Silver Dollar Sells Ranger-Page Silver-Zinc-Lead Project to Bunker Hill Mining

Rhea-AI Summary

Silver Dollar Resources (OTCQX: SLVDF) agreed to sell its Ranger-Page silver-zinc-lead project in Shoshone County, Idaho to Bunker Hill Mining for CAD$3,500,000 payable by issuance of 23,333,334 Bunker Hill common shares at a deemed price of CAD$0.15 per share.

Shares are subject to a statutory six-month hold and contractual escrow with staged releases at 6, 9 and 12 months. Closing is expected on or before November 28, 2025, subject to a 15-business-day title due diligence by Bunker Hill and customary closing conditions. The deal joins the Ranger-Page and Bunker Hill land positions and is intended to support Bunker Hill's restart targeted for H1 2026.

Positive

- CAD$3.5M consideration paid via 23,333,334 shares

- Contiguous land package unites Ranger-Page and Bunker Hill holdings

- Exploration upside with Page vein open at depth and along strike

- Restart alignment supports Bunker Hill restart targeted H1 2026

Negative

- All-cash equivalent paid in shares (23,333,334 shares) increases share issuance

- Closing conditional on 15-business-day title due diligence and CSE acceptance

- Majority of shares escrowed until 12-month anniversary of closing

News Market Reaction

On the day this news was published, SLVDF declined 3.91%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

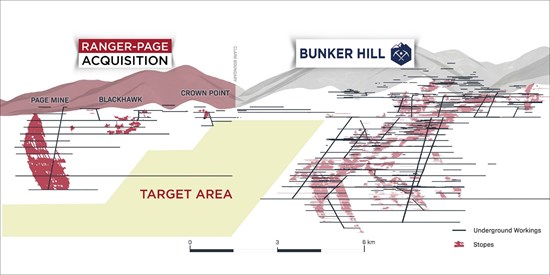

The historical Ranger-Page workings and mineralized zones are geologically continuous with the Bunker Hill system

Vancouver, British Columbia--(Newsfile Corp. - October 27, 2025) - Silver Dollar Resources Inc. (CSE: SLV) (OTCQX: SLVDF) (FSE: 4YW) is pleased to announce it has signed an asset purchase agreement (the "Agreement") with Bunker Hill Mining Corp., whereby Bunker Hill Mining Corp. and its subsidiary (together, "Bunker Hill") will acquire from Silver Dollar Resources Inc. and its subsidiary (together, "Silver Dollar" or the "Company"), the right, title and interest in the assets related to the Ranger-Page Project located in Shoshone County, Idaho, USA (the "Target Assets"), which includes Silver Dollar's

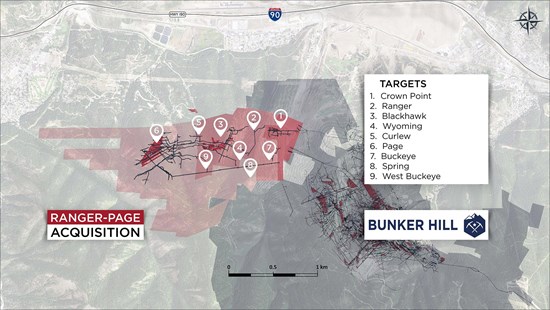

Figure 1: Plan map showing combined Bunker Hill - Ranger-Page land package.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7232/271979_39a2aa04d46b4906_001full.jpg

Sam Ash, President and CEO of Bunker Hill Mining, stated: "The addition of the Ranger-Page Mines represents another step in our vision to re-establish Bunker Hill as a leading producer in the Silver Valley. The Ranger-Page workings and mineralized zones are geologically continuous with the Bunker Hill system, offering immediate synergies for exploration, development, and potential future production."

"Amalgamating the Ranger-Page Project with Bunker Hill Mining is a strategic and logical transaction that aligns perfectly with the plan we contemplated when we acquired the Project last year," said Greg Lytle, President and CEO of Silver Dollar. "While the transaction has happened faster than expected, we are confident the timing is optimal for both companies. Ranger-Page enhances Bunker Hill's exploration prospects and provides Silver Dollar with a strong equity position in a near-term producer, benefiting from the upside of the combined assets."

Figure 2: Cross Section showing the Bunker Hill - Ranger-Page underground workings and target area.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7232/271979_39a2aa04d46b4906_002full.jpg

Strategic Highlights:

Consolidated Land Position: The acquisition unites the Ranger-Page and Bunker Hill properties into a contiguous land package, creating one of the largest and most prospective holdings by any single company in the Silver Valley.

Exploration Upside: Historical drilling and production data from the Ranger-Page indicate high-grade silver-lead-zinc mineralization along the Page vein system, which remains open at depth and along strike.

Infrastructure Synergies: The Ranger-Page Mines' existing underground workings and surface access points could provide additional flexibility for future mine planning, ventilation, and exploration access to deeper levels of the Bunker Hill system.

Complementary to Restart Plan: The acquisition is aligned with Bunker Hill's ongoing restart of operations at the Bunker Hill Mine, targeted for H1 2026, and enhances the Company's upside optionality for future resource expansion and mill feed sources.

Community benefits: This has the potential to create more local employment opportunities within the Silver Valley and stimulate procurement from regional suppliers in ways that benefit the local communities.

Transaction Summary

Under the terms of the agreement, Bunker Hill agreed to acquire all of Silver Dollar's interest in the Ranger-Page Project and associated claims from Silver Dollar for total consideration of CAD

| Release Date | Payment Shares Release Schedule from Contractual Escrow |

| 6-month anniversary of Closing Date | 2,333,333 Shares |

| 9-month anniversary of Closing Date | 2,333,333 Shares |

| 12-month anniversary of Closing Date | Balance of Shares (18,666,668 Shares) |

The Agreement is subject to Bunker Hill's due diligence review in respect of the title to the Ranger-Page Project within 15 business days of the date of the Agreement and it also includes representations, warranties, covenants and indemnities customary in transactions of this nature. Silver Dollar will, subject to Canadian Securities Exchange acceptance, pay a finder's fee by the allocation of 1,166,667 of the Bunker Hill Common Shares to each of Kluane Capital FZCO and Canal Front Investments Inc. in respect of the transaction. The finders' shares will be subject to the same statutory and contractual escrow restrictions as described above.

Closing of the transaction is expected to be completed on or before November 28, 2025.

About the Ranger-Page Project

Located in a world-class silver district, the Ranger-Page land package covers six historic mines and adjoins the Bunker Hill Mining property. The primary target areas are up and down plunge from historic underground mining, along strike where ground induced polarization (IP) surveys have identified anomalies, and where surface trenching identified near surface mineralization. Additional exploration targets have also been identified away from historic mine infrastructure, using soil geochemical data, mapping, and ground IP survey data.

About Bunker Hill Mining Corp.

Bunker Hill is an American mineral exploration and development company focused on revitalizing its historic mining asset: the renowned zinc, lead, and silver deposit in northern Idaho's prolific Coeur d'Alene mining district. This strategic initiative aims to breathe new life into a once-productive mine, leveraging modern exploration techniques and sustainable development practices to unlock the potential of this mineral-rich region. Bunker Hill Mining Corp. aims to maximize shareholder value by responsibly harnessing the mineral wealth in the Silver Valley mining district, focusing its efforts on this single, high-potential asset. Information about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR+ and EDGAR databases.

About Silver Dollar Resources Inc.

Silver Dollar is a dynamic mineral exploration company focused on two of North America's premier mining regions: Idaho's prolific Silver Valley and the Durango-Zacatecas silver-gold belt. Our portfolio includes the advanced-stage Ranger-Page and La Joya projects, as well as the early-stage Nora project. The Company's financial backers include renowned mining investor Eric Sprott, our largest shareholder. Silver Dollar's management team is committed to an aggressive growth strategy and is actively reviewing potential acquisitions with a focus on drill-ready projects in mining-friendly jurisdictions.

For additional information, you can visit our website at silverdollarresources.com, download our investor presentation, and follow us on X at x.com/SilverDollarRes.

ON BEHALF OF THE BOARD

Signed "Gregory Lytle"

Gregory Lytle,

President, CEO & Director

Silver Dollar Resources Inc.

Direct line: (604) 839-6946

Email: greg@silverdollarresources.com

179 - 2945 Jacklin Road, Suite 416

Victoria, BC, V9B 6J9

Forward-Looking Statements:

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the closing of the transaction are forward-looking statements. Often, but not always, forward looking information can be identified by words such as "pro forma," "plans," "expects," "will," "may," "should," "budget," "scheduled," "estimates," "forecasts," "intends," "anticipates," "believes," "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved.

In making the forward-looking statements in this news release, the Company has made certain assumptions, including without limitation, the receipt of any necessary regulatory approvals in connection with the transaction and the purchaser's satisfaction with its due diligence review.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, the ability of the Company to obtain any necessary regulatory approvals and the purchaser's satisfaction with its due diligence review.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements in this news release except as otherwise required by law.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents of this news release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/271979