Rezolute Provides Insights from its Phase 3 sunRIZE Study in Congenital Hyperinsulinism and Shares Findings from its Expanded Access Program in Tumor Hyperinsulinism

Rhea-AI Summary

Rezolute (Nasdaq: RZLT) reported Phase 3 sunRIZE results in congenital hyperinsulinism and shared Expanded Access Program (EAP) outcomes in tumor HI on Jan 7, 2026.

The company said sunRIZE did not meet its primary or key secondary endpoints but observed pharmacologic activity: target therapeutic concentrations in 5 mg/kg and 10 mg/kg arms and sensitive biomarker increases in circulating insulin. All 59 completers entered an open-label extension (OLE); 57 remain with exposures ~6 weeks to ~18 months.

In the EAP, 75% of patients on IV dextrose/TPN discontinued infusions. Rezolute plans FDA discussions in Q1 2026 and expects upLIFT topline results in H2 2026.

Positive

- Target drug levels achieved in 5 mg/kg and 10 mg/kg groups

- Biomarker responses showed increased circulating insulin indicative of activity

- All 59 sunRIZE completers entered the open-label extension

- 57 participants remain in OLE with up to ~18 months exposure

- 75% of EAP patients on IV dextrose/TPN discontinued infusions

Negative

- sunRIZE failed primary endpoint (hypoglycemia events)

- Key secondary endpoint (time in hypoglycemia) also not met

- Reductions vs placebo were not statistically significant

- Pronounced placebo/study effect complicated ambulatory endpoints

- upLIFT topline results delayed until H2 2026

News Market Reaction – RZLT

On the day this news was published, RZLT gained 23.04%, reflecting a significant positive market reaction. Argus tracked a peak move of +14.4% during that session. Our momentum scanner triggered 38 alerts that day, indicating elevated trading interest and price volatility. This price movement added approximately $41M to the company's valuation, bringing the market cap to $221M at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

RZLT was down 2.8% while close biotech peers were mixed: RIGL +4.29%, RLAY +4.48%, VIR +3.03%, KALV -1.33%, TBPH -0.22%. This points to stock-specific dynamics rather than a broad sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 11 | Phase 3 topline | Negative | -87.2% | sunRIZE failed primary and key secondary endpoints in congenital HI. |

| Nov 10 | Equity inducement | Neutral | -7.5% | Inducement stock options granted under Nasdaq Listing Rule 5635(c)(4). |

| Nov 06 | Earnings update | Positive | +2.7% | Reported Q1 FY26 results and confirmed timelines for sunRIZE and upLIFT. |

| Nov 05 | Investor event | Positive | +5.1% | Announced virtual event to review ersodetug Phase 3 programs and markets. |

| Oct 15 | Conference participation | Neutral | +6.9% | Planned appearances at multiple late-2025 healthcare investor conferences. |

Clinical trial news has driven large moves, including a sharp selloff after the initial sunRIZE miss, while corporate and conference updates have produced smaller, mixed reactions.

Over the past nine months, Rezolute has progressed ersodetug through key Phase 3 milestones in congenital and tumor hyperinsulinism. The company moved from interim DMC support and full enrollment in sunRIZE to baseline data disclosure and FDA alignment on using sunRIZE as confirmatory evidence. The December 2025 topline sunRIZE miss triggered a steep -87.2% reaction. Today’s announcement reframes those results with detailed pharmacologic insights and expanded access outcomes in tumor HI, tying directly back to prior clinical communications.

Market Pulse Summary

The stock surged +23.0% in the session following this news. A strong positive reaction aligns with how prior clinical milestones sometimes produced substantial moves, as seen with earlier sunRIZE and upLIFT updates. Investors previously repriced the stock sharply after the initial sunRIZE miss, so any renewed optimism could reflect perceived value in pharmacologic activity and tumor HI EAP outcomes. However, the failed primary and key secondary endpoints, reliance on open-label and EAP data, and the need for statistically robust upLIFT results in ~16 patients could limit sustainability.

Key Terms

phase 3 medical

expanded access program regulatory

biomarker medical

open-label extension medical

breakthrough therapy designation regulatory

insulinomas medical

total parental nutrition (tpn) medical

glucose infusion rate medical

AI-generated analysis. Not financial advice.

Company believes that data from sunRIZE and the Expanded Access Program (EAP) provide evidence of activity of ersodetug in both indications

Company plans to meet with FDA to align on path forward for congenital HI

REDWOOD CITY, Calif., Jan. 07, 2026 (GLOBE NEWSWIRE) -- Rezolute, Inc. (Nasdaq: RZLT) (“Rezolute” or the “Company”), a late-stage rare disease company focused on treating hypoglycemia caused by all forms of hyperinsulinism (HI), today shared observations from the Phase 3 sunRIZE study in patients with congenital HI and provided details on the treatment of tumor HI patients with ersodetug under the Company’s EAP.

Congenital HI

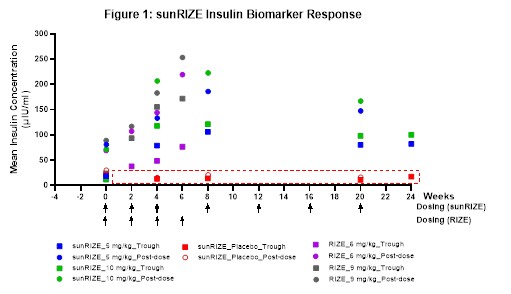

While sunRIZE did not meet its primary (hypoglycemia events) or key secondary (time in hypoglycemia) endpoints, the Company believes that the totality of the data further supports previous clinical evidence that ersodetug is active against hypoglycemia in patients. Specifically, there was evidence of pharmacologic activity as target therapeutic drug concentrations were achieved in both treatment groups (5 mg/kg and 10 mg/kg) with highly sensitive biomarker responses (increases in circulating insulin) in the active treatment groups that are indicative of reduced insulin activity at its receptor. Notably, these responses were consistent with those of the Company’s Phase 2 RIZE study (see Figure 1).

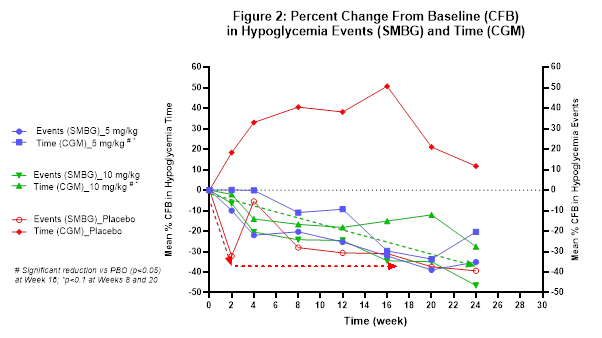

The study also demonstrated reductions from baseline in events and time in hypoglycemia in both treatment groups, but not enough to be statistically significant compared to the pronounced study effect in the placebo arm. While in the early stages of evaluating study data and understanding the results, learnings in the field of glycemic control and initial observations from sunRIZE inform the Company’s belief that the pharmacologic response can translate to clinical efficacy. The magnitude of the placebo response observed for hypoglycemia events reveals a significant challenge in studying glucose in an ambulatory setting, where factors such as intensive monitoring where caregivers receive alerts regarding hypoglycemic events and frequent clinical interactions can independently influence outcomes.

The Company believes that the extent of reduction from baseline in hypoglycemia events and time in hypoglycemia relative to placebo (see Figure 2) may have been impacted by the prolonged treatment duration of six months and the fact that glucose monitoring is necessary for safe patient management while also serving as the key endpoint in the study. This sentiment has been shared with the Company by investigator physicians as well as study participants. The Company is currently exploring how to characterize the overall study dynamic including evaluating patient-reported quality of life outcomes.

In light of these limitations, assessing the potential benefit in the ongoing open-label extension (OLE) portion of the study will be important. All 59 participants who completed the study elected to continue to receive ersodetug in the OLE. To date, 57 participants remain in the OLE, with an exposure duration ranging from ~6 weeks for the most recently entered patients, to ~18 months. The Company believes that a potential indicator of ersodetug’s underlying efficacy is that several children in the OLE have been able to stop taking all other therapies and are now receiving ersodetug as monotherapy.

The Company looks forward to interacting with FDA in Q1 2026 under its Breakthrough Therapy Designation to further characterize these and other clinical outcomes to inform a review of the full sunRIZE dataset with the intent of exploring options for this indication.

Tumor HI

Over the past two years, Rezolute has collaborated with investigators across the United States and in Europe to provide ersodetug to more than a dozen patients with severe and refractory hypoglycemia due to tumor HI, including malignant pancreatic neuroendocrine tumors (insulinomas) and non-islet cell tumors. The Company has previously reported that the therapy was generally well-tolerated, and that patients experienced substantial improvement in hypoglycemia, which led to a reduction in the rate of glucose infusion in the hospital (GIR) or the complete discontinuation of infusion and discharge from the hospital.

Presented in a table filed today on Form 8-K with the U.S. Securities and Exchange Commission are cumulative data from the initial 9 participants in the EAP, including patient characteristics, ersodetug dosing, and observed outcomes. This same data cohort was provided to FDA last year in support of the Company’s request for Breakthrough Therapy Designation and subsequently informed the discussion with FDA that led to revision of the Phase 3 upLIFT study in tumor HI to a single arm, open-label study. In summary,

This outcome is highly relevant to the ongoing upLIFT study and provides additional evidence of the activity and potential efficacy of ersodetug across various forms of HI. Notably, the GIR assessment in the EAP is the primary endpoint in upLIFT, which measures the number of participants (out of ~16) who achieve at least a

About sunRIZE

The Phase 3 sunRIZE study (RZ358-301) was a multi-center, randomized, double-blind, placebo-controlled, parallel arm study designed to evaluate the efficacy and safety of ersodetug in patients with congenital hyperinsulinism (HI), ages 3 months to 45 years old, who were experiencing continued hypoglycemia on currently available standard of care (SOC). Eligible participants were randomized to one of three treatment arms to receive either ersodetug (5 or 10 mg/kg) or matched placebo-control as add on to existing SOC. Study drug was administered every other week during an initial loading phase, and then every 4 weeks during the 6-month controlled pivotal treatment period. Following the pivotal treatment phase of the study, participants could roll-over into an optional open-label extension phase to continue to receive ersodetug.

The study enrolled 63 participants in more than a dozen countries around the world, inclusive of U.S. patients. The primary and key secondary efficacy endpoints in the study were the change from baseline in the average number of hypoglycemia events per week and the average percent time in hypoglycemia, respectively, over six months of treatment.

About Ersodetug

Ersodetug is a fully human monoclonal antibody that binds allosterically to the insulin receptor to decrease receptor over-activation by insulin and related substances (such as IGF-2) in the setting of hyperinsulinism (HI), thereby improving hypoglycemia. Because ersodetug acts downstream from the pancreas, it has the potential to be universally effective at treating hypoglycemia due to any congenital or acquired form of HI.

About Rezolute, Inc.

Rezolute is a late-stage rare disease company focused on treating hypoglycemia caused by hyperinsulinism (HI). The Company’s antibody therapy, ersodetug, is designed to treat all forms of HI and has been studied in clinical trials and used in real-world cases for the treatment of both congenital and tumor HI. For more information, visit www.rezolutebio.com.

Forward-Looking Statements

This release, like many written and oral communications presented by Rezolute and our authorized officers, may contain certain forward-looking statements regarding our prospective performance and strategies within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and are including this statement for purposes of said safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe future plans, strategies, and expectations of Rezolute, are generally identified by use of words such as "anticipate," "believe," "estimate," "expect," "intend," "plan," "project," "seek," "strive," "try," or future or conditional verbs such as "could," "may," "should," "will," "would," or similar expressions. These forward-looking statements include, but are not limited to, the potential efficacy of ersodetug in treating hypoglycemia associated with either congenital or tumor HI, the possibility of FDA agreeing to a streamlined path for advancing the congenital HI program notwithstanding the lack of statistical significance in the sunRIZE study, or the timing of the release of topline results for upLIFT. Our ability to predict results or the actual effects of our plans or strategies is inherently uncertain. Accordingly, actual results may differ materially from anticipated results. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release. Except as required by applicable law or regulation, Rezolute undertakes no obligation to update these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were made. Important factors that may cause such a difference include any other factors discussed in our filings with the SEC, including the Risk Factors contained in Rezolute’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which are available at the U.S. Securities and Exchange Commission’s website at www.sec.gov. You are urged to consider these factors carefully in evaluating the forward-looking statements in this release and are cautioned not to place undue reliance on such forward-looking statements, which are qualified in their entirety by this cautionary statement.

Rezolute Contacts:

Christen Baglaneas

cbaglaneas@rezolutebio.com

508-272-6717

Carrie McKim

cmckim@rezolutebio.com

336-608-9706

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/29e42211-3bf5-4995-a1c1-9642d5f28ab4

https://www.globenewswire.com/NewsRoom/AttachmentNg/9bdb41c4-5a9f-4da2-894e-2bf0b1ca7b40