Schwab Trading Activity Index™: November Score Rises Modestly Following Fed, Election Decisions

More Schwab clients net bought equities than net sold, with the most buying in the Information Technology, Health Care, and Consumer Staples sectors. Selling was most pronounced in Communication Services, Financials, and Consumer Discretionary.

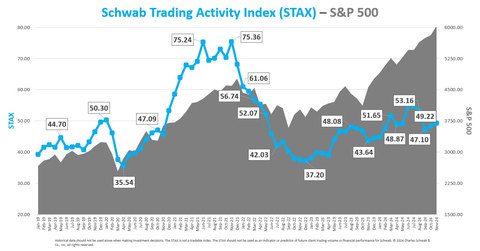

Schwab Trading Activity Index vs. S&P 500 (Graphic: Charles Schwab)

The reading for the five-week period ending November 29, 2024, ranks “moderate low” compared to historic averages.

“In November, as the outcome of the

With Fed announcements and elections now in the rear-view, some uncertainty and market volatility may have abated, as reflected by a jump in equities and a fall in the CBOE Volatility Index® (VIX). For much of the STAX period, interest rates and stock prices moved in tandem, but that relationship reversed in the final weeks as rates dropped and stocks continued to rise. All three major

The

The VIX fell by

Popular names bought by Schwab clients during the period included:

- NVIDIA Corp. (NVDA)

- Palantir Technologies Inc. (PLTR)

- Advanced Micro Devices Inc. (AMD)

- Super Micro Computer Inc. (SMCI)

- MicroStrategy Inc. (MSTR)

Names net sold by Schwab clients during the period included:

- Apple Inc. (AAPL)

- Walt Disney Co. (DIS)

- Tesla Inc. (TSLA)

- Bank of America Corp. (BAC)

- Ford Motor Co. (F)

About the STAX

The STAX value is calculated based on a complex proprietary formula. Each month, Schwab pulls a sample from its client base of millions of funded accounts, which includes accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly STAX.

For more information on the Schwab Trading Activity Index, please visit www.schwab.com/investment-research/stax. Additionally, Schwab clients can chart the STAX using the symbol $STAX in either the thinkorswim® or thinkorswim Mobile platforms.

Investing involves risk, including loss of principal. Past performance is no guarantee of future results. Content intended for educational/informational purposes only. Not investment advice, or a recommendation of any security, strategy, or account type.

Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The STAX is not a tradable index. The STAX should not be used as an indicator or predictor of future client trading volume or financial performance for Schwab.

About Charles Schwab

At Charles Schwab, we believe in the power of investing to help individuals create a better tomorrow. We have a history of challenging the status quo in our industry, innovating in ways that benefit investors and the advisors and employers who serve them, and championing our clients’ goals with passion and integrity.

More information is available at aboutschwab.com. Follow us on X, Facebook, YouTube, and LinkedIn.

1224-A2P3

View source version on businesswire.com: https://www.businesswire.com/news/home/20241209563932/en/

At the Company

Margaret Farrell

Director, Corporate Communications

(203) 434-2240

margaret.farrell@schwab.com

Source: The Charles Schwab Corporation