Torex Gold Reports Latest Results from Drilling Program at ELG Underground

Rhea-AI Summary

Torex Gold (OTC:TORXF) announced further assay results from its 2025 ELG Underground drilling program focused on El Limón Sur and Sub-Sill trends. Highlights include multiple high‑grade intercepts such as 21.2 m at 28.13 gpt AuEq (LS-414), 24.6 m at 17.06 gpt AuEq (LS-424) and 2.7 m at 50.73 gpt AuEq (SST-387). Torex reported 25,163 m drilled between Feb–Jul 2025, with 36,086 m of the planned 48,000 m program reported and a $12 million 2025 drilling budget. The company says results support potential resource expansion, replacement of mined reserves and its objective to extend ELG Underground mine life beyond 2029 while helping to sustain payable production above 450,000 oz AuEq per year beyond 2030. All assays are reported uncapped.

Positive

- LS-414: 21.2 m at 28.13 gpt AuEq

- LS-424: 24.6 m at 17.06 gpt AuEq

- Drilling progress: 36,086 m reported of 48,000 m planned (2025)

- Budget: $12 million allocated to 2025 ELG Underground drilling

Negative

- All assays uncapped: reported grades are uncapped, which can inflate headline intervals

News Market Reaction

On the day this news was published, TORXF gained 5.42%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Excellent results continue to support the potential to expand and upgrade mineral resources and support replacement of mined reserves

(All amounts expressed in U.S. dollars unless otherwise stated)

Toronto, Ontario--(Newsfile Corp. - October 6, 2025) - Torex Gold Resources Inc. (the "Company" or "Torex") (TSX: TXG) announces further assay results from the Company's 2025 drilling program at ELG Underground, primarily focused on drilling around the El Limón Sur and Sub-Sill trends. These new results continue to support the Company's target of extending the mine life of ELG Underground by identifying new structures of higher-grade mineralization, expanding resources, and replacing mined reserves.

Jody Kuzenko, President & CEO of Torex, stated:

"We continue to be impressed by the drilling results at ELG Underground. The discovery of second order mineralized structures parallel to the El Limón Sur and Sub-Sill trends underpins our belief that we have yet to unlock the full geologic potential of this deposit. Importantly, the drilling results along these newly discovered structures are returning exceptional grades, including 21.2 metres ("m") at 28.13 grams per tonne gold equivalent ("gpt AuEq") in LS-414 and 24.6 m at 17.06 gpt AuEq in LS-424, a strong indication that we will be able to add to the resource inventory with our year-end mineral reserves and resources update in March 2026.

"At the El Limón Sur and Sub-Sill trends, drilling targeting the intersection of these north-south trending corridors with the northeast trending faults continues to extend known mineralization both laterally and vertically, which is expected to further build on the track record of year-over-year resource and reserve growth demonstrated at ELG Underground.

"With

All references to drill hole intercepts are to true widths unless otherwise stated. Further information on drill results and gpt AuEq calculations can be found in Tables 1 to 5, with more detailed drill results found in Table 4 (El Limón Sur Trend) and Table 5 (Sub-Sill Trend).

HIGHLIGHTS

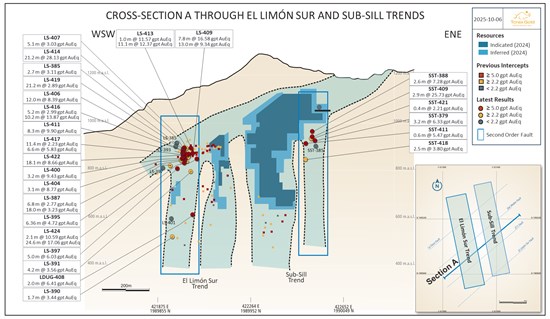

El Limón Sur and Sub-Sill Second Order Structures

- Drilling has discovered two second order structures associated with the El Limón Sur and Sub-Sill trends. Both of these structures returned exceptional high grade results, with notable intercepts to the west of the El Limón Sur Trend that include 11.1 m at 12.37 gpt AuEq in LS-413; 21.2 m at 28.13 gpt AuEq in LS-414; 10.2 m at 13.87 gpt AuEq in LS-416; 18.1 m at 8.66 gpt AuEq in LS-422; and 24.6 m at 17.06 gpt AuEq in LS-424. At the new mineralized corridor to the east of the Sub-Sill Trend, the most compelling results are 2.9 m at 25.73 gpt AuEq in SST-409 and 3.2 m at 6.33 gpt AuEq in SST-379 (Figure 1, Table 1).

- The discovery of these new structures indicates there may be more undiscovered mineralized trends/corridors at ELG Underground and continues to demonstrate the underlying resource potential of the deposit. The new discoveries also support the potential to expand and upgrade resources with the year-end mineral reserves and resources update.

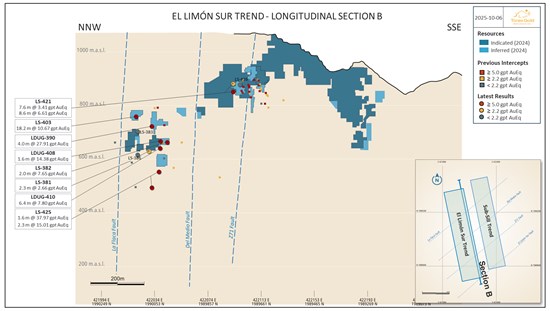

El Limón Sur Trend

- Drilling at depth confirmed high-grade mineralization at 480 metres above sea level ("m.a.s.l.") in drill hole LS-425, 1.6 m at 37.97 gpt AuEq and 2.3 m at 15.01 gpt AuEq, indicating the Trend remains open at depth.

- Drilling also returned multiple high-grade intercepts between 800 m.a.s.l. and 480 m.a.s.l. outside of the defined resource boundary, supporting the target of expanding resources. Notable results include 18.2 m at 10.67 gpt AuEq in LS-403, 8.6 m at 6.61 gpt AuEq in LS-421, 4.0 m at 27.91 gpt AuEq in LDUG-390, and 6.4 m at 7.80 gpt AuEq in LDUG-410 (Figure 2, Table 2).

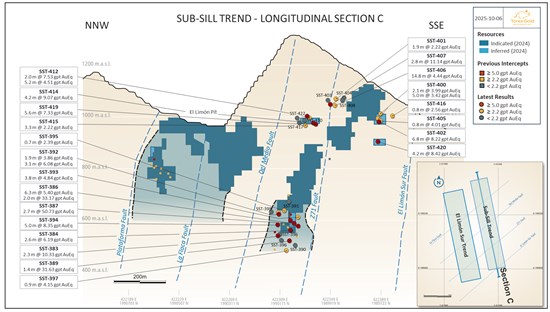

Sub-Sill Trend

- At the Sub-Sill Trend, drilling has demonstrated continuous mineralization at depth around 500 m.a.s.l. as well as at shallower levels where mineralization is open laterally, indicating the potential for resource growth in both directions. Notable mineralized intercepts include 6.8 m at 8.22 gpt AuEq in SST-402, 14.8 m at 4.44 gpt AuEq in SST-406, 4.2 m at 9.07 gpt AuEq in SST-414, 5.0 m at 8.35 gpt AuEq in SST-394, and 2.7 m at 50.73 gpt AuEq at SST-387 (Figure 3, Table 3).

ELG UNDERGROUND DRILLING PROGRAM

Drilling results continue to support the primary objective of the ELG Underground drilling program to increase resource inventory and replace mined reserves to support the Company's overall objective of maintaining production above 450,000 gold equivalent ounces ("oz AuEq") per year beyond 2030. The program remains focused on identifying high-grade mineralization extensions along the El Limón Sur, El Limón Deep, El Limón West, and Sub-Sill trends. Drilling results presented in this release focus on the success along the El Limón Sur and Sub-Sill trends.

Torex has budgeted

NEWLY DISCOVERED SECOND ORDER STRUCTURES

The latest drilling results have outlined high-grade mineralization along two second order structures running parallel to both the El Limón Sur and Sub-Sill trends. These parallel structures likely acted as conduits for mineralizing fluids (Figure 1). The highest-grade intercepts and more continuous mineralization occur at the intersection of these secondary structures and northeast first order structures, primarily at the Z71 and La Flaca faults. The discovery of these new structures shows that the mineralized potential of this deposit is yet to be fully defined and indicates a strong potential to continue to expand resources and replace reserves year after year.

Table 1: Recent highlights from the 2025 drilling program along the second order structures

| Drill Hole | From (m) | To (m) | Core Length (m) | True Width (m) | Au (gpt) | Ag (gpt) | Cu (%) | AuEq (gpt) |

| LS-413 | 75.9 | 87.5 | 11.6 | 11.1 | 12.04 | 1.4 | 0.19 | 12.37 |

| LS-414 | 66.1 | 87.5 | 21.4 | 21.2 | 27.99 | 4.9 | 0.05 | 28.13 |

| LS-416 | 78.1 | 89.0 | 10.9 | 10.2 | 13.83 | 1.9 | 0.01 | 13.87 |

| LS-422 | 75.0 | 95.0 | 20.0 | 18.1 | 8.52 | 1.8 | 0.07 | 8.66 |

| LS-424 | 153.4 | 180.3 | 26.9 | 24.6 | 16.99 | 2.5 | 0.02 | 17.06 |

| SST-379 | 315.9 | 323.0 | 7.1 | 3.2 | 4.43 | 34.1 | 0.91 | 6.33 |

| SST-409 | 307.5 | 317.0 | 9.5 | 2.9 | 23.91 | 25.6 | 0.92 | 25.73 |

Notes to Table:

1) Drill hole intercepts are shown both in core length and true widths. Core recovery (%) is shown in Tables 4 and 5. Core and true width lengths subject to rounding. All assay results are uncapped.

2) The gold equivalent grade calculation used is as follows: AuEq (gpt) = Au (gpt) + Ag (gpt) * 0.0127 + Cu (%) * 1.6104 and uses the same metal prices (

EL LIMÓN SUR TREND

Recent drilling along the El Limón Sur Trend has been focused on the central and northern zones, near the Trend's intersections with the Z71 and La Flaca faults (Figure 2). Drilling has confirmed continuous high-grade intercepts at levels above 750 m.a.s.l. (LS-403, LS-421, LDUG-390, and LDUG-410) where mineralization remains open laterally. More discrete intercepts with very high grades were encountered at depth (LS-425) down to at least 480 m.a.s.l., demonstrating mineralization remains open in that direction. These results show potential for new Inferred Resources.

Table 2: Recent highlights from the 2025 drilling program along the El Limón Sur Trend

| Drill Hole | From (m) | To (m) | Core Length (m) | True Width (m) | Au (gpt) | Ag (gpt) | Cu (%) | AuEq (gpt) |

| LDUG-390 | 45.9 | 50.2 | 4.3 | 4.0 | 27.89 | 1.6 | 0.01 | 27.91 |

| LDUG-410 | 112.0 | 121.0 | 9.0 | 6.4 | 7.63 | 3.9 | 0.07 | 7.80 |

| LS-403 | 96.0 | 125.0 | 29.0 | 18.2 | 6.98 | 22.7 | 2.11 | 10.67 |

| LS-425 | 157.0 | 158.7 | 1.8 | 1.6 | 37.94 | 1.9 | 0.00 | 37.97 |

Notes to Table:

1) Drill hole intercepts are shown both in core length and true widths. Core recovery (%) is shown in Table 4. Core and true width lengths subject to rounding. All assay results are uncapped.

2) The gold equivalent grade calculation used is as follows: AuEq (gpt) = Au (gpt) + Ag (gpt) * 0.0127 + Cu (%) * 1.6104 and use the same metal prices (

SUB-SILL TREND

Drilling along the Sub-Sill Trend is currently focused on the main ore shoot near the Trend's intersection with the Z71 fault (Figure 3). The objectives of the program in this area are to upgrade Inferred Resources to the Indicated category, extend resources beyond the current resource boundary, and confirm mineralization continuity and extension at depth.

Results indicate strong potential to upgrade Inferred Resources as shown by the mineralization encountered in drill holes SST-402, SST-406, and SST-414. At the main ore shoot, drill holes SST-397, SST-389, and SST-383 confirm the extension of mineralization at depth down to 500 m.a.s.l. and indicate that mineralization remains open in that direction. Drill holes SST-394 and SST-387 show that mineralization also remains open laterally (Table 3).

Table 3: Recent highlights from the 2025 drilling program along the Sub-Sill Trend

| Drill Hole | From (m) | To (m) | Core Length (m) | True Width (m) | Au (gpt) | Ag (gpt) | Cu (%) | AuEq (gpt) |

| SST-383 | 158.0 | 161.8 | 3.8 | 2.3 | 10.28 | 1.0 | 0.02 | 10.33 |

| SST-387 | 182.7 | 187.5 | 4.8 | 2.7 | 49.85 | 23.1 | 0.36 | 50.73 |

| SST-389 | 183.5 | 186.0 | 2.6 | 1.4 | 31.58 | 3.4 | 0.01 | 31.63 |

| SST-394 | 151.0 | 157.6 | 6.6 | 5.0 | 1.11 | 85.4 | 3.82 | 8.35 |

| SST-397 | 220.0 | 222.0 | 2.0 | 0.9 | 4.14 | 0.5 | 0.00 | 4.15 |

| SST-402 | 101.2 | 110.0 | 8.8 | 6.8 | 7.21 | 10.6 | 0.54 | 8.22 |

| SST-406 | 31.0 | 46.0 | 15.0 | 14.8 | 3.25 | 9.5 | 0.67 | 4.44 |

Notes to Table:

1) Drill hole intercepts are shown both in core length and true widths. Core recovery (%) is shown in Table 5. Core and true width lengths subject to rounding. All assay results are uncapped.

2) The gold equivalent grade calculation used is as follows: AuEq (gpt) = Au (gpt) + Ag (gpt) * 0.0127 + Cu (%) * 1.6104 and use the same metal prices (

ELG MINE COMPLEX GEOLOGY

The ELG Mine Complex, located in the central part of the Guerrero Gold Belt in southwest Mexico, is hosted in the Mesozoic carbonate-rich Morelos Platform which has been intruded by Paleocene granodiorite stocks, sills, and dikes, and the uplifting of the block close to surface by maar-diatreme complexes. Skarn-hosted gold mineralization develops along contacts of the intrusive rocks and carbonate-rich sedimentary rocks of the Cuautla and Morelos Formations, as well as along the footwall contact of the Mezcala Formation. At depth, the mineralization has a strong structural control related to the main stages of deformation, with the collision of allochthonous terrain being responsible for the major north-south faults, while the almost east-west faulting is associated with the beginning of the subduction process.

Gold mineralization at ELG occurs in spatial association with a skarn body that was developed along a two-kilometre- long corridor following the northeast contact of the ELG granodiorite stock. The skarn zone that occurs at the marble stratigraphic level of the Morelos Formation is in contact with hornfels developed in the Mezcala Formation. At El Limón, skarn mineralization is also structurally controlled by north-south and north-east trending faults. Early-stage deposition corresponds to skarn alteration and mineralization at ELG and is fairly typical of calcic gold-skarn systems. Zones of coarse, massive, garnet-dominant skarn appear within and along the stock margin, with fine-grained pyroxene-dominant skarn more common at greater distances from the contact with the stock. Significant gold mineralization at ELG is spatially associated with the skarn, preferentially occurring in pyroxene-rich exoskarn but also hosted in garnet-rich endoskarn that has been affected by retrograde alteration, which suggests that the most important gold event is strongly related to bismuth, late stage, and of epithermal origin.

Dikes and sills are found to crosscut the hornfels and marble along the structural trends mentioned above and are spatially associated with the skarn formation. In some cases, these are the control of main gold mineralization stage at depth.

The style of mineralization at the El Limón Deep, El Limón Sur, Sub-Sill, and El Limón West trends is characterized by gold, with locally high silver and copper grades. Given that gold precipitates due to the buffer exerted by the early stage of calc-silicate alteration and sulfide mineralization, it is free and generally dissociated from the previous copper event mainly related to chalcopyrite.

QA/QC AND QUALIFIED PERSON

Torex maintains an analytical quality assurance and quality control ("QA/QC") and data verification program to monitor laboratory performance and ensure high-quality assays. Results from this program confirm the reliability of the assay results. All sampling and analytical work for the mine exploration program is performed by SGS de Mexico S.A. de C.V. ("SGS") in Durango, and by SGS at Morelos mine site facilities in Mexico. Gold analyses comprise fire assay with atomic absorption or gravimetric finish. External check assays for QA/QC purposes are performed at ALS Chemex de Mexico S.A. de C.V.

The analytical QA/QC program is currently overseen by Carlo Nasi, Manager, Geology for Minera Media Luna, S.A. de C.V. All samples reported have been checked against Company and Lab standards, and blanks. No core duplicate samples are taken.

Core sizes are mostly HQ in diameter and NQ core diameter is used sporadically if ground conditions require. Samples are sawn lengthwise in half. One half of the core is bagged and sealed for analytical analysis and one half is retained in the core box for reference.

Sample preparation is carried out by SGS facilities in Durango and the Morelos mine site, Mexico and consists of drying and crushing 3 to 5 kg to >

External check assays for QC purposes are done on pulps and performed at ALS Global in Queretaro, Mexico. Approximately

Internal and external check control results are reviewed daily by MML and an external audit by Qualitica Consulting Inc. is carried out quarterly. The outcome of the test work indicates that the precision and accuracy of the results received from SGS' Durango and ELG mine site facilities are within acceptable tolerance ranges.

Scientific and technical information contained in this news release has been reviewed and approved by Rochelle Collins, P.Geo. (PGO #1412), Principal, Mineral Resource Geologist with Torex Gold Resources Inc., a "qualified person" ("QP") as defined by NI 43-101. Ms. Collins has verified the information disclosed, including sampling, analytical, and test data underlying the drill results. Verification included visually reviewing the drill holes in three dimensions, comparing the assay results to the original assay certificates, reviewing the drilling database, and reviewing core photography consistent with standard practice. Ms. Collins consents to the inclusion in this release of said information in the form and context in which they appear.

Additional information on ELG Underground, sampling and analyses, analytical labs, and methods used for data verification is available in the Company's technical report entitled the "Morelos Property, NI 43-101 Technical Report, ELG Mine Complex Life of Mine Plan and Media Luna Feasibility Study, Guerrero State, Mexico", dated effective March 16, 2022 filed on March 31, 2022 (the "2022 Technical Report") and in the annual information form ("AIF") dated March 21, 2025, each filed on SEDAR+ at www.sedarplus.ca and the Company's website at www.torexgold.com.

ABOUT TOREX GOLD RESOURCES INC.

Torex Gold Resources Inc. is a Canadian mining company engaged in the exploration, development, and production of gold, copper, and silver from its flagship Morelos Complex in Guerrero, which is currently Mexico's largest single gold producer. The Company recently acquired a portfolio of early-stage exploration properties, including the Batopilas and Guigui projects in Chihuahua, Mexico, and the Gryphon and Medicine Springs projects in Nevada, USA, and has also entered into a definitive agreement to acquire a

The Company's key strategic objectives are: deliver Media Luna to full production and build EPO; optimize Morelos production and costs; grow reserves and resources; disciplined growth and capital allocation; retain and attract best industry talent; and to be an industry leader in responsible mining. In addition to realizing the full potential of the Morelos Property, the Company continues to seek opportunities to acquire assets that enable diversification and deliver value to shareholders.

FOR FURTHER INFORMATION, PLEASE CONTACT:

TOREX GOLD RESOURCES INC.

Jody Kuzenko

President and CEO

Direct: (647) 725-9982

jody.kuzenko@torexgold.com

Dan Rollins

Senior Vice President, Corporate Development & Investor Relations

Direct: (647) 260-1503

dan.rollins@torexgold.com

CAUTIONARY NOTES ON FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking statements" and "forward-looking information" (collectively, "Forward-Looking Information") within the meaning of applicable Canadian securities legislation. Generally, Forward-Looking Information can be identified by the use of forward-looking terminology such as "objective", "target", "continue", "potential", "focus", "demonstrate", "belief" or variations of such words and phrases or statements that certain actions, events or results "will", "would", "could" or "is expected to" occur. Forward-Looking Information also includes, but is not limited to, statements that drilling results disclosed herein: provide strong indications that the Company will be able to add to resource inventory generally; will support, together with previously disclosed drilling results, extending the ELG Underground mine life beyond 2029; indicate that there may be more undiscovered mineralized trends/corridors at ELG Underground mine; indicate potential for resource growth in both directions at the Sub-Sill Trend; support the ability to expand and upgrade resources, and replace mined reserves, year after year; support the potential for new inferred resources at El Limón Sur Trend and the Sub-Sill Trend; support the Company's objective of sustaining production levels for the Morelos Complex above 450,000 gold equivalent ounces beyond 2030; and indicate the potential to extend mineralization and increase mineral resources. Forward-Looking Information also include the Company's key strategic objectives to: deliver Media Luna to full production and build EPO; optimize Morelos production and costs; grow reserves and resources; pursue disciplined growth and capital allocation; retain and attract best industry talent; and be an industry leader in responsible mining. Forward-Looking Information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such Forward-Looking Information, including, without limitation, risks and uncertainties associated with: the ability to upgrade mineral resources to categories of mineral resources with greater confidence levels or to mineral reserves; risks associated with mineral reserve and mineral resource estimation; and those risk factors identified in the 2022 Technical Report, the AIF, and the Company's management's discussion and analysis for the three and six months ended June 30, 2025 (the "MD&A") or other unknown but potentially significant impacts. Forward-Looking Information is based on the assumptions discussed in the 2022 Technical Report, AIF, and MD&A, and such other reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances at the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the Forward-Looking Information, there may be other factors that cause results not to be as anticipated. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on Forward-Looking Information. The Company does not undertake to update any Forward-Looking Information, whether as a result of new information or future events or otherwise, except as may be required by applicable securities laws. The 2022 Technical Report, AIF and MD&A are filed on SEDAR+ at www.sedarplus.ca and the Company's website at www.torexgold.com.

Figure 1: Drilling has identified second order structures running parallel to main trends and extended known mineralization both laterally and vertically

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1863/269120_126a4f57e4408b60_001full.jpg

Figure 2: Drilling results along the El Limón Sur Trend indicate the potential to expand resources at depth

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1863/269120_126a4f57e4408b60_002full.jpg

Figure 3: Drilling results along the Sub-Sill Trend demonstrate potential to expand and upgrade mineral resources

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1863/269120_126a4f57e4408b60_003full.jpg

Table 4: Drill results along the El Limón Sur Trend

| Intercept | |||||||||||||||||

| Drill Hole | Program | UTM-E (m) | UTM-N (m) | Elevation (m) | Azimuth (°) | Dip (°) | Final Depth (m) | From (m) | To (m) | Core Length (m) | True Width (m) | Au (gpt) | Ag (gpt) | Cu (%) | AuEq (gpt) | Core Recovery (%) | |

| LDUG-390 | Infill | 422209.5 | 1990019.0 | 722.0 | 291.0 | -1.0 | 90.0 | 45.9 | 50.2 | 4.3 | 4.0 | 27.89 | 1.6 | 0.01 | 27.91 | 100.0 | |

| Including | 48.3 | 50.2 | 1.9 | 1.8 | 58.80 | 3.0 | 0.00 | 58.84 | 100.0 | ||||||||

| LDUG-408 | Infill | 422209.6 | 1990017.6 | 721.5 | 258.5 | -27.5 | 384.0 | 114.5 | 116.4 | 1.9 | 1.6 | 13.70 | 13.0 | 0.32 | 14.38 | 100.0 | |

| 222.7 | 225.0 | 2.3 | 2.0 | 6.38 | 1.9 | 0.01 | 6.41 | 100.0 | |||||||||

| LDUG-410 | Infill | 422209.8 | 1990017.7 | 721.3 | 257.9 | -43.5 | 456.0 | 112.0 | 121.0 | 9.0 | 6.4 | 7.63 | 3.9 | 0.07 | 7.80 | 98.3 | |

| LS-380 | Step-Out | 421646.8 | 1989805.7 | 571.1 | 86.0 | -13.7 | 627.0 | 434.5 | 436.9 | 2.4 | 2.3 | 1.92 | 6.4 | 0.20 | 2.34 | 100.0 | |

| LS-381 | Step-Out | 422210.2 | 1990019.6 | 721.1 | 291.0 | -53.0 | 207.0 | 110.6 | 114.6 | 4.0 | 2.3 | 1.23 | 13.8 | 0.78 | 2.66 | 99.7 | |

| LS-382 | Step-Out | 422209.9 | 1990016.9 | 721.1 | 242.0 | -32.0 | 171.0 | 104.4 | 107.1 | 2.7 | 2.0 | 5.95 | 5.6 | 1.01 | 7.65 | 100.0 | |

| Including | 104.4 | 105.4 | 1.0 | 0.8 | 14.30 | 5.0 | 0.87 | 15.76 | 100.0 | ||||||||

| LS-383 | Step-Out | 422204.5 | 1990127.8 | 676.5 | 242.0 | 15.0 | 132.0 | 105.2 | 109.0 | 3.8 | 3.2 | 0.30 | 0.5 | 0.08 | 0.43 | 100.0 | |

| LS-385 | Infill | 422149.1 | 1989629.2 | 807.9 | 270.0 | 40.0 | 180.0 | 126.7 | 130.2 | 3.5 | 2.7 | 2.93 | 1.5 | 0.10 | 3.11 | 100.0 | |

| 169.1 | 174.4 | 5.3 | 4.0 | 0.10 | 1.5 | 0.05 | 0.20 | 99.1 | |||||||||

| LS-386 | Step-Out | 422204.5 | 1990128.2 | 676.5 | 242.0 | -30.0 | 132.0 | 117.2 | 120.0 | 2.8 | 2.1 | 0.41 | 7.2 | 0.67 | 1.59 | 100.0 | |

| LS-387 | Step-Out | 422149.1 | 1989629.15 | 806.271 | 268.11 | 18.13 | 219 | 93.1 | 100.3 | 7.2 | 6.8 | 2.32 | 7.4 | 0.22 | 2.77 | 100.0 | |

| 107.0 | 126.0 | 19.0 | 18.0 | 3.01 | 3.2 | 0.11 | 3.23 | 99.5 | |||||||||

| Including | 115.0 | 119.0 | 4.0 | 3.8 | 6.12 | 2.0 | 0.07 | 6.26 | 98.3 | ||||||||

| 136.0 | 142.0 | 6.0 | 5.5 | 4.64 | 15.2 | 0.15 | 5.1 | 100.0 | |||||||||

| Including | 140.6 | 142.0 | 1.4 | 1.3 | 18.50 | 54.0 | 0.25 | 19.6 | 100.0 | ||||||||

| LS-390 | Step-Out | 421646.8 | 1989805.2 | 570.8 | 93.0 | -8.5 | 620.0 | 314.0 | 315.7 | 1.8 | 1.7 | 1.63 | 18.4 | 0.98 | 3.44 | 99.0 | |

| LS-391 | Step-Out | 422149.4 | 1989629.1 | 805.0 | 268.6 | -10.4 | 222.0 | 70.5 | 74.7 | 4.3 | 4.2 | 3.05 | 21.7 | 0.15 | 3.56 | 100.0 | |

| LS-393 | Step-Out | 422149.3 | 1989627.9 | 807.2 | 242.9 | 33.6 | 201.0 | 162.1 | 170.1 | 8.0 | 5.9 | 0.02 | 0.5 | 0.01 | 0.05 | 100.0 | |

| LS-395 | Step-Out | 422146.6 | 1989628.0 | 805.5 | 243.0 | 6.0 | 189.0 | 160.1 | 167.6 | 7.5 | 6.6 | 4.55 | 1.0 | 0.10 | 4.72 | 100.0 | |

| LS-397 | Step-Out | 422149.5 | 1989629.1 | 805.3 | 270.0 | 2.0 | 210.0 | 132.0 | 137.0 | 5.0 | 5.0 | 5.89 | 2.4 | 0.07 | 6.03 | 100.0 | |

| 193.6 | 198.7 | 5.1 | 5.1 | 0.40 | 18.4 | 0.62 | 1.64 | 100.0 | |||||||||

| LS-400 | Step-Out | 422149.2 | 1989628.4 | 806.5 | 256.5 | 26.0 | 201.0 | 114.0 | 117.7 | 3.7 | 3.2 | 8.78 | 12.2 | 0.30 | 9.43 | 100.0 | |

| LS-401 | Step-Out | 421647.0 | 1989805.2 | 571.4 | 94.0 | 5.7 | 400.0 | 312.5 | 314.1 | 1.5 | 1.5 | 1.42 | 1.0 | 0.00 | 1.44 | 100.0 | |

Notes to Table

1) Drill hole intercepts are shown both as core length and true widths.

2) Core lengths subject to rounding. All assay results are uncapped.

3) Coordinates are WGS 1984 UTM Zone 14N.

4) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

5) The gold equivalent grade calculation used is as follows: AuEq (gpt) = Au (gpt) + Ag (gpt) * 0.0127 + Cu (%) * 1.6104 and use the same metal prices (

Table 4 (continued): Drill results along the El Limón Sur Trend

| Intercept | |||||||||||||||||

| Drill Hole | Program | UTM-E (m) | UTM-N (m) | Elevation (m) | Azimuth (°) | Dip (°) | Final Depth (m) | From (m) | To (m) | Core Length (m) | True Width (m) | Au (gpt) | Ag (gpt) | Cu (%) | AuEq (gpt) | Core Recovery (%) | |

| LS-403 | Infill | 422204.4 | 1990128.1 | 678.5 | 242.1 | 44.7 | 154.5 | 96.0 | 125.0 | 29.0 | 18.2 | 6.98 | 22.7 | 2.11 | 10.67 | 100.0 | |

| Including | 100.5 | 103.5 | 3.0 | 1.9 | 10.04 | 56.0 | 4.67 | 18.27 | 100.0 | ||||||||

| Including | 111.8 | 117.8 | 6.1 | 3.8 | 14.47 | 28.7 | 3.14 | 19.90 | 100.0 | ||||||||

| LS-404 | Infill | 422120.4 | 1989649.6 | 895.9 | 307.9 | -23.3 | 150.0 | 118.0 | 122.3 | 4.3 | 3.1 | 8.55 | 1.6 | 0.12 | 8.77 | 100.0 | |

| LS-406 | Infill | 422120.3 | 1989649.4 | 896.2 | 301.1 | -17.1 | 162.0 | 85.4 | 100.0 | 14.6 | 12.0 | 8.29 | 2.5 | 0.04 | 8.39 | 100.0 | |

| Including | 98.2 | 100.0 | 1.8 | 1.5 | 37.74 | 5.0 | 0.20 | 38.12 | 100.0 | ||||||||

| 133.0 | 142.4 | 9.4 | 7.5 | 7.13 | 1.6 | 0.14 | 7.38 | 99.4 | |||||||||

| Including | 138.5 | 141.4 | 2.8 | 2.3 | 12.40 | 1.5 | 0.03 | 12.47 | 98.4 | ||||||||

| LS-407 | Infill | 422120.4 | 1989649.9 | 896.8 | 309.3 | -0.2 | 132.0 | 104.4 | 111.0 | 6.6 | 5.1 | 3.00 | 0.6 | 0.01 | 3.03 | 100.0 | |

| LS-409 | Infill | 422120.4 | 1989650.1 | 896.2 | 312.7 | -15.0 | 141.0 | 73.1 | 84.0 | 10.9 | 7.8 | 16.52 | 1.2 | 0.03 | 16.58 | 100.0 | |

| Including | 78.0 | 82.0 | 4.0 | 2.8 | 33.41 | 2.0 | 0.04 | 33.50 | 100.0 | ||||||||

| 95.0 | 112.2 | 17.2 | 13.0 | 9.16 | 1.5 | 0.10 | 9.34 | 99.5 | |||||||||

| Including | 104.2 | 108.0 | 3.8 | 2.9 | 27.50 | 2.0 | 0.11 | 27.70 | 99.6 | ||||||||

| LS-411 | Infill | 422120.2 | 1989649.2 | 896.3 | 294.0 | -13.9 | 144.0 | 101.3 | 110.6 | 9.4 | 8.3 | 9.85 | 0.7 | 0.03 | 9.90 | 100.0 | |

| Including | 101.3 | 103.7 | 2.4 | 2.2 | 20.52 | 1.3 | 0.02 | 20.56 | 100.0 | ||||||||

| LS-413 | Infill | 422120.2 | 1989649.1 | 896.7 | 288.0 | -1.0 | 116.6 | 56.8 | 57.9 | 1.1 | 1.0 | 11.00 | 16.0 | 0.23 | 11.57 | 98.1 | |

| 75.9 | 87.5 | 11.6 | 11.1 | 12.04 | 1.4 | 0.19 | 12.37 | 100.0 | |||||||||

| Including | 84.0 | 87.5 | 3.5 | 3.3 | 35.27 | 2.4 | 0.36 | 35.88 | 100.0 | ||||||||

| LS-414 | Infill | 422120.1 | 1989648.4 | 896.7 | 278.0 | -2.0 | 111.0 | 66.1 | 87.5 | 21.4 | 21.2 | 27.99 | 4.9 | 0.05 | 28.13 | 100.0 | |

| Including | 76.6 | 79.5 | 2.9 | 2.9 | 36.94 | 7.9 | 0.01 | 37.07 | 100.0 | ||||||||

| Including | 83.0 | 87.5 | 4.5 | 4.5 | 102.79 | 5.3 | 0.04 | 102.92 | 100.0 | ||||||||

| LS-416 | Infill | 422120.2 | 1989648.4 | 896.4 | 277.0 | -14.0 | 132.0 | 65.6 | 71.1 | 5.4 | 5.2 | 2.81 | 1.6 | 0.10 | 2.99 | 100.0 | |

| 78.1 | 89.0 | 10.9 | 10.2 | 13.83 | 1.9 | 0.01 | 13.87 | 100.0 | |||||||||

| Including | 81.0 | 82.9 | 1.9 | 1.8 | 32.34 | 3.0 | 0.00 | 32.38 | 100.0 | ||||||||

| Including | 85.0 | 85.8 | 0.8 | 0.8 | 33.17 | 2.0 | 0.00 | 33.20 | 100.0 | ||||||||

Notes to Table

1) Drill hole intercepts are shown both as core length and true widths.

2) Core lengths subject to rounding.All assay results are uncapped.

3) Coordinates are WGS 1984 UTM Zone 14N.

4) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

5) The gold equivalent grade calculation used is as follows: AuEq (gpt) = Au (gpt) + Ag (gpt) * 0.0127 + Cu (%) * 1.6104 and use the same metal prices (

Table 4 (continued): Drill results along the El Limón Sur Trend

| Intercept | |||||||||||||||||

| Drill Hole | Program | UTM-E (m) | UTM-N (m) | Elevation (m) | Azimuth (°) | Dip (°) | Final Depth (m) | From (m) | To (m) | Core Length (m) | True Width (m) | Au (gpt) | Ag (gpt) | Cu (%) | AuEq (gpt) | Core Recovery (%) | |

| LS-417 | Infill | 422120.3 | 1989648.3 | 896.0 | 274.1 | -26.8 | 165.0 | 65.2 | 78.0 | 12.8 | 11.4 | 1.99 | 2.3 | 0.13 | 2.23 | 99.2 | |

| 89.3 | 96.7 | 7.4 | 6.6 | 5.79 | 1.1 | 0.02 | 5.83 | 100.0 | |||||||||

| Including | 94.5 | 96.7 | 2.2 | 1.9 | 13.09 | 2.4 | 0.05 | 13.20 | 100.0 | ||||||||

| LS-419 | Step-Out | 422120.2 | 1989647.9 | 896.5 | 259.3 | -9.0 | 129.0 | 63.3 | 85.1 | 21.8 | 21.2 | 2.77 | 1.2 | 0.06 | 2.89 | 100.0 | |

| Including | 65.8 | 66.8 | 1.0 | 1.0 | 18.01 | 3.0 | 0.06 | 18.14 | 100.0 | ||||||||

| LS-421 | Step-Out | 422239.9 | 1989748.4 | 900.5 | 260.0 | -21.2 | 303.0 | 76.0 | 84.3 | 8.3 | 7.6 | 2.79 | 14.4 | 0.28 | 3.41 | 98.7 | |

| 143.5 | 152.9 | 9.4 | 8.6 | 6.29 | 6.0 | 0.15 | 6.61 | 100.0 | |||||||||

| LS-422 | Infill | 422120.3 | 1989648.2 | 896.0 | 264.1 | -24.2 | 132.0 | 75.0 | 95.0 | 20.0 | 18.1 | 8.52 | 1.8 | 0.07 | 8.66 | 99.4 | |

| Including | 89.7 | 93.0 | 3.3 | 3.0 | 35.65 | 3.7 | 0.12 | 35.89 | 100.0 | ||||||||

| LS-424 | Infill | 422240.0 | 1989748.3 | 900.6 | 253.0 | -17.5 | 270.0 | 153.4 | 180.3 | 26.9 | 24.6 | 16.99 | 2.5 | 0.02 | 17.06 | 99.4 | |

| Including | 159.6 | 166.1 | 6.4 | 5.9 | 52.95 | 5.6 | 0.04 | 53.08 | 99.3 | ||||||||

| 225.9 | 228.2 | 2.3 | 2.1 | 10.00 | 8.3 | 0.30 | 10.59 | 100.0 | |||||||||

| LS-425 | Step-Out | 422318.1 | 1990011.1 | 629.9 | 269.5 | -27.1 | 296.0 | 157.0 | 158.7 | 1.8 | 1.6 | 37.94 | 1.9 | 0.00 | 37.97 | 100.0 | |

| Including | 158.1 | 158.7 | 0.7 | 0.6 | 91.50 | 4.0 | 0.00 | 91.55 | 100.0 | ||||||||

| 281.6 | 284.5 | 2.9 | 2.3 | 7.93 | 60.7 | 3.92 | 15.01 | 100.0 | |||||||||

| Including | 281.6 | 282.8 | 1.2 | 1.0 | 11.00 | 102.0 | 6.70 | 23.09 | 100.0 | ||||||||

| LS-426 | Step-Out | 422240.3 | 1989748.3 | 900.7 | 249.0 | -19.0 | 315.0 | 93.8 | 96.4 | 2.7 | 2.4 | 1.41 | 6.6 | 0.11 | 1.68 | 100.0 | |

Notes to Table

1) Drill hole intercepts are shown both as core length and true widths.

2) Core lengths subject to rounding. All assay results are uncapped.

3) Coordinates are WGS 1984 UTM Zone 14N.

4) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

5) The gold equivalent grade calculation used is as follows: AuEq (gpt) = Au (gpt) + Ag (gpt) * 0.0127 + Cu (%) * 1.6104 and use the same metal prices (

Table 5: Drill results at the Sub-Sill Trend

| Intercept | |||||||||||||||||

| Drill Hole | Program | UTM-E (m) | UTM-N (m) | Elevation (m) | Azimuth (°) | Dip (°) | Final Depth (m) | From (m) | To (m) | Core Length (m) | True Width (m) | Au (gpt) | Ag (gpt) | Cu (%) | AuEq (gpt) | Core Recovery (%) | |

| LDUG-411 | Infill | 422299.9 | 1990429.1 | 719.5 | 248.0 | 1.0 | 200.0 | 173.9 | 178.0 | 4.1 | 3.8 | 0.03 | 3.4 | 0.09 | 0.21 | 100.0 | |

| LDUG-412 | Step-Out | 422300.2 | 1990429.1 | 718.7 | 248.0 | -18.5 | 180.0 | 151.3 | 153.7 | 2.5 | 2.2 | 0.47 | 44.0 | 0.09 | 1.17 | 100.0 | |

| SST-379 | Step-Out | 422534.9 | 1990159.5 | 1162.3 | 176.1 | -47.9 | 354.0 | 315.9 | 323.0 | 7.1 | 3.2 | 4.43 | 34.1 | 0.91 | 6.33 | 99.1 | |

| SST-383 | Step-Out | 422181.6 | 1990137.6 | 674.2 | 113.4 | -64.0 | 261.0 | 158.0 | 161.8 | 3.8 | 2.3 | 10.28 | 1.0 | 0.02 | 10.33 | 100.0 | |

| Including | 161.3 | 161.8 | 0.5 | 0.3 | 67.30 | 4.0 | 0.06 | 67.45 | 100.0 | ||||||||

| SST-384 | Step-Out | 422211.5 | 1990128.4 | 674.7 | 104.0 | -36.5 | 285.0 | 205.7 | 209.0 | 3.3 | 2.6 | 6.15 | 2.2 | 0.01 | 6.19 | 100.0 | |

| Including | 207.7 | 209.0 | 1.3 | 1.0 | 14.90 | 4.0 | 0.00 | 14.95 | 100.0 | ||||||||

| SST-385 | Step-Out | 422534.9 | 1990159.9 | 1162.1 | 175.0 | -54.5 | 387.0 | 311.9 | 324.7 | 12.7 | 5.5 | 1.16 | 4.6 | 0.10 | 1.38 | 100.0 | |

| SST-386 | Infill | 422211.3 | 1990128.2 | 674.9 | 113.5 | -32.8 | 228.0 | 149.4 | 157.6 | 8.2 | 6.3 | 4.56 | 11.3 | 0.43 | 5.40 | 100.0 | |

| Including | 150.5 | 151.5 | 0.9 | 0.7 | 23.40 | 20.0 | 0.66 | 24.71 | 100.0 | ||||||||

| 173.4 | 176.0 | 2.6 | 2.0 | 33.04 | 3.6 | 0.05 | 33.17 | 100.0 | |||||||||

| Including | 173.4 | 175.0 | 1.6 | 1.2 | 46.00 | 4.0 | 0.00 | 46.06 | 100.0 | ||||||||

| SST-387 | Step-Out | 422214.0 | 1990018.2 | 720.5 | 76.2 | -54.7 | 222.0 | 182.7 | 187.5 | 4.8 | 2.7 | 49.85 | 23.1 | 0.36 | 50.73 | 100.0 | |

| Including | 185.4 | 187.5 | 2.2 | 1.2 | 111.21 | 20.7 | 0.07 | 111.58 | 100.0 | ||||||||

| SST-388 | Step-Out | 422576.1 | 1989995.6 | 1198.9 | 196.8 | -70.6 | 270.0 | 246.3 | 255.0 | 8.7 | 2.6 | 5.83 | 17.2 | 0.76 | 7.28 | 100.0 | |

| Including | 246.3 | 248.7 | 2.4 | 0.7 | 17.69 | 6.1 | 0.14 | 17.99 | 100.0 | ||||||||

| SST-389 | Step-Out | 422210.6 | 1990127.3 | 674.2 | 129.2 | -61.9 | 210.0 | 183.5 | 186.0 | 2.6 | 1.4 | 31.58 | 3.4 | 0.01 | 31.63 | 100.0 | |

| Including | 183.5 | 184.6 | 1.1 | 0.6 | 63.80 | 7.0 | 0.01 | 63.91 | 100.0 | ||||||||

| SST-390 | Step-Out | 422213.3 | 1990018.5 | 720.6 | 61.0 | -73.3 | 261.0 | 234.3 | 237.3 | 3.0 | 1.1 | 0.03 | 0.5 | 0.00 | 0.04 | 100.0 | |

| SST-391 | Infill | 422210.5 | 1990125.9 | 675.5 | 145.0 | -7.1 | 90.0 | 70.0 | 73.0 | 3.0 | 1.7 | 0.79 | 3.3 | 0.09 | 0.98 | 100.0 | |

| SST-392 | Infill | 422211.4 | 1990128.4 | 675.2 | 87.4 | -18.6 | 210.0 | 161.1 | 163.1 | 2.0 | 1.9 | 2.54 | 17.9 | 0.68 | 3.86 | 100.0 | |

| 186.3 | 189.6 | 3.3 | 3.1 | 2.13 | 32.2 | 2.20 | 6.08 | 99.5 | |||||||||

| SST-393 | Step-Out | 422215.4 | 1990018.5 | 720.5 | 74.4 | -37.8 | 324.0 | 193.5 | 198.5 | 5.0 | 3.8 | 4.78 | 1.1 | 0.02 | 4.84 | 100.0 | |

| Including | 193.5 | 195.0 | 1.5 | 1.1 | 12.40 | 0.5 | 0.00 | 12.41 | 100.0 | ||||||||

| SST-394 | Step-Out | 422211.5 | 1990128.4 | 674.7 | 88.3 | -39.7 | 276.0 | 151.0 | 157.6 | 6.6 | 5.0 | 1.11 | 85.4 | 3.82 | 8.35 | 36.1 | |

| SST-395 | Step-Out | 422210.7 | 1990126.0 | 674.7 | 133.0 | -39.0 | 111.0 | 71.1 | 72.2 | 1.2 | 0.7 | 1.33 | 9.0 | 0.59 | 2.39 | 100.0 | |

Notes to Table

1) Drill hole intercepts are shown both as core length and true widths.

2) Core lengths subject to rounding. All assay results are uncapped.

3) Coordinates are WGS 1984 UTM Zone 14N.

4) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

5) The gold equivalent grade calculation used is as follows: AuEq (gpt) = Au (gpt) + Ag (gpt) * 0.0127 + Cu (%) * 1.6104 and use the same metal prices (

Table 5 (continued): Drill results at the Sub-Sill Trend

| Intercept | |||||||||||||||||

| Drill Hole | Program | UTM-E (m) | UTM-N (m) | Elevation (m) | Azimuth (°) | Dip (°) | Final Depth (m) | From (m) | To (m) | Core Length (m) | True Width (m) | Au (gpt) | Ag (gpt) | Cu (%) | AuEq (gpt) | Core Recovery (%) | |

| SST-396 | Step-Out | 422182.0 | 1990137.8 | 674.2 | 107.9 | -57.1 | 231.0 | 162.2 | 167.5 | 5.3 | 3.0 | 2.04 | 0.9 | 0.04 | 2.12 | 100.0 | |

| 188.0 | 192.0 | 4.0 | 2.5 | 1.88 | 0.5 | 0.02 | 1.92 | 100.0 | |||||||||

| SST-397 | Step-Out | 422182.1 | 1990137.8 | 674.2 | 128.8 | -65.5 | 261.0 | 220.0 | 222.0 | 2.0 | 0.9 | 4.14 | 0.5 | 0.00 | 4.15 | 97.3 | |

| SST-398 | Step-Out | 422211.4 | 1990129.0 | 675.2 | 77.0 | -18.4 | 315.0 | 151.4 | 155.0 | 3.7 | 3.4 | 0.57 | 8.5 | 0.30 | 1.16 | 100.0 | |

| SST-400 | Infill | 422247.0 | 1989748.0 | 904.0 | 101.3 | 41.5 | 178.5 | 132.5 | 139.3 | 6.8 | 5.0 | 3.01 | 5.0 | 0.22 | 3.42 | 97.9 | |

| 166.2 | 169.0 | 2.8 | 2.1 | 3.78 | 3.1 | 0.11 | 3.99 | 100.0 | |||||||||

| SST-401 | Infill | 422384.2 | 1989903.8 | 1051.1 | 263.1 | 33.4 | 60.0 | 42.6 | 44.8 | 2.3 | 1.9 | 2.15 | 1.2 | 0.03 | 2.22 | 100.0 | |

| SST-406 | Infill | 422342.8 | 1989895.6 | 1044.5 | 270.5 | 8.7 | 60.0 | 31.0 | 46.0 | 15.0 | 14.8 | 3.25 | 9.5 | 0.67 | 4.44 | 99.5 | |

| Including | 33.9 | 34.7 | 0.7 | 0.7 | 14.56 | 105.0 | 9.21 | 30.73 | 98.3 | ||||||||

| SST-402 | Infill | 422246.6 | 1989747.8 | 903.9 | 112.5 | 44.0 | 177.0 | 101.2 | 110.0 | 8.8 | 6.8 | 7.21 | 10.6 | 0.54 | 8.22 | 99.4 | |

| SST-403 | Infill | 422383.2 | 1989905.2 | 1050.5 | 294.0 | 19.5 | 70.0 | 57.2 | 60.2 | 3.0 | 2.6 | 0.85 | 13.4 | 0.43 | 1.71 | 100.0 | |

| SST-404 | Infill | 422384.1 | 1989902.9 | 1050.1 | 237.0 | 19.0 | 100.0 | 81.5 | 83.7 | 2.3 | 1.8 | 0.04 | 0.5 | 0.01 | 0.05 | 100.0 | |

| SST-405 | Infill | 422246.5 | 1989747.7 | 904.1 | 120.3 | 46.0 | 150.0 | 109.8 | 111.0 | 1.1 | 0.8 | 2.34 | 17.0 | 0.90 | 4.01 | 100.0 | |

| SST-406 | Infill | 422342.8 | 1989895.6 | 1044.5 | 270.5 | 8.7 | 60.0 | 31.0 | 46.0 | 15.0 | 14.8 | 3.25 | 9.5 | 0.67 | 4.44 | 99.5 | |

| Including | 33.9 | 34.7 | 0.7 | 0.7 | 14.56 | 105.0 | 9.21 | 30.73 | 98.3 | ||||||||

| SST-407 | Infill | 422343.2 | 1989896.9 | 1044.7 | 308.5 | 15.2 | 50.0 | 31.7 | 35.4 | 3.7 | 2.8 | 7.85 | 33.5 | 1.78 | 11.14 | 100.0 | |

| SST-408 | Infill | 422342.2 | 1989894.0 | 1045.7 | 233.1 | 23.7 | 70.0 | 51.8 | 54.0 | 2.2 | 1.6 | 1.70 | 0.5 | 0.01 | 1.72 | 100.0 | |

| SST-409 | Step-Out | 422570.9 | 1990144.5 | 1162.7 | 187.4 | -45.7 | 340.0 | 307.5 | 317.0 | 9.5 | 2.9 | 23.91 | 25.6 | 0.92 | 25.73 | 100.0 | |

| Including | 312.0 | 315.3 | 3.3 | 1.0 | 61.51 | 61.0 | 2.25 | 65.90 | 100.0 | ||||||||

| SST-410 | Infill | 422093.9 | 1990077.2 | 1041.4 | 118.0 | -18.1 | 186.0 | 162.3 | 167.1 | 4.8 | 4.0 | 1.68 | 2.7 | 0.12 | 1.90 | 100.0 | |

| SST-411 | Step-Out | 422570.6 | 1990144.9 | 1162.6 | 193.0 | -46.0 | 357.0 | 338.0 | 339.6 | 1.6 | 0.6 | 5.05 | 24.0 | 0.07 | 5.47 | 99.0 | |

| SST-412 | Infill | 422093.9 | 1990077.2 | 1041.4 | 117.1 | -11.8 | 205.0 | 184.2 | 186.5 | 2.3 | 2.0 | 7.45 | 2.0 | 0.03 | 7.53 | 100.0 | |

| Including | 184.2 | 185.4 | 1.2 | 1.0 | 13.23 | 2.0 | 0.02 | 13.29 | 100.0 | ||||||||

| 190.9 | 196.9 | 6.0 | 5.2 | 4.32 | 1.9 | 0.10 | 4.51 | 100.0 | |||||||||

| Including | 190.9 | 191.9 | 0.9 | 0.8 | 22.7 | 3.0 | 0.0 | 22.8 | 100.0 | ||||||||

Notes to Table

1) Drill hole intercepts are shown both as core length and true widths.

2) Core lengths subject to rounding. All assay results are uncapped.

3) Coordinates are WGS 1984 UTM Zone 14N.

4) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

5) The gold equivalent grade calculation used is as follows: AuEq (gpt) = Au (gpt) + Ag (gpt) * 0.0127 + Cu (%) * 1.6104 and use the same metal prices (

Table 5 (continued): Drill results at the Sub-Sill Trend

| Intercept | |||||||||||||||||

| Drill Hole | Program | UTM-E (m) | UTM-N (m) | Elevation (m) | Azimuth (°) | Dip (°) | Final Depth (m) | From (m) | To (m) | Core Length (m) | True Width (m) | Au (gpt) | Ag (gpt) | Cu (%) | AuEq (gpt) | Core Recovery (%) | |

| SST-414 | Infill | 422093.6 | 1990076.8 | 1041.2 | 127.0 | -20.0 | 192.0 | 185.1 | 190.7 | 5.6 | 4.2 | 8.19 | 9.7 | 0.47 | 9.07 | 98.7 | |

| Including | 188.7 | 190.7 | 2.0 | 1.5 | 14.58 | 15.0 | 0.65 | 15.81 | 98.6 | ||||||||

| SST-415 | Infill | 422093.7 | 1990077.0 | 1041.0 | 123.0 | -26.0 | 170.0 | 158.2 | 162.4 | 4.2 | 3.3 | 1.86 | 4.0 | 0.19 | 2.22 | 100.0 | |

| SST-416 | Infill | 422246.7 | 1989747.6 | 903.4 | 119.0 | 35.2 | 216.0 | 177.0 | 178.0 | 1.0 | 0.8 | 2.46 | 1.0 | 0.06 | 2.56 | 100.0 | |

| SST-417 | Infill | 422093.9 | 1990077.4 | 1041.0 | 113.0 | -23.2 | 165.0 | 150.6 | 153.0 | 2.4 | 2.0 | 0.06 | 0.8 | 0.05 | 0.15 | 100.0 | |

| SST-418 | Infill | 422547.4 | 1990154.1 | 1162.5 | 195.4 | -59.6 | 380.0 | 359.8 | 367.4 | 7.5 | 2.5 | 2.57 | 17.1 | 0.63 | 3.80 | 99.8 | |

| Including | 366.0 | 367.4 | 1.4 | 0.5 | 6.56 | 65.0 | 2.27 | 11.05 | 99.0 | ||||||||

| SST-419 | Infill | 422093.4 | 1990076.4 | 1041.1 | 135.0 | -21.7 | 190.0 | 181.4 | 190.0 | 8.6 | 5.6 | 6.61 | 9.4 | 0.37 | 7.33 | 100.0 | |

| SST-420 | Infill | 422247.0 | 1989748.0 | 901.3 | 98.9 | 0.3 | 150.0 | 112.5 | 116.8 | 4.3 | 4.2 | 8.11 | 4.0 | 0.16 | 8.42 | 100.0 | |

| Including | 115.5 | 116.8 | 1.3 | 1.3 | 23.40 | 3.0 | 0.07 | 23.54 | 100.0 | ||||||||

| SST-421 | Step-Out | 422547.4 | 1990154.1 | 1162.5 | 184.8 | -50.3 | 369.0 | 290.8 | 292.1 | 1.3 | 0.4 | 1.62 | 7.0 | 0.31 | 2.21 | 99.7 | |

| SST-422 | Infill | 422094.0 | 1990077.4 | 1041.2 | 110.0 | -17.1 | 186.0 | 144.1 | 146.0 | 1.9 | 1.7 | 0.19 | 1.0 | 0.01 | 0.22 | 100.0 | |

| SST-425 | Infill | 422547.4 | 1990154.1 | 1162.5 | 192.0 | -56.9 | 474.0 | 114.2 | 116.3 | 2.1 | 0.6 | 0.04 | 92.0 | 0.21 | 1.54 | 100.0 | |

Notes to Table

1) Drill hole intercepts are shown both as core length and true widths.

2) Core lengths subject to rounding. All assay results are uncapped.

3) Coordinates are WGS 1984 UTM Zone 14N.

4) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

5) The gold equivalent grade calculation used is as follows: AuEq (gpt) = Au (gpt) + Ag (gpt) * 0.0127 + Cu (%) * 1.6104 and use the same metal prices (

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/269120