VERB Beats All Analysts Q1 2025 Financial Performance Estimates

- Revenue grew 80% QoQ to $1.305M and 18,543% YoY

- Strategic acquisition of Lyvecom AI platform for $8.5M

- Secured $5M in non-dilutive, non-convertible preferred stock funding

- Zero debt position with strong cash reserves of $12.236M

- Net loss reduced by 29% YoY

- Operating loss improved by 17% YoY

- Cash position expected to fund operations through 2028

- Still operating at a net loss of $2.438M in Q1 2025

- General and Administrative expenses increased 12% YoY

- Modified EBITDA remains negative at -$1.038M

Insights

VERB's Q1 results show impressive 80% QoQ revenue growth with strong trajectory and improved financial position, though still operating at a loss.

VERB has delivered a remarkable financial turnaround in Q1 2025, with revenue reaching

The growth drivers are clearly identified in the segmental breakdown: MARKET.live contributed

On profitability, VERB is making progress but still operating at a loss. Net loss improved by

The balance sheet has been substantially strengthened. VERB eliminated all debt and secured

The

What's particularly encouraging is that VERB's improvement stems from genuine revenue growth rather than just cost-cutting - general and administrative expenses actually increased by

Management Delivers Impressive

Beats All Revenue and EPS Estimates By A Wide Margin

Q1 2025 Revenue Exceeds Entire 2024 Annual Revenue

Closed

Zero Debt - Strong Cash Position – Expected To Fund Operations Into 2028 And Beyond

Increased Growth Projected For Q2 2025

LAS VEGAS, May 13, 2025 (GLOBE NEWSWIRE) -- Verb Technology Company, Inc. (Nasdaq: VERB) ("VERB" or the "Company"), Transforming the Landscape of Social Commerce, Social Telehealth and Social Crowdfunding with MARKET.live; VANITYPrescribed; GoodGirlRx; and the GO FUND YOURSELF TV Show, today filed its Form 10-Q reporting financial and operating results for the quarter ending March 31, 2025.

Q1 Highlights

For the Quarter Ended March 31, 2025

- Total Q1 revenue -

$1.30 5 million, an increase of$582 thousand , or80% over Q4 2024; and an increase of$1.29 8 million, or 18,543% , over the prior year comparable quarter. Represents the greatest amount of revenue generated since the strategic sale of the Company’s direct sales SaaS business unit in June 2023 - Q1 2025 Revenue Exceeds Entire 2024 Annual Revenue

- Net loss reduced by

$1.0 million , represents an improvement of29% over the prior year comparable quarter - Operating loss reduced by

$558 thousand , represents an improvement of17% over the prior year comparable quarter - General and Administrative expenses slight increase of

$0.4 million , represents an increase of12% over prior year; indicates that the Company’s current enhanced financial performance is attributable to increases in revenue – not excessive cost cutting measures - ZERO DEBT - All Remaining Debt retired in Q1

- Closed Acquisition of AI Social Commerce Technology Platform Lyvecom in deal valued at

$8.5 Million - Opportunistically Added

$5 Million in Cash to the Company’s balance sheet through non-dilutive, non-convertible, non-voting, preferred stock deal – replenished all the cash used in Lyvecom acquisition and more - Strong Cash Position – expected to fund operations into 2028 and beyond

Results of Operations

Three Months Ended March 31, 2025 Compared to Three Months Ended March 31, 2024

The following is a comparison of the results of our operations for the three months ended March 31, 2025 and 2024 (in thousands):

| Three Months Ended March 31, | ||||||||||||

| 2025 | 2024 | Change | ||||||||||

| Revenue | $ | 1,305 | $ | 7 | $ | 1,298 | ||||||

| Costs and expenses | ||||||||||||

| Cost of revenue, exclusive of depreciation and amortization shown separately below | 347 | 5 | 342 | |||||||||

| Depreciation and amortization | 286 | 256 | 30 | |||||||||

| General and administrative | 3,331 | 2,963 | 368 | |||||||||

| Total costs and expenses | 3,964 | 3,224 | 740 | |||||||||

| Operating loss from continuing operations | (2,659 | ) | (3,217 | ) | 558 | |||||||

| Other income (expense) | ||||||||||||

| Interest income | 121 | - | 121 | |||||||||

| Unrealized gain on short-term investments | 83 | - | 83 | |||||||||

| Interest expense | (1 | ) | (225 | ) | 224 | |||||||

| Other income (expense), net | 18 | (3 | ) | 21 | ||||||||

| Total other income (expense), net | 221 | (228 | ) | 449 | ||||||||

| Net loss | $ | (2,438 | ) | $ | (3,445 | ) | $ | 1,007 | ||||

Revenue

Revenue was

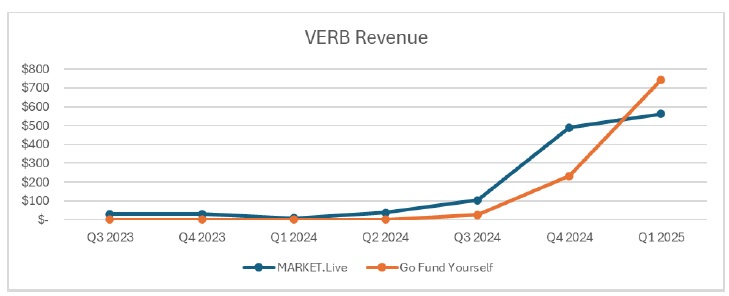

The table below sets forth our quarterly revenues beginning with the quarter ended September 30, 2023 (the first quarter following the sale of our SaaS business unit) through the quarter ended March 31, 2025, which reflects the trend of revenue over the past seven fiscal quarters:

| Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | ||

| MARKET.live | $ | 29 | 29 | 7 | 37 | 103 | 490 | 561 |

| GO FUND YOURSELF | $ | - | - | - | - | 25 | 233 | 744 |

| CONSOLIDATED | $ | 29 | 29 | 7 | 37 | 128 | 723 | 1,305 |

Operating Expenses

Depreciation and amortization expenses were

General and administrative expenses including stock compensation expense were

Other Income (Expense), net

Other income, net, for the three months ended March 31, 2025 was

Three Months Ended March 31, 2025 Compared to Three Months Ended December 31, 2024

The following is a comparison of the results of our operations for the three months ended March 31, 2025 and December 31, 2024 (in thousands):

| March 31, 2025 | December 31, 2024 | Change | |||||||||||||

| Revenue | $ | 1,305 | $ | 723 | $ | 582 | |||||||||

| Costs and expenses | |||||||||||||||

| Cost of revenue, exclusive of depreciation and amortization shown separately below | 347 | 134 | 213 | ||||||||||||

| Depreciation and amortization | 286 | 279 | 7 | ||||||||||||

| General and administrative | 3,331 | 4,020 | (689 | ) | |||||||||||

| Total costs and expenses | 3,964 | 4,433 | (469 | ) | |||||||||||

| Operating loss from continuing operations | (2,659 | ) | (3,710 | ) | 1,051 | ||||||||||

| Other income (expense) | |||||||||||||||

| Interest income | 121 | 331 | (210 | ) | |||||||||||

| Unrealized gain (loss) on short-term investments | 83 | (153 | ) | 236 | |||||||||||

| Interest expense | (1 | ) | (1 | ) | - | ||||||||||

| Other income (expense), net | 18 | 164 | (146 | ) | |||||||||||

| Total other income (expense), net | 221 | 341 | (120 | ) | |||||||||||

| Net loss | $ | (2,438 | ) | $ | (3,369 | ) | $ | 931 | |||||||

Revenue

Revenue was

Operating Expenses

Depreciation and amortization expenses were

General and administrative expenses including stock compensation expense were

Use of Non-GAAP Measures – Modified EBITDA

In addition to our results under generally accepted accounting principles (“GAAP”), we present Modified EBITDA as a supplemental measure of our performance. However, Modified EBITDA is not a recognized measurement under GAAP and should not be considered as an alternative to net income, income from operations or any other performance measure derived in accordance with GAAP or as an alternative to cash flow from operating activities as a measure of liquidity. We define Modified EBITDA as net income (loss), plus depreciation and amortization, share-based compensation, unrealized (gain) loss on short-term investments, interest expense, financing costs, and other (income) expense, and other non-recurring charges.

Management considers our core operating performance to be that which our managers can affect in any particular period through their management of the resources that affect our underlying revenue and profit generating operations that period. Non-GAAP adjustments to our results prepared in accordance with GAAP are itemized below. You are encouraged to evaluate these adjustments and the reasons we consider them appropriate for supplemental analysis. In evaluating Modified EBITDA, you should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments in this presentation. Our presentation of Modified EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

| Three Months Ended March 31, | |||||||

| (in thousands) | 2025 | 2024 | |||||

| Net loss | $ | (2,438 | ) | $ | (3,445 | ) | |

| Adjustments | |||||||

| Depreciation and amortization | 286 | 256 | |||||

| Share-based compensation | 958 | 378 | |||||

| Unrealized gain on short-term investments | (83 | ) | - | ||||

| Interest expense | 1 | 225 | |||||

| Other (income) expense, net | (18 | ) | 3 | ||||

| Other costs (a) | 256 | 84 | |||||

| Total EBITDA adjustments | 1,400 | 946 | |||||

| Modified EBITDA | $ | (1,038 | ) | $ | (2,499 | ) | |

(a) Represents a litigation accrual in 2024. Represents severance costs in addition to acquisition costs incurred for Lyvecom acquisition in 2025.

We present Modified EBITDA because we believe it assists investors and analysts in comparing our performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. In addition, we use Modified EBITDA in developing our internal budgets, forecasts and strategic plan; in analyzing the effectiveness of our business strategies in evaluating potential acquisitions; and in making compensation decisions and in communications with our board of directors concerning our financial performance. Modified EBITDA has limitations as an analytical tool, which includes, among others, the following:

- Modified EBITDA does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments;

- Modified EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

- Modified EBITDA does not reflect future interest expense, or the cash requirements necessary to service interest or principal payments, on our debts; and

- Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Modified EBITDA does not reflect any cash requirements for such replacements.

Liquidity and Capital Resources

Overview

As of March 31, 2025 and 2024, we had the following balances of cash, restricted cash, and highly liquid investments.

| March 31, 2025 | December 31, 2024 | |||||||

| Cash | $ | 6,275 | $ | 7,617 | ||||

| Restricted Cash | 880 | 878 | ||||||

| Investments: Government-Backed Securities | 3,884 | 3,731 | ||||||

| Investments: Corporate Bonds | 1,197 | 1,182 | ||||||

| Total | $ | 12,236 | $ | 13,408 | ||||

Conference Call Information

VERB CEO, Rory J. Cutaia will hold a conference call today, May 13, 2025, at 1:00 p.m. Eastern time to discuss the first quarter 2025 results and strategic plans for the remainder of 2025 and beyond. A telephonic replay of the conference call is available from 4:00 p.m. Eastern time today through May 27, 2025.

VERB Q1 2025 Earnings Call

Date: Tuesday, May 13, 2025

Time: 1:00 p.m. Eastern time (10:00 a.m. Pacific time)

To access by phone: Please call the conference telephone number 10-15 minutes prior to the start time. An operator will register your name and organization.

Meeting Link: CLICK HERE

Toll Free: 1-877-407-4018

Toll/International: 1-201-689-8471

Telephonic Replay: Available after 5:00 p.m. Eastern time on the same day through May 27, 2025 at 11:59 PM ET

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13753877

About VERB

Verb Technology Company, Inc. (Nasdaq: VERB), is Transforming the Landscape of Social Commerce, Social Telehealth and Social Crowdfunding with MARKET.live; VANITYPrescribed; GoodGirlRx; and the GO FUND YOURSELF TV Show. The Company operates several business units, each of which leverages its social commerce technology and video marketing expertise. MARKET.live, together with recently acquired AI social commerce technology innovator Lyvecom, is a multi-vendor, livestream social shopping platform that allows brands and merchants to deliver a true omnichannel livestream shopping experience across their own websites, apps, and social platforms. Advanced AI capabilities power real-time user-generated-content creation, automated video content repurposing, and AI-powered virtual live shopping hosts that are virtually indistinguishable from human hosts, capable of real-time audience engagement. Brands utilize our proprietary AI model trained on tens of thousands of video commerce interactions to automate content creation and our intelligent tools designed to optimize merchandising strategies and increase conversion rates. GO FUND YOURSELF is a revolutionary interactive social crowd funding platform and TV show for public and private companies seeking broad-based exposure across social media channels for their crowd-funded Regulation CF and Regulation A offerings. The platform combines a ground-breaking interactive TV show with MARKET.live’s back-end capabilities allowing viewers to tap, scan or click on their screen to facilitate an investment, in real time, as they watch companies presenting before the show’s panel of “Titans”. Presenting companies that sell consumer products are able to offer their products directly to viewers during the show in real time through shoppable onscreen icons. VANITYPrescribed.com and GoodGirlRx.com are telehealth portals, intended to redefine telehealth by offering a seamless, digital-first experience that empowers individuals to take control of their healthcare needs. They were designed and developed to disrupt the traditional healthcare model by providing tailored healthcare solutions at affordable, fixed prices – without hidden fees, membership costs, or inflated pharmaceutical markups. GoodGirlRx.com, a partnership with Savannah Chrisley, a well-known lifestyle personality and advocate for health and wellness, offers customers access to convenient, no-hassle telehealth services and pharmaceuticals, including the new weight-loss drugs, with fixed pricing regardless of dosage, breaking away from the industry’s traditional model of excessive pricing and pharmaceutical gatekeeping.

The Company is headquartered in Las Vegas, NV and operates full-service production and creator studios in Los Alamitos, California.

For more information, please visit: www.verb.tech

Follow VERB and MARKET.live here:

VERB on Facebook: https://www.facebook.com/VerbTechCo

VERB on Twitter: https://twitter.com/VerbTech_Co

VERB on LinkedIn: https://www.linkedin.com/company/verb-tech

VERB on YouTube: https://www.youtube.com/channel/UC0eCb_fwQlwEG3ywHDJ4_KQ

Sign up for E-mail Alerts here: https://ir.verb.tech/news-events/email-alerts

FORWARD-LOOKING STATEMENTS

This communication contains “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve risks and uncertainties and include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance, or achievements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, those identified in our filings with the Securities and Exchange Commission (the “SEC”), including our annual, quarterly and current reports filed with the SEC and the risk factors included in our annual report on Form 10-K filed with the SEC today. Any forward-looking statement made by us herein is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement whether as a result of new information, future developments or otherwise.

Investor Relations Contact: investors@verb.tech

Media Contact: info@verb.tech

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/2dafa316-c785-42b3-9d3c-7e43a0b4ce58