SS&C GlobeOp Hedge Fund Performance Index and Capital Movement Index

Key Terms

hedge fund performance index financial

capital movement index financial

assets under administration financial

forward redemption indicator financial

correlation technical

SS&C GlobeOp Hedge Fund Performance Index: November performance

SS&C GlobeOp Capital Movement Index: December net flows advance

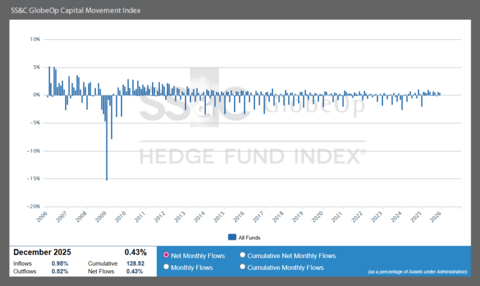

SS&C GlobeOp Capital Movement Index

Hedge fund flows as measured by the SS&C GlobeOp Capital Movement Index advanced

“SS&C GlobeOp’s Capital Movement Index for December 2025 was

SS&C GlobeOp Hedge Fund Performance Index

The SS&C GlobeOp Hedge Fund Performance Index is an asset-weighted, independent monthly window on hedge fund performance. On the ninth business day of each month it provides a flash estimate of the gross aggregate performance of funds for which SS&C GlobeOp provides monthly administration services on the SS&C GlobeOp platform. Interim and final values, both gross and net, are provided in each of the two following months, respectively. Online data can be segmented by gross and net performance, and by time periods. The SS&C GlobeOp Hedge Fund Performance Index is transparent, consistent in data processing, and free from selection or survivorship bias. Its inception date is January 1, 2006.

The SS&C GlobeOp Hedge Fund Performance Index offers a unique reflection of the return on capital invested in funds. It does not overstate exposure to, or the contribution of, any single strategy to aggregate hedge fund performance. Since its inception, the correlation of the SS&C GlobeOp Performance Index to many popular equity market indices has been approximately

SS&C GlobeOp Capital Movement Index

The SS&C GlobeOp Capital Movement Index represents the monthly net of hedge fund subscriptions and redemptions administered by SS&C GlobeOp on the SS&C GlobeOp platform. This monthly net is divided by the total assets under administration (AuA) for fund administration clients on the SS&C GlobeOp platform.

Cumulatively, the SS&C GlobeOp Capital Movement Index for December 2025 stands at 128.52 points, a increase of 0.43 points over November 2025. The Index has advanced 3.15 points over the past 12 months. The next publication date is January 14, 2026.

Published on the ninth business day of each month, the SS&C GlobeOp Capital Movement Index presents a timely and accurate view of investments in hedge funds on the SS&C GlobeOp administration platform. Data is based on actual subscriptions and redemptions independently calculated and confirmed from real capital movements, and published only a few business days after they occur. Following the month of its release, the Index may be updated for capital movements that occurred after the fifth business day.

SS&C GlobeOp Hedge Fund Performance Index

Base |

100 points on 31 December 2005 |

Flash estimate (current month) |

|

Year-to-date (YTD) |

|

Last 12 month (LTM) |

|

Life to date (LTD) |

|

*All numbers reported above are gross |

SS&C GlobeOp Capital Movement Index

Base |

100 points on 31 December 2005 |

All time high |

150.77 in September 2013 |

All time low |

99.67 in January 2006 |

12-month high |

128.52 in December 2025 |

12-month low |

123.40 in January 2025 |

Largest monthly change |

- 15.21 in January 2009 |

SS&C GlobeOp Forward Redemption Indicator

All time high |

|

All time low |

|

12-month high |

|

12-month low |

|

Largest monthly change |

|

About the SS&C GlobeOp Hedge Fund Index®

The SS&C GlobeOp Hedge Fund Index (the Index) is a family of indices published by SS&C GlobeOp. A unique set of indices by a hedge fund administrator, it offers clients, investors and the overall market a welcome transparency on liquidity, investor sentiment and performance. The Index is based on a significant platform of diverse and representative assets.

The SS&C GlobeOp Capital Movement Index and the SS&C GlobeOp Forward Redemption Indicator provide monthly reports based on actual and anticipated capital movement data independently collected from all hedge fund clients for whom SS&C GlobeOp provides administration services on the SS&C GlobeOp platform.

The SS&C GlobeOp Hedge Fund Performance Index is an asset-weighted benchmark of the aggregate performance of funds for which SS&C GlobeOp provides monthly administration services on the SS&C GlobeOp platform. Flash estimate, interim and final values are provided, in each of three months respectively, following each business month-end.

While individual fund data is anonymized by aggregation, the SS&C GlobeOp Hedge Fund Index data will be based on the same reconciled fund data that SS&C GlobeOp uses to produce fund net asset values (NAV). Funds acquired through the acquisition of Citi Alternative Investor Services are integrated into the index suite starting with the January 2017 reporting periods. SS&C GlobeOp’s total assets under administration on the SS&C GlobeOp platform represent approximately

About SS&C Technologies

SS&C is a global provider of services and software for the financial services and healthcare industries. Founded in 1986, SS&C is headquartered in

Additional information about SS&C (Nasdaq: SSNC) is available at www.ssctech.com.

Follow SS&C on X, LinkedIn and Facebook.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251210284981/en/

For more information

Brian Schell

Chief Financial Officer

SS&C Technologies

Tel: +1-816-642-0915

E-mail: InvestorRelations@sscinc.com

Justine Stone

Investor Relations

SS&C Technologies

Tel: +1-212-367-4705

E-mail: InvestorRelations@sscinc.com

Media Contacts

Prosek

Tel: +1-646-818-9195

E-mail: pro-SSC@prosek.com

Source: SS&C