SWK Holdings Corporation Announces Financial Results for Fourth Quarter 2024

Rhea-AI Summary

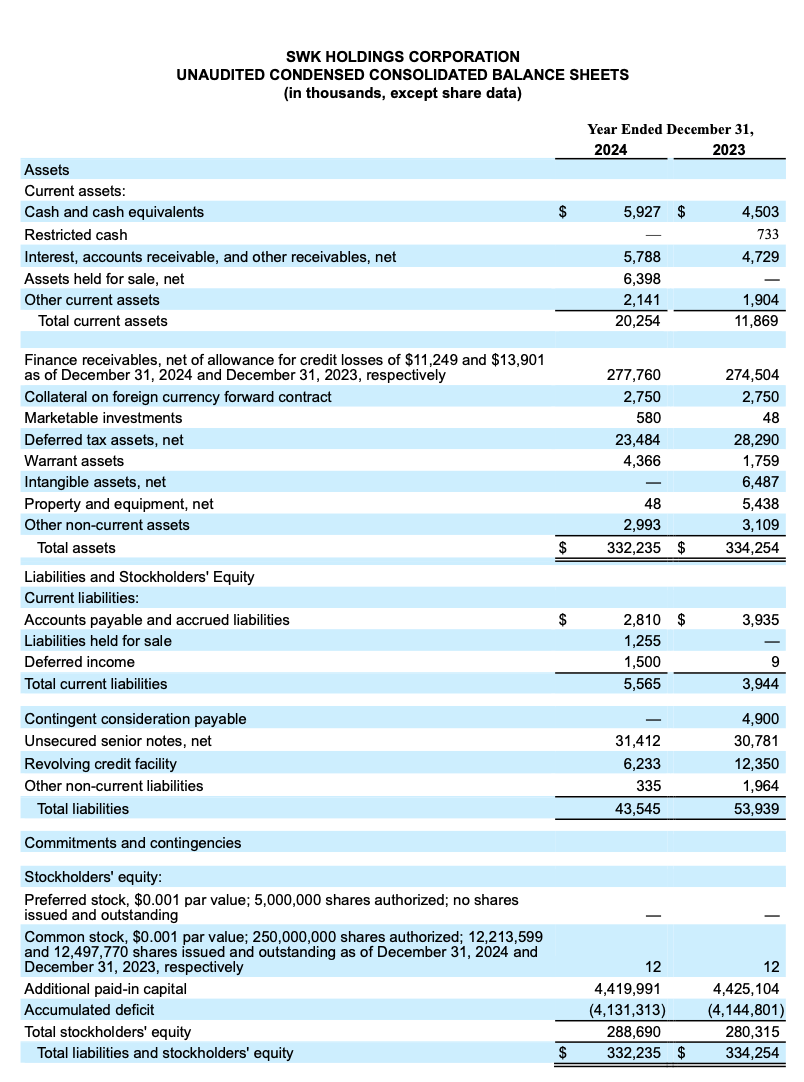

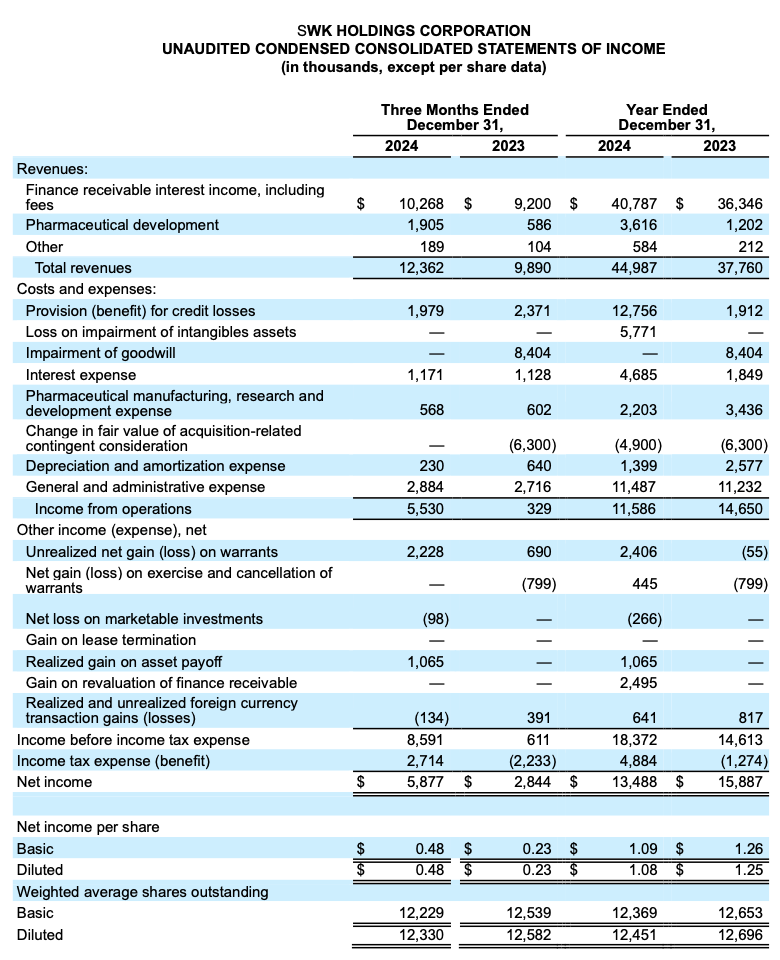

SWK Holdings (NASDAQ:SWKH) reported strong financial results for Q4 2024, with GAAP net income reaching $5.9 million ($0.48 per diluted share), up from $2.8 million in Q4 2023. Total revenue increased 25% to $12.4 million.

Key financial metrics include:

- Finance receivables segment revenue up 11.6% to $10.3 million

- Net finance receivables of $277.8 million, up 1.2% year-over-year

- Effective yield increased to 15.5%, up 150 basis points

- GAAP book value per share rose 5% to $23.45

- Non-GAAP tangible financing book value per share increased 8.3% to $21.15

The company monetized its performing royalty portfolio for approximately $51.3 million and plans to declare a dividend upon closing the final transaction. Portfolio improvements include successful workout conclusions and new financing agreements, including a $15 million commitment with Impedimed and an expanded $30 million credit facility with Eton.

Positive

- GAAP net income doubled to $5.9 million in Q4 2024 vs Q4 2023

- Total revenue increased 25% year-over-year to $12.4 million

- Effective yield improved by 150 basis points to 15.5%

- Book value per share increased 5% to $23.45

- Monetization of royalty portfolio for $51.3 million with planned dividend distribution

- Highest loan portfolio risk scoring achieved

Negative

- Three finance receivables remain in nonaccrual status worth $13.8 million

- Modest 1.2% growth in net finance receivables year-over-year

News Market Reaction 1 Alert

On the day this news was published, SWKH gained 6.71%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Conference Call Scheduled for Thursday, March 20, 2025, at 09:00 a.m. CST

Corporate Highlights

Fourth quarter 2024 GAAP net income was

$5.9 million , compared with GAAP net income of$2.8 million for the fourth quarter 2023.Fourth quarter 2024 finance receivables segment adjusted non-GAAP net income was

$6.2 million , compared with adjusted non-GAAP net income of$3.7 million for the fourth quarter 2023.As of December 31, 2024, net finance receivables were

$277.8 million , a1.2% increase from December 31, 2023.The fourth quarter 2024 effective yield was

15.5% , a 150 basis points increase from fourth quarter 2023.As of December 31, 2024, GAAP book value per share was

$23.45 , a5.0% increase from$22.33 on December 31, 2023.As of December 31, 2024, non-GAAP tangible financing book value per share was

$21.15 , an8.3% increase from$19.53 as of December 31, 2023.In March 2025, through two transactions SWK monetized its performing royalty portfolio for approximately

$51.3 million and anticipates declaring a dividend on the closing of the larger transaction.

DALLAS, TX / ACCESS Newswire / March 19, 2025 / SWK Holdings Corporation (NASDAQ:SWKH) ("SWK" or the "Company"), a life science-focused specialty finance company catering to small- and mid-sized commercial-stage companies, today provided a business update and announced its financial and operating results for the fourth quarter ended December 31, 2024.

"For the fourth quarter 2024, SWK's core Finance Receivables segment reported an

SWK CEO Jody Staggs said "During the fourth quarter, we closed an up to

Mr. Staggs added, "Improved operating results and capital raises at multiple borrowers combined with the conclusion of three workouts has led to our highest loan portfolio risk scoring since we have tracked the metric. The strength of our loan portfolio coupled with the monetization of our performing royalty portfolio at a slight premium to book value underpin the

Fourth Quarter 2024 Financial Results

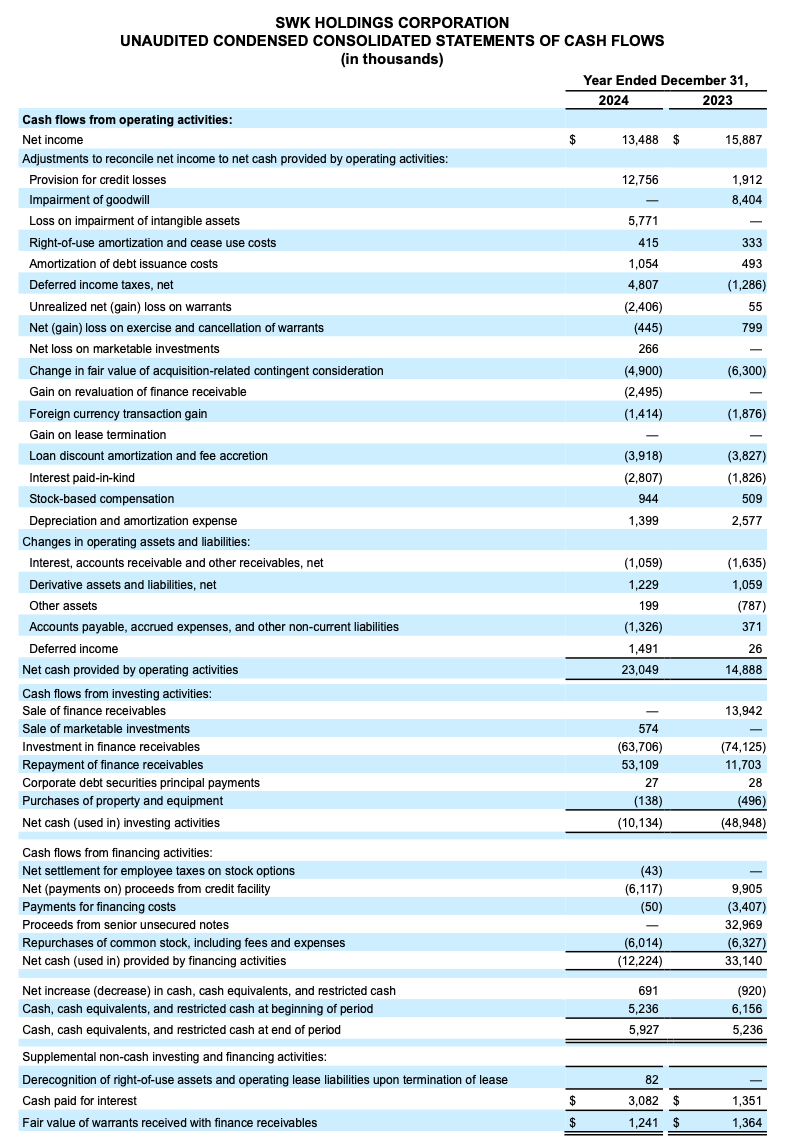

For the fourth quarter 2024, SWK reported total revenue of

Income before income tax expense for the quarter was

GAAP net income for the quarter ended December 31, 2024, increased to

For the fourth quarter 2024, non-GAAP adjusted net income was

Total investment assets (defined as finance receivables, marketable investments, and warrant assets less the allowance for credit losses) were

GAAP book value per share was

Portfolio Status

During the fourth quarter, SWK closed a term loan with Triple Ring totaling

During the fourth quarter, Veru made a

During the fourth quarter, SWK received a

The fourth quarter 2024 effective yield was

As of December 31, 2024, the Company had three finance receivables in nonaccrual status: (1) the Flowonix Medical, Inc. ("Flowonix") royalty, with a carrying value of

As of December 31, 2024, the Company had

Total portfolio investment activity for the three months ended December 31, 2024, and 2023 was as follows (in thousands):

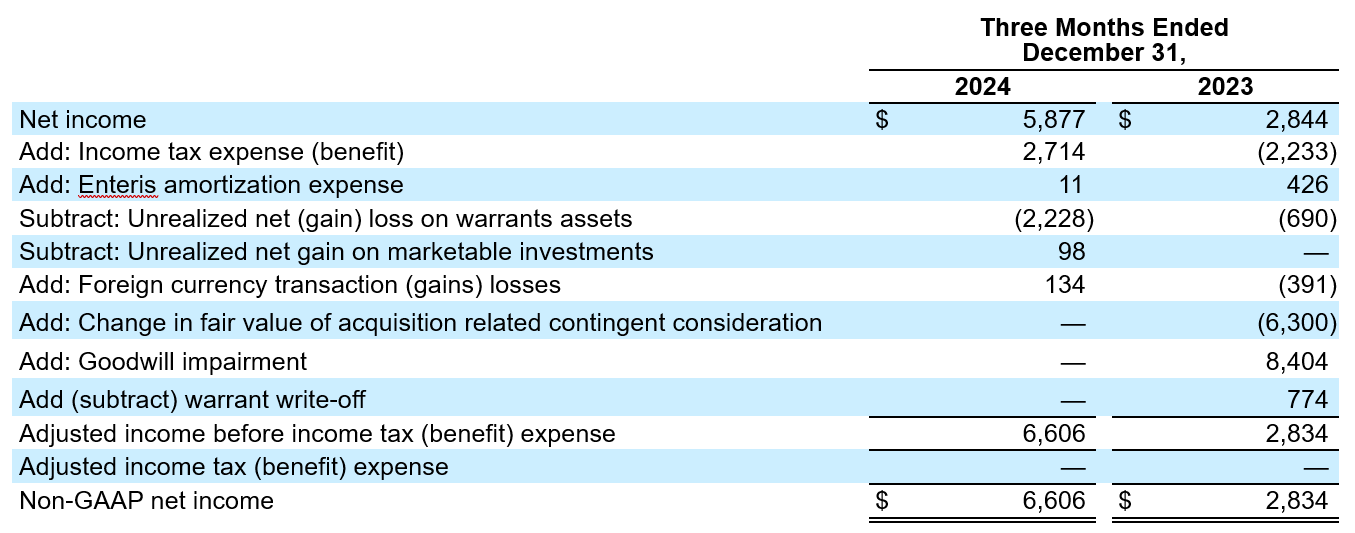

Adjusted Non-GAAP Net Income

The following table provides a reconciliation of SWK's reported (GAAP) consolidated net income to SWK's adjusted consolidated net income (Non-GAAP) for the three-month periods ended December 31, 2024 and 2023. The table eliminates provisions for income taxes, non-cash mark-to-market changes on warrant assets and equity securities, amortization of Enteris intangible assets, and foreign currency transaction gains and losses.

In the table above, management has deducted the following non-cash items: (i) change in the fair-market value of equities and warrants, as mark-to-market changes are non-cash, (ii) income taxes, as the Company has substantial net operating losses to offset against future income, (iii) amortization expense associated with Enteris intangible assets, (iv) (gain) loss on remeasurement of contingent consideration, (v) goodwill impairment, and (vi) foreign currency (gains) losses.

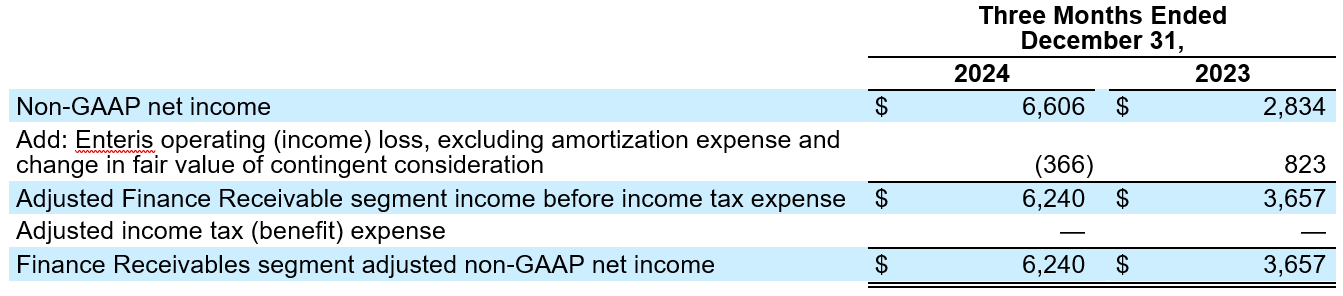

Finance Receivables Adjusted Non-GAAP Net Income

The following table provides a reconciliation of SWK's consolidated adjusted income before provision for income tax expense, listed in the table above, to the non-GAAP adjusted net income for the Finance Receivable segment for the three-month periods ended December 31, 2024 and 2023. The table eliminates Enteris operating loss. The adjusted income before income tax expense is derived in the table above and eliminates income tax expense, non-cash mark-to-market changes on equity securities, amortization of Enteris intangible assets, foreign currency transaction (gains) losses and any non-cash impact on the remeasurement of contingent consideration.

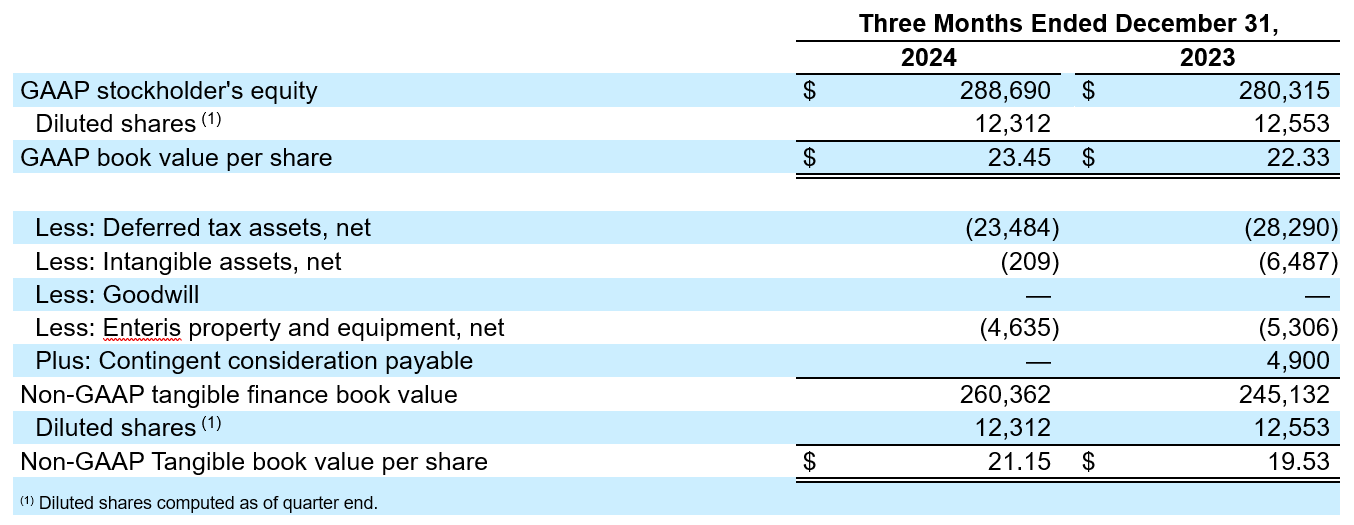

Non-GAAP Tangible Finance Book Value Per Share

The following table provides a reconciliation of SWK's GAAP book value per share to its non-GAAP tangible finance book value per share as of December 31, 2024 and 2023. The table eliminates the deferred tax assets, intangible assets, goodwill, Enteris property and equipment and acquisition-related contingent consideration (in thousands, except per share data):

Non-GAAP Financial Measures

This release includes non-GAAP adjusted net income, non-GAAP finance receivable segment net income, and non-GAAP tangible financing book value per share, which are metrics that are not compliant with generally accepted accounting principles in the United States (GAAP).

Non-GAAP adjusted net income is adjusted for certain items (including (i) changes in the fair-market value of public equity-related assets and SWK's warrant assets as mark-to-market changes are non-cash, (ii) income taxes as the Company has substantial net operating losses to offset against future income, (iii) changes in the fair-market value of contingent consideration associated with the Enteris acquisition as these changes are non-cash, and (iv) depreciation and amortization expenses, primarily associated with the Enteris acquisition.

In addition to the adjustments noted above, non-GAAP finance receivable segment net income also excludes Enteris operating losses.

Non-GAAP tangible financing book value per share excludes the deferred tax asset, intangible assets, goodwill, Enteris PP&E, and contingent consideration associated with the Enteris transaction.

These non-GAAP measures may not be directly comparable to similar measures used by other companies in the Company's industry, as other companies may define such measures differently. Management believes that these measures are useful to investors and management in understanding our ongoing operations and in analysis of ongoing operating trends and provides useful additional information relating to our operations and financial condition. The Company encourages investors to carefully consider its results under GAAP, as well as its supplemental non-GAAP information and the reconciliation between these presentations, to better understand its business. Non-GAAP financial results are reported in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Further, non-GAAP financial measures, even if similarly titled, may not be calculated in the same manner by all companies, and therefore should not be compared.

Conference Call Information

SWK Holdings will host a conference call on March 20, 2025, at 9:00 a.m. CST, to discuss its corporate and financial results for the fourth quarter 2024.

Interested participants and investors may access the call via the numbers below:

888-506-0062 (U.S.)

973-528-0011 (International)

The participant Access Code is 698628 or ask for the SWK Holdings call

An archive of the webcast will remain available on the SWK Holdings' website for 12 months, starting later that day. https://investors.swkhold.com/events

About SWK Holdings Corporation

SWK Holdings Corporation is a life science focused specialty finance company partnering with small- and mid-sized commercial-stage healthcare companies. SWK provides non-dilutive financing to fuel the development and commercialization of lifesaving and life-enhancing medical technologies and products. SWK's unique financing structures provide flexible financing solutions at an attractive cost of capital to create long-term value for all SWK stakeholders. SWK's solutions include structured debt, traditional royalty monetization, synthetic royalty transactions, and asset purchases typically ranging in size from

Safe Harbor For Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements including words such as "believes," "expects," "anticipates," "intends," "estimates," "plan," "will," "may," "look forward," "intend," "guidance," "future" or similar expressions are forward-looking statements. Because these statements reflect SWK's current views, expectations and beliefs concerning future events, these forward-looking statements involve risks and uncertainties. Investors should note that many factors, as more fully described under the caption "Risk Factors" and elsewhere in SWK's Form 10-K, Form 10-Q and Form 8-K filings with the Securities and Exchange Commission and as otherwise enumerated herein, could affect the Company's future financial results and could cause actual results to differ materially from those expressed in such forward-looking statements. The forward-looking statements in this press release are qualified by these risk factors. These are factors that, individually or in the aggregate, could cause the Company's actual results to differ materially from expected and historical results. You should not place undue reliance on any forward-looking statements, which speak only as of the date they are made. We assume no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise.

For more information, please contact:

Investor Relations and Media

Susan Xu

728-323-0959

investorrelations@swkhold.com

SOURCE: SWK Holdings Corp.

View the original press release on ACCESS Newswire