Solis Minerals Confirms Due Diligence Completed on Cucho

Rhea-AI Summary

Solis Minerals (OTC:SLMFF) has completed due diligence on the Cucho Copper Project in Peru and confirmed strong porphyry-style exploration potential based on historical drilling, relogged core, updated geological modelling and geophysics. Drill permitting is advanced and a ~5,000-metre drill program is targeted to commence late H1 2026.

Commercial terms were renegotiated to defer/share milestone payments and align cash and share payments with permit and drilling milestones, enabling staged earn-in to JVCo up to 75% (option to acquire 100%).

Positive

- Drill permitting advanced; drilling targeted late H1 2026

- Staged earn-in preserves capital; JV equity to reach 51% after drilling

- Renegotiated payments defer upfront cash to align with milestones

- Extensive historical intercepts showing broad, near-surface copper mineralisation

Negative

- 5,000-metre drilling commitment required to trigger key payments

- Initial equity at exercise reduced to 10%, diluting early upside

HIGHLIGHTS

Solis Minerals has completed due diligence on the Cucho Copper Project.

Geological review confirms high exploration potential, supported by historical drilling, core relogging, expanded surface mapping and updated geological modelling¹.

Drill permitting is advanced with drilling targeted for late H1 2026.

Solis Minerals has renegotiated commercial terms favourably, to better align milestone payments with permitting and drilling events.

Historical drilling (2,000 metres across seven shallow holes) delivered significant intercepts²:

COP14-01: 169.7 metres @

0.24% Cu,0.012% Mo and 1.0 g/t Ag (from surface)Inc. 39.5 metres @

0.34% Cu,0.014% Mo and 1.1 g/t Ag (from 27.3 metres)

COP14-02: 178.7 metres @

0.23% Cu,0.022% Mo and 0.9 g/t Ag (from 38.6 metres)Inc. 20.0 metres @

0.32% Cu,0.020% Mo and 0.8 g/t Ag (from 135.9 metres)

COP14-05: 96.7 metres @

0.28% Cu,0.018% Mo and 1.4 g/t Ag (from 37.2 metres)Inc. 52.7 metres @

0.35% Cu,0.016% Mo and 1.0 g/t Ag (from 82.5 metres)Inc. 33 metres @

0.41% Cu,0.03% Mo and 1.9 g/t Ag (from 86.5 metres)

COP14-06: 175.4 metres @

0.28% Cu,0.012% Mo and 1.3 g/t Ag (from surface)Inc. 91.2 metres @

0.33% Cu,0.007% Mo and 0.8 g/t Ag (from surface)Inc. 38 metres @

0.40% Cu,0.02% Mo and 1.7 g/t Ag (from 60.4 metres)

COP14-07: 269.1 metres @

0.25% Cu,0.011% Mo and 1.1 g/t Ag (from surface)Inc. 19.9 metres @

0.36% Cu,0.002% Mo and 1.0 g/t Ag (from 13.6 metres)Inc. 11 metres @

0.41% Cu and 1.6 g/t Ag (from 13.6 metres)

Inc. 18.0 metres @

0.36% Cu,0.020% Mo and 0.6 g/t Ag (from 138.2 metres)Inc. 12 metres @

0.40% Cu,0.02% Mo and 1.3 g/t Ag (from 140 metres)

West Leederville, Western Australia--(Newsfile Corp. - February 5, 2026) - Solis Minerals Ltd (ASX: SLM) ("Solis Minerals", "SLM" or "the Company") is pleased to provide an update on the Cucho Copper Project ("Cucho" or the "Project") (SLM up to

Chief Executive Officer, Mitch Thomas, commented:

"Cucho is a standout project within our Peruvian portfolio. The broad mineralised copper intercepts, strong geophysical signatures, and clear structural controls highlight a system with genuine scale. Permitting is advancing rapidly. Against a backdrop of record copper prices and strong market fundamentals, our first drilling at Cucho aims to demonstrate the potential of this porphyry system and advance Solis Minerals toward resource discovery in 2026."

Figure 1: Map of Peru Solis Minerals' exploration projects as well as development and operating projects held by major mining companies.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1134/282855_solisfig1.jpg

Cucho Copper Project

Background

Cucho was discovered by geologists from Quippu Exploraciones ("Quippu" or the "Vendors") (a Peruvian privately held exploration company) in 2008 in the Ancash Department of coastal Peru. Following a maiden drilling campaign in 2014, it was defined as a potential large-scale porphyry copper-molybdenum system. The project area was expanded by Quippu between 2021 and 2022 through the acquisition of neighboring concessions. Subsequent surface activities and re-interpretation of geophysics defined an expansive 3 x 1.8-kilometer mineralisation footprint.

Cucho represents a compelling exploration and development opportunity with extensive historical datasets, existing drill-defined copper mineralisation from surface, and clear geological indicators of a district-scale mineralised system.

The Company considers Cucho to have the potential to host a globally significant copper deposit and intends to advance the Project rapidly to exploration drilling.

Pursuant to the binding agreement signed with Quippu in October 2025, and now modified favourably by negotiated commercial terms, Solis Minerals has the right to earn up to a

Due diligence

The Company has completed the following workstreams as part of its detailed due diligence:

Permitting and concession review; drill permitting applications are advanced

Logistics and infrastructure review; 40kms to the coast and excellent supporting infrastructure

Geological modelling⁴; confirming several compelling targets

Core relogging and lithology review; confirming geological modelling assumptions

Drone magnetometry survey; results targeted for release Q1 2026; to support drill sequencing

Surface mapping; including identification of new mineralised areas

Application for adjacent concessions; expanding to the north and east of the project area⁵

Solis Minerals' due diligence activities over recent months have reaffirmed a strongly favorable view of the exploration and project development prospectivity of Cucho.

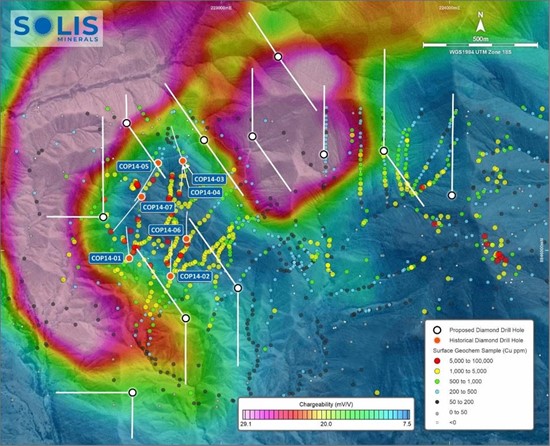

Data collected during the due diligence phase has been reflected within the planned drill campaign scheduled for late Q2 2026. Approximately 14 drill pad locations are being permitted to provide flexibility during the drill campaign (Figure 2).

Figure 2: Cucho historical drilling, chargeability (IP) and surface geochemistry with preliminary locations of drill pads for the planned H1 2026 drill programme⁶.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1134/282855_solisfig2.jpg

Commercial updates

Solis Minerals has renegotiated the terms of future milestone payments favorably to better align payments with key exploration milestones (permitting and drilling). Key differences from the terms announced 21 October 2025⁷:

1. Exercise phase

- Cash reduced from US

$300,000 → US$100,000 payable February 2026. - Share consideration of US

$100,000 payable February 2026. - Previously required payment of A

$1,000,000 in SLM shares has been deferred and split into:- A

$500,000 payable following Drill Permits phase (i.e., once permits are awarded); - A

$500,000 payable following the Drilling phase (i.e., following drill completion).

- A

- Solis Minerals' equity at exercise adjusted to

10% (reflecting lower upfront consideration).

2. Drill Permits phase

- Cash increased from US

$200,000 → US$300,000 upon receipt of drilling permits. - Additional A

$500,000 in SLM shares incorporated (deferred from Exercise phase). - All payments are conditional upon full receipt of permits required for drilling.

- JVCo equity increases to

30% .

3. Drilling phase

- Share consideration increased by A

$500,000 (the second half of the deferred Exercise phase). - Cash component remains US

$200,000. - Importantly, both amounts are payable only upon completion of a 5,000-metre drilling program.

- JVCo equity increases to

51% , unchanged from the original terms. No other changes have been made to the Cucho transaction terms. Country and regional activity

The region surrounding Cucho is experiencing increasing exploration activity from major international mining companies, reflecting the district's strong geological endowment and growing interest in large Andean porphyry copper systems.

Australian-listed AusQuest Limited (ASX: AQD) is actively drilling its Cangallo Copper Project, located within the same coastal Peruvian batholith that hosts Cucho. Cangallo displays comparable geological characteristics, including porphyry-style vein networks, multiphase intrusive centers, and a similar magmatic-hydrothermal evolution.

AusQuest has released results from 23 drill holes (21 RC and 2 diamond), demonstrating broad copper mineralisation⁸:

CANRC001: 348m @

0.26% Cu, 0.06 ppm Au from 6mCANRC002: 188m @

0.28% Cu, 0.07 ppm Au from 214mCANRC003: 154m @

0.37% Cu, 0.06 ppm Au from 36mCANRC004: 10m @

0.17% Cu, 0.07 ppm Au from 228mCANRC005: 226m @

0.22% Cu, 0.07 ppm Au from 4mCANRC006: 138m @

0.17% Cu, 0.03 ppm Au from 270m

CANRC007: 136m @

0.25% Cu from 22m; 121m @0.26% Cu from 256mCANRC008: 304m @

0.30% Cu, 0.06 ppm Au from 34mCANRC009: 130m @

0.23% Cu from 18m; 242m @0.16% Cu from 166mCANRC010: 274m @

0.19% Cu from 36mCANRC011: 124m @

0.16% Cu from 18m; 126m @0.23% Cu from 226mCANRC012: 324m @

0.30% Cu, 0.07 ppm Au from 36mCANRC013: 234m @

0.30% Cu, 0.06 ppm Au from 110mCANRC014: 330m @

0.30% Cu, 0.06 ppm Au from 32mCANRC016: 14m @

0.14% Cu, 0.02 ppm Au from 278mCANRC017: 150m @

0.21% Cu, 0.05 ppm Au from 276mCANRC018: 42m @

0.20% Cu, 0.02 ppm Au from 14mCANRC019: 314m @

0.20% Cu, 0.04 ppm Au from 106mCANRC021: 156m @

0.16% Cu, 0.05 ppm Au from 2mCANDD001: 144m @

0.15% Cu, 0.04 g/t Au from 686mCANDD002: 555m @

0.26% Cu, 0.06 g/t Au from 5m

These intercepts are comparable to historical drilling at Cucho that confirm the presence of large, vertically extensive porphyry system⁹. Notably, historic drilling at Cucho averaged only 280m depth, with two holes ending in mineralisation and mineralisation remaining open in all directions, leaving significant untested potential.

The emerging Elida Copper Project, located 40 km from Cucho and owned by Element 29, demonstrates the region's prospectivity. Elida hosts an inferred resource of 321.7 Mt @

Both Cucho and Elida share hallmark features of Andean porphyry copper-molybdenum systems: large multiphase intrusive centres, extensive hydrothermal alteration, strong geophysical signatures, and long copper intercepts beginning near surface with clear expansion potential at depth.

Additional advanced exploration in the region includes Vale's (NYSE: VALE) Umami Project, Alpayana's Antarumi Project, and ongoing base-metals exploration by Fortescue (ASX: FMG) adjacent to the Cucho concessions (see Figure 3).

Figure 3: Cucho project and regional exploration projects and programmes by FMG, Vale, Element 29 and Alpayana.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1134/282855_solisfig3.jpg

Next Steps

Milestones for the Cucho project for the first half of 2026:

Ongoing surface activities (mapping, exploration footprint expansions) to refine drill targets

Permitting (targeting completion by H1 2026)

Drilling commencement (targeting commencement late H1 2026)

Against an excellent backdrop of high copper and gold prices, Solis Minerals remains committed to delivery of its objective to Discover copper-gold resources that can host large-scale mining in one of the world's leading copper-gold regions.

ENDS

This announcement is authorised for release by the Board.

Contact

Mitch Thomas

Chief Executive Officer

Solis Minerals Limited

mthomas@solisminerals.com.au

+61 458 890 355

Media & Broker Enquiries:

Fiona Marshall

White Noise Communications

fiona@whitenoisecomms.com

+61 400 512 109

About Solis Minerals Limited

Solis Minerals is an emerging exploration company, focused on unlocking the potential of its South American copper-gold portfolio. The Company is led by a highly-credentialled and proven team with excellent experience across the mining lifecycle in South America. Solis Minerals is actively considering a range of copper and broader battery material opportunities. South America is a key player in the global export market for copper and Solis Minerals, under its leadership team, is strategically positioned to capitalise on growth opportunities within this mineral-rich region.

Forward-Looking Statements

This news release contains certain forward-looking statements that relate to future events or performance and reflect management's current expectations and assumptions. Such forward-looking statements reflect management's current beliefs and are based on assumptions made and information currently available to the Company. Readers are cautioned that these forward-looking statements are neither promises nor guarantees and are subject to risks and uncertainties that may cause future results to differ materially from those expected, including, but not limited to, market conditions, availability of financing, actual results of the Company's exploration and other activities, environmental risks, future metal prices, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry. All the forward-looking statements made in this news release are qualified by these cautionary statements and those in our continuous disclosure filings available on SEDAR+ at www.sedarplus.ca. These forward-looking statements are made as of the date hereof, and the Company does not assume any obligation to update or revise them to reflect new events or circumstances save as required by applicable law.

Qualified Person Statement

The technical information in this news release was reviewed by Dr. Paul Pearson, a Fellow of the Australian institute of Mining and Metallurgy (AusIMM), a qualified person as defined by National Instrument 43-101 (NI 43-101). Paul Pearson is the Head of Exploration for the Company.

Competent Person Statement

The information in this ASX release concerning Geological Information and Exploration Results is based on and fairly represents information compiled by Mr Paul Pearson, a Competent Person who is a Fellow of the Australasian Institute of Mining and Metallurgy. Mr Pearson is Head of Exploration of Solis Minerals Ltd. and has sufficient experience which is relevant to the style of mineralisation and types of deposit under consideration and to the exploration activities undertaken to qualify as a Competent Person as defined in the 2012 Edition of the "Australian Code for Reporting of Mineral Resources and Ore Reserves". Mr Pearson consents to the inclusion in this report of the matters based on information in the form and context in which it appears. Mr Pearson has provided his prior written consent regarding the form and context in which the Geological Information and Exploration Results and supporting information are presented in this Announcement.

Disclaimer

In relying on the above mentioned ASX announcement and pursuant to ASX Listing Rule 5.23.2, the Company confirms that it is not aware of any new information or data that materially affects the information included in the above-mentioned announcement.

1 Source: https://api.investi.com.au/api/announcements/slm/267d6ab3-063.pdf

2 Source: https://api.investi.com.au/api/announcements/slm/f0dc998f-9e4.pdf

3 Source: https://api.investi.com.au/api/announcements/slm/f0dc998f-9e4.pdf

4 Reference: https://api.investi.com.au/api/announcements/slm/267d6ab3-063.pdf

5 Reference: https://api.investi.com.au/api/announcements/slm/3c6d8897-42d.pdf

6 Reference: https://api.investi.com.au/api/announcements/slm/f0dc998f-9e4.pdf

7 Source: https://api.investi.com.au/api/announcements/slm/f0dc998f-9e4.pdf

8 References: CANRC001 - 008: https://investorhub.ausquest.com.au/announcements/6779925, 009 - 012:

https://investorhub.ausquest.com.au/announcements/7063246, 013 -021: https://investorhub.ausquest.com.au/announcements/7126919, D001 - 002: https://investorhub.ausquest.com.au/announcements/7321974

9 Comparisons with other projects or mines, including those that are in production or at a more advanced stage of development, are not intended to imply that the Company will achieve similar results, recoveries, or economic outcomes. The potential quantity and grade of any resource at Cucho is conceptual in nature, and there has been insufficient exploration to estimate a Mineral Resource. It is uncertain if further exploration will result in the estimation of a Mineral Resource. Investors should not place undue reliance on such comparisons.

10 Source: https://www.e29copper.com/projects/elida/

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/282855