University Bancorp 3Q2025 Net Income $4,371,716 $0.85 Per Share

Rhea-AI Summary

University Bancorp (OTCQB:UNIB) reported unaudited 3Q2025 net income of $4,371,716 or $0.85 per share on 5,169,518 average shares. For the 9 months ended Sept 30, 2025 net income was $5,535,896 ($1.19 per share) versus $7,913,973 ($1.53) for the prior-year period. Twelve months ended Sept 30, 2025 net income was $8,640,829 ($1.67 per share).

Shareholders' equity was $98.32 million ($19.02 per share) at Sept 30, 2025. Total consolidated assets were $1.1586 billion; management plans ~$84 million of loan sales to keep assets below $1 billion at year-end. Cash and available securities were $26.0 million and a $12.5 million credit line was approved.

Positive

- 3Q2025 net income of $4,371,716 ($0.85 per share)

- Shareholders' equity $98.32 million ($19.02 per share) at 9/30/2025

- TTM revenue $135.07 million

- Approved credit line of $12.5 million

- Faith-based deposits surpassed $145 million

- Licensed mortgage lending in all 50 states

Negative

- 9-month net income fell to $5.54M from $7.91M prior year (~30% decline)

- Total assets $1.1586B, above $1B regulatory threshold

- Planned loan sales ~$84M to avoid >$1B regulatory costs

- Efficiency ratio high at 86.2%

News Market Reaction

On the day this news was published, UNIB declined 1.90%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

ANN ARBOR, MI / ACCESS Newswire / October 31, 2025 / University Bancorp, Inc. (OTCQB:UNIB) announced that it had an unaudited net income attributable to University Bancorp, Inc. ("UNIB") common stock shareholders in 3Q2024 of

For the 9 months ended September 30, 2025, net income was

For the 12 months ended September 30, 2025, net income was

Shareholders' equity attributable to University Bancorp, Inc. common stock shareholders was

President Stephen Lange Ranzini noted, "In late 2024, University Bank's shareholders' equity passed

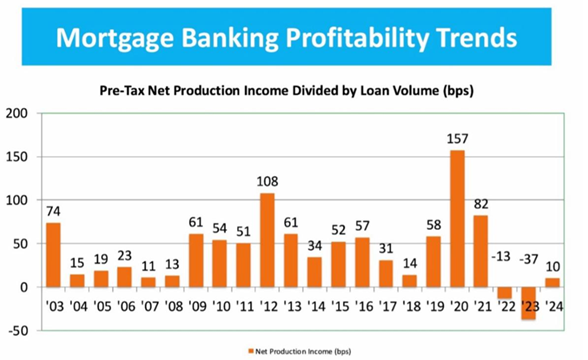

Return on Equity (ROE) at University Bancorp continues at acceptable levels, despite mortgage originations nationwide continuing to be at 30-year lows with respect to units originated, with the annualized ROE for the TTM ended September 30, 2025 being

Overall, our business development efforts continue at a rapid pace. For example, faith-based deposits have grown past

Earnings in 4Q2025 will be positively impacted by a sale of about

At 9/30/2025 cash & equity investment securities at UNIB, available to meet working capital needs and to support investment opportunities at UNIB were

A portion of UNIB's working capital,

Currency Exchange International (Symbol CURN), a Canadian bank holding company that specializes in foreign exchange, of which we own

12.41% , 762,339 shares of common stock at an average price per share of$13.38 . The firm is trading at about 6x EBIT adjusted for the now completed exit from their unprofitable Canadian business, however in our opinion it is worth 10x EBIT or$30 per share, and it is a growing business.Pulsar Helium (Symbol PSRHF), of which we own

4.999% of the common stock, 7,505,265 shares at an average price per share of$0.45 . Pulsar Helium probably has between$42 million to$210 million of Helium-3, an unique resource that is very useful for producing electricity from fusion reactors. While Helium-3 is available on the Moon, Pulsar has the only commercially viable deposit of Helium-3 known on Earth. The estimated range for Helium-4 in its reservoir is in our opinion probably$1 billion to$5 billion . The range for CO2 in its reservoir is probably$0.5 billion to$2.5 billion . All production costs and the cost of separating the gas produced from Pulsar's reservoir is expected to be offset by the sale of the CO2 to the food processing industry, or to a new use, cooling for AI Data Centers, a superior alternative to using large amounts of water, which is meeting with political resistance. There is a20% mineral rights royalty payable on all production . Between shares outstanding and options / warrants that are in the money that are expected to be exercised shortly, the company has about 165 million shares outstanding. At the current share price of US$0.58 1 the market capitalization of the company, which currently has no debt and sufficient cash on hand to get to production in under two years with a project finance loan, is$96 million . The value of the company is probably between$600 million and$3 billion , or$3.64 t o$18.18 per share. Of note, at 9/30/2025 our Pulsar Helium shares were marked to market at$0.32 per share, and they closed today at$0.58 1 per share.

Other Key statistics as of 9/30/2025:

TTM Revenue | $ | 135,074,269 | ||

10 Year Average ROE | 26.6 | % | ||

5 Year Average ROE | 15.1 | % | ||

Current Ratio, # | 397.4 | x | ||

Efficiency Ratio, %+ | 86.2 | % | ||

Total Consolidated Assets | $ | 1,158,646,487 | ||

TTM ROA% | 0.86 | % | ||

TCE/TA % | 9.07 | % | ||

NPAs/Assets % | 0.57 | % | ||

Texas Ratio % | 8.36 | % | ||

NIM % | 4.22 | % | ||

NCOs/Loans | 0.001 | % | ||

Trailing 12 Months P-E Ratiox | 10.1 | x | ||

Price to Book Value Ratiox | 89 | % |

Treasury Shares | 37,381 shares |

#Parent company only current assets divided by 12-month projected cash expenses.

+Calculated as: (non-interest expense/ (net interest income + non-interest income)).

xBased on last sale of

Excluding goodwill & other intangibles related to the acquisition of Midwest Loan Services and Ann Arbor Insurance Center, net tangible shareholders' equity attributable to University Bancorp, Inc. common stock shareholders was

Shareholders and investors are encouraged to refer to the financial information including the investor presentations, audited financial statements, strategic plan and prior press releases, available on our investor relations web page at: http://www.university-bank.com/bancorp/.

A detailed income statement, balance sheet and other financial information for UNIB and University Bank as of 9/30/2025 is available here: https://www.university-bank.com/wp-content/uploads/2025/10/UNIB-UBank-3Q2025-Detailed-Financials.pdf.

University Bank's FDIC Call Report, with substantial additional information including loan origination and loan investment composition and delinquency ratios and Tier 1 Capital ratios for 9/30/2025 is available here: https://cdr.ffiec.gov/public/ManageFacsimiles.aspx

About UNIB

When UNIB announced its 2024 financial results, we noted the following key accomplishments:

Revenue in 2024 grew

18.65% . Our 10-year average revenue growth was18.70% ;Return on Equity (ROE) for 2024 was

12.5% . Our 10-year average ROE was25.97% ;Shareholders' equity at University Bank exceeded

$100 million for the first time ever.Shareholders' equity at UNIB at 12/31/2024 was

$93,590,773 (excluding minority interest of$11,961,541) , or$18.10 per share, based on common shares outstanding at December 31, 2024 of 5,169,518.

Shareholders and investors are encouraged to refer to the financial information including the investor presentations, audited financial statements, strategic plan and prior press releases, available on our investor relations web page at: http://www.university-bank.com/bancorp/.

Ann Arbor-based University Bancorp is a Federal Reserve regulated financial holding company that owns:

100% of University Bank, a bank based in Ann Arbor, Michigan;100% of Crescent Assurance, PCC, a captive insurance company licensed in Washington DC; and100% of Hyrex Servicing, a master mortgage servicing firm, based in Ann Arbor, Michigan.

University Bank together with its Michigan-based subsidiaries, holds and manages a total of over

UIF, a faith-based banking firm based in Southfield, MI;

University Lending Group, a retail residential mortgage originator based in Clinton Township, MI;

Midwest Loan Services, a residential mortgage subservicer based in Houghton, MI;

Community Banking, based in Ann Arbor, MI, which provides traditional community banking services in the Ann Arbor area;

Ann Arbor Insurance Centre, an independent insurance agency based in Ann Arbor, MI.

Reverse Mortgage Lending, a reverse residential mortgage lender based in Southfield, MI; and

Mortgage Warehouse Lending, a mortgage warehouse lender based in Southfield, MI.

CAUTIONARY STATEMENT: This press release contains certain forward-looking statements that involve risks and uncertainties. Forward-looking statements include, but are not limited to, statements concerning future growth in assets, pre-tax income and net income, budgeted income levels, the sustainability of past results, mortgage origination levels and margins, valuations, and other expectations and/or goals. Such statements are subject to certain risks and uncertainties which could cause actual results to differ materially from those expressed or implied by such forward-looking statements, including, but not limited to, economic, competitive, governmental and technological factors affecting our operations, markets, products, services, interest rates and fees for services. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. We undertake no obligation to update any information or forward-looking statement.

Contact:

Stephen Lange Ranzini, President and CEO

Phone: 734-741-5858, Ext. 9226

Email: ranzini@university-bank.com

SOURCE: University Bancorp, Inc.

View the original press release on ACCESS Newswire