Southern Silver Intersects 10.5 metres averaging 1,115g/t AgEq at Cerro Las Minitas Project in Durango, México

Rhea-AI Summary

Southern Silver (OTC:SSVFF) reported rush assays from initial drilling on the newly acquired Puro Corazon claim at the Cerro Las Minitas project, Durango, Mexico on Dec 1, 2025. Highlights include a 10.5 metre interval estimated true thickness averaging 560 g/t Ag, 0.1 g/t Au, 11.2% Pb, 12.3% Zn (1,115 g/t AgEq) and a 3.4 m subinterval averaging 1,067 g/t Ag (1,982 g/t AgEq), both near surface. Ten of 21 holes (~4,000 m) are complete, ~12,000 m planned. Final assays expected by end of Q1 2026 with plans to update the Mineral Resource Estimate and PEA.

Positive

- 10.5 m at 560 g/t Ag (1,115 g/t AgEq) near surface

- Subinterval 3.4 m at 1,067 g/t Ag (1,982 g/t AgEq)

- Drill program ongoing: 10 of 21 holes complete (~4,000 m) with 12,000 m planned

- Company plans to update Mineral Resource Estimate and PEA after Q1 2026 assays

Negative

- Multiple assay intervals and step-out holes remain pending

- Less than 40% of planned drill program completed, early-stage results

- One composite reports 68.6% dilution on reported intercept

News Market Reaction

On the day this news was published, SSVFF gained 14.72%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

SSVFF gained 14.08%, outpacing peers like WAMFF (+4.39%) and FNMCF (+3.66%). With no peers in the momentum scanner and mixed, modest moves across comparables, the reaction appears more company-specific to the Cerro Las Minitas drill results.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 01 | Drill results | Positive | +14.7% | Bonanza-grade near-surface silver-zinc-lead intercepts at Puro Corazon. |

| Oct 24 | Corporate update | Neutral | +0.0% | AGM results, stock option plan approval, and new director appointment. |

| Oct 06 | Drill program start | Positive | -2.4% | Initiation of 12,000 m drill program and integration work at Puro Corazon. |

| Sep 17 | Asset acquisition | Positive | +1.6% | Agreement to acquire Puro Corazon claim and launch large infill drilling. |

Positive, project-focused news has generally aligned with favorable price reactions, while one prior drill-program launch saw a short-term divergence.

This announcement builds on a series of Cerro Las Minitas developments over recent months. On Sep 17, 2025, Southern Silver agreed to acquire the Puro Corazon claim, with a planned 12,000 m drill program and a Q1 2026 PEA update, and the stock rose 1.65%. A drill program launch on Oct 6, 2025 saw a -2.39% move despite positive operational detail. A corporate update on Oct 24, 2025 had a flat reaction. Today’s bonanza-grade assays on Dec 1, 2025 coincided with a strong 14.72% gain, reinforcing the importance of concrete high-grade results.

Market Pulse Summary

The stock surged +14.7% in the session following this news. A strong positive reaction aligns with the bonanza-grade assays reported at Puro Corazon, where intervals up to 1,982 g/t AgEq were intersected. The move also fits a pattern where prior positive Cerro Las Minitas milestones, such as the Puro Corazon acquisition’s 1.65% gain, were rewarded. However, earlier drill-program news on Oct 6, 2025 saw a -2.39% divergence, showing that enthusiasm can fade if subsequent results or technical studies do not reinforce initial expectations.

Key Terms

national instrument 43-101 regulatory

preliminary economic assessment regulatory

channel samples technical

titration technical

lidar survey technical

AI-generated analysis. Not financial advice.

Vancouver, British Columbia--(Newsfile Corp. - December 1, 2025) - Southern Silver Exploration Corp. (TSXV: SSV) (the "Company" or "Southern Silver") reports today that rush assays from initial drilling on the recently acquired Puro Corazon claim have returned near surface Bonanza-grade silver mineralization from thick, semi-massive to massive-sulphide replacements in a hanging-wall lens outside of the main skarn target.

The highlight assays were returned from hole 25CLM-203 and include:

10.5 metre interval (estimated true thickness) averaging 560g/t Ag, 0.1g/t Au,

0.1% Cu,11.2% Pb and12.3% Zn (1,115g/t AgEq), including a 3.4 metre interval (estimated true thickness) averaging 1,067g/t Ag, 0.2g/t Au,0.2% Cu,20.0% Pb and19.1% Zn (1,982g/t AgEq)(1) located within 200 metres of surface; andtwo narrower, high-grade intercepts occurring several metres down hole from the highlight intercept (above), which composite to a 2.6 metre interval (estimated true thickness) averaging 143g/t Ag,

4.8% Pb and1.5% % Zn (280g/t AgEq) (1) located a further 6 metres down hole.

(1) see AgEq calculation criteria in notes to Table 1.

The replacement interval contains semi-massive to massive sulphides with up to

In addition, step-out holes from 25CLM-203 have intersected similar replacement-style massive to semi-massive sulphide intercepts both laterally and at depth. These intervals have been logged and sampled, with assays pending.

Vice President of Exploration, Rob Macdonald stated "We're off to a strong start at Puro Corazon. These initial bonanza-grade silver intercepts confirm the near surface, high-grade nature of the mineralization and the overall prospectivity of the recently acquired Puro Corazon claim. With approximately

Assays from drill hole 25CLM-202 were also received and identified mineralized skarn located adjacent to the historic Santo Nino workings which are located to the north of the Puro Corazon claim boundary and on the larger CLM property. Highlights include:

- a 2.4 metre interval (estimated true thickness) averaging 62g/t Ag,

3.0% Pb and5.2% Zn (273g/t AgEq).

These are the first set of assays released from the Puro Corazon drilling program. As of this writing, ten of the proposed twenty-one holes are now complete for a total of 4,000 metres, with three holes currently in progress. Approximately 12,000 metres of drilling is planned to test the Puro Corazon claim both laterally and to depths of up to 450 metres below surface. Drilling continues on the property with less than

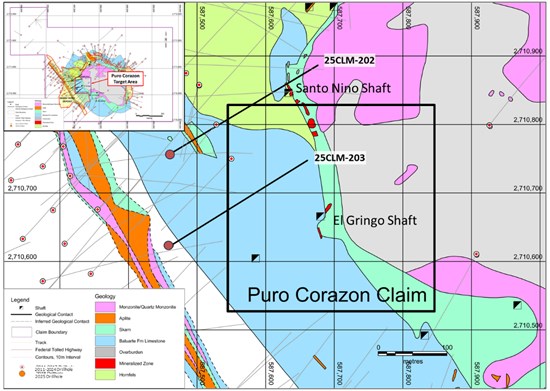

Figure 1: Plan view of the drilling on the recently acquired Puro Corazon Claim.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5344/276315_a2d850b8a49cca2f_002full.jpg

The Company also reports that it has initiated an underground sampling program in the historic Puro Corazon workings. Up to 2000 individual channel samples are planned throughout the 13 different mine levels of the Puro Corazon mine. The sampling will be utilized to inform updated resource models from the mine area as well as establish potential site for future bulk-sampling of the mineralization. Sampling has started and results will be reported as assays are received.

Next Steps

The Company is planning to incorporate the results of the Puro Corazon drilling program into the much larger Cerro Las Minitas project to significantly enhance the project economics. Final assays are expected to be received by the end of the first quarter of 2026, after which the Company intends to:

- update the Mineral Resource Estimate of the Cerro Las Minitas project; followed by

- an update of the Preliminary economic Assessment ("PEA") of the project in accordance with the provisions of National Instrument 43-101.

The Company reports that work on the Cerro Las Minitas project continues advancing numerous upside opportunities identified subsequent to the July 2024 PEA, while also derisking and advancing the project with the commencement of baseline data collection, hydrology, geotechnical, archaeological and land surveys and studies.

As currently modelled, the Cerro Las Minitas project features a large-scale underground mining operation with robust project economics and high gross revenues in a well located and mining friendly jurisdiction in southeast Durango, Mexico. For more information on the details of the current economic assessment of the Cerro Las Minitas project please refer to Southern Silver's news release dated June 10, 2024.

Table 1: Select Assay Results from the Cerro Las Minitas project.

| Collar Data | Est. True | ||||||||||||||

| Hole # | Az | Dip | Depth | From | To | Interval | Thickness | Ag | Au | Cu | Pb | Zn | AgEq | ZnEq | Notes |

| Deg | Deg | (m) | (m) | (m) | (m) | (m) | (g/t) | (g/t) | (%) | (%) | (%) | (g/t) | (%) | ||

| 25CLM-202 | 59.0 | -47.0 | 369.0 | 236.0 | 244.6 | 8.7 | 7.0 | 40 | 0.0 | 0.0 | 1.7 | 2.7 | 148 | 5.5 | |

| inc. | 237.0 | 240.0 | 2.9 | 2.4 | 62 | 0.0 | 0.1 | 3.0 | 5.2 | 266 | 9.9 | ||||

| ASSAYS | |||||||||||||||

| PENDING | |||||||||||||||

| 25CLM-203 | 59.0 | -47.0 | 399.0 | 244.7 | 258.0 | 13.4 | 10.5 | 560 | 0.1 | 0.1 | 11.2 | 12.3 | 1115 | 41.6 | |

| inc. | 244.7 | 249.0 | 4.3 | 3.4 | 1067 | 0.2 | 0.2 | 20.0 | 19.1 | 1982 | 74.0 | ||||

| 25CLM-203 | 59.0 | -47.0 | 399.0 | 262.7 | 266.0 | 3.4 | 2.6 | 143 | 0.0 | 0.1 | 4.8 | 1.5 | 280 | 10.4 | |

| inc. | 262.7 | 263.0 | 0.4 | 0.3 | 396 | 0.0 | 0.0 | 7.2 | 5.8 | 691 | 25.8 | ||||

| and inc. | 265.3 | 266.0 | 0.7 | 0.6 | 443 | 0.1 | 0.3 | 17.6 | 3.6 | 903 | 33.7 | ||||

| ASSAYS | |||||||||||||||

| PENDING | |||||||||||||||

1) Analyzed by FA/AA for gold and ICP-AES by ALS Laboratories, North Vancouver, BC. Silver (>100ppm), copper, lead and zinc (>

2) High silver overlimits (>1500g/t Ag) and gold overlimits (>10g/t Au) re-assayed with FA-Grav. High Pb (>

3) AgEq and ZnEq calculations utilized relative metallurgical recoveries of Au

4) Composites are calculated using a 80g/t AgEq cut-off in sulphide and 0.5g/t AuEq in the oxide gold zone. Composites have <

About Southern Silver Exploration Corp.

Southern Silver Exploration Corp. is an exploration and development company with a focus on the discovery of world-class mineral deposits either directly or through joint-venture relationships in mineral properties in major jurisdictions. Our specific emphasis is the

Robert Macdonald, MSc. P.Geo, is a Qualified Person as defined by National Instrument 43-101 and supervised directly the collection of the data from the CLM project that is reported in this disclosure and is responsible for the presentation of the technical information in this disclosure.

On behalf of the Board of Directors

"Lawrence Page"

Lawrence Page, K.C.

President & Director, Southern Silver Exploration Corp.

For further information, please visit Southern Silver's website at southernsilverexploration.com or contact us at 604.641.2759 or by email at corpdev@mnxltd.com .

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Forward-looking statements in this news release include plans to advance and develop the CLM property including updating the Mineral Resource Estimate followed by an update of the PEA. These statements are based on a number of assumptions, including, but not limited to, general economic conditions, interest rates, commodity markets, regulatory and governmental approvals for the Company's projects, and the availability of financing for the Company's development projects on reasonable terms. Factors that could cause actual results to differ materially from those in forward looking statements include the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276315