Torex Gold Reports Promising Drill Results from Media Luna West

Rhea-AI Summary

Torex Gold (OTCQX: TORXF) reported results from the 2025 Media Luna West drilling program that defined a 400 x 300 m mineralized footprint and totalled 11,303 m across 24 drill holes. Notable high-grade intercepts include 12.25 gpt AuEq over 11.0 m (ML25-1088D) and 17.79 gpt AuEq over 12.9 m (ML25-1095D). The company said these results support an expected inaugural Inferred Resource to be declared with the annual reserves and resources update in March 2026. Drilling remains open along strike and future work will target north and south expansion and resource category upgrades.

Positive

- Mineralized footprint defined at 400 x 300 m

- High-grade intercepts: 12.25 gpt AuEq over 11.0 m and 17.79 gpt AuEq over 12.9 m

- Completed 11,303 m of drilling across 24 holes in 2024–2025

- Inaugural Inferred Resource targeted for declaration in March 2026

Negative

- Reported intercepts are core lengths not true widths; true widths pending geological modelling

- Upcoming resource will be Inferred, indicating lower confidence until infill and categorization drilling occurs

News Market Reaction

On the day this news was published, TORXF declined 1.20%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

TORXF was up 2.12% with gold peers like WGXRF (+7.92%) and OCANF (+3.91%) also positive, indicating a supportive sector backdrop alongside the company-specific drill results.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 01 | Drill results update | Positive | -1.2% | High-grade Media Luna West drilling supporting inaugural Inferred Resource in 2026. |

| Nov 19 | NCIB renewal | Positive | -0.4% | Renewal of normal course issuer bid allowing repurchase of up to 8.13M shares. |

| Nov 05 | Q3 2025 earnings | Positive | +5.8% | Strong Q3 free cash flow, robust production, and initiation of a quarterly dividend. |

| Nov 05 | Capital return plan | Positive | +5.8% | Launch of combined dividend and buyback program signalling structured capital returns. |

| Oct 22 | Acquisition close | Neutral | -0.1% | Completion of Prime Mining deal adding Los Reyes with sizeable gold and silver resources. |

Recent shareholder-friendly capital return and strong operational updates often saw positive reactions, while technical or buyback announcements occasionally faced near-term divergence.

Over the last few months, Torex Gold has combined operational execution with capital returns and portfolio expansion. Q3 2025 results showed strong production and free cash flow, supporting an inaugural dividend and share repurchases on Nov 5, 2025. Around the same time, the company completed the Prime Mining acquisition, adding the Los Reyes project. This drill update at Media Luna West, defining a 400 x 300 m mineralized footprint over 11,303 m in 24 holes, extends the exploration pipeline that underpins Torex’s long-term production profile.

Market Pulse Summary

This announcement highlighted drilling success at Media Luna West, defining a 400 x 300 m mineralized footprint from 11,303 m of drilling across 24 holes and several high-grade AuEq intercepts. Management indicated these results should support an inaugural Inferred Resource in March 2026, positioning the area as a potential future mining front within the Morelos Complex. Investors may track upcoming resource updates, follow-on drilling, and technical studies to understand how this exploration progress translates into long-term production and project value.

Key Terms

inferred resource technical

indicated technical

breccias technical

calc-silicate technical

qa/qc technical

fire assay technical

aqua regia digestion technical

AI-generated analysis. Not financial advice.

Results support declaration of an inaugural Inferred Resource with the annual update

(All amounts expressed in U.S. dollars unless otherwise stated)

Toronto, Ontario--(Newsfile Corp. - December 1, 2025) - Torex Gold Resources Inc. (the "Company" or "Torex") (TSX: TXG) (OTCQX: TORXF) is pleased to provide results from the 2025 drilling program at Media Luna West, which support the Company's strategy to target near-mine opportunities in the Media Luna Cluster in order to further enhance and extend the production profile of the Morelos Complex.

Jody Kuzenko, President & CEO of Torex, stated:

"The results from this year's drilling program at Media Luna West defined a mineralized footprint of 400 x 300 metres ("m") situated in very close proximity to the main Media Luna deposit. Drilling continued to return impressive, high-grade results, most notably 12.25 grams per tonne gold equivalent ("gpt AuEq") over 11.0 m in drill hole ML25-1088D and 17.79 gpt AuEq over 12.9 m in ML25-1095D. Based on these results and ongoing modelling work, we expect to declare an inaugural Inferred Resource with our annual mineral reserves and resources update in March 2026. Future drilling at Media Luna West will be focused on expanding the resource footprint towards the north along the main north-south corridor and to the south towards the highly prospective San Miguel fault, as well as upgrading resources from the Inferred to the Indicated category.

"These latest results build on the drilling success we have had within the Media Luna Cluster and reinforce the quality of the mineralization we see on the south side of the property. We believe Media Luna West could be a potential new mining front should the area be evaluated as economically viable, which becomes more likely now that we can leverage the infrastructure constructed at Media Luna.

"The results from Media Luna West are part of the investment we made this year to expand the resource footprint more broadly across the Morelos Property. We look forward to sharing the results from drilling conducted at other targets across the Media Luna Cluster and Atzcala over the coming months as we believe they will further showcase the true exploration potential at Morelos and our ability to sustain production above 450,000 gold equivalent ounces at reserve metal prices well beyond 2030."

MEDIA LUNA WEST DRILLING & EXPLORATION PROGRAM

Drilling and exploration programs at the Media Luna Cluster support the Company's objective of enhancing and extending the production profile of Morelos by expanding resources and increasing reserves. Progress continues to be made across the Media Luna Cluster in the mission to refine the new structural framework through the identification of multiple alteration events, various and distinct mineralization styles, and main mineralization controls.

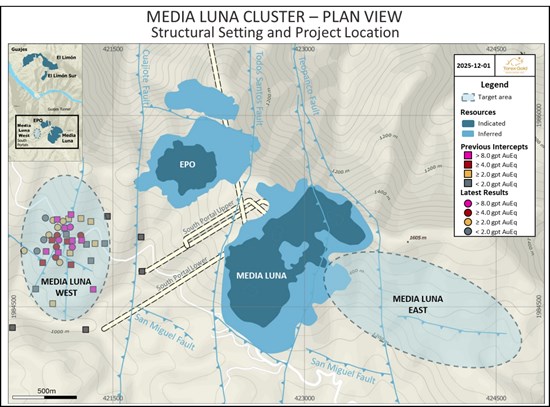

The deeper understanding of the structural controls across the Morelos Property has reoriented exploration at Media Luna West to focus on the intersection of the north-south structural corridor with west-northwest-striking faults linked to the San Miguel fault. The fault is thought to be the structure that provided the mineralizing fluids to the north-south structural corridor at Media Luna West during the mineralization events (Figure 1).

Drilling at Media Luna West in 2025 has been aimed at declaring an inaugural Inferred Resource with the ultimate goal of potentially establishing a new mining front within the Media Luna Cluster should the resources prove to be economically viable through future infill drilling as well as technical and commercial evaluation. Drilling has primarily been focused on exploring the mineralized continuity of the high-grade intercepts encountered in the previously drilled holes ML24-1043DB (13.40 gpt AuEq over 28.4 m) and ML23-986A (29.78 gpt AuEq over 14.1 m), and to define the mineralized footprint (Table 3). A total of 10,744 m of drilling was conducted across 23 drill holes (including eight parent holes) during 2025. This release contains all drilling completed during 2025 and one drill hole from 2024's program that was not previously reported, totaling 11,303 m over 24 drill holes.

Drill hole intercepts for Media Luna West are core lengths and not true widths, as true widths will be determined once the geological modelling is completed. The gold equivalent grade calculations reported for each intercept use the same metal prices (

References to future gold equivalent production is based on forecast Au, Ag, and Cu production based on the metal price ratios implied by metal prices used to estimate mineral reserves (

Figure 1: Plan view of Media Luna Cluster showing Media Luna West drill intercepts, the resource footprints for EPO and Media Luna, and the Media Luna East target area.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1863/276437_7121c8e7b4cdcaca_001full.jpg

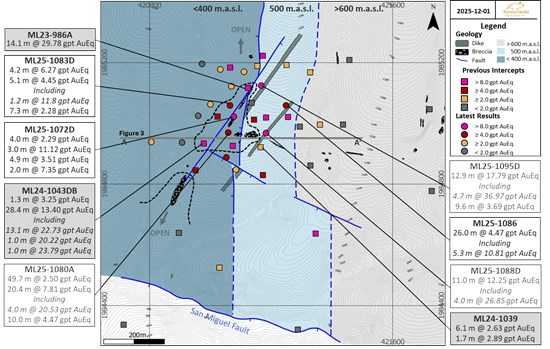

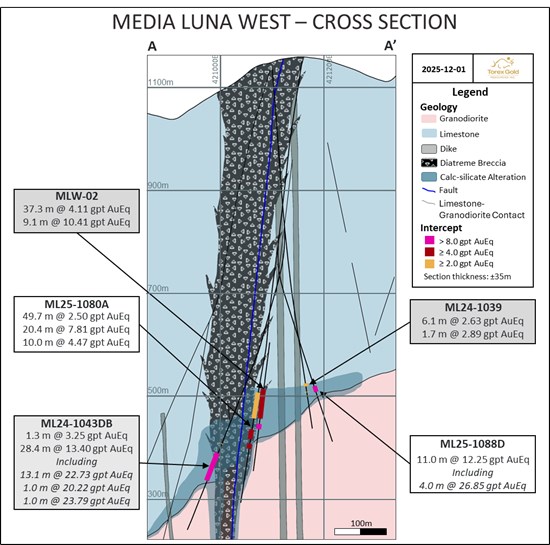

North-south faults define structural blocks in which mineralization is found at different elevations depending on whether it lies in the hanging wall or footwall of the structures (Figure 2). Drill holes ML25-1080A and ML25-1088D testing for mineralization at the hanging wall of the reverse fault portray relevant intercepts at elevations over 400 m above sea level ("m.a.s.l"), while drill hole ML24-1043DB, drilled at the footwall, intercepted mineralization at elevations below 400 m.a.s.l. (Figure 3).

Results from drill holes ML25-1080A and ML25-1088D confirm that the local-scale mineralization controls are the fringes of the diatreme breccias and the contact between the granodiorite stock and the overlying limestones within the calc-silicate alteration envelope (Figure 3). Based on the current observations, the mineralization sequence commenced with a copper-rich mineralization event hosted in the calc-silicate alteration that developed along the contact of the granodiorite intrusive and the limestones. Later reactivation of the north-south and north-west faults allowed for the intrusion of phreatomagmatic breccias, providing ground preparation for a late gold-rich fluid that preferentially mineralized the fringes of the breccias and enriched the previous copper-bearing mineralization with gold. The latter explains the gold-rich intercepts at the fringes of the breccias, and the gold-copper mineralization more commonly found within the calc-silicate alteration.

A mineralized footprint of 400 x 300 m has now been defined. The system remains open to the north along the north-south mineralized corridor and to the south as surface mapping shows continuity of the breccia bodies towards the San Miguel fault.

The advanced exploration program for Media Luna West in 2025 was successfully completed with compelling results that could support the delivery of an inaugural Inferred Resource with the annual mineral reserve and resource update in March 2026. Once declared, Media Luna West is expected to advance to the next stage of the exploration pipeline through a resource categorization program that will commence in 2026 with a target of upgrading Inferred Resources to the Indicated Resources category.

Table 1: Highlights from the 2025 drilling program at Media Luna West

| Drill Hole | From (m) | To (m) | Core Length (m) | Au (gpt) | Ag (gpt) | Cu (%) | AuEq (gpt) |

| ML25-1080A | 652.3 | 702.0 | 49.7 | 2.47 | 0.9 | 0.01 | 2.50 |

| 724.0 | 744.4 | 20.4 | 7.42 | 6.2 | 0.20 | 7.81 | |

| incl. | 730.0 | 734.0 | 4.0 | 20.22 | 9.0 | 0.12 | 20.53 |

| 751.9 | 761.9 | 10.0 | 4.23 | 3.5 | 0.12 | 4.47 | |

| ML25-1083D | 718.7 | 722.9 | 4.2 | 6.22 | 2.8 | 0.01 | 6.27 |

| 752.6 | 757.8 | 5.1 | 2.43 | 35.9 | 0.97 | 4.45 | |

| incl. | 753.9 | 755.1 | 1.2 | 6.68 | 95.7 | 2.43 | 11.80 |

| 770.0 | 777.3 | 7.3 | 1.31 | 9.2 | 0.52 | 2.28 | |

| ML25-1088D | 647.0 | 658.0 | 11.0 | 11.70 | 10.3 | 0.26 | 12.25 |

| incl. | 652.6 | 656.6 | 4.0 | 26.33 | 11.3 | 0.24 | 26.85 |

| ML25-1095D | 703.6 | 716.5 | 12.9 | 17.25 | 8.7 | 0.27 | 17.79 |

| incl. | 705.7 | 710.4 | 4.7 | 36.35 | 14.3 | 0.27 | 36.97 |

| 763.5 | 773.1 | 9.6 | 0.87 | 37.4 | 1.46 | 3.69 |

Notes to Table:

1) Intercepts are reported as core length (not true width/thickness). True width/thickness will be determined once the geological modelling is completed.

2) Core recovery is shown in Table 2.

3) The gold equivalent grade calculation used is as follows: AuEq = Au (gpt) + (Ag (gpt) * 0.0127) + (Cu (%) * 1.6104) and use the same metal prices (

4) All assay results are uncapped. Core lengths subject to rounding.

MEDIA LUNA WEST GEOLOGY

The Media Luna West target is part of the Media Luna Cluster, which also includes Media Luna, Media Luna East, EPO, and Todos Santos. They are hosted within the Mesozoic carbonate-rich Morelos Platform, overlayed by Cuautla and Mezcala formations and have been intruded by Paleocene stocks, sills, and dikes of granodioritic to tonalitic composition.

The north-south thick-skin deep-seated faults control the architecture of the mineralized zones with sub-parallel second-order faults generating favourable traps for the different mineralizing fluids during the multiple stages of deformation.

Cu-Ag and later Au mineralization is hosted within the intense extension fractures in the footwalls and hanging walls of the faults related to the emplacement of the approximately north-south-striking dikes and breccias. Mineralization is better developed along the contact of Morelos formation limestones and Media Luna granodiorite. The margins of altered dikes and sills of the calc-silicate envelope also act as a secondary control of mineralization.

The mineral assemblage is characterized by pyroxene, garnet, and magnetite. Metal deposition occurred during hydrated minerals alteration and is associated with a mineral assemblage comprising of amphibole, phlogopite, chlorite, and calcite ± quartz ± epidote as well as variable amounts of magnetite and sulfides, primarily pyrrhotite. The style of mineralization at both Media Luna West and Media Luna East is characterized by Au with locally high Ag and Cu grades. Given that Au precipitates due to the buffer exerted by the early stage of calc-silicate alteration and sulfide mineralization, it occurs as free Au and is generally dissociated from the earlier Cu mineralization event that is mainly represented by chalcopyrite.

QA/QC

Torex maintains an industry-standard analytical quality assurance and quality control ("QA/QC") and data verification program to monitor laboratory performance and ensure high-quality assays. Results from this program confirm the reliability of the assay results.

The exploration program and analytical QA/QC program for Media Luna Cluster drilling is currently overseen by José Antonio San Vicente Díaz, Chief Exploration Geologist for Minera Media Luna, S.A. de C.V. All samples reported have been checked against Company and Lab standards and blanks. No core duplicate samples are taken.

HQ-size core is sawn in half with half the core retained in the core box and the other half bagged and tagged for shipment to the sample preparation facility. Sample preparation is carried out by Bureau Veritas ("BV"), an accredited laboratory, at its facilities in Durango, Mexico and consists of crushing a 1 kg sample to >

Additional information on sampling and analyses, analytical labs, and methods used for data verification is available in the Company's technical report entitled the "Morelos Property, NI 43-101 Technical Report, ELG Mine Complex Life of Mine Plan and Media Luna Feasibility Study, Guerrero State, Mexico", dated effective March 16, 2022 filed on March 31, 2022 (the "2022 Technical Report") and in the annual information form ("AIF") dated March 21, 2025, each filed on SEDAR+ at www.sedarplus.ca and the Company's website at www.torexgold.com.

QUALIFIED PERSON

Scientific and technical information contained in this news release has been reviewed and approved by Rochelle Collins, P.Geo. (PGO #1412), Principal, Mineral Resource Geologist with Torex Gold Resources Inc. and a "qualified person" ("QP") as defined by NI 43-101. Ms. Collins has verified the data disclosed herein, including sampling, analytical, and test data underlying the drill results. Verification included visually reviewing the drill holes in three dimensions, comparing the assay results to the original assay certificates, reviewing the drilling database, and reviewing core photography consistent with standard practice. Ms. Collins consents to the inclusion in this release of said information in the form and context in which it appears.

ABOUT TOREX GOLD RESOURCES INC.

Torex Gold Resources Inc. is a Canadian mining company engaged in the exploration, development, and production of gold, copper, and silver from its flagship Morelos Complex in Guerrero, which is currently Mexico's largest single gold producer. The Company also owns the advanced stage Los Reyes gold-silver project in Sinaloa, Mexico and recently acquired a portfolio of early-stage exploration properties, including the Batopilas and Guigui projects in Chihuahua, Mexico, and the Gryphon and Medicine Springs projects in Nevada, USA.

The Company's key strategic objectives are to: deliver Media Luna to full production and build EPO; optimize Morelos production and costs; grow reserves and resources; pursue disciplined growth and capital allocation; retain and attract best industry talent; and be an industry leader in responsible mining. In addition to realizing the full potential of the Morelos Property, the Company continues to seek opportunities to acquire assets that enable diversification and deliver value to shareholders.

FOR FURTHER INFORMATION, PLEASE CONTACT:

TOREX GOLD RESOURCES INC.

Jody Kuzenko

President and CEO

Direct: (647) 725-9982

jody.kuzenko@torexgold.com

Dan Rollins

Senior Vice President, Corporate Development & Investor Relations

Direct: (647) 260-1503

dan.rollins@torexgold.com

CAUTIONARY NOTES ON FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking statements" and "forward-looking information" (collectively, "Forward-Looking Information") within the meaning of applicable Canadian securities legislation. Generally, Forward-Looking Information can be identified by the use of forward-looking terminology such as "objective", "target", "continue", "potential", "focus", "demonstrate", "belief" or variations of such words and phrases or statements that certain actions, events or results "will", "would", "could" or "is expected to" occur. Forward-Looking Information also includes, but is not limited to, statements that drilling results disclosed herein: support the Company's strategy to target near-mine opportunities in the Media Luna Cluster and the Company's objective of enhancing and extending the production profile of Morelos by expanding resources and increasing reserves; support the declaration of an inaugural Inferred Resource in March 2026 with an ultimate goal of potentially establishing a new mining front within the Media Luna Cluster should the resources prove to be economically viable; showcase the true exploration potential of Morelos and the ability to sustain production above 450,000 gold equivalent ounces well beyond 2030; and the expectation that a resource categorization program will commence in 2026 with a target of upgrading Inferred Resources to the Indicated Resources category. Forward-Looking Information also include the Company's key strategic objectives to: deliver Media Luna to full production and build EPO; optimize Morelos production and costs; grow reserves and resources; pursue disciplined growth and capital allocation; retain and attract best industry talent; and be an industry leader in responsible mining. Forward-Looking Information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such Forward-Looking Information, including, without limitation, risks and uncertainties associated with: the ability to upgrade mineral resources to categories of mineral resources with greater confidence levels or to mineral reserves; risks associated with mineral reserve and mineral resource estimation; and those risk factors identified in the 2022 Technical Report, the AIF, and the Company's management's discussion and analysis for the three and nine months ended September 30, 2025 (the "MD&A") or other unknown but potentially significant impacts. Forward-Looking Information is based on the assumptions discussed in the 2022 Technical Report, AIF, and MD&A, and such other reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances at the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the Forward-Looking Information, there may be other factors that cause results not to be as anticipated. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on Forward-Looking Information. The Company does not undertake to update any Forward-Looking Information, whether as a result of new information or future events or otherwise, except as may be required by applicable securities laws. The 2022 Technical Report, AIF and MD&A are filed on SEDAR+ at www.sedarplus.ca and the Company's website at www.torexgold.com.

Figure 2: Plan view of Media Luna West showing high-grade drilling intercepts over different structural blocks at distinct elevations. Mineralization remains open to the north along the main north-south corridor and to the south towards the San Miguel fault.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1863/276437_7121c8e7b4cdcaca_002full.jpg

Figure 3: Media Luna West section view showing high-grade intercepts of over 30 m of vertical continuity within the favourable alteration zone and notably at the fringes of a diatreme breccia as main mineralization controls.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1863/276437_7121c8e7b4cdcaca_003full.jpg

Table 2: Media Luna West drill results

| Intercept | |||||||||||||||

| Drill Hole | Program | UTM-E (m) | UTM-N (m) | Elevation (m) | Azimuth (°) | Dip (°) | Final Depth (m) | From (m) | To (m) | Core Length (m) | Au (gpt) | Ag (gpt) | Cu (%) | AuEq (gpt) | Core Recovery (%) |

| ML24-1051D | Adv. Expl. | 421015.7 | 1984856.4 | 1093.1 | 786 | 677.5 | 681.0 | 3.5 | 2.17 | 11.6 | 0.44 | 3.01 | |||

| 696.0 | 698.0 | 2.0 | 3.13 | 10.9 | 0.22 | 3.63 | |||||||||

| ML25-1059 | Adv. Expl. | 421097.7 | 1984931.3 | 1134.0 | 270 | -75 | 407 | Parent hole | |||||||

| ML25-1062D | Adv. Expl. | 421097.7 | 1984931.3 | 1134.0 | 1013 | 956.4 | 958.5 | 2.1 | 0.22 | 38.4 | 1.78 | 3.57 | |||

| ML25-1066D | Adv. Expl. | 421097.7 | 1984931.3 | 1134.0 | 980 | No significant values | |||||||||

| ML25-1068 | Adv. Expl. | 421150.0 | 1984902.5 | 1119.2 | 260 | -80 | 600 | Parent hole | |||||||

| ML25-1068A | Adv. Expl. | 421150.0 | 1984902.5 | 1119.2 | 867 | 692.0 | 694.0 | 2.0 | 4.47 | 0.7 | 0.00 | 4.48 | |||

| ML25-1069 | Adv. Expl. | 421168.2 | 1985019.8 | 1183.7 | 270 | -77 | 506 | Parent hole | |||||||

| ML25-1072D | Adv. Expl. | 421168.2 | 1985019.8 | 1183.7 | 909 | 718.0 | 722.0 | 4.0 | 1.90 | 3.5 | 0.21 | 2.29 | |||

| 728.0 | 731.0 | 3.0 | 10.72 | 4.2 | 0.22 | 11.12 | |||||||||

| 758.0 | 762.9 | 4.9 | 3.33 | 4.4 | 0.07 | 3.51 | |||||||||

| 770.0 | 772.0 | 2.0 | 7.02 | 4.0 | 0.18 | 7.35 | |||||||||

| ML25-1073 | Adv. Expl. | 421113.2 | 1985076.8 | 1190.9 | 259 | -80 | 356 | Parent hole | |||||||

| ML25-1073A | Adv. Expl. | 421113.2 | 1985076.8 | 1190.9 | 941 | 815.6 | 821.4 | 5.9 | 3.78 | 2.2 | 0.09 | 3.95 | |||

| ML25-1074D | Adv. Expl. | 421168.2 | 1985019.8 | 1183.7 | 936 | No significant values | |||||||||

| ML25-1080 | Adv. Expl. | 421157.8 | 1984959.8 | 1152.0 | 272 | -81 | 356 | Parent hole | |||||||

| ML25-1080A | Adv. Expl. | 421157.8 | 1984959.8 | 1152.0 | 866 | 652.3 | 702.0 | 49.7 | 2.47 | 0.9 | 0.01 | 2.50 | |||

| 724.0 | 744.4 | 20.4 | 7.42 | 6.2 | 0.20 | 7.81 | |||||||||

| incl. | 730.0 | 734.0 | 4.0 | 20.22 | 9.0 | 0.12 | 20.53 | ||||||||

| 751.9 | 761.9 | 10.0 | 4.23 | 3.5 | 0.12 | 4.47 | |||||||||

| ML25-1083D | Adv. Expl. | 421113.2 | 1985076.8 | 1190.9 | 860 | 718.7 | 722.9 | 4.2 | 6.22 | 2.8 | 0.01 | 6.27 | |||

| 752.6 | 757.8 | 5.1 | 2.43 | 35.9 | 0.97 | 4.45 | |||||||||

| incl. | 753.9 | 755.1 | 1.2 | 6.68 | 95.7 | 2.43 | 11.80 | ||||||||

| 770.0 | 777.3 | 7.3 | 1.31 | 9.2 | 0.52 | 2.28 | |||||||||

Notes to Table

1) Intercepts are core lengths and do not represent true thickness of mineralized zones. True width/thickness will be determined once the geological modelling is completed.

2) Core lengths subject to rounding.

3) Coordinates are WGS 1984 UTM Zone 14N

4) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

5) The gold equivalent grade calculation used is as follows: AuEq = Au (gpt) + (Ag (gpt) * 0.0127) + (Cu (%) * 1.6104) and use the same metal prices (

6) All assay results are uncapped.

Table 2 (continued): Media Luna West drill results

| Intercept | |||||||||||||||

| Drill Hole | Program | UTM-E (m) | UTM-N (m) | Elevation (m) | Azimuth (°) | Dip (°) | Final Depth (m) | From (m) | To (m) | Core Length (m) | Au (gpt) | Ag (gpt) | Cu (%) | AuEq (gpt) | Core Recovery (%) |

| ML25-1084 | Adv. Expl. | 421034.2 | 1985188.4 | 1192.9 | 262 | -82 | 452 | Parent hole | |||||||

| ML25-1084A | Adv. Expl. | 421034.2 | 1985188.4 | 1192.9 | 881 | No significant values | |||||||||

| ML25-1086 | Adv. Expl. | 421112.8 | 1985080.1 | 1191.0 | 93 | -79 | 800 | 684.0 | 710.0 | 26.0 | 1.58 | 35.9 | 1.51 | 4.47 | |

| incl. | 692.3 | 697.6 | 5.3 | 5.93 | 60.4 | 2.55 | 10.81 | ||||||||

| ML25-1088D | Adv. Expl. | 421157.8 | 1984959.8 | 1152.0 | 758 | 647.0 | 658.0 | 11.0 | 11.70 | 10.3 | 0.26 | 12.25 | |||

| incl. | 652.6 | 656.6 | 4.0 | 26.33 | 11.3 | 0.24 | 26.85 | ||||||||

| ML25-1091 | Adv. Expl. | 421113.2 | 1985078.5 | 1191.0 | 360 | -84 | 446 | Parent hole | |||||||

| ML25-1094D | Adv. Expl. | 421034.2 | 1985188.4 | 1192.9 | 882 | 838.2 | 840.4 | 2.2 | 0.80 | 29.9 | 1.09 | 2.93 | |||

| ML25-1095D | Adv. Expl. | 421113.2 | 1985078.5 | 1191.0 | 839 | 703.6 | 716.5 | 12.9 | 17.25 | 8.7 | 0.27 | 17.79 | |||

| incl. | 705.7 | 710.4 | 4.7 | 36.35 | 14.3 | 0.27 | 36.97 | ||||||||

| 763.5 | 773.1 | 9.6 | 0.87 | 37.4 | 1.46 | 3.69 | |||||||||

| ML25-1102D | Adv. Expl. | 421113.2 | 1985078.5 | 1191.0 | 887 | 774.6 | 782.2 | 7.6 | 0.21 | 29.0 | 1.16 | 2.45 | |||

| ML25-1106 | Adv. Expl. | 421037.1 | 1985186.9 | 1192.9 | 119 | -78 | 392 | Parent hole | |||||||

| ML25-1112D | Adv. Expl. | 421037.1 | 1985186.9 | 1192.9 | 935 | 882.0 | 883.7 | 1.7 | 0.80 | 42.4 | 0.88 | 2.76 | |||

Notes to Table

1) Intercepts are core lengths and do not represent true thickness of mineralized zones. True width/thickness will be determined once the geological modelling is completed.

2) Core lengths subject to rounding.

3) Coordinates are WGS 1984 UTM Zone 14N

4) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

5) The gold equivalent grade calculation used is as follows: AuEq = Au (gpt) + (Ag (gpt) * 0.0127) + (Cu (%) * 1.6104) and use the same metal prices (

6) All assay results are uncapped.

Table 3: Previously reported drill results

| Intercept | |||||||||||||||

| Drill Hole | Program | UTM-E (m) | UTM-N (m) | Elevation (m) | Azimuth (°) | Dip (°) | Final Depth (m) | From (m) | To (m) | Core Length (m) | Au (gpt) | Ag (gpt) | Cu (%) | AuEq (gpt) | Core Recovery (%) |

| ML23-986 | Drill Test | 421112.8 | 1985080.1 | 1190.8 | 321 | -88 | 166 | Parent hole | |||||||

| ML23-986A | Drill Test | 421112.8 | 1985080.1 | 1190.8 | 870 | 784.5 | 798.6 | 14.1 | 27.50 | 27.9 | 1.20 | 29.78 | |||

| MLW-02 | Drill Test | 421168.8 | 1985018.2 | 1183.4 | 220 | -75 | 838 | 676.3 | 713.6 | 37.3 | 4.08 | 2.1 | 0.00 | 4.11 | |

| 721.5 | 732.9 | 11.4 | 2.98 | 0.7 | 0.00 | 2.99 | |||||||||

| 752.1 | 761.1 | 9.1 | 10.31 | 2.2 | 0.04 | 10.41 | |||||||||

| ML24-1039 | Drill Test | 421099.8 | 1984933.8 | 1135.8 | 87 | -85 | 700 | 616.6 | 622.7 | 6.1 | 0.65 | 24.2 | 1.04 | 2.63 | |

| 635.8 | 637.5 | 1.7 | 2.73 | 2.4 | 0.08 | 2.89 | |||||||||

| ML24-1043DB | Drill Test | 421099.8 | 1984933.8 | 1135.8 | 87 | -85 | 925 | 765.7 | 767.2 | 1.3 | 3.16 | 2.5 | 0.04 | 3.25 | |

| 796.4 | 830.0 | 28.4 | 13.36 | 1.7 | 0.01 | 13.40 | |||||||||

| incl. | 806.3 | 820.0 | 13.1 | 22.66 | 2.7 | 0.02 | 22.73 | ||||||||

| incl. | 825.0 | 826.0 | 1.0 | 20.20 | 1.3 | 0.00 | 20.22 | ||||||||

| incl. | 829.0 | 830.0 | 1.0 | 23.70 | 2.7 | 0.03 | 23.79 | ||||||||

Notes to Table

1) Intercepts are core lengths and do not represent true thickness of mineralized zones. True width/thickness will be determined once the geological modelling is completed.

2) Core lengths subject to rounding.

3) Coordinates are WGS 1984 UTM Zone 14N

4) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

5) The gold equivalent grade calculation used is as follows: AuEq = Au (gpt) + (Ag (gpt) * 0.0127) + (Cu (%) * 1.6104) and use the same metal prices (

6) All assay results are uncapped.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276437