SAGA Metals Provides Update on Double Mer Uranium Project: A Well-Positioned Asset in North America as the Uranium Boom Accelerates

Rhea-AI Summary

SAGA Metals (OTCQB: SAGMF) on Nov 3, 2025 updated investors on its 100%‑owned Double Mer Uranium Project in Labrador. The 25,600‑hectare property hosts an 18 km uranium trend with three drill targets (Luivik, Nanuk, Katjuk), surface assays to 0.428% U3O8 and radiometric peaks to 27,000 CPS. The project is drill‑ready with permits secured and a refurbished 10‑person winter camp for year‑round work. The release also highlights market context for rising uranium demand and announces issuance of 950,000 options at $0.435 (3‑year term, staged vesting).

Positive

- Drill permits secured for maiden diamond program

- Assays to 0.428% U3O8 confirming near‑surface mineralization

- 18 km contiguous uranium‑rich strike with three target zones

- Fully refurbished 10‑person winter camp for year‑round operations

Negative

- Exploration stage with no NI 43‑101 mineral resource reported

- 950,000 options issued at $0.435 could dilute shareholders if exercised

News Market Reaction

On the day this news was published, SAGMF declined 5.86%, reflecting a notable negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, British Columbia, Nov. 03, 2025 (GLOBE NEWSWIRE) -- SAGA Metals Corp. (“SAGA” or the “Company”) (TSXV: SAGA) (OTCQB: SAGMF) (FSE: 20H), a North American exploration company advancing critical mineral discoveries, is strategically positioned to capitalize on the explosive growth in the uranium sector as global nuclear commitments and artificial intelligence (AI) infrastructure propel demand far beyond current supply horizons.

SAGA’s Double Mer Uranium Project: Large-Tonnage Potential in Labrador

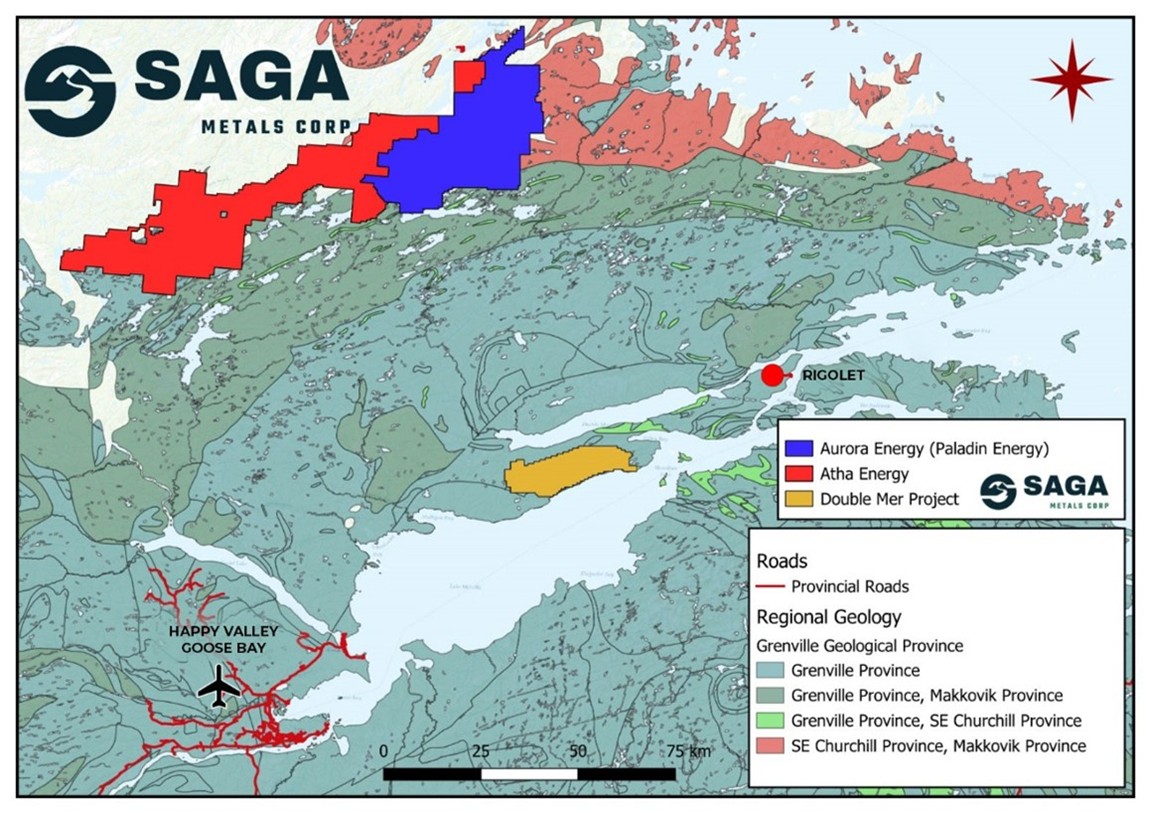

Amid this uranium fervor, SAGA Metals is well-positioned with its high potential Double Mer Uranium Project in Labrador, Canada—a drill-ready asset primed to contribute to North America’s critical minerals security. Located 90 km northeast of Happy Valley-Goose Bay near the prolific Central Mineral Belt (CMB), the

Figure 1: Regional map of the Double Mer Uranium Project in Labrador, Canada

SAGA Metals recent exploration efforts at the Double Mer Uranium Project have confirmed*:

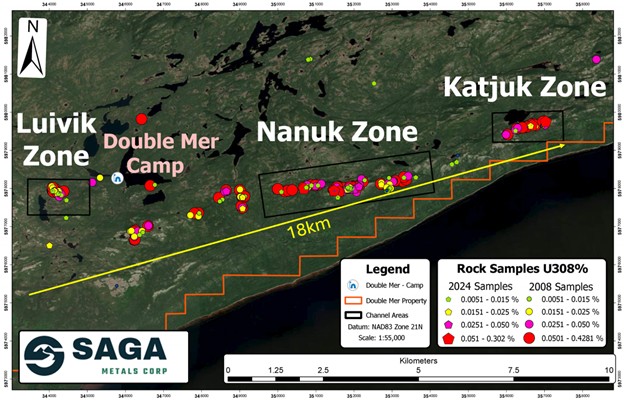

- High-Potential Uranium Zones Identified for Drilling: Three key zones—Luivik, Nanuk, and Katjuk—have been pinpointed along an expansive east-west 18-kilometer uranium-rich trend. Each zone shows U3O8 mineralization in pegmatites and structurally enriched formations (see Figure 2 below).

- Assays Validate Targets: Rock sampling in 2024 confirms the uranium potential across all three zones, enhancing confidence in the project's viability with surface samples showing uranium oxide (U3O8) concentrations as high as

0.428% U3O8 - Count-per-second (CPS) radiometric peaks up to 27,000—surpassing historical benchmarks

- Observed uranophane staining (oxidization of uranium minerals) on the surface of pegmatites across the 18 km trend with confirmed uraninite minerals hosted within.

- Full Winterized Camp Completed in early 2025 and ready for 10 person teams.

(* Press released results: “SAGA Metals Reports Channel Sample Assay Results at Double Mer Uranium Project”, December 3, 2024)

Mineralization at Double Mer occurs in multiple styles, including uraninite-bearing pegmatites, sheared gneiss, and iron carbonate-rich zones with sheeted smoky quartz veins, indicating large-tonnage potential open along strike and at depth.

Figure 2: Map of the Double Mer Uranium Project highlight the 18km trend verified through surface sample and uranium count radiometrics

Selected samples across the 18 km strike were collected by SAGA’s exploration team during prior exploration surface programs for the purposes of petrography, mineralogical and petrochemical interpretations. The pegmatites can be subdivided into two subgroups based on radioelement and rare earth-bearing minerals in association with the mafic mineral abundance of biotite. The results of this analysis confirmed the presence of uraninite and have shown unequivocally that both pegmatite subgroups identified on the property are genetically related and belong to the same magmatic event.

Figure 3: Highly strained granitic pegmatite showing an East-West foliation and significant uranophane mineralization located in the Katjuk (Arrow) Zone. One of multiple pegmatite units which are interleaved between a gossanous and silicified biotite schist and granitic gneiss.

Double Mer Uranium Project: Fully Permitted and Drill-Ready

The project is fully drill-ready, with permits secured for a maiden diamond drill program aimed at systematically testing the high-grade anomalies. Supporting this is SAGA's ten-person winterized exploration camp, refurbished earlier in 2025 with upgrades to personnel cabins, kitchen, dry facilities, electrical systems, generator, and dock—ensuring year-round operations in Labrador.

Figure 4: SAGA’s Double Mer Uranium Project Base Camp

"This uranium bull market appears to be just getting started as Uranium futures rose past

The Uranium Market in a snapshot - Canadian firms Cameco, Brookfield sign

The uranium market is experiencing a renaissance, with major industry players ramping up involvement to meet escalating needs1. Leading producer Cameco Corporation recently announced a landmark

Supply constraints are intensifying the bullish outlook, with annual global reactor demand estimated at 180 million pounds U3O8 consistently outpacing primary production throughout 2025, creating a structural deficit projected to widen over the next decade5. The World Nuclear Association forecasts a 25

A key driver of this demand explosion is the AI revolution, where data centers' electricity consumption is projected to double by 2030 and reach nearly

Compounding these market dynamics, the U.S. government has taken aggressive steps to secure domestic uranium supply and revitalize its nuclear sector. In May 2025, President Trump signed four executive orders aimed at quadrupling U.S. nuclear capacity to 400 GW by 2050, including directives to expand domestic uranium mining, processing, and enrichment while reducing reliance on foreign sources like Russia and China10. The Uranium for Energy Independence Act of 2025 (H.R. 1622) further bolsters this by incentivizing U.S.-sourced uranium purchases for federal agencies, while the Department of Energy launched a new consortium in August 2025 under the Defense Production Act to strengthen the nuclear fuel supply chain11. These policies not only de-risk North American projects but position uranium explorers like SAGA for rapid advancement12.

To learn more about SAGA Metals Double Mer Uranium Project please visit the project page found here on the corporate website: https://sagametals.com/double-mer-uranium-project/

Option Issuances

In addition, the Company announces the issuance of an aggregate of 950,000 incentive stock options (the “Options”) to certain directors and officers of the Company. Each Option entitles the holder thereof to acquire one common share of the Company at a price of

Qualified Person

Peter Webster, P. Geo., of Mercator Geological Services is an Independent Qualified Person as defined under National Instrument 43-101 and has reviewed and approved the technical information disclosed in this news release.

Sources:

- Uranium Market’s Critical Shortfall Threatens 2025 Global Energy Security Financial Content (Oct 16, 2025)

- US strikes

$80 billion deal for new nuclear power plants Reuters (Oct 28, 2025) - Canadian firms Cameco, Brookfield sign

$80B US nuclear reactor deal with U.S. government CBC News (Oct 28, 2025) - Google and NextEra to revive major Iowa nuclear facility as AI energy demand surges CNBC (Oct 27, 2025)

- Uranium Supply Deficit Widens as Nuclear Demand Surges Discovery Alert (Sep 29, 2025)

- Uranium demand set to surge

28% by 2030 as nuclear power gains momentum, WNA says Reuters (Sep 5, 2025) - Uranium Price Forecast to Rise in 2025 Amid Nuclear “Game Changer” deVere Group (Sep 17, 2025)

- AI is set to drive surging electricity demand from data centres IEA (2025)

- Amazon, Google and Microsoft Are Investing in Nuclear Power The New York Times (Oct 16, 2024)

- President Trump Signs 4 Executive Orders to Deploy New Nuclear Reactors Holland & Knight (May 2025)

- H.R.1622 - 119th Congress (2025-2026): Uranium for Energy Independence Act of 2025 Congress.gov (2025)

- Energy Department to Establish New Consortium for Nuclear Fuel Supply Chain Department of Energy (Aug 2025)

About SAGA Metals Corp.

SAGA Metals Corp. is a North American mining company focused on the exploration and discovery of a diversified suite of critical minerals that support the global transition to green energy. The Radar Titanium Project comprises 24,175 hectares and entirely encloses the Dykes River intrusive complex, mapped at 160 km² on the surface near Cartwright, Labrador. Exploration to date, including a 2,200m drill program, has confirmed a large and mineralized layered mafic intrusion hosting vanadiferous titanomagnetite (VTM) with strong grades of titanium and vanadium.

The Double Mer Uranium Project, also in Labrador, covers 25,600 hectares featuring uranium radiometrics that highlight an 18km east-west trend, with a confirmed 14km section producing samples as high as

Additionally, SAGA owns the Legacy Lithium Property in Quebec's Eeyou Istchee James Bay region. This project, developed in partnership with Rio Tinto, has been expanded through the acquisition of the Amirault Lithium Project. Together, these properties cover 65,849 hectares and share significant geological continuity with other major players in the area, including Rio Tinto, Winsome Resources, Azimut Exploration, and Loyal Metals.

With a portfolio that spans key minerals crucial to the green energy transition, SAGA is strategically positioned to play an essential role in the clean energy future.

On Behalf of the Board of Directors

Mike Stier, Chief Executive Officer

For more information, contact:

Rob Guzman, Investor Relations

SAGA Metals Corp.

Tel: +1 (844) 724-2638

Email: rob@sagametals.com

www.sagametals.com

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Disclaimer

This news release contains forward-looking statements within the meaning of applicable securities laws that are not historical facts. Forward-looking statements are often identified by terms such as “will”, “may”, “should”, “anticipates”, “expects”, “believes”, and similar expressions or the negative of these words or other comparable terminology. All statements other than statements of historical fact, included in this release are forward-looking statements that involve risks and uncertainties. In particular, this news release contains forward-looking information pertaining to the exploration of the Company’s Double Mer Project. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, environmental risks, limitations on insurance coverage, inherent risks and uncertainties involved in the mineral exploration and development industry, particularly given the early-stage nature of the Company’s assets, and the risks detailed in the Company’s continuous disclosure filings with securities regulations from time to time, available under its SEDAR+ profile at www.sedarplus.ca. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements only as expressly required by applicable law.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/4e92faef-60df-487c-a67c-e3ad3e4d4573

https://www.globenewswire.com/NewsRoom/AttachmentNg/3c09f8e0-f1e4-42bc-b1f1-1e933292cf13

https://www.globenewswire.com/NewsRoom/AttachmentNg/b243f45c-ffa9-4476-a11c-01a1b96c3e00

https://www.globenewswire.com/NewsRoom/AttachmentNg/90454ce6-028c-4e18-9ecd-54126d3f20d7