Silver Dollar Samples Up to 2,753 g/t AgEq in Underground Sampling Campaign at its La Joya Silver Project

Rhea-AI Summary

Silver Dollar Resources (OTCQX:SLVDF) reported results from an underground sampling program at the 100%‑owned La Joya project in Durango, Mexico, including 16 channel samples from historic La Embotelladora workings.

Key highlights: Sample R-300 returned 2,753 g/t AgEq over 0.4 m and R-291 returned 328 g/t AgEq over 0.4 m. Preliminary numerical and vein‑trend modeling is underway to support a strategic shift from open pit to underground targeting ENE, NNE and E‑W structural trends.

The release cites AgEq pricing and assumed historic recoveries used in calculations and notes the historical 2013 PEA and MRE remain unverified by a qualified person for current resource status.

Positive

- R-300 returned 2,753 g/t AgEq over 0.4 m

- R-291 returned 328 g/t AgEq over 0.4 m

- 16 underground channel samples confirm localized high‑grade structures

- Preliminary numerical modeling targets E‑W, ENE and NNE structural trends

Negative

- High grades reported over very narrow widths (e.g., 0.4 m)

- Historical MRE from the 2013 PEA has not been independently verified

- AgEq uses assumed historic recoveries and specific metal prices, introducing sensitivity

News Market Reaction

On the day this news was published, SLVDF declined 0.51%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Geologic Modeling of High-Grade Drill Intercepts Underway

VANCOUVER, BC / ACCESS Newswire / November 25, 2025 / Silver Dollar Resources Inc. (CSE:SLV)(OTCQX:SLVDF)(FSE:4YW) ("Silver Dollar" or the "Company") is pleased to report underground sample assay results and preliminary geologic modeling of existing high-grade drill results in support of an exploration and mining strategy shift from open pit to underground at its

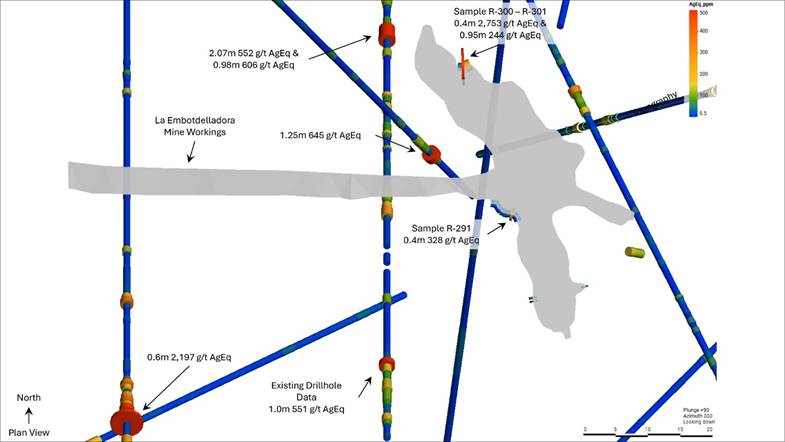

A total of 16 channel samples were collected from the historic La Embotelladora mine workings, showing mineralization localized in ENE and NNE structural zones. Sample R-300 returned 2,753 grams per tonne (g/t) silver equivalent (AgEq) over 0.4 metres (m) representing the NNE trending zone. Sample R-291 returned 328 g/t AgEq over 0.4m representing the ENE structural zone (Table 1). These data combined with existing drilling results are aiding in the Company's ongoing strategy of transitioning La Joya from an open pit to an underground project by confirming high grade mineralization localization in a network of prospective structures. Ongoing geologic modeling will focus on validating this thesis through re-focused exploration planning.

Sample ID | Width (m) | Ag g/t | Au g/t | Cu g/t | Pb g/t | Zn g/t | AgEq g/t |

R-289 | 0.4 | 2 | 0.0 | 387 | 26 | 171 | 6 |

R-290 | 0.6 | 5 | 0.3 | 464 | 17 | 158 | 21 |

R-291 | 0.4 | 166 | 0.2 | 23,110 | 43 | 153 | 328 |

R-292 | 1.1 | 11 | 0.1 | 1,900 | 14 | 186 | 26 |

R-293 | 0.7 | 4 | 0.4 | 606 | 13 | 145 | 23 |

R-294 | 0.6 | 2 | 0.0 | 254 | 9 | 153 | 5 |

R-295 | 0.6 | 2 | 0.1 | 448 | 9 | 163 | 7 |

R-296 | 0.85 | 5 | 0.1 | 457 | 369 | 1,620 | 13 |

R-297 | 0.8 | 5 | 0.1 | 689 | 292 | 4,440 | 18 |

R-298 | 0.3 | 1 | 0.1 | 367 | 11 | 156 | 6 |

R-299 | 0.85 | 26 | 0.0 | 2,160 | 20 | 204 | 41 |

R-300 | 0.4 | 1,800 | 0.6 | 139,860 | 1,340 | 4,550 | 2,753 |

R-301 | 0.95 | 148 | 0.1 | 13,870 | 36 | 234 | 244 |

R-302 | 0.32 | 34 | 0.5 | 416 | 15 | 129 | 57 |

R-303 | 0.4 | 9 | 1.1 | 460 | 4 | 182 | 54 |

R-304 | 0.26 | 3 | 0.2 | 549 | 58 | 364 | 15 |

Table 1: Assay results from underground sampling campaign.

Silver equivalent is calculated using the following metal prices in USD: Au

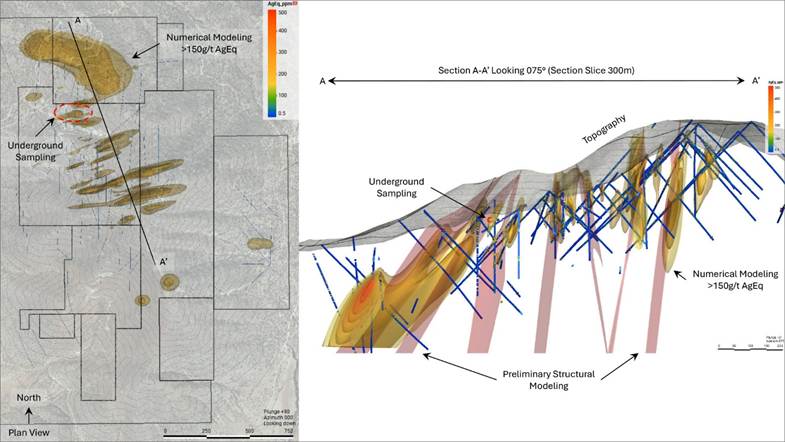

Silver Dollar has also completed preliminary numerical modeling of existing drillhole assay data to identify additional high-grade mineralization. Numerical models were trended using preliminary vein modeling, which focused on a series of emerging E-W trends. Ongoing geologic modeling will incorporate other local trends, including a NNE structural trend, and the impact of stratigraphic-structural intersections on plunging mineral trends.

"With silver, copper, and gold prices all reaching record highs this year, it's an opportune time to re-conceptualize La Joya from a new underground perspective," said Greg Lytle, President of Silver Dollar. "The goal of our geological modeling is to assess La Joya's underground potential based on a compilation of all historical data, consider hypothetical underground mining methods, and identify high-priority exploration targets to add value to the Project."

Procedure, quality assurance/quality control and data verification:

All rock samples were collected, described, photographed, and bagged on-site. The samples were delivered by Silver Dollar staff to ActLabs in Zacatecas, Mexico for analysis. ActLabs is ISO 9001:2015 certified. Rock samples were crushed, pulverized and screened to -80 mesh at the lab, prior to analysis. Gold is analyzed by a 30g Fire Assay with AA (atomic absorption spectroscopy) finish, then gravimetric finish if greater than 10ppm Gold. Silver and 34 other elements were analyzed using a four-acid digestion with an ICP-OES (Inductively Coupled Plasma Optical Emission spectroscopy) finish. Silver, lead, zinc, and copper over limits were re-assayed using an ore-grade four-acid digestion with ICP-AES (Inductively coupled plasma atomic emission spectroscopy) finish. Control samples comprising certified reference samples and blank samples were systematically inserted into the sample stream and analyzed as part of the Company's quality assurance and quality control protocol.

About the La Joya Property:

La Joya is an advanced exploration stage property consisting of 15 mineral concessions totaling 4,646 hectares and hosts the Main Mineralized Trend (MMT), Santo Nino, and Coloradito deposits.

The previous operator, Silvercrest Mines, released a Preliminary Economic Assessment (PEA) NI 43-101 Technical Report on the La Joya Property in December 2013. The PEA included a mineral resource estimate (MRE) on the MMT and Santo Nino deposits (See Historical MRE Table) that was based on 89 holes totaling 30,085 m of Silvercrest's drilling between 2010 and 2012 (See Historical MRE Model). The MRE was reported to conform to CIM definitions for resource estimation; however, a qualified person of Silver Dollar has not done sufficient work to classify the historical resource, and the Company is not treating it as a current mineral resource. Independent data verification and an assessment of the mineral resource estimation methods are required to verify the historical mineral resource.

The Property is situated approximately 75 kilometres southeast of the Durango state capital city of Durango in a high-grade silver region with past-producing and operating mines, including Silver Storm's La Parrilla Mine, Industrias Penoles' Sabinas Mine, Grupo Mexico's San Martin Mine, Sabinas Mine, First Majestic's Del Toro Mine, and Pan American Silver's La Colorada Mine (Figure 4).

Dale Moore, P.Geo., an independent Qualified Person (QP) as defined in NI 43-101, has reviewed and approved the technical contents of this news release on behalf of the Company.

About Silver Dollar Resources Inc.

Silver Dollar is a dynamic mineral exploration company focused on two of North America's premier mining regions: Idaho's prolific Silver Valley and the Durango-Zacatecas silver-gold belt. Our portfolio includes the advanced-stage Ranger-Page and La Joya projects, as well as the early-stage Nora project. The Company's financial backers include renowned mining investor Eric Sprott, our largest shareholder. Silver Dollar's management team is committed to an aggressive growth strategy and is actively reviewing potential acquisitions with a focus on drill-ready projects in mining-friendly jurisdictions.

For additional information, you can visit our website at silverdollarresources.com, download our investor presentation, and follow us on X at x.com/SilverDollarRes.

ON BEHALF OF THE BOARD

Signed "Gregory Lytle"

Gregory Lytle,

President, CEO & Director

Silver Dollar Resources Inc.

Direct line: (604) 839-6946

Email: greg@silverdollarresources.com

179 - 2945 Jacklin Road, Suite 416

Victoria, BC, V9B 6J9

Forward-Looking Statements:

This news release may contain "forward-looking statements." Forward-looking statements involve known and unknown risks, uncertainties, assumptions, and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date of this news release and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents of this news release.

SOURCE: Silver Dollar Resources Inc.

View the original press release on ACCESS Newswire