University Bancorp 2020 Net Income $28,002,817, $5.39 Per Share; #1 Publicly Traded Bank in U.S. With ROAE of 65.4%

Rhea-AI Summary

University Bancorp, Inc. (OTCQB:UNIB) reported audited net income of $28,002,817 for 2020, translating to $5.39 per share, a significant increase from $3,616,824 in 2019. Return on equity surged to 97.0% compared to 13.2% in the prior year. The company experienced a 23.2% growth in mortgages serviced. However, results faced challenges due to a net negative impact from unusual expenses totaling $5,445,421.

The company's shareholder equity rose to $51,594,523, or $10.83 per share. Amid the pandemic, it adapted by increasing retail mortgage channels while discontinuing wholesale operations.

Positive

- Net income increased to $28,002,817 in 2020 from $3,616,824 in 2019.

- Earnings per share rose to $5.39, a significant gain compared to $0.64 in 2019.

- Return on equity jumped to 97.0% from 13.2% year-over-year.

- Shareholders' equity increased to $51,594,523, or $10.83 per share.

- Mortgages serviced grew by 23.2% in 2020.

- Operational adaptations during the pandemic resulted in increased retail origination volume.

Negative

- Unusual expenses totaled $5,445,421, negatively impacting results.

- A boost in Allowance for Loan Losses by $3,590,210 was made in response to pandemic-related economic conditions.

- Operational losses of $1,507,885 in the wholesale division during 1Q2020.

News Market Reaction

On the day this news was published, UNIB declined 0.58%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

ANN ARBOR, MI / ACCESSWIRE / July 30, 2021 / University Bancorp, Inc. (OTCQB:UNIB) announced that it had audited net income of

For 2020, University Bancorp, Inc. (the Company) had a return on equity attributable to common stock shareholders of

President Stephen Lange Ranzini noted, "For the 16 years from 2004 to 2020 University Bank's annual revenue grew an average of

At Midwest Loan Services, the increase in internal originations and organic growth of our sub-servicing clients led the number of mortgages serviced to grow

Results in 2020 were restrained by several notable items, which had a net overall negative impact of

Unusual expenses:

1.With the sharp drop in long-term mortgage interest rates during 2020, the valuation of mortgage servicing rights (MSRs) decreased

2.The Allowance for Loan Losses was boosted by

3.Pre-tax losses in the amount of

4.An earn-out contingency related to the March 2019 Huron Valley Financial acquisition was booked in the amount of

Unusual gains:

5. The value of the hedged mortgage origination pipeline rose

Results in 2019 were restrained by several notable items, which had a net overall negative cumulative impact of

Unusual expenses:

1.With the sharp drop in long-term mortgage interest rates during 2019, the valuation of MSRs decreased

2.All potential indemnification requests related to a portfolio of mortgage loans sold in the early 2000s was settled for a payment of

Unusual gains:

3.The value of the hedged mortgage origination pipeline rose

4.A portfolio of mortgage servicing rights (MSRs) was purchased from a subservicing customer that liquidated, at a discount of approximately

Results in 2019 were also negatively impacted by pre-tax losses in the amount of

Results in 2020 were positively impacted by an increase in margins on mortgage originations sold to the secondary market, which was caused by the pandemic and the Federal Reserve's reaction to it. The following graph is the best index that we are aware of for the overall industry-wide margins on standard FNMA and FHLMC loans sold in the secondary market.

Margins began to rise in mid-February 2020 and rose to record levels, as the industry struggled with capacity constraints caused by the surge in applications caused by record low interest rates, and financial and operational dislocations caused by the global pandemic. Margins have since moderated to lower but still elevated levels.

In 2020, our residential mortgage origination groups originated

Year | ULG | UIF | ||||||

2014 | 8.5 | % | 25.0 | % | ||||

2015 | 15.4 | % | 25.1 | % | ||||

2016 | 14.5 | % | 19.9 | % | ||||

2017 | 9.6 | % | 27.0 | % | ||||

2018 | 4.1 | % | 16.5 | % | ||||

2019 | 5.0 | % | 36.5 | % | ||||

2020 | 38.8 | % | 32.4 | % | ||||

In early March 2020, because we were unable to slow down the incoming level of mortgage applications from our retail lending channels, we announced that we would exit the wholesale mortgage origination business via our subsidiary Midwest Loan Solutions (MLS) in order to devote increased resources to our retail channels. We made the tough decision to shift our back-office mortgage origination capacity to fully serve our higher margin retail customers and to discontinue serving our wholesale mortgage origination customers after a transition period. We discontinued accepting new loan registrations from the wholesale channel in mid-March 2020 and the wholesale back office team transitioned to supporting our retail originations. As the wholesale business unit was in start-up mode during 2019 and 2018, we lost

We achieved these record volumes in 2020 despite the rise of the coronavirus pandemic, which prompted us to quickly move

As a result of the pandemic, Michigan and the Ann Arbor Metropolitan Statistical Area saw a sharp drop in employment in 2020. Despite this, the performance of our portfolio loans and our overall asset quality continues to perform well, and we are experiencing low loan delinquencies. University Bank continues to use an outside vendor to perform stress testing analysis and these tests assume a severely adverse (depressionary) national economic scenario worse than the last depression we experienced, in which we assume

At 12/31/2020, we had the following with respect to delinquent loans (including both delinquent portfolio loans and delinquent loans held for sale):

Delinquent 30 Days to 59 Days,

Delinquent 60 Days to 89 Days,

Delinquent Over 90 Days & on Non-Accrual,

+In addition, we owned the MSRs on

The allowance for loan losses stood at

Excluding goodwill & other intangibles related to the acquisition of Midwest Loan Services and Ann Arbor Insurance Center, net tangible shareholders' equity attributable to University Bancorp, Inc. common stock shareholders was

Net income was

Results in 4Q2020 were restrained by the typical seasonal mortgage origination slowdown as well as several notable items, which had an overall negative impact of

Unusual expenses:

1.With the drop in long-term mortgage interest rates, the valuation of MSRs decreased by

2.An earn-out contingency related to the Huron Valley Financial acquisition was booked in the amount of

Unusual gains:

3.With the improved economic conditions, the allowance for loan losses was reduced by

4.The value of the hedged mortgage origination pipeline rose

Results in 4Q2019 were restrained by the typical seasonal mortgage origination slowdown as well as several notable items, which had an overall negative impact of

Unusual expenses:

1.The value of the hedged mortgage origination pipeline fell

Unusual gains:

2.With the rise in long-term mortgage interest rates, the valuation of MSRs increased by

Results in 4Q2019 were negatively impacted by pre-tax losses in the amount of

Total Assets at 12/31/2020 were

The Tier 1 Leverage Capital Ratio at 12/31/2020 rose to

Basel 3 Common Equity Tier 1 Capital at 12/31/2020 was

Cash & equity investment securities at the Company, available to meet working capital needs and investment opportunities at University Bank were

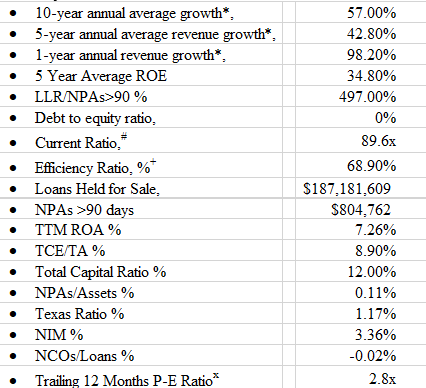

Other key statistics as of 12/31/2020:

*Using 2020, 2019, 2018, 2017, 2016, 2015 and 2010 revenue which were

#Parent company only current assets divided by 12-month projected cash expenses.

+Calculated as: (non-interest expense/(net interest income + non-interest income))

xBased on last sale of

Treasury shares as of 12/31/2020 were 441,381. During 2020, the Company paid a total of

The audited financial statements are available on the Company website at: https://www.university-bank.com/bancorp-financial-statements/.

Shareholders and investors are encouraged to refer to the financial information including the investor presentations, audited financial statements, strategic plan and prior press releases, available on our investor relations web page at: http://www.university-bank.com/bancorp/.

Ann Arbor-based University Bancorp owns

- University Lending Group, a retail residential mortgage originator based in Clinton Township, MI;

- Midwest Loan Services, a residential mortgage subservicer based in Houghton, MI;

- UIF, a faith-based banking firm based in Southfield, MI;

- Community Banking, based in Ann Arbor, MI, which provides traditional community banking services in the Ann Arbor area;

- Midwest Loan Solutions, a reverse residential mortgage lender and warehouse lender based in Southfield, MI;

- Ann Arbor Insurance Centre, an independent insurance agency based in Ann Arbor.

CAUTIONARY STATEMENT: This press release contains certain forward-looking statements that involve risks and uncertainties. Forward-looking statements include, but are not limited to, statements concerning future growth in assets, pre-tax income and net income, budgeted income levels, the sustainability of past results, mortgage origination levels and margins, valuations, and other expectations and/or goals. Such statements are subject to certain risks and uncertainties which could cause actual results to differ materially from those expressed or implied by such forward-looking statements, including, but not limited to, economic, competitive, governmental and technological factors affecting our operations, markets, products, services, interest rates and fees for services. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. We undertake no obligation to update any information or forward-looking statement.

Contact: Stephen Lange Ranzini, President and CEO

Phone: 734-741-5858, Ext. 9226

Email: ranzini@university-bank.com

SOURCE: University Bancorp, Inc.

View source version on accesswire.com:

https://www.accesswire.com/657736/University-Bancorp-2020-Net-Income-28002817-539-Per-Share-1-Publicly-Traded-Bank-in-US-With-ROAE-of-654