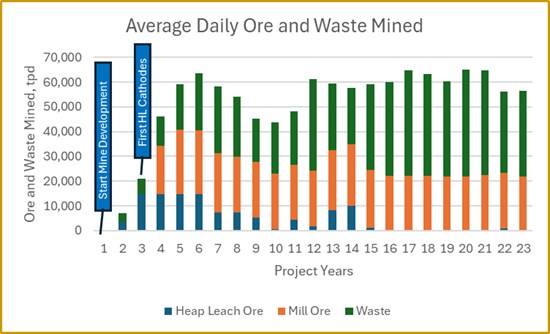

Key Project Indicators for the First 23 years of Project Life are illustrated below: Mine development and construction start in Year 1 and continues into Year 2 with some heap leach ore stockpiled. Heap Leach and SX-EW construction complete in Year 2 and SX-EW cathode is produced in Year 3. Mill construction is completed in Year 3, and copper-gold concentrate is produced in Year 4. Gold Doré bars from gravity concentrate are produced starting in Year 4.

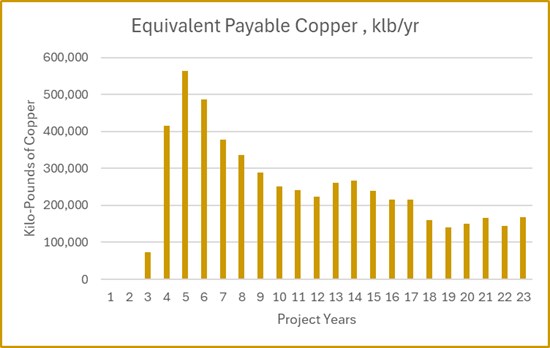

Average annual production during the first five years is projected at 284 million

Figure 1 - Annual Mining of Ore and Waste, LOM W:O Ratio 0.872

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3477/260781_8ad8b17694fa5afa_011full.jpg

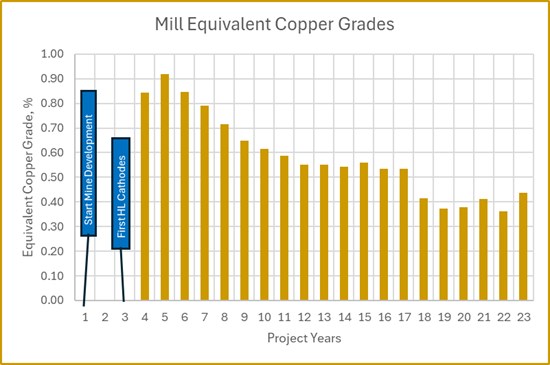

Figure 2 - Annual Mill Equivalent Copper Ore Grade,

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3477/260781_8ad8b17694fa5afa_012full.jpg

Figure 3 - Annual Equivalent Pounds of Payable Cu, Averages 436 million lbs. for Years 4-84

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3477/260781_8ad8b17694fa5afa_013full.jpg

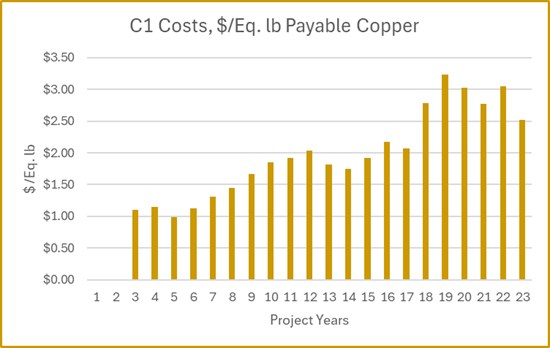

Figure 4 - Annual C1 Costs, USD (2024 figures) per Pound of Equivalent Payable Copper5

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3477/260781_8ad8b17694fa5afa_014full.jpg

Figure 5 - Cumulative, by year, Net Present Value at

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3477/260781_8ad8b17694fa5afa_015full.jpg

Figure 6 - Cumulative, by year, Project Internal Rate of Return, Large Rapid Project Return on Investment

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3477/260781_8ad8b17694fa5afa_016full.jpg

The PFS was prepared by M3 Engineering & Technology Corporation of Tucson, Arizona ("M3"). The resource, reserve, mine plan, mine operating costs and mine capital costs were developed by Independent Mining Consultants Inc. ("IMC") of Tucson, Arizona. M3 evaluated mineral process testing, provided process and infrastructure designs, and estimated operating and capital costs for the rest of the project outside of the mining area. The Company will file the full NI 43-101 technical report on SEDAR+ and the Company's website within 45 days. All dollar figures in this news release are in 2024 USD.

Reserve Base

The table below presents the mineral reserve for the Kingking Project based on the mine and plant production schedules developed for the study. The mineral reserve amounts to 849 million tonnes of proven and probable milling reserves grading

Table 1 - Mineral Reserve

| Mineral Reserve (Milling): | Tonnes Mt | NSR ($/t) | Tot Cu (%) | Sol Cu (%) | Gold (g/t) | Copper (Mlbs) | Gold (Koz) |

| Proven Mineral Reserve: | 142.3 | 37.83 | 0.33 | 0.12 | 0.49 | 1,037 | 2,253 |

| Oxide Mill Ore | 45.4 | 58.56 | 0.52 | 0.30 | 0.71 | 516 | 1,033 |

| Sulfide Mill Ore | 76.5 | 31.90 | 0.26 | 0.04 | 0.45 | 444 | 1,117 |

| Low Grade Stockpile | 20.4 | 13.93 | 0.17 | 0.02 | 0.16 | 78 | 103 |

| Probable Mineral Reserve: | 706.5 | 25.51 | 0.24 | 0.04 | 0.33 | 3,803 | 7,519 |

| Oxide Mill Ore | 52.0 | 43.46 | 0.36 | 0.21 | 0.59 | 412 | 986 |

| Sulfide Mill Ore | 499.7 | 27.08 | 0.25 | 0.03 | 0.36 | 2,776 | 5,751 |

| Low Grade Stockpile | 154.9 | 14.43 | 0.18 | 0.02 | 0.16 | 615 | 782 |

| Proven/Probable Reserve: | 848.9 | 27.57 | 0.26 | 0.06 | 0.36 | 4,840 | 9,771 |

| Oxide Mill Ore | 97.4 | 50.50 | 0.43 | 0.25 | 0.64 | 928 | 2,018 |

| Sulfide Mill Ore | 576.2 | 27.72 | 0.25 | 0.03 | 0.37 | 3,220 | 6,868 |

| Low Grade Stockpile | 175.3 | 14.37 | 0.18 | 0.02 | 0.16 | 692 | 885 |

| Mineral Reserve (Leaching): | Tonnes Mt | NSR ($/t) | Tot Cu (%) | Sol Cu (%) | Gold (g/t) | Copper (Mlbs) | Gold (Koz) |

| Proven Mineral Reserve | 50.2 | 14.97 | 0.25 | 0.16 | N.A. | 275 | N.A. |

| Probable Mineral Reserve | 60.4 | 12.22 | 0.21 | 0.12 | N.A. | 280 | N.A. |

| Prov/Prob Leach Reserve | 110.5 | 13.47 | 0.23 | 0.14 | N.A. | 555 | N.A. |

| Copper Mineral Reserve Milling and Leaching | Tonnes Mt | NSR ($/t) | Tot Cu (%) | Sol Cu (%) | Gold (g/t) | Copper (Mlbs) | Gold (Koz) |

| Proven/Probable Reserve | 959.4 | 25.95 | 0.26 | 0.06 | N.A. | 5,396 | N.A. |

| Proven Mineral Reserve | 192.5 | 31.87 | 0.31 | 0.13 | N.A. | 1,312 | N.A. |

| Probable Mineral Reserve | 766.9 | 24.46 | 0.24 | 0.05 | N.A. | 4,083 | N.A. |

Mining Schedule

The PFS assumes a base case ore delivery rate of 100,000 tpd considering 40 ktpd to an on-off heap leach and 60 ktpd to mill. IMC prepared a 31-year mine plan followed by 7 years of processing stockpiled ore. Heap leach ore declines in year 7 and is much reduced after year 15. The mine schedule excludes inferred mineral resources, which are waste in the mine reserve analysis. The mine schedule has six development phases and is optimized for metals production at the mill while maintaining low waste to ore ratio in the early years. The availability of high quantities of near surface copper oxide leachable material in the early years reduces the pre-stripping to 9,800 tonnes of waste and allows for early development for copper heap leach processing, which starts in year 3, approximately 1 year before the mill starts. A mill ore stockpile near the crusher of 175 million tonnes of low-grade sulfide ore (

Table 2 - Production Summary

| First 5 Years | Life of Mine | ||

| Processed Tonnes | Mill | 96 million* | 849 million |

| Heap Leach | 69 million | 111 million | |

| Copper (%) | Mill | 0.49 | 0.26 |

| Heap Leach | 0.26 | 0.23 | |

| Gold (g/tonne) | Mill | 0.67 | 0.36 |

| Waste to Ore Ratio | 0.54 | 0.87 |

*Four years of mill production. Mill plant starts one year after heap leach.

Development Overview

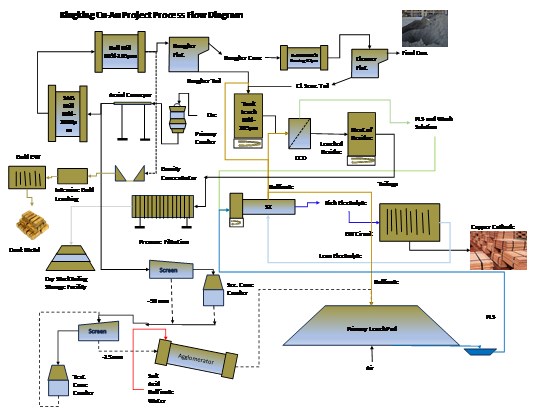

The proposed open pit mine and processing plant will produce copper/gold concentrate, copper cathode, and gold Doré bullion. Ore will be transported from the primary crusher located near the mine to the mill and heap leach area by aerial conveyor. Higher-grade oxide dominant ore containing above cutoff grade gold and all sulfide ore will be treated in a concentrator at 60,000 tpd. The concentrator process will consist of crushing, grinding, gravity concentration of free gold, and flotation of sulfide copper and gold to concentrate. An agitated leach circuit will leach oxide copper from mill flotation tails. Oxide ore containing little or no gold, below cutoff grade, will be treated in a heap leach at 40,000 tpd. The heap leach process will consist of crushing, agglomeration, and leaching utilizing on-off cells. Pregnant solutions from the mill agitated leach and heap leach processes will report to a common SX-EW facility for production of cathode copper. Milling copper recoveries of

Figure 7 - Kingking Cu-Au Project Process Flow Diagram

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3477/260781_8ad8b17694fa5afa_017full.jpg

Production Rates, Capital Costs, Operating Costs, Metal Prices and Financial Valuation

Project production, capital and operating costs, metal prices, financials and sensitivities are shown in the table below.

Table 3 - Project Production, Costs, Metal Prices, Financials, and Sensitivities

| Base Case - 40ktpd Leach / 60ktpd Mill 31-yr Open Pit followed by 7-yr Sulfide Stockpile | Base Case | Case 1 | Case 2 | Case 3 | |

| Ore Production Rate LOM (ktonnes/day) | 69 | 69 | 69 | 69 | |

| Projected Mine Life (yrs) | 38 | 38 | 38 | 38 | |

| Metal Price Assumptions | |||||

| Copper ($/lb) | 4.30 | 5.16 | 4.30 | 4.30 | |

| Gold ($/oz.) | 2,150 | 2,580 | 2,150 | 2,150 | |

| Average Annual Production | |||||

| Gold | (oz.) (kg) | 185,828 5,780 | 185,828 5,780 | 185,828 5,780 | 185,828 5,780 |

| Copper | (thousand lbs.) (metric tons) | 119,633 54,265 | 119,633 54,265 | 119,633 54,265 | 119,633 54,265 |

| Copper Equivalent | (thousand lbs.) (metric tons) | 212,547 96,411 | 212,547 96,411 | 212,547 96,411 | 212,547 96,411 |

| LOM Revenue ( | |||||

| Gold | |||||

| Copper | |||||

| Less Treatment and Refining Charges | |||||

| Total Revenue | |||||

| Avg. Annual Net Cash Flow ( | |||||

| LOM Total Net Cash Flow ( | |||||

| Initial Capital ( | |||||

| Sustaining Capital ( | |||||

| LOM Operating Costs | |||||

| Mining Cost ($/tonne mined) /($/tonne ore)* | 2.30/4.31 | 2.30/4.31 | 2.76/5.17 | 2.30/4.31 | |

| Process Plants Operating Cost ($/tonne ore) | 10.42 | 10.42 | 12.51 | 10.42 | |

| General Administration ($/tonne ore) | 1.15 | 1.15 | 1.38 | 1.15 | |

| Other ($/tonne ore) | 0.23 | 0.23 | 0.28 | 0.23 | |

| Total Operating Cost ($/ tonne ore) | 16.11 | 16.11 | 19.34 | 16.11 | |

| C1 Cost/ Copper Equivalent lb. | |||||

| C1 Cost / lb. Copper net of by products | |||||

| Pre-Tax Economic Indicators | |||||

| NPV @ | |||||

| IRR (%) | |||||

| Payback (yrs) | 1.9 | 1.5 | 2.0 | 2.2 | |

| After-Tax Economic Indicators** | |||||

| NPV @ | | ||||

| IRR (%) | |||||

| Payback (yrs) | 1.9 | 1.5 | 2.0 | 2.2 | |

*Mine operating costs reflect higher cost contract mining.

**Assumes an income tax holiday for the first ten years of the project

Opportunities

Opportunities to improve project economics are being evaluated to be considered in the Definitive Feasibility Study. These include the following:

Chloride leach of low-grade sulfide stockpile on the leach pad which will allow for recovery of metals much earlier in the mine life and associated cash flows. Additional assessment of extending leach pad life through processing only higher grades in the mill.

Grinding efficiency assessment to eliminate ore hardness throughput constraint. This may include additional ball mill capacity at appropriate interval or use of roll crushing or pre-crushing of a portion of mill ore.

Locked cycle flotation optimization with new reagent suites to increase mill copper and gold recovery to copper concentrate.

Substitution of secondary crushing with high-pressure grinding rolls for the SAG/pebble crusher circuit may provide significant electrical operating cost savings.

NATIONAL INSTRUMENT 43-101 COMPLIANCE

The following Qualified Persons under National Instrument 43-101 ("NI 43-101") have reviewed and approved of the scientific, technical and economic information contained in this news release: Daniel Roth, PE, P.Eng. and Benjamin Bermudez, PE of M3 Engineering & Technology Corp., Art S. Ibrado, PE of Fort Lowell Consulting, Michael G. Hester, FAusIMM of Independent Mining Consultants, Inc., Donald Earnest, P.Geo., SME-RM of Resource Evaluation Inc., and John G. Aronson, SME, CEP of ESG Resiliency Plus, LLC.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This announcement includes certain "forward-looking statements" within the meaning of Canadian securities legislation. All statements, other than statements of historical fact included herein are forward-looking statements. Forward-looking statements involve various risks and uncertainties and are based on certain factors and assumptions. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include uncertainties related to fluctuations in gold, copper and other commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; uncertainties relating to the completion of a bankable feasibility study; uncertainty of estimates of capital and operating costs, recovery rates production estimates and estimated economic return; the need for cooperation of the Company's joint venture partner and government agencies in the development of the Company's mineral projects; the need to obtain additional financing to develop the Company's mineral projects; the possibility of delay in development programs or in construction projects and uncertainty of meeting anticipated program milestones for the Company's mineral projects; and other risks and uncertainties disclosed under the heading "Risk Factors" in the Annual Information Form dated March 22, 2013, and filed with Canadian securities regulatory authorities on the SEDAR+ website at www.sedarplus.ca.

For Further Investor Information Please Contact:

Nicolaos Paraskevas

Email: info@kingking.ph

St. Augustine Gold and Copper Ltd.

1 The benefit cost ratio (BCR) is calculated by dividing the after-tax net present value (at

2 The LOM waste to ore ratio is from the IMC mine schedule file dated December 23, 2023.

3 The equivalent copper grade is the weighted average over the first five years of mill operations, accounting for copper in concentrate, tailings leach cathode, and copper equivalent from gold in concentrate and bullion. It is calculated by dividing the total equivalent copper (in tonnes) by the total ore treated.

4 The figure represents the average equivalent payable copper produced over Years 3 to 8, including Heap Leach cathode from Year 3, divided by 5. Excluding the Year 3 Heap Leach cathode results in a weighted average of 427,835 klb/year.

5 These costs include the following: concentrate shipping, smelting and refining; cathode shipping; gold shipping and refining, mine site operating costs.

6 The mill equivalent copper grade is calculated by converting the payable gold revenue from the milling ore to equivalent copper by dividing the payable gold revenue by the price of copper in the model (

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/260781