Scryb Reports Financial Results for Q3 2025: Positive Outlook for Cybeats Technologies Corp.

Rhea-AI Summary

Scryb Inc. (CSE: SCYB) has reported its Q3 2025 financial results, highlighting significant developments in its largest holding, Cybeats Technologies Corp. Following deconsolidation in November 2024, Scryb maintains a 40% ownership stake with 75 million common shares in Cybeats.

Cybeats demonstrated strong performance with Q2 2025 revenue of $744,664, marking a 51% increase from Q2 2024. The company significantly improved its net loss position to $(856,431), a 164% improvement year-over-year. Post quarter-end, Cybeats secured a $3.2 million financing and reported its strongest pipeline to date, with notable client expansions and strategic partnerships.

The company's SBOM Studio continues to gain traction among major industrial players including Emerson Electric, Rockwell Automation, Schneider Electric, and Johnson Controls.

Positive

- Revenue growth of 51% year-over-year to $744,664 in Q2 2025

- Significant net loss improvement of 164% compared to Q2 2024

- Secured $3.2 million in financing post quarter-end

- Strong customer retention and expansion with major industrial clients

- Strongest pipeline in company history with multiple POCs and pilots

Negative

- Continuing net loss of $(856,431) in Q2 2025

- Deconsolidation impact on corporate structure

Toronto, Ontario--(Newsfile Corp. - September 3, 2025) - Scryb Inc. (CSE: SCYB) ("Scryb'' or the "Company") has filed financial results for its third quarter ended June 30, 2025 ("Q3 2025"), and also provides commentary on Scryb's largest holding, Cybeats, which filed its second quarter ended June 30, 2025 Interim Financial Statements and Management's Discussion and Analysis ("MD&A").

Scryb's reported results for Q3 2025 reflect the transition to equity accounting for Cybeats following the deconsolidation in November 2024. Balance sheet improvements were driven by portfolio realignment, disciplined expense control, and balance-sheet simplification. Further to the deconsolidation, Scryb is positioned with a cleaner balance sheet and is able to report on Cybeats' performance as an investment going forward. Scryb maintains a 75 million common share position in Cybeats, which is approximately

Cybeats Technologies Corp.

Over the past quarter Cybeats has secured multiple client expansions, and is broadening its market reach and growth potential by establishing strategic partnerships, including channel and white-label arrangements. With ongoing product enhancements, strong customer retention, and the completion of a

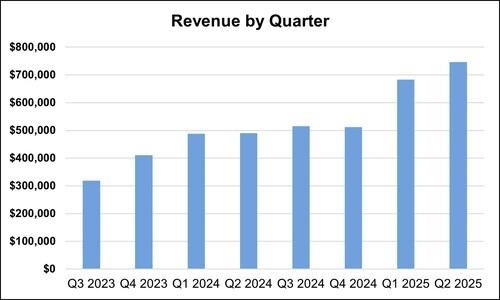

Cybeats also announced it has the strongest pipeline in its history with potential customers in all stages of advancement including POCs, planned POCs and pilots. Below is a graph of revenue growth and Cybeats Financial Highlights for the three months ended June 30, 2025 ("Q2 2025") with comparatives for the three months ended June 30, 2024 ("Q2 2024"):

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/952/264910_08c6d91e14a44ab9_001full.jpg

Cybeats Revenue in Q2 2025 was

$744,664 versus$492,331 in Q2 2024, an increase of51% or$252,333. T his growth was due to the addition of new customers and the expansion of our existing customers.Net loss in Q2 2025 was

$(856,431) , versus a loss of$(2,261,534) in Q2 2024, an improvement of$1,405,103 or164% . The reduction in net loss was due to operational efficiencies.SBOM Studio continues to drive adoption across critical infrastructure and industrial control system sectors, with global leaders like Emerson Electric, Rockwell Automation, Schneider Electric, and Johnson Controls.

Both sets of financial statements discussed in this release are filed on SEDAR+ at www.sedarplus.ca for more information.1

About Scryb Inc.

Scryb invests in and actively supports a growing portfolio of innovative and high-upside ventures across AI, biotech, digital health, and cybersecurity.

Contact:

James Van Staveren, CEO

Phone: 647-847-5543

Email: info@scryb.ai

Forward-looking Information Cautionary Statement

Except for statements of historic fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the CSE. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. There are no assurances that the commercialization plans for the technology described in this news release will come into effect on the terms or time frame described herein. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional risk disclosures are available in the Company's filings on https://www.sedarplus.ca/.

_____________________________

1 https://www.newswire.ca/news-releases/cybeats-technologies-corp-announces-second-quarter-fiscal-2025-financial-results-851613444.html

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/264910