Thunder Gold Phase Three Drill Results Demonstrate Broad, Consistent Mineralization at Tower Mountain

Rhea-AI Summary

Thunder Gold (TSXV:TGOL / OTCQB:TGOLF) reported complete Phase Three drill results at its 100% owned Tower Mountain property on December 8, 2025. Phase Three comprised 12 holes (2,164 m) including seven holes (1,632 m) on the Bench-3738-Ellen breccia channel, with all seven holes intersecting gold mineralization.

Key metrics: standout intercepts include 1.83 g/t Au over 18.0 m within 0.47 g/t Au over 333.0 m, 0.53 g/t Au over 181.5 m, and 1.293 g/t Au over 10.5 m. The Bench-3738-Ellen trend measures 800 m x 200 m x 300 m with only ~30% of that volume drill-tested. All permits remain valid through 2028. Results will be included in a Mineral Resource Estimate being prepared by Micon International.

Positive

- All seven 3738 holes intersected continuous gold mineralization

- Long intercepts including 333.0 m at 0.47 g/t Au

- Bench-3738-Ellen trend sized at 800×200×300 m, only 30% tested

- Phase Three drilling cost less than C$300 per metre

- Exploration permits valid through 2028

Negative

- Several major intercepts are low-grade long intervals (e.g., 0.47 g/t Au over 333.0 m)

- True widths cannot be estimated for multiple reported intervals due to insufficient data

- Phase Three remains limited: only 12 holes (2,164 m) completed across a large target area

News Market Reaction 1 Alert

On the day this news was published, TGOLF declined 10.26%, reflecting a significant negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

TGOLF gained 24.68% while peers were mixed: CAMZF up 0.78%, KBXFF up 1.57%, NTMFF flat, STLNF up 0.37%, and RBMNF down 54.52%, suggesting a stock-specific reaction to the drill results.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 08 | Phase Three results | Positive | -10.3% | Complete Phase Three drill results with broad mineralization at Tower Mountain. |

| Nov 17 | Investor webinar | Neutral | -1.3% | Planned webinar to discuss Phase Three strategy and project outlook. |

| Oct 21 | MRE engagement | Positive | -2.7% | Engaged Micon to complete NI 43‑101 Mineral Resource Estimate for west TMIC. |

| Sep 23 | Phase Three funding | Positive | -1.3% | Announced fully funded Phase Three drill program at Tower Mountain. |

| Sep 08 | Phase Two results | Positive | +31.8% | Phase Two drilling confirmed consistency and expansion with strong gold intercepts. |

Positive operational news has often seen muted or negative next-day reactions, with only one prior drilling update showing a strong upside move.

This announcement continues a 2025 sequence focused on advancing the Tower Mountain project. Phase Two results on Sep 8 delivered strong intercepts and a 31.78% price gain. Subsequent updates on the fully funded Phase Three program, engagement of Micon for an NI 43‑101 Mineral Resource Estimate, and an investor webinar in September–November 2025 all saw modest price declines. The current Phase Three results on Dec 8 report broad mineralization across 12 holes, contrasting with the prior day‑after decline of -10.26% recorded for this same news item in earlier data.

Market Pulse Summary

The stock dropped -10.3% in the session following this news. A negative reaction despite constructive drilling results would fit a 2025 pattern where several positive Tower Mountain updates, including funding and NI 43‑101 MRE engagement, saw next‑day declines of up to -10.26%. The market has not consistently rewarded de‑risking steps, even when intercepts such as 1.83 g/t Au over 18.0 m and long mineralized intervals were reported. This backdrop suggests that sentiment around execution, funding needs, or macro factors has previously outweighed operational progress.

Key Terms

breccia technical

intrusive complex technical

cut-off grade technical

fire assay technical

atomic absorption technical

PhotonAssay technical

AI-generated analysis. Not financial advice.

Thunder Bay, Ontario--(Newsfile Corp. - December 8, 2025) - Thunder Gold Corp. (TSXV: TGOL) (FSE: Z25) (OTCQB: TGOLF) ("Thunder Gold" or the "Company") is pleased to announce complete results for the Phase Three drill program at its

Highlights:

All seven holes testing the 800-metre-long Bench-3738-Ellen breccia channel (west of the TMIC contact) intersected broad, consistent intervals of gold mineralization as predicted.

The initial hole testing the South Bench Target extended the previously identified mineralization and identified a new zone of near surface gold mineralization.

A shallow hole, testing a new target identified by soil and rock sampling this summer, intersected significant gold mineralization from the collar to a depth of 30 metres.

Results at the 3738 Target indicate the target breccia channel measures 150 to 200 metres (true width), returns steady, consistent gold grades and remains open along strike and down dip.

The Bench-3738-Ellen trend measures 800 metres x 200 metres x 300 metres, and only

30% of this volume is drill-tested representing a compelling, immediately accessible, fully-permitted, low-cost drill target.Significant gaps remain untested along the breccia channel offering immediate, low-cost opportunities to expand the near surface resource potential west of the TMIC.

Additional resource upside lies around the remaining 6,000-metre circumference of the TMIC.

All necessary exploration permits are valid through 2028.

Wes Hanson, President and CEO, states, "Phase Three drilling at the 3738 Target delivered exactly what we set out to demonstrate - precision testing of key gaps in our exploration model delivering tangible results that reinforce our confidence in the scale and continuity of mineralization west of the TMIC contact. We completed seven drill holes at the 3738 Target (1,633 metres). All seven holes intersected mineralization, at expected grades, exactly where predicted by our exploration model. These latest results will be included in the Mineral Resource Estimate being prepared by Micon International Ltd.

"We believe Tower Mountain can be advanced more efficiently than any other project in the Shebandowan Greenstone Belt. Our recent drill results confirm ample opportunities to increase the resource potential. Our proximity to Thunder Bay and built infrastructure results in one of the lowest discovery costs in Canada. Internal modeling indicates that the current, drill-defined mineralization west of the TMIC can be extracted without impacting existing or planned infrastructure routes.

"Our 2025 drilling has delivered on all our objectives. We demonstrated near term resource growth potential west of the TMIC, within the historical drill pattern, offering immediate, short-term, low-cost resource growth opportunity. We demonstrated long-term resource growth potential elsewhere around the 6,000-metre TMIC circumference. We maintained capital efficiency, directing two thirds of every dollar raised to exploration at our cornerstone project. Our 2025 results validate the strength and predictability of our exploration model - providing investors with increasing confidence in the scalability of the Tower Mountain project."

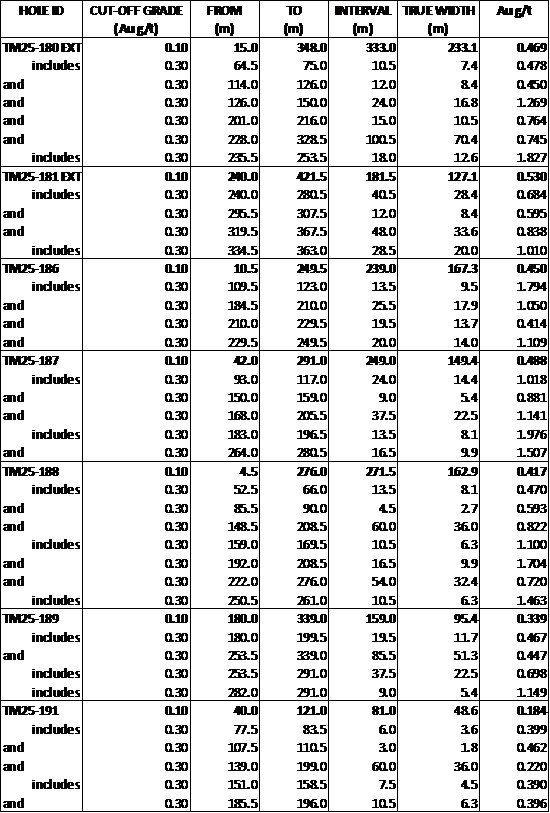

Highlights

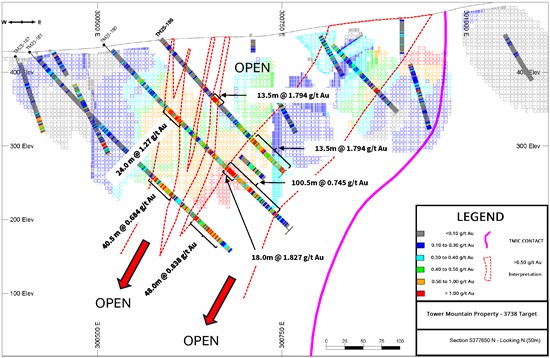

At the 3738-Target, drilling expanded the mineralized footprint with all seven (7) holes returning significant intercepts. Standout results include: 1.83 g/t Au over 18.0 metres within 0.47 g/t Au over 333.0 metres (TM25-180 extension), 0.53 g/t Au over 181.5 metres (TM25-181 extension), 1.05 g/t Au over 25.5 metres (TM25-186), 1.98 g/t Au over 13.5 metres (TM25-187), 0.42 g/t over 271.5 metres (TM25-188), 0.698 g/t Au over 37.5 metres (TM25-189).

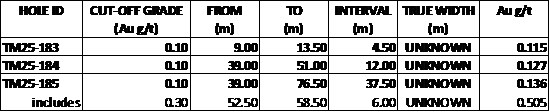

At the H Target (northern TMIC contact) three (3) of three (3) holes intersected mineralization including 0.51 g/t Au over 6.00 metres (TM25-185).

A single, shallow hole testing the southwest extension of the A-Target, intersected 1.293 g/t Au over 10.5 metres (TM25-190). This hole tested a soil geochemistry anomaly and surface prospecting samples that returned anomalous gold results from the summer field program.

The first hole targeting the South Bench Target intersected 0.666 g/t Au over 25.5 metres, 21.0 metres from the collar.

Phase Three drilling commenced October 1, 2025, and continued through November 7, 2025. Twelve (12) holes (2,164 metres) were completed at an estimated all-in drilling cost of less than C

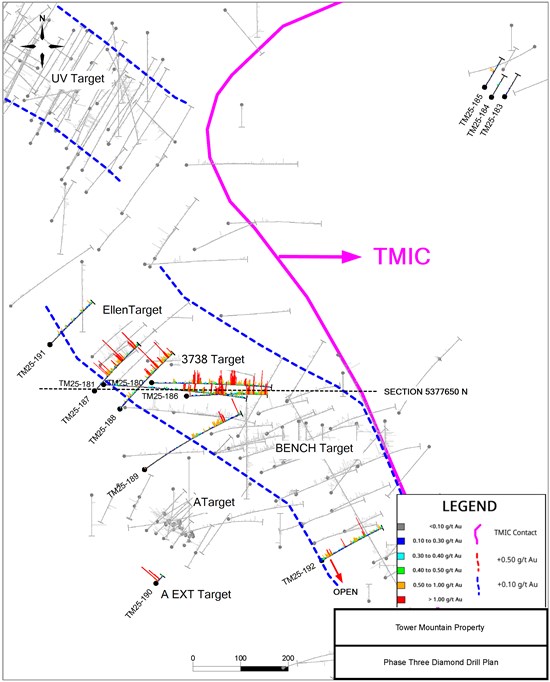

Figure 1.0 is a plan view of the Phase Three drilling showing the location of the completed holes.

3738-Target

Seven (7) holes (1,632 metres) were completed at the 3738 Target during Phase 3. The holes tested an interpreted 400 metres of strike length from hole TM25-189 through to hole TM25-191. Results suggest continuous mineralization persists between the Bench and Ellen Targets. The positive drill results shall be incorporated into the drill database that informs on the Mineral Resource Estimate being prepared by Micon International.

Table 1.0 summarizes the results of the 3738 drill holes. The Table includes the previously reported portions of holes TM25-180 and TM25-181, from 0 to 252.0 metres. The extension of both holes intersected significant mineralization producing results that vary from the those reported for the Phase Two drill program.

Figure 2.0 is a cross-section of holes TM25-180, TM25-181 and TM25-186 drill holes. The location of the section is identified on Figure 1.0 as SECTION 5377650 N.

FIGURE 1.0 -Phase Three 2025 Drill Hole Location Plan

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5364/277229_5e3abdc394ad589a_001full.jpg

TABLE 1.0 - 3738-Target Results - Phase Three Drill Program, Dec. 2025

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5364/277229_5e3abdc394ad589a_002full.jpg

FIGURE 2.0 - 3738-Target - Section 5377650 N (Looking North; 25-metre projection window)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5364/277229_5e3abdc394ad589a_003full.jpg

H Target

Three (3) holes, (249 metres) were completed at the H-Target, 25 metres east, west and below hole TM25-182 (Phase Two) that intersected 0.73 g/t Au over 6.0 metres. All three holes intersected mineralization above a 0.10 g/t Au cut-off grade. TM25-185, 25 metres northwest of TM25-182, intersected 0.505 g/t Au over 6.00 metres suggesting a relative flat lying target.

TABLE 3.0 - H-Target Results - Tower Mountain Property, Phase Three Drill Program, Dec. 2025

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5364/277229_5e3abdc394ad589a_004full.jpg

Intervals in Table 3.0 are reported as core length not True Width. True Width cannot be estimated at this time due to insufficient data.

NEW West Contact Targets

TM25-190 was a shallow hole testing a cluster of elevated rock samples collected 150 metres south of the A Target (Reference Figure 1.0). The hole collared in mineralization, intersecting 0.661 g/t Au over 30.0 metres including 1.293 g/t Au over 10.5 metres.

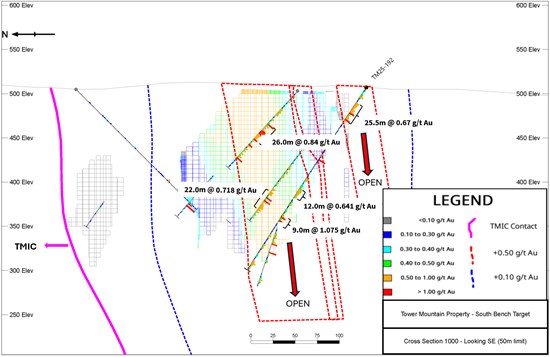

TM25-192, the final hole of Phase Three, was drilled at the south end of the Bench Target, approximately 25 metres south and 50 metres below hole TM11-82 (0.718 g/t Au over 22.0 metres), targeting another gap in the Company's exploration model. TM25-192 intersected 0.641 g/t Au over 12.0 metres vertically below the TM11-82 intersection. It also intersected 0.666 g/t Au over 25.5 metres near surface, a previously unrecognized zone of mineralization that is open to the southeast and down-dip. (Reference Figures 1.0 & 3.0).

TABLE 3.0 - New Target Results - Tower Mountain Property, Phase Three Drill Program, Dec. 2025

| HOLE ID | CUT-OFF GRADE (Au g/t) | FROM (m) | TO (m) | INTERVAL (m) | TRUE WIDTH (m) | Au g/t |

| TM25-190 | 0.10 | 7.50 | 30.00 | 22.50 | UNKNOWN | 0.661 |

| includes | 0.30 | 7.50 | 18.00 | 10.50 | UNKNOWN | 1.293 |

| TM25-192 | 0.10 | 3.00 | 252.00 | 249.00 | 174.30 | 0.311 |

| includes | 0.30 | 21.00 | 46.50 | 25.50 | 17.85 | 0.666 |

| and | 0.30 | 93.00 | 100.50 | 7.50 | 5.25 | 0.571 |

| and | 0.30 | 124.50 | 186.00 | 61.50 | 43.05 | 0.476 |

| includes | 0.30 | 139.50 | 151.50 | 12.00 | 8.40 | 0.641 |

| and | 0.30 | 175.50 | 184.50 | 9.00 | 6.30 | 1.075 |

Intervals for TM25-190 in Table 3.0 are reported as core length not True Width. True Width cannot be estimated at this time due to insufficient data.

Overall, Phase Three successfully demonstrated ample opportunities to increase the mineralization footprint exist within the historical drill pattern as postulated. Drilling around the perimeter of the TMIC is fully permitted through 2028. The western contact area is immediately accessible and offers over 40,000 metres of drilling soon to be quantified in a current, independent, Mineral Resource Estimate. At current gold prices, the Company considers the west contact, consisting of the UV, Bench, Ellen, A and 3738 Targets, to be a compelling exploration target that offers opportunity for rapid resource growth. This, combined with the unmatched access to fully built, publicly maintained infrastructure, allows for more rapid project advancement than many other large-tonnage, low-grade projects.

FIGURE 3.0 - South Bench-Target - Section 1000 (Looking SE 25-metre projection limit)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5364/277229_5e3abdc394ad589a_005full.jpg

Care and Control Procedures

Diamond drilling is conducted by qualified contractors independent of the Company. NQ diameter drill core is recovered by the independent contractor and placed in core boxes. The end of each drilled interval is recorded on wooden blocks and placed at the end of each drilled interval in the core box. Once the core box is full, the Hole ID and box number are recorded on each box. A lid is positioned over each box by the independent contractor. The hole number and box number are recorded on the lid. The lid is sealed to the core box using packing tape to prevent core spillage. The boxes, with lids, are stacked at the drill until the end of the shift. At shift change, all boxes are transported from the drill site to a marshalling area where they are transferred into the custody of the drill foreman. The drill foreman delivers the shift production to the Company's core logging facility where it is received by the Company's geological team. Here the core lids are removed, the boxes are organized by hole number and box number. The core is logged by a Technician, under the supervision of the Company's QP. The Technician rotates the core, washes the core, measures the core into 1.0 metre intervals recording the downhole depth physically on the drill core. The Technician then logs the core for recovery and rock quality, and completes magnetic susceptibility readings at the previously recorded metre intervals. The Technician records the hole number and starting and ending meterage of each box. All information collected by the Technician is recorded digitally in the Company's database.

A contract geologist, under the supervision of the Company's QP, completes a geological log of each hole recording lithology, alteration, mineralization, veining and structure. The geologist identifies the individual samples for each hole. A standard 1.5 metre sample interval is used. The geologist marks the core with start, stop and cut lines for the sample technician. The geologist places a sample tag at the start of each sample interval. The geologist records the interval start and stop depth in the tag book and determines where to insert Certified Reference Materials ("CRM") into the sample stream. CRM includes both Standards and Blanks. Typically, both are inserted alternately every tenth sample, at a number ending in (0). Multiple standards are utilized, each at different grades between from 0.20 to 10.00 g/t Au.

The geologist transfers each hole to the sample Technician on completion of logging and sampling. The Technician physically attaches each tag to the core box prior to sampling. The Technician labels 6-mil plastic sample bags with sequential core numbers from the tag book using a black felt marker. The sample Technician removes CRM sample bags and delivers those to the geologist. The geologist inserts the CRMs according to the sample tag book and returns the CRMs, bagged and sealed, to the sample Technician.

The sample Technician cuts the core along the marked cut line provided by the geologist. The cut core is placed in the pre-designated plastic sample bag. The corresponding sample tag is added to the bag. The bag is sealed and set aside. The remaining half-core is returned to the original core box. Once a box is completed, it is placed into a temporary storage rack until the entire hole is cut. The sample Technician typically completes twenty (20) sequential samples before taking the individually bagged, tagged and sealed samples and placing them into a rice bag. The starting and ending sample numbers for each rice bag are recorded on the exterior of each rice bag in felt marker. Each rice bag is sealed and stored for transportation to the lab only when the entire drill hole has been completed.

On completion of core cutting, the core is transferred back to the core Technician who then creates permanent metal tags for each core box with the hole number, box number, starting and ending depth of each box. The Technician then takes the core to the core photography area, where the core is photographed, dry and wet, for its entirety. On completion of the photography, photos are uploaded to the digital database for each hole. The half-core is then placed into permanent storage racks and its location is noted in the core storage area.

The rice bags for each hole are transferred to the Company's Logistics Manager. The geologist prepares a sample submission form identifying the analytical suite requested. This is provided to the Logistic Manager in physical form and communicated to the selected analytical lab electronically by email. The Company's QP is copied on all sample submission forms.

The Logistics Manager delivers the rice bags for each completed drill hole to the selected analytical facility.

Quality Assurance and Quality Control

All samples are currently delivered to Activation Laboratories Ltd. ("Actlabs") facility in Thunder Bay, Ontario. Actlabs is independent from the Company and is fully accredited by the Standards Council of Canada ("SCC") as per SCC-15308 ISO/IEC 17025:2017 General requirements for the competence of testing and calibration laboratories. Actlabs current certification expires February 27, 2030.

The Company typically utilizes two primary analytical procedures offered by Actlabs. The majority of samples are prepared according to Actlabs RX1 procedure; dried, crushed to

The 30-gram sample aliquot is analyzed using Actlabs 1A2 procedure, lead collection fire assay fusion (FA) with an atomic absorption (AAS) finish. All assay results greater than 5.0 g/t Au are re-assayed using Actlabs 1A3-30 method which uses a gravimetric finish for higher accuracy. All assays greater than 30.0 g/t Au are re-assayed using Actlabs 1A4-1000 screen metallics method where a representative 1000-gram sample is split from the crushed reject fraction, pulverized to

The Company requested Actlabs PhotonAssay procedure for the final 535 samples of the Phase Three drill program (approximately

The PhotonAssay method requires each sample to be crushed to

Actlabs reports the results to the Company's QP and Logistics Manager. The QP is responsible for monitoring CRM results, flagging and investigating any failures and if necessary, requesting any re-assaying. Typically, five samples preceding and following an unexplained failure are re-assayed using the original sample pulp. Occasionally, re-assaying is requested for a new pulp generated from the crushed reject.

Qualified Person

Technical information in this news release has been reviewed and approved by Wes Hanson, P.Geo., President and CEO of Thunder Gold Corp., who is a Qualified Person under the definitions established by National Instrument 43-101.

About the Tower Mountain Gold Property

The

About Thunder Gold Corp.

Thunder Gold is advancing the Tower Mountain Project in Thunder Bay, Ontario - an emerging gold system with the scale, consistency, and quality to support a long-life, open-pit operation. Results from our disciplined drill programs have consistently reinforced confidence in the continuity and predictability of the discovery, while highlighting significant potential for expansion across multiple zones of the Tower Mountain Intrusive Complex. With industry-leading drilling costs, existing infrastructure and a skilled local workforce, Tower Mountain represents a rare combination of size, scalability, and cost-effective growth.

At Thunder Gold, our vision is clear: to unlock a discovery that has the potential to become a transformational gold project, delivering long-term value for shareholders while contributing to the future of Canada's mining industry. For more information about the Company, please visit:

On behalf of the Board of Directors,

Wes Hanson, P.Geo., President and CEO

For further information, contact:

Wes Hanson, CEO

(647) 202-7686

whanson@thundergoldcorp.com

Kaitlin Taylor, Investor Relations

IR@thundergoldcorp.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation (collectively, "forward-looking statements"). Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. All statements, other than statements of historical fact, are forward-looking statements and are based on predictions, expectations, beliefs, plans, projections, objectives and assumptions made as of the date of this news release, including without limitation; anticipated results of geophysical drilling programs, geological interpretations and potential mineral recovery. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to the gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty or reliance on forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise any forward-looking statements, other than as required by applicable law, to reflect new information, events or circumstances, or changes in management's estimates, projections or opinions. Actual events or results could differ materially from those anticipated in the forward-looking statements or from the Company's expectations or projections.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/277229