Solis Announces: Compelling Targets Identified from New Geophysical Modelling of the Cucho Project, Peru

Rhea-AI Summary

Solis Minerals (OTC:SLMFF) announced new 3D reprocessing of historical magnetics and induced polarization data at the Cucho copper‑molybdenum project, Peru, identifying multiple compelling targets including a deeply rooted Eastern Chargeable Body open >500–600 m that is a priority for testing.

The company plans a drill programme in Q2 2026, a drone magnetics survey in December 2025, expanded surface geochemistry, and says community approvals are in place with drill permitting commenced. Solis can earn up to 75% of Cucho and holds a seven‑year option to acquire 100%.

Positive

- Eastern Chargeable Body open at >500–600 m depth

- Priority targets defined for a Q2 2026 diamond drill programme

- Drone magnetics survey scheduled for December 2025

- Community approvals received; drill permitting has commenced

- Historic drill intercept: COP14‑07 269.1 m @ 0.25% Cu

Negative

- Historic drilling totals ~2,000 metres, testing only ~7% of footprint

- 2014 NI‑43‑101 concluded key anomalies were left without verification

- Current model relies on reprocessed historical datasets, not new deep geophysics

News Market Reaction

On the day this news was published, SLMFF gained 66.67%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Peers in Copper show mixed moves: PSGR up 7.11%, BCUFF down 7.89%, TWOSF up 0.96%, while others are flat. With SLMFF flat pre-news, movements appear stock-specific rather than a coordinated sector rotation.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 02 | Project targeting update | Positive | +66.7% | New 3D geophysical modelling at Cucho defined multiple priority drill targets. |

| Oct 20 | Project acquisition | Positive | +287.7% | Agreement to earn up to 75% and option to 100% of Cucho copper project. |

| Oct 20 | Equity financing | Positive | +287.7% | A$5.9M placement to fund Cucho acquisition, exploration and working capital. |

| Oct 15 | Year-end change | Neutral | +287.7% | Change of financial year-end to December 31 to align reporting and planning. |

| Oct 14 | Board appointment | Positive | +287.7% | Appointment of experienced geologist as Non-Executive Director to support growth. |

Recent news has coincided with very strong positive price reactions: the Cucho acquisition and financing on Oct 20 and other corporate updates all saw > +66% to +287% next-day moves, suggesting high sensitivity to project and financing headlines.

Over the last few months, Solis has focused on building a Peruvian copper portfolio. On Oct 14, it strengthened governance with a new non-executive director. On Oct 15, it aligned reporting by shifting its financial year-end. On Oct 20, it both agreed to acquire up to 75% of the Cucho Copper Project and secured up to A$5.9M in funding, which prompted sharp price gains. The current Cucho geophysical targeting update on Dec 2 follows through on advancing that acquisition into a drill-ready exploration program.

Market Pulse Summary

The stock surged +66.7% in the session following this news. A strong positive reaction aligns with how Solis shares previously responded to Cucho-related catalysts, with past news around the project and financing showing moves above +66% and up to +287.72%. The identification of a large, deeply rooted chargeable body and multiple drill targets adds exploration leverage but also exploration risk. Investors have historically reacted aggressively to such updates, so sustainability would have depended on follow-through drilling results and ongoing funding capacity.

Key Terms

porphyry medical

batholithic medical

granodiorite medical

chalcopyrite medical

molybdenite medical

resistivity technical

supergene medical

AI-generated analysis. Not financial advice.

Highlights

New modelling of historical magnetic and induced polarization ("IP") data from Cucho has identified a number of compelling targets, supported by surface geochemistry.

These targets likely form part of a deeply-rooted porphyry copper-molybdenum system.

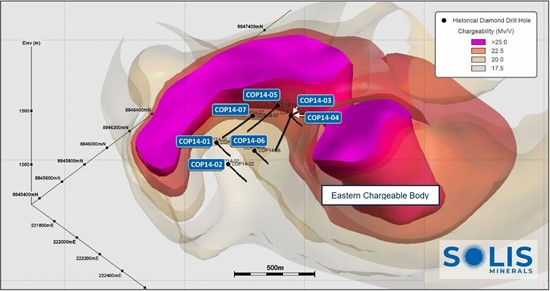

Drone-borne magnetic survey is scheduled for December 2025 (Figure 1), aimed at mapping structures and magnetic features associated the currently recognised alteration / hydrothermal system. Expanded surface geochemistry sampling will also commence shortly.

Community approvals have been received and drill permitting has recently commenced.

West Leederville, Western Australia--(Newsfile Corp. - December 2, 2025) - Solis Minerals Limited (ASX: SLM) ("Solis Minerals" or the "Company") is pleased to announce that new 3D geophysical modelling at Cucho (the "Project") has highlighted compelling geophysical, geological and geochemical targets to be tested in a 2026 diamond drilling programme.

Chief Executive Officer, Mitch Thomas, commented:

"We are excited by the results of new geophysical modelling at Cucho, which supports a number of highly prospective targets, defined by combinations of demagnetization, elevated chargeability and conductivity, with elevated surface geochemistry."

Figure 1: Coverage of geophysical studies at Cucho; including magnetics survey for December 2025

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1134/276644_6854a20c044cd9cd_001full.jpg

1. Background

Solis Minerals has the right to earn up to a

Figure 2: Solis Minerals' portfolio of exploration projects in Peru

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1134/276644_6854a20c044cd9cd_002full.jpg

The Cucho project covers a land package of 3,600 hectares and alteration-mineralisation anomaly footprint of 3 x 1.8 kilometres. The anomaly is defined by coincident copper-molybdenum geochemistry, surface mineralisation, and strong IP chargeability anomalies. Mineralisation is hosted in batholithic granodiorite, with stockwork veining and copper oxide staining at surface within the surficial exposed oxide zone, transitioning to primary chalcopyrite-molybdenite sulphides at depth.

Previous drilling encountered significant mineralisation in all seven drill-holes completed with grades consistent with operating mines across the Andean copper belt:

COP14-01: 169.7 metres @

0.24% Cu,0.012% Mo and 1.0 g/t Ag (from surface)Inc. 39.5 metres @

0.34% Cu,0.014% Mo and 1.1 g/t Ag (from 27.3 metres)

COP14-02: 178.7 metres @

0.23% Cu,0.022% Mo and 0.9 g/t Ag (from 38.6 metres)Inc. 20.0 metres @

0.32% Cu,0.020% Mo and 0.8 g/t Ag (from 135.9 metres)

COP14-05: 96.7 metres @

0.28% Cu,0.018% Mo and 1.4 g/t Ag (from 37.2 metres)Inc. 52.7 metres @

0.35% Cu,0.016% Mo and 1.0 g/t Ag from 82.5 metres

COP14-06: 175.4 metres @

0.28% Cu,0.012% Mo and 1.3 g/t Ag (from surface)Inc. 91.2 metres @

0.33% Cu,0.007% Mo and 0.8 g/t Ag (from surface)

COP14-07: 269.1 metres @

0.25% Cu,0.011% Mo and 1.1 g/t Ag (from surface)Inc. 19.9 metres @

0.36% Cu,0.002% Mo and 1.0 g/t Ag (from 13.6 metres)Inc. 18.0 metres @

0.36% Cu,0.020% Mo and 0.6 g/t Ag (from 138.2 metres)

Historical drilling had limitations that led to a 2014 Technical Report, prepared under NI-43-101 Standards, concluding that "the main geochemical and geophysical anomalies were left without verification by drilling". These findings are consistent with the new geological modelling reported on in this announcement. Solis Minerals plans to drill these targets in Q2 2026.

The geological setting, alteration assemblages, and scale of the mineralised system are directly comparable to large porphyry copper projects including Hudbay's Mason and Constancia (Hudbay Minerals, TSX: HBM), Teck's Zafranal project (Teck Resources, NYSE: TECK), Element 29's Elida project (Element 29 Resources, TSXV: ECU) and Newmont's Illari copper-gold project (NYSE: NEM)2.

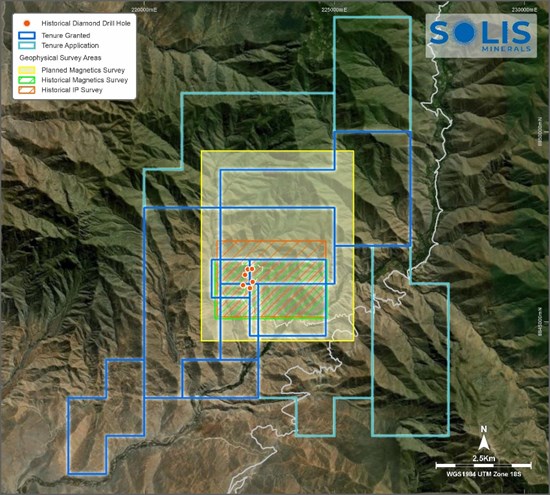

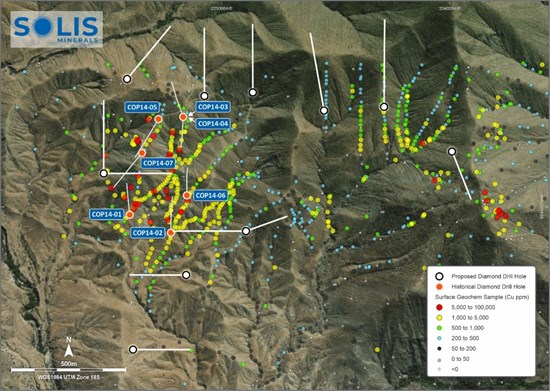

The Cucho Copper Project presents a compelling case for the presence of significant mineralisation across the historically drilled area (the Central Zone) and extending into undrilled anomalies across the North, West and South Zones (Figures 3, 4). While the current drilled area - based on just 2,000-metres of relatively shallow, historical scout drilling in the Central Zone - demonstrates promising copper and molybdenum grades, it represents only

Figure 3: Plan view of large geophysical chargeability anomalies at Cucho with drill hole traces overlaid with geochemistry sample assays. Priority drill targets presented. X-section included in Figure 4.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1134/276644_6854a20c044cd9cd_003full.jpg

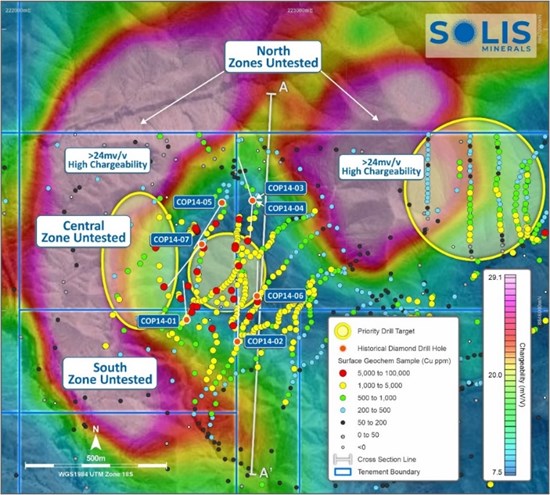

Figure 4: Cucho long section with projection of drill core traces on geophysical IP chargeability anomalies.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1134/276644_6854a20c044cd9cd_004full.jpg

2. Geophysical 3D Modelling

Solis recently commissioned Deep Sounding Exploration Geophysics of Lima, Peru to reprocess and model historical ground magnetic and induced polarization data from the Project. The results of geophysical modelling were subsequently integrated with the historical geology and geochemistry datasets to provide a robust interpretation of the porphyry mineralisation environment. The essential conclusions resulting from this work are as follows:

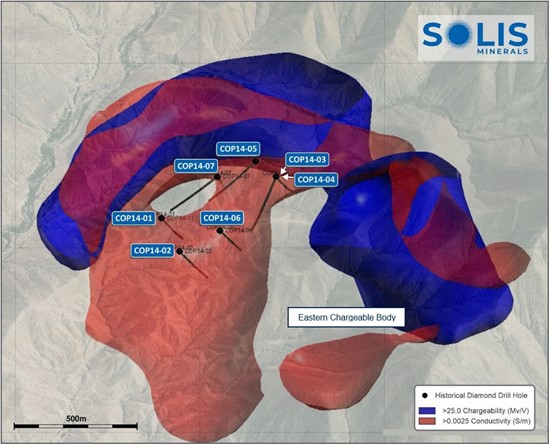

Important structural discontinuities, defined by breaks in the magnetic, resistivity, chargeability and geochemistry datasets, strike mainly NW-SE, NE-SW and N-S (Figure 5). These suggest significant vertical displacements across some of these features which may juxtapose different levels of the porphyry-style mineral system;

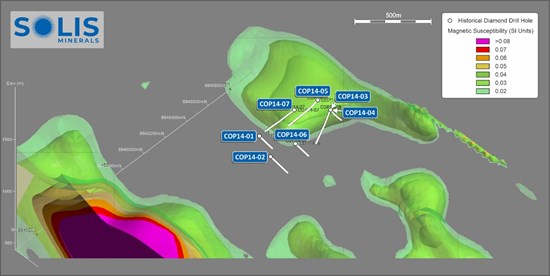

A pronounced reduction in magnetic susceptibility occurs from east to west across a major NE-SW structural break (Figure 6). Combined with an increase in the overall chargeability from east to west, the conclusion is that the western half of the modelled area has been the subject of much more intense hydrothermal alteration. The change in geophysical characteristics corresponds to a contrast between less altered, magnetic diorites in the east and more altered granodiorites and granite porphyries in the west. The east to west change in inferred alteration intensity also corresponds to a sharp increase in the abundance of porphyry geochemical pathfinder elements such as molybdenum.

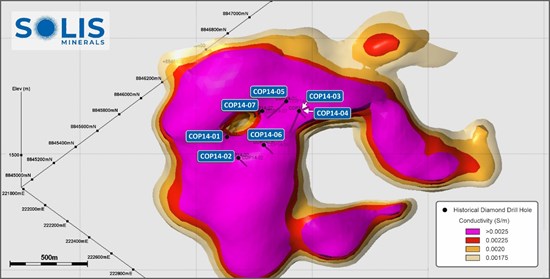

More conductive (i.e. less resistive) material is concentrated at higher levels closer to surface (Figure 7) and is consistent with supergene alteration processes and generation of more conductive clays etc in a leaching environment. The overall lateral correspondence between the zone of highest chargeability and highest conductivity over the scale of the IP survey is consistent with the near surface oxidation of hypogene sulphides, developed over a kilometric-scale sulphidic mineral system.

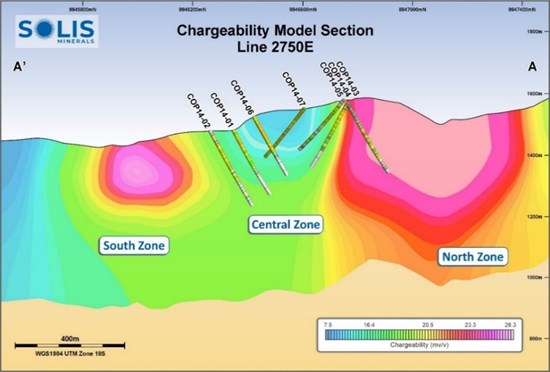

A deeply-rooted and strongly chargeable body, open at both ends and to depths in excess of 500-600 meters, is considered the first priority for drilling (Figure 7). This hundreds of metres dimension feature is referred to here as the "Eastern Chargeable body". The sulphidic character of this strongly chargeable material is supported in the surface geochemical data by a zone of broadly corresponding elevated total sulphur (S).

The Eastern Chargeable Body is separated from the area of historically-drilled, strongly copper-anomalous altered intrusive rocks by a prominent NW-SE structural discontinuity (Figure 8). The currently interpretation is that probable higher levels of the porphyry system have been downthrown in this block and that potentially economic copper-molybdenum mineralized material is preserved at depth beneath the sulphidic shell defined by the elevated chargeability.

Figure 5: 3D Block model of modelled magnetic susceptibility at Cucho

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1134/276644_6854a20c044cd9cd_005full.jpg

Figure 6: 3D Block model of modelled chargeability at Cucho

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1134/276644_solis6.jpg

Figure 7: 3D Block model of modelled resistivity at Cucho

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1134/276644_6854a20c044cd9cd_008full.jpg

Figure 8: 3D integration of the chargeability and conductivity over the Eastern Chargeable body

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1134/276644_solis8.jpg

3. Conclusions

New 3D modelling of historical magnetics, chargeability and resistivity data, integrated with geology and geochemical data, confirms the existence of widespread hydrothermal alteration associated with a kilometric-scale copper-molybdenum porphyry system.

Inferred vertical throw on a system of NW-SE, NE-SW and N-S striking, syn- to post-mineral fault structures potentially juxtaposed contrasting levels of the porphyry system, and potentially preserved economic copper-molybdenum zones in certain blocks. One such target exists beneath a deeply-rooted, hundreds of metres-scale chargeable anomaly ("Eastern Chargeable Body") (Figures 6, 8).

A number of highly prospective targets have been identified, defined by combinations of demagnetization, elevated chargeability and conductivity, and elevated surface geochemistry in the porphyry pathfinders.

4. Next steps

The Company is designing a diamond drilling programme to test the Eastern Charbable Body and other compelling targets to depth, in close coordination with community consultation and permitting process (Figure 9).

In addition, the company is initiating new geological mapping, geochemical rock chip and soil sampling and drone-based magnetics programmes to further understand and extend the already well-established porphyry mineral system.

Figure 9: Cucho historical drilling and surface geochemistry with preliminary locations of drill pads

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1134/276644_6854a20c044cd9cd_011full.jpg

ENDS

This announcement is authorised for release by the Board of Solis Minerals Limited.

| Contact Mitch Thomas Chief Executive Officer Solis Minerals Limited +61 458 890 355 | Media & Broker Enquiries: Fiona Marshall White Noise Communications fiona@whitenoisecomms.com +61 400 512 109 |

About Solis Minerals Limited

Solis Minerals is an emerging exploration company, focused on unlocking the potential of its South American copper portfolio. The Company is building a significant copper portfolio in the Coastal Belt of Peru. The Company is led by a highly-credentialled and proven team with excellent experience across the mining lifecycle in South America. Solis is actively considering a range of copper opportunities. South America is a key player in the global export market for copper and Solis, under its leadership team, is strategically positioned to capitalise on growth opportunities within this mineral-rich region.

Forward-Looking Statements

This news release contains certain forward-looking statements that relate to future events or performance and reflect management's current expectations and assumptions. Such forward-looking statements reflect management's current beliefs and are based on assumptions made and information currently available to the Company. Readers are cautioned that these forward-looking statements are neither promises nor guarantees and are subject to risks and uncertainties that may cause future results to differ materially from those expected, including, but not limited to, market conditions, availability of financing, actual results of the Company's exploration and other activities, environmental risks, future metal prices, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry. All the forward-looking statements made in this news release are qualified by these cautionary statements and those in our continuous disclosure filings. These forward-looking statements are made as of the date hereof, and the Company does not assume any obligation to update or revise them to reflect new events or circumstances save as required by applicable law.

Qualified Person Statement

The technical information in this news release was reviewed by Dr. Paul Pearson, a Fellow of the Australian institute of Mining and Metallurgy (AusIMM), a qualified person as defined by National Instrument 43-101 (NI 43-101). Paul Pearson is the Head of Exploration of the Company.

Competent Person Statement

The information in this ASX release concerning Geological Information and Exploration Results is based on and fairly represents information compiled by Paul Pearson, a Competent Person who is a Fellow of the Australasian Institute of Mining and Metallurgy. Paul Pearson is Head of Exploration of Solis Minerals Ltd. and has sufficient experience which is relevant to the style of mineralisation and types of deposit under consideration and to the exploration activities undertaken to qualify as a Competent Person as defined in the 2012 Edition of the "Australian Code for Reporting of Mineral Resources and Ore Reserves". Paul Pearson consents to the inclusion in this report of the matters based on information in the form and context in which it appears. Paul Pearson has provided his prior written consent regarding the form and context in which the Geological Information and Exploration Results and supporting information are presented in this Announcement.

Disclaimer Regarding Historical Results

Some historical results were reported under NI 43-101 and are not JORC-compliant. A Competent Person has not done sufficient work to classify these results under the JORC Code. These results are considered indicative and have not been independently validated.

1 Source: https://api.investi.com.au/api/announcements/slm/f0dc998f-9e4.pdf

2 The Company cautions that any reference to other projects or mines is for illustrative purposes only. Investors are advised that Solis Minerals is at an early stage of exploration and does not currently have a Mineral Resource or Ore Reserve estimate in accordance with the JORC Code (2012 Edition). Comparisons with other projects or mines, including those that are in production or at a more advanced stage of development, are not intended to imply that the Company will achieve similar results, recoveries, or economic outcomes. The potential quantity and grade of any resource at Solis Minerals is conceptual in nature, and there has been insufficient exploration to estimate a Mineral Resource. It is uncertain if further exploration will result in the estimation of a Mineral Resource. Investors should not place undue reliance on such comparisons.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276644