Americas Gold and Silver Provides Update on Rapid Progress at Newly Acquired Crescent Silver Mine in Idaho

Rhea-AI Summary

Americas Gold and Silver (NYSE American: USAS) reported rapid post‑closing progress at the newly acquired Crescent Silver Mine in Idaho, following the December 3, 2025 closing. The company installed grid electrical power to the Hooper tunnel and all three adits (Hooper, BC4, Countess), cutting estimated power costs from about $0.55/kWh to ~$0.07/kWh. Site work also included a 6‑inch air line to BC4, new communications between adits, operationalizing underground equipment, and adding five new pieces to expand the underground fleet to 11 units. Office and staff facilities are being remodeled. Americas is targeting a mid‑2026 restart of silver, copper and antimony production and expects synergies with its neighbouring Galena Complex.

Positive

- Power cost reduction from ~$0.55/kWh to ~$0.07/kWh via grid connection

- Targeted mid-2026 restart of silver, copper and antimony production

- Expanded underground fleet to 11 pieces including two 20‑ton trucks

- Installed 6‑inch air line to BC4 to eliminate diesel compressors

- Deployed communications linking Hooper, BC4, and Countess adits

Negative

- None.

News Market Reaction – USAS

On the day this news was published, USAS declined 4.62%, reflecting a moderate negative market reaction. Argus tracked a peak move of +9.6% during that session. Our momentum scanner triggered 16 alerts that day, indicating notable trading interest and price volatility. This price movement removed approximately $77M from the company's valuation, bringing the market cap to $1.59B at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

USAS gained 6.03% while momentum peers were mixed: UAMY up 5.23%, but CRML and SGML down 4.44% and 4.09%. Mixed peer action points to a stock-specific response to the Crescent progress update rather than a uniform sector rotation.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 12 | Crescent acquisition | Positive | +0.0% | Closed Crescent Silver Mine purchase and secured funding for capital programs. |

| Dec 09 | Shareholder stake change | Negative | +7.1% | Eric Sprott sold 5,000,000 shares, modestly reducing his ownership stake. |

| Nov 10 | Q3 2025 results | Positive | +9.8% | Reported strong Q3 growth in silver output and revenue with positive EBITDA. |

| Oct 20 | Production update | Positive | +3.1% | Announced 98% YoY silver production increase and higher lead production. |

| Oct 16 | Antimony results | Positive | +1.7% | Highlighted strong antimony and copper production and 99%+ antimony extraction. |

Recent operational and production updates have generally seen positive price alignment, while acquisition and large shareholder activity showed weaker or contrary reactions.

Over the last few months, Americas Gold and Silver reported several operational milestones, including strong Q3 2025 production growth and antimony and copper output at Galena, with multiple updates showing positive price reactions of up to 9.77%. The Crescent Silver Mine acquisition on Dec 12, 2025 had a flat (0%) reaction initially. This new Crescent progress update follows that acquisition, emphasizing infrastructure upgrades and fleet expansion as the company continues scaling production in Idaho’s Silver Valley.

Market Pulse Summary

This announcement details rapid post-acquisition progress at the Crescent Silver Mine, including major power cost reductions from $0.55/kWh to $0.07/kWh, new underground equipment bringing the fleet to 11 units, and connectivity upgrades across three adits. In the context of earlier Q3 2025 production gains and the December acquisition, investors may watch for on-schedule mid-2026 restart milestones and how Crescent complements the nearby Galena Complex.

Key Terms

adit technical

antimony technical

AI-generated analysis. Not financial advice.

Toronto, Ontario--(Newsfile Corp. - January 8, 2026) - Americas Gold and Silver Corporation (TSX: USA) (NYSE American: USAS) ("Americas" or the "Company") is pleased to announce significant advancements toward production at the recently acquired high grade Crescent Silver Mine in Idaho's Silver Valley, just weeks after closing the transaction on December 3, 2025. Americas has progressed rapidly with infrastructure upgrades, equipment repairs and additions as well as site upgrades to position the mine for a mid-2026 restart of silver, copper and antimony production, leveraging synergies with the Company's neighbouring Galena Complex. These upgrades help bring Crescent, a highly prolific and high-grade past producing silver mine, up to modern standards as part of the Company's efforts to scale production in the Silver Valley.

Key Highlights:

Material reduction in power costs through the installation of low-cost grid electrical power to the Hooper tunnel, connecting grid power to all three adits (Hooper, BC4, and Countess) replacing reliance on higher cost diesel generators. Initial power reduction estimations are from ~

$0.55 /kWh all the way down to ~$0.07 /kWh.Installed a 6-inch air line down the mountain to service the BC4 Adit to provide compressed air for drilling, eliminating the use of higher cost and emission-heavy diesel compressors at BC4.

Deployed communication lines connecting Hooper, BC4, and Countess for significantly improved safety and productivity in coordination of rehabilitation plan.

Operationalized all existing underground equipment included in the acquisition, adding two new 20-ton trucks, two 2-yard loaders, one 4-yard loader, bringing total expanded and upgraded underground mining fleet to 11 pieces.

Established designated laydown areas for ground support, pipe, and other materials to streamline workflows.

Initiated upgrades of the site complex, including remodeling of the main office building and staff facility buildings.

Figure 1: Connecting grid power to the hooper adit - ripping a cable trench using a D-6 CAT Cable Trencher

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5082/279803_52addefa74fe0b9a_002full.jpg

Paul Andre Huet, Chairman and CEO, commented: "In less than a month since closing the Crescent acquisition, our team has achieved remarkable progress towards restarting production - from running grid power electrical lines down the mountain to power all three adits and eliminating higher-cost generators, to adding new equipment and organizing the site for efficient operations. This rapid execution is an excellent start to our plan to establish best-in-class operations at Crescent. We're poised to unlock multiple synergies with our neighbouring Galena Complex from procurement savings and equipment sharing to G&A efficiencies and spare processing capacity.

Utilization of grid electrical power through the power line installation is a great example of the progress we are making at Crescent as it is expected to reduce power costs compared to the prior diesel generators from approximately 55 cents per kWh, down to as little as 7 cents per kWh. We've also moved very quickly to expand and upgrade the mining fleet at Crescent with the addition of two new trucks and three new loaders. This equipment will be put to immediate use in completing development work ahead of a targeted mid-2026 restart.

We're very pleased that the revitalization of the high-grade Crescent Silver Mine is well under way and we are proud to continue to contribute to the Silver Valley's economy through job creation and investment in increased domestic silver, copper and antimony production."

Figure 2: One of the new 20-ton haul trucks being deployed at the Crescent Silver Mine

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5082/279803_52addefa74fe0b9a_003full.jpg

About the Crescent Silver Mine

Crescent Silver Mine is a past-producing underground mine which has produced over 25 million ounces of silver at an average grade of 26 opt (891 g/t) between 1917 and 1981. The mine is located approximately 4 miles southeast of Kellogg, Idaho, and consists of 10 acres of surface rights and 15 acres of patented claims and mineral rights over 64 patented claims. The mineralized material at Crescent is tetrahedrite, which is identical to the Galena Ag-Cu-Sb material and ideally suited for Galena and Coeur Mills. The property hosts 3.8 million ounces of historical Measured and Indicated Resource, as well as an historical Inferred Resource of 19.1 million ounces. The Company intends to mine Crescent using a combination of cut and fill and long hole stoping mining, similar to the successful optimization of neighbouring Galena currently underway.

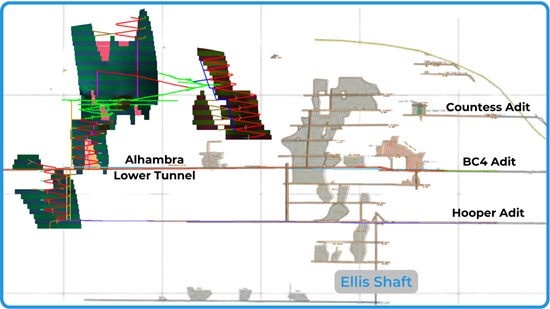

Figure 3: Long section view of Crescent Silver Mine with key adits, shaft and tunnels

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5082/279803_52addefa74fe0b9a_004full.jpg

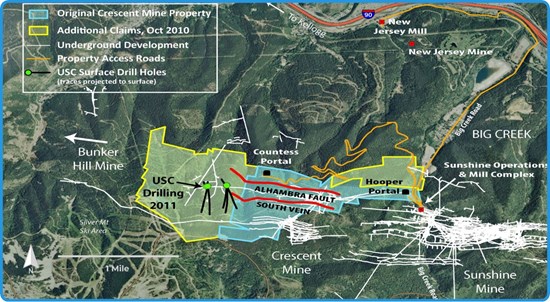

Figure 4: Overview of the Crescent Silver Mine, including infrastructure and vein locations

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5082/279803_52addefa74fe0b9a_005full.jpg

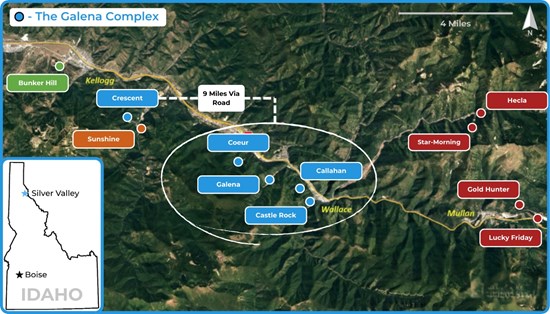

Figure 5: Location of the Crescent Silver Mine in relation to the Galena Complex and other selected properties in Idaho's Silver Valley

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5082/279803_52addefa74fe0b9a_006full.jpg

About Americas Gold and Silver Corporation

Americas Gold & Silver is a rapidly growing North American mining company producing silver, copper, and antimony from high-grade operations in the U.S. & Mexico. In Dec. 2024, Americas acquired

For more information:

Maxim Kouxenko

Manager, Investor Relations

Americas Gold and Silver Corporation

+1 (647) 888-6458

Cautionary Statement on Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable securities laws. Forward-looking information includes, but is not limited to, Americas' expectations, intentions, plans, assumptions and beliefs with respect to, among other things, estimated and targeted production rates and results for silver, copper and antimony, the expected prices of silver, copper and antimony, as well as the related costs, expenses and capital expenditures; the Company's execution of and expected benefits from its growth strategy and plans, including the expected timing and completion of required development and the expected operational and production results therefrom at the Crescent Silver Mine, including the anticipated improvements to production and lowering of costs; statements relating to the expected restart of the Crescent Silver Mine and the anticipated synergies with the Galena Complex; statements relating to the expected power cost reductions at the Crescent Silver Mine; and statements relating to results from recent infrastructure upgrades at the Crescent Silver Mine. Guidance and outlook references contained in this press release were prepared based on current mine plan assumptions with respect to production, development, costs and capital expenditures, the metal price assumptions disclosed herein, and assumes no further adverse impacts to the Crescent Silver Mine from power or equipment issues, and completion of the infrastructure upgrades at the Crescent Silver Mine on its expected schedule and budget, the realization of the anticipated benefits therefrom, and is subject to the risks and uncertainties outlined below. The ability to achieve production targets at the Crescent Silver Mine through implementing the development plan, including the completion of the power, air, communication and equipment upgrades on its expected schedule and budget, allowing the Company to generate sufficient operating cash flows while facing market fluctuations in commodity prices and inflationary pressures, are significant judgments in the consolidated financial statements with respect to the Company's liquidity. Should the Company experience negative operating cash flows in future periods, the Company may need to raise additional funds through the issuance of equity or debt securities. Often, but not always, forward-looking information can be identified by forward-looking words such as "anticipate", "believe", "expect", "goal", "plan", "intend", "potential', "estimate", "may", "assume" and "will" or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions, or statements about future events or performance. Forward-looking information is based on the opinions and estimates of Americas as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of Americas to be materially different from those expressed or implied by such forward-looking information. With respect to the business of Americas, these risks and uncertainties include risks relating to widespread epidemics or pandemic outbreak, actions that have been and may be taken by governmental authorities to contain such epidemic or pandemic or to treat its impact and/or the availability, effectiveness and use of treatments and vaccines (including the effectiveness of boosters); interpretations or reinterpretations of geologic information; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; potential litigation; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms or at all; the ability to operate the Company's projects; and risks associated with the mining industry such as economic factors (including future commodity prices, currency fluctuations and energy prices), ground conditions, power supply disruptions and other factors limiting mine access or regular operations without interruption, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities, labor relations or disruptions, social and political developments, risks associated with generally elevated inflation and inflationary pressures, risks related to changing global economic conditions, and market volatility, risks relating to geopolitical instability, political unrest, war, and other global conflicts may result in adverse effects on macroeconomic conditions including volatility in financial markets, adverse changes in trade policies, inflation, supply chain disruptions and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Americas' filings with the Canadian Securities Administrators on SEDAR+ and with the SEC. Americas does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law. Americas does not give any assurance (1) that Americas will achieve its expectations, or (2) concerning the result or timing thereof. All subsequent written and oral forward‐looking information concerning Americas are expressly qualified in their entirety by the cautionary statements above.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/279803