Solaris Reports 148m of 0.72% CuEq within 325m of 0.51% CuEq from Surface; Updated Mineral Resource Estimate Expected This Month

Rhea-AI Summary

Solaris Resources has announced promising results from its 2024 drilling program at the Warintza Project in Ecuador. Key findings include:

- SLSE-36: 148m at 0.72% CuEq within 325m at 0.51% CuEq.

- SLS-77: 108m at 0.70% CuEq within 273m at 0.57% CuEq.

- SLS-78: 78m at 0.70% CuEq within 114m at 0.65% CuEq.

- SLS-79: 78m at 0.60% CuEq within 248m at 0.50% CuEq.

- SLST-03: 312m at 0.62% CuEq within 1,028m at 0.30% CuEq.

These results, along with other findings, will be included in an updated mineral resource estimate expected this month. The 2024 drill program has been expanded to 60,000m across 140 holes to improve coverage. Solaris continues to focus on resource extension at Warintza Southeast, Patrimonio exploration, and technical drilling to support a pre-feasibility study in the second half of 2025.

Positive

- 148m at 0.72% CuEq within 325m at 0.51% CuEq from SLSE-36.

- 108m at 0.70% CuEq within 273m at 0.57% CuEq from SLS-77.

- 78m at 0.70% CuEq within 114m at 0.65% CuEq from SLS-78.

- 78m at 0.60% CuEq within 248m at 0.50% CuEq from SLS-79.

- 312m at 0.62% CuEq within 1,028m at 0.30% CuEq from SLST-03.

- Expanded drill program to 60,000m across 140 holes.

- Updated mineral resource estimate expected this month.

Negative

- None.

News Market Reaction – SLSR

On the day this news was published, SLSR declined 1.37%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

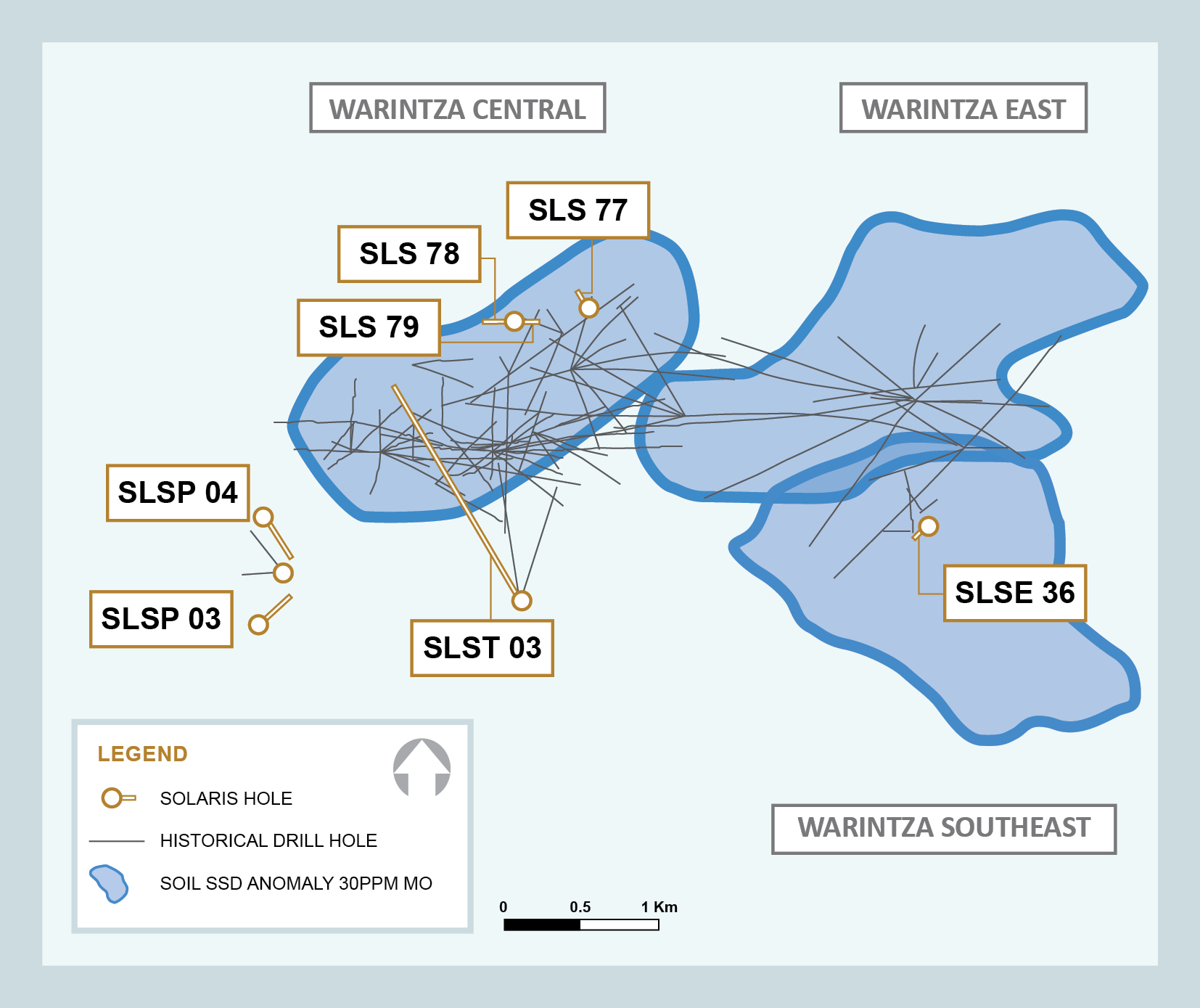

VANCOUVER, British Columbia, July 09, 2024 (GLOBE NEWSWIRE) -- Solaris Resources Inc. (TSX: SLS; NYSE: SLSR) (“Solaris” or the “Company”) is pleased to report drill results from the ongoing 2024 drilling program at its Warintza Project (“Warintza” or “the Project”) in southeastern Ecuador. These include the final assays for inclusion in the updated mineral resource estimate which is expected to be released this month. Highlights are listed below with a corresponding image in Figure 1 and results in Tables 1-2.

Highlights

- SLSE-36 was collared at the southeasternmost platform at Warintza Southeast and returned 148m of

0.72% CuEq¹ within a broader interval of 325m of0.51% CuEq¹ from surface and remains open in strong mineralization, with the final 34m averaging0.90% CuEq¹

- SLS-77 was collared on the northern boundary of the Northeast Extension of Warintza Central and returned 108m of

0.70% CuEq¹ from near surface within a broader interval of 273m of0.57% CuEq¹ from surface

- SLS-78 was collared from a new platform 100m to the west and drilled west through leached cap before returning 78m of

0.70% CuEq¹ within a broader interval of 114m of0.65% CuEq¹ from 72m depth and then entering low grade granodiorite

- SLS-79 was collared from the same platform and drilled west at steep inclination, returning 78m of

0.60% CuEq¹ from near surface within a broader interval of 248m of0.50% CuEq¹, ending in strong mineralization

- SLST-03 was collared approximately 300m south of Warintza Central at the Trinche platform and drilled northwest into an open volume to convert undefined waste within the expected pit shell, returning 312m of

0.62% CuEq¹ within a broader interval of 1,028m of0.30% CuEq¹ from surface

- Patrimonio hole 04 consistent with 01 and 02 intersected an approximately 150m thick tabular zone of replacement mineralization dipping shallowly to the west for which the source has not yet been encountered. SLSP-03 was collared at higher elevation and intersected a low grade layer in the host lava sequence before passing into a barren, post-mineral porphyry that intruded and displaced the targeted mineralized layer. Mineral alteration zoning and geochemistry suggests that the core of the mineralized system lies to the south

- 2024 drill program was recently expanded to 60,000m comprising 140 holes from 80 platforms providing significantly improved drilling coverage with 27,000m in 74 holes completed to the end of June, with seven rigs targeting >8km of drilling in July due to improved site logistics from infrastructure development at site

- Ongoing drilling is focused on Patrimonio exploration, resource extension at Warintza Southeast, and infill and technical drilling to support the PFS in H2/25, including geotechnical holes which are expected to fulfill a dual role in providing information to aid in the understanding of the geology of the Caya-Mateo epithermal gold and silver target area

Figure 1 – Plan View of Drilling to Date

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) |

| SLS-79 | July 09, 2024 | 15 | 263 | 248 | 0.41 | 0.02 | 0.05 | 0.50 |

| Including | 54 | 132 | 78 | 0.52 | 0.01 | 0.05 | 0.60 | |

| SLS-78 | 72 | 186 | 114 | 0.54 | 0.02 | 0.07 | 0.65 | |

| Including | 93 | 171 | 78 | 0.58 | 0.02 | 0.08 | 0.70 | |

| SLS-77 | 0 | 273 | 273 | 0.43 | 0.02 | 0.10 | 0.57 | |

| Including | 21 | 129 | 108 | 0.56 | 0.02 | 0.10 | 0.70 | |

| SLSE-36 | 0 | 325 | 325 | 0.40 | 0.02 | 0.05 | 0.51 | |

| Including | 177 | 325 | 148 | 0.58 | 0.03 | 0.07 | 0.72 | |

| Including | 291 | 325 | 34 | 0.76 | 0.03 | 0.08 | 0.90 | |

| SLSP-04 | 30 | 204 | 174 | 0.25 | 0.02 | 0.06 | 0.35 | |

| Including | 104 | 152 | 48 | 0.30 | 0.02 | 0.08 | 0.43 | |

| SLSP-03 | 0 | 310 | 310 | 0.10 | 0.01 | 0.04 | 0.14 | |

| SLST-03 | 16 | 1044 | 1028 | 0.24 | 0.01 | 0.03 | 0.30 | |

| Including | 646 | 958 | 312 | 0.51 | 0.02 | 0.06 | 0.62 |

Notes to table: True widths are interpreted to be very close to drilled widths due to the bulk-porphyry style mineralized zones at Warintza.

Table 2 - Collar Locations

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLS-79 | 800197 | 9648470 | 1340 | 263 | 270 | -88 |

| SLS-78 | 800197 | 9648469 | 1340 | 220 | 270 | -65 |

| SLS-77 | 800439 | 9648493 | 1271 | 324 | 320 | -85 |

| SLSE-36 | 801529 | 9647848 | 1154 | 325 | 220 | -85 |

| SLSP-04 | 799364 | 9647811 | 1526 | 309 | 145 | -60 |

| SLSP-03 | 799349 | 9647450 | 1627 | 310 | 40 | -65 |

| SLST-03 | 800192 | 9647550 | 1592 | 1123 | 330 | -50 |

Notes to table: The coordinates are in WGS84 17S Datum.

Endnotes

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t), utilizing metal prices of US

$3.50 /lb Cu, US$15.00 /lb Mo, and US$1,500 /oz Au, and assumes recoveries of90% Cu,85% Mo, and70% Au based on preliminary metallurgical test work.

Technical Information and Quality Control & Quality Assurance

Sample assay results have been independently monitored through a quality control/quality assurance (“QA/QC”) program that includes the insertion of blind certified reference materials (standards), blanks and field duplicate samples. Logging and sampling are completed at a secured Company facility located on site. Drill core is cut in half on site and samples are securely transported to ALS Labs in Quito. Sample pulps are sent to ALS Labs in Lima, Peru and Vancouver, Canada for analysis. Total copper and molybdenum contents are determined by four-acid digestion with AAS finish. Gold is determined by fire assay of a 30-gram charge. In addition, selected pulp check samples are sent to Bureau Veritas lab in Lima, Peru. Both ALS Labs and Bureau Veritas lab are independent of Solaris. Solaris is not aware of any drilling, sampling, recovery or other factors that could materially affect the accuracy or reliability of the data referred to herein. Details on the surface sampling conducted at the Project are set out in the technical report titled, “NI 43-101 Technical Report for the Warintza Project, Ecuador (Amended)” with an effective date of April 1, 2022, prepared by Mario E. Rossi and available on the Company’s SEDAR+ profile and website. The drillhole data has been verified by Jorge Fierro, M.Sc., DIC, PG, using data validation and quality assurance procedures under high industry standards.

Qualified Person

The scientific and technical content of this press release has been reviewed and approved by Jorge Fierro, M.Sc., DIC, PG, Vice President Exploration of Solaris who is a “Qualified Person” as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects. Jorge Fierro is a Registered Professional Geologist through the SME (registered member #4279075).

On behalf of the Board of Solaris Resources Inc.

“Daniel Earle”

President & CEO, Director

For Further Information

Jacqueline Wagenaar, VP Investor Relations

Direct: 416-366-5678 Ext. 203

Email: jwagenaar@solarisresources.com

About Solaris Resources Inc.

Solaris is advancing a portfolio of copper and gold assets in the Americas, which includes a world class copper resource with expansion and discovery potential at its Warintza Project in Ecuador; a series of grass roots exploration projects with discovery potential in Peru and Chile; and significant leverage to increasing copper prices through its

Cautionary Notes and Forward-looking Statements

This document contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). The use of the words “will” and “expected” and similar expressions are intended to identify forward-looking statements. These statements include statements that these drill results include the final assays for inclusion in the updated mineral resource estimate which is expected to be released this month, SLST-03 was collared approximately 300m south of Warintza Central at the Trinche platform and drilled northwest into an open volume to convert undefined waste within the expected pit shell, SLSP-03 was collared at higher elevation and intersected a low grade layer in the host lava sequence before passing into a barren, post-mineral porphyry that intruded and displaced the targeted mineralized layer, Mineral alteration zoning and geochemistry suggests that the core of the mineralized system lies to the south, 2024 drill program was recently expanded providing significantly improved drilling coverage, with seven rigs targeting >8km of drilling in July due to improved site logistics from infrastructure development at site, ongoing drilling is focused on Patrimonio exploration, resource extension at Warintza Southeast, and infill and technical drilling to support the PFS in H2/25, including geotechnical holes which are expected to fulfill a dual role in providing information to aid in the understanding of the geology of the Caya-Mateo epithermal gold and silver target area. Although Solaris believes that the expectations reflected in such forward-looking statements and/or information are reasonable, readers are cautioned that actual results may vary from the forward-looking statements. The Company has based these forward-looking statements and information on the Company’s current expectations and assumptions about future events including assumptions regarding the exploration and regional programs. These statements also involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in the Solaris Management’s Discussion and Analysis, for the year ended December 31, 2023 available at www.sedarplus.ca. Furthermore, the forward-looking statements contained in this news release are made as at the date of this news release and Solaris does not undertake any obligation to publicly update or revise any of these forward-looking statements except as may be required by applicable securities laws.

A figure accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/49abf5fc-358c-4309-8736-846f652bc0b2