United States Antimony Announces Critical Mineral Acquisition Fostung Tungsten Property Ontario, Canada

Rhea-AI Summary

United States Antimony (NYSE American:UAMY) has acquired the Fostung Tungsten Properties in Ontario, Canada for $5 million in cash plus a 0.5% NSR royalty. The property spans 1,114 hectares near Sudbury and contains an inferred resource of 12.4 million tonnes grading 0.213% tungsten trioxide.

The acquisition is strategically significant as China currently controls 80-85% of global tungsten processing capacity. There has been no commercial tungsten concentrate production in the USA or Canada since 2016, while demand exceeds $1 billion annually in these markets. The property's location offers advantages including proximity to infrastructure, power access, and potential use of existing milling facilities.

Positive

- Strategic acquisition of tungsten resource in North America amid global supply constraints

- Inferred resource of 12.4 million tonnes at 0.213% tungsten trioxide grade

- Favorable location near existing infrastructure and mining facilities in Sudbury region

- Potential for early open pit mining operation

- Modern ore sorting processing methods show promise for upgrading the ore

Negative

- Considerable work required before production can begin

- Additional 1% NSR royalty held by previous owner adds to production costs

- Resource estimate needs updating to comply with SEC SK 1300 regulations

News Market Reaction

On the day this news was published, UAMY declined 9.13%, reflecting a notable negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

"The Critical Minerals and ZEO Company"

DALLAS, TX / ACCESS Newswire / June 27, 2025 / United States Antimony Corporation ("USAC," "US Antimony," the "Company"), (NYSE American:UAMY), announced today that it has completed an acquisition of

TUNGSTEN

Tungsten's unique properties, which include a high melting point, density, hardness, and conductivity, make it indispensable in many sectors which include:

Aerospace (kinetic energy penetrators)

Defense (shielding of tanks and counterweights)

Electronics (semiconductors, x-ray tubes)

Tooling & Manufacturing (high speed cutting tolls and drills)

Energy (Electrodes and arc welding)

Medical (Radiation shielding)

SUPPLY

China controls the vast majority of worldwide tungsten supply and controls 80

PROCESSING

Sudbury is the premier mining region of Canada so there is potential to use existing milling infrastructure. Recent work by the property vendors has shown that modern ore sorting processing methods, utilizing the fluorescent and other unique properties of the tungsten minerals, can upgrade the ore. We plan to continue this work and assess other techniques to determine the possibility of fine crushing on site, followed by concentration to yield an upgraded product that could be trucked to existing mills or tungsten plants in Canada or possibly in the USA. Conventional froth flotation milling at a plant in close proximity to the deposit will remain as the back-up option.

GEOLOGY & RESOURCES

The Fostung deposit occurs in the Espanola Formation, which is part of the Huronian succession (2.1 to 2.5 billion years old) meta-sediments of the north shore of Lake Huron geology and is similar to the geology at our Iron Mask Cobalt Property (See Press Release dated August 13, 2024) located about 65 kilometers (40 miles) northwest of Sudbury and acquired last year. Previous work on Iron Mask has concentrated on showings of high-grade cobalt, nickel, copper, and bismuth.. At Fostung a inferred resource of 12.4 million tonnes (13.7 million US tons) grading

Commenting on today's announcement, Mr. Joseph Bardswich, P. Eng., Executive Vice President and Chief Mining Engineer for USAC, stated, "Our first significant acquisition of a Tungsten deposit fits well within our company policy of only seeking mineral deposits that we believe can be quickly and inexpensively developed. The location of the Fostung property, close to both the Town of Espanola, the Sagamok First Nation, the Whitefish River First Nation and the Whitefish First Nation, provides opportunities for acquisition of supplies, equipment, contractors, and experienced personnel. Good road access and proximity to electrical power are added benefits. While we recognize that there is considerable work to be done before production can be considered, this proximity to significant infrastructure and the potential for an early open pit mining operation, makes Fostung our Company's first Tungsten choice."

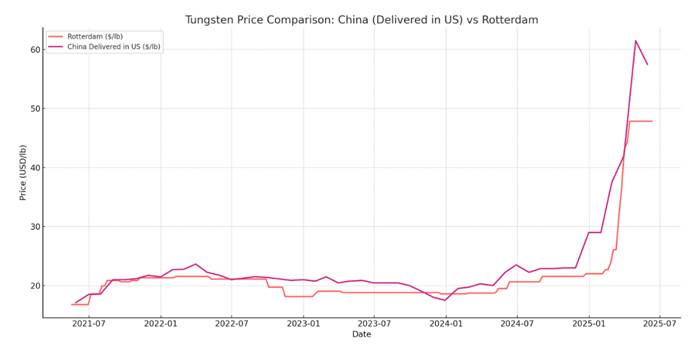

TUNGSTEN HISTORICAL PRICE COMPARISON

USAC has analyzed data from May 2021 through June 2025, highlighting consistent price elevation in Chinese tungsten material delivered to the U.S. due to logistics, tariffs, and export controls. Meanwhile, Rotterdam-based pricing-converted to $/lb for comparison-remains more stable but equally affected by European market dynamics. This price volatility underscores the strategic importance of secure, domestic sources of tungsten as well as other critical minerals. The analysis compares prices of Chinese tungsten bars delivered to the United States against ingot prices from the Rotterdam market over a four-year period from May 2021 to June 2025. The data reveals sustained pricing volatility, with Chinese tungsten consistently carrying a premium due to delivery costs, tariffs, and increased export restrictions under China's tightening critical mineral policies.

The Company's internal pricing review was supported by two key data sets, with prices standardized to USD/lb for comparability (May 2021 - June 2025) Argus Media

About USAC:

United States Antimony Corporation and its subsidiaries in the U.S., Mexico, and Canada ("USAC," "U.S. Antimony," the "Company," "Our," "Us," or "We") sell antimony, zeolite, and precious metals primarily in the U.S. and Canada. The Company processes third party ore primarily into antimony oxide, antimony metal, antimony trisulfide, and precious metals at its facilities located in Montana and Mexico. Antimony oxide is used to form a flame-retardant system for plastics, rubber, fiberglass, textile goods, paints, coatings, and paper, as a color fastener in paint, and as a phosphorescent agent in fluorescent light bulbs. Antimony metal is used in bearings, storage batteries, and ordnance. Antimony trisulfide is used as a primer in ammunition. The Company also recovers precious metals, primarily gold and silver, at its Montana facility from third party ore. At its Bear River Zeolite ("BRZ") facility located in Idaho, the Company mines and processes zeolite, a group of industrial minerals used in water filtration, sewage treatment, nuclear waste and other environmental cleanup, odor control, gas separation, animal nutrition, soil amendment and fertilizer, and other miscellaneous applications. The Company acquired mining claims and leases located in Alaska and Ontario, Canada and leased a metals concentration facility in Montana in 2024 that could expand its operations as well as its product offerings.

About Transition Metals Corp.

Transition Metals Corp. (XTM-TSX.V) is a Canadian-based, multi-commodity explorer. Its award-winning team of geoscientists has extensive exploration experience which actively develops and tests new ideas for discovering mineralization in places that others have not looked, often allowing the Company to acquire properties inexpensively. Joint venture partners earn an interest in the projects by funding a portion of higher-risk drilling and exploration, allowing Transition to conserve capital and minimize shareholder's equity dilution.

About 1930153 ON Ltd.

1930153 ON Ltd. is a private Sudbury-based company with interests in Northern Ontario properties, that is focused on advancing mineral projects in Ontario in part by applying modern extraction and processing technologies.

Forward-Looking Statements:

Readers should note that, in addition to the historical information contained herein, this press release may contain forward-looking statements within the meaning of, and intended to be covered by, the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based upon current expectations and beliefs concerning future developments and their potential effects on the Company including matters related to the Company's operations, pending contracts and future revenues, financial performance and profitability, ability to execute on its increased production and installation schedules for planned capital expenditures, and the size of forecasted deposits. Although the Company believes that the expectations reflected in the forward-looking statements and the assumptions upon which they are based are reasonable, it can give no assurance that such expectations and assumptions will prove to have been correct. The reader is cautioned not to put undue reliance on these forward-looking statements, as these statements are subject to numerous factors and uncertainties. In addition, other factors that could cause actual results to differ materially are discussed in the Company's most recent filings, including Form 10-K and Form 10-Q with the Securities and Exchange Commission.

Forward-looking statements are typically identified by words such as "believe," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "pro forma," and other similar words and expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in the forward-looking statements and future results could differ materially from historical performance.

CONTACT:

United States Antimony Corp.

4438 W. Lovers Lane, Unit 100

Dallas, TX 75209

Jonathan Miller, VP, Investor Relations

E-Mail: Jmiller@usantimony.com

Phone: 406-606-4117

SOURCE: United States Antimony Corp.

View the original press release on ACCESS Newswire