Silver One Reports Filing of Technical Report to Mineral Resource Estimate on Its Candelaria Project, Nevada

Rhea-AI Summary

Positive

- Total resources of 108.18M ounces of silver equivalent in Measured and Indicated categories demonstrate significant resource potential

- High-grade underground resource with 168 g/t Ag and 0.27 g/t Au in M&I categories

- Multiple resource types including open-pit, underground, stockpiles and heap-leach pads provide operational flexibility

- NI 43-101 compliance adds credibility to the resource estimates

Negative

- Resources are not mineral reserves and have not demonstrated economic viability

- About 80% of assays in the database are from cyanide soluble silver and gold assays only, potentially affecting accuracy

- Project requires various permits and approvals with no guarantee of success

- Inferred resources have lower confidence levels and require additional exploration for upgrade

News Market Reaction

On the day this news was published, SLVRF declined 1.00%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Candelaria's project resources (from open-pit, underground, stockpiles and heap-leach pads) now total 108.18 million ounces of silver equivalent in the Measured and Indicated categories, and 29.46 million ounces of silver equivalent in the Inferred category

Vancouver, British Columbia--(Newsfile Corp. - June 19, 2025) - Silver One Resources Inc. (TSXV: SVE) (OTCQX: SLVRF) (FSE: BRK1) ("Silver One" or the "Company") is pleased to announce it has filed on SEDAR a National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") technical report (the "Technical Report") with respect to the Candelaria Project (the "Project"), located in Nevada, USA. The Technical Report titled "Mineral Resource Estimate on the Candelaria Property" dated April 30, 2025, prepared by James A. McCrea, P. Geo, supports the initial mineral resource estimate ("MRE") at the Project (see news release dated May 6, 2025).

Highlights:

Mount Diablo and Northern Belle pit-constrained resources:

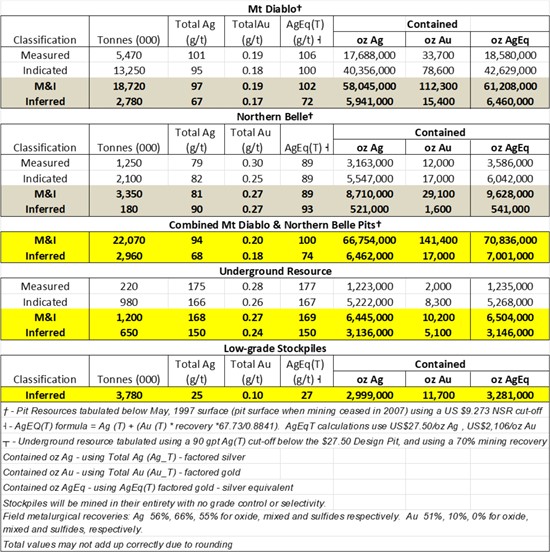

Measured and Indicated (M&I) resource of 22,070,000 tonnes averaging 94 g/t Ag and 0.20 g/t Au, for 66.754 million ounces of silver and 141,400 ounces of gold, or 70.84 million ounces of silver equivalent ("AgEq") (see note ˧ in table 1).

Inferred resource of 2,960,000 tonnes averaging 68 g/t Ag and 0.18 g/t Au, for 6.462 million ounces of silver and 17,000 ounces of gold (7.00 million oz AgEq).

Underground Measured and Indicated resource of 1,200,000 tonnes averaging 168 g/t Ag and 0.27 g/t Au, for 6.45 million ounces of silver and 10,200 ounces of gold (6.50 million oz AgEq).

Underground Inferred resource of 650,000 tonnes averaging 150 g/t Ag and 0.24 g/t Au, for 3.136 million ounces of silver and 5,100 ounces of gold (3.15 million oz AgEq).

Candelaria's project resources (from open-pit, underground, stockpiles and heap-leach pads) now total 108.18 million ounces of silver equivalent in the Measured and Indicated categories, and 29.46 million ounces of silver equivalent in the Inferred category.

Table 1. Candelaria in-ground, underground, and stockpiles mineral resource estimates.

Totals above include pit Constrained Mineral Resources (Mt. Diablo and Northern Belle) at a US

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4730/256071_9d2bcf61f4fe89b4_0001full.jpg

1. A Mineral Resource is a concentration or occurrence of solid material of economic interest in or on the Earth's crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction.

An Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity.

An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

An Indicated Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation.

An Indicated Mineral Resource has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a Probable Mineral Reserve.

2. Mineral resources, which are not mineral reserves, do not have demonstrated economic viability. The estimate of mineral resources has no known issues and does not appear materially affected by any known environmental, permitting, legal, title, socio-political, marketing, or other relevant issues. There is no guarantee that Silver One will be successful in obtaining any or all of the requisite consents, permits or approvals, regulatory or otherwise for the project or that the project will be placed into production.

3. The mineral resources in this study were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum ('CIM'), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the Standing Committee on Reserve Definitions and adopted by the CIM Council on May 10, 2014.

4. This Mineral Resource Estimate for the near-surface material is based on material within an optimized open pit shell that results from a US

5. The Mineral Resource Estimate for underground material was calculated using a 90 g/t Ag(T) cut-off below the

6. Total Ag (AgT) and Au (AuT) mean total silver and gold assays (FA/Gravity) reported by the lab. It also means Calculated silver and gold values for historic samples collected by previous operators that were assayed for cyanide soluble silver or gold only, but not assayed for total gold and silver. Average total silver and gold for Mt. Diablo, Northern Belle and Underground resources in this table are derived from silver and gold assays in a database that consists of up to

The Technical Report is available for review on SEDAR+. Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the mineral resource estimate. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

Qualified Persons

The mineral resource estimate was prepared by James A. McCrea, P. Geo, an independent Qualified Person as defined by National Instrument 43-101 who has reviewed and approved the content of the news release relating to the mineral resource estimate.

The technical content of this news release, not related to the mineral resource estimate, has been reviewed and approved by Robert M. Cann, P. Geo, a Qualified Person as defined by National Instrument 43-101 and an independent consultant to the Company.

About Silver One

Silver One is focused on the exploration and development of quality silver projects. The Company holds

The Company owns 636 lode claims and five patented claims on its Cherokee project located in Lincoln County, Nevada, host to multiple silver-copper-gold vein systems, traced to date for over 11 km along-strike.

Silver One also owns a

For more information, please contact:

Silver One Resources Inc.

Gary Lindsey - VP, Investor Relations

Phone: 604-974‐5274

Mobile: (720) 273-6224

Email: gary@strata-star.com

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. Silver One cautions that all forward-looking statements are inherently uncertain, and that actual performance may be affected by a number of material factors, many of which are beyond Silver One's control. Such factors include, among other things: risks and uncertainties relating to Silver One's limited operating history, ability to obtain sufficient financing to carry out its exploration and development objectives on the Candelaria Project, obtaining the necessary permits to carry out its activities and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Silver One undertakes no obligation to publicly update or revise forward-looking information.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/256071