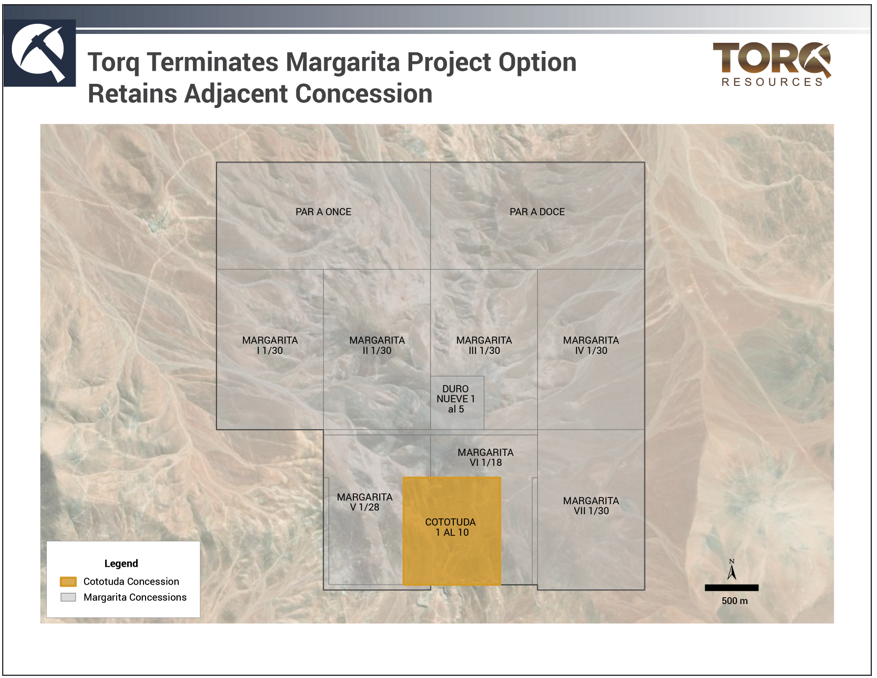

Torq Terminates Margarita Project Option, Retains Adjacent Concession

Rhea-AI Summary

Torq Resources (OTCQB:TRBMF) has announced the termination of its option to acquire interest in the Margarita Project in Chile. The decision comes as the company shifts focus to its Santa Cecilia copper/gold project, which has a US$48M Earn-in Option granted to Gold Fields.

The company will maintain 100% ownership of the 90-hectare La Cototuda concession adjacent to Margarita, which has minimal holding costs and no royalty burden. The termination will have no material impact on financial statements as capitalized costs were previously written off.

Additionally, Torq has completed its inaugural drill program at Santa Cecilia under the Gold Fields joint venture, with results pending from laboratory analysis.

Positive

- Retention of strategic 90-hectare La Cototuda concession with minimal holding costs

- US$48M Earn-in Option with Gold Fields for Santa Cecilia project remains active

- Completion of inaugural drill program at Santa Cecilia

- No material financial statement impact from Margarita termination

Negative

- Termination of Margarita Project option due to financial constraints

- Reduction in overall project portfolio

News Market Reaction

On the day this news was published, TRBMF gained 26.06%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, BC / ACCESS Newswire / July 31, 2025 / Torq Resources Inc. (TSXV:TORQ)(OTCQB:TRBMF) ("Torq" or the "Company") announces it has elected to terminate the option to earn its interest in the Margarita Project, Chile due to financial constraints and the Company's increasing focus on the US

The Company will continue to retain

Shawn Wallace, CEO and Chair states, "As we continue to focus our exploration efforts on new major discoveries at Santa Cecilia, eliminating the projects with large option payment requirements is in the best interest of our shareholders given our available resources."

As stated in the press release July 07, 2025, the Company has completed its inaugural drill program under the joint venture with Gold Fields at the Santa Cecilia project. All drill samples have been sent to the laboratory and the company looks forward to sharing results once they become available.

ON BEHALF OF THE BOARD,

Shawn Wallace

CEO & Chair

Investor Relations

KIN Communications Inc.

604-684-6730

torq@kincommunications.com

For further information on Torq Resources, please visit www.torqresources.com or contact the company at (778) 729-0500 or info@torqresources.com.

About Torq Resources

Torq is a Vancouver-based copper and gold exploration company with a portfolio of premium holdings in Chile. The Company is establishing itself as a leader of new exploration in prominent mining belts, guided by responsible, respectful and sustainable practices. The Company was built by a management team with prior success in monetizing exploration assets and its specialized technical team is recognized for their extensive experience working with major mining companies, supported by robust safety standards and technical proficiency. The technical team includes Chile-based geologists with invaluable local expertise and a noteworthy track record for major discovery in the country. Torq is committed to operating at the highest standards of applicable environmental, social and governance practices in the pursuit of a landmark discovery. For more information, visit www.torqresources.com.

Forward Looking Information

This release includes certain statements that may be deemed "forward-looking statements". Forward-looking information in this release includes statements that relate to the possibility that drilling will demonstrate the extension of favourable geological structures. These statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company to be materially different (either positively or negatively) from any future results, performance or achievements expressed or implied by some of the principal forward-looking statements. See Torq's Annual Information Form filed April 29, 2024, at www.sedarplus.ca for disclosure of the risks and uncertainties faced in this business.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Torq Resources Inc.

View the original press release on ACCESS Newswire