New Insurance Industry Report: First Quarter Losses Outpace Historical Averages but Stabilize in Second Quarter, Combined Ratio Improves

Rhea-AI Summary

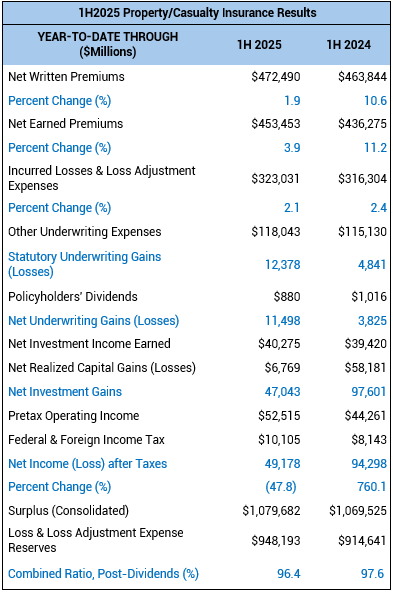

Verisk (Nasdaq: VRSK) and APCIA reported that the U.S. insurance industry achieved $11.5 billion in underwriting gains for the first half of 2025, improving from $3.8 billion in the same period of 2024. The industry saw premiums written increase to $472 billion, up from $464 billion year-over-year, while the combined ratio improved to 96.4% from 97.6%.

Despite significant first-quarter losses from the Palisades and Eaton wildfires, second-quarter performance stabilized. Policyholders' surplus remained strong at $1.08 trillion, though realized capital gains declined sharply to $6.8 billion from $58.1 billion in the previous year. The industry faces ongoing challenges from extreme weather events, inflation, and line-specific pressures impacting long-term profitability.

Positive

- Underwriting gains increased significantly to $11.5 billion from $3.8 billion year-over-year

- Combined ratio improved to 96.4% from 97.6%

- Premium growth continued with written premiums reaching $472 billion

- Policyholders' surplus remained strong at $1.08 trillion

Negative

- Realized capital gains dropped dramatically to $6.8 billion from $58.1 billion

- Net written premium growth slowed to 1.9%

- Record-breaking catastrophe losses from California wildfires in Q1

- Ongoing challenges from extreme weather events and inflation threaten long-term profitability

News Market Reaction – VRSK

On the day this news was published, VRSK gained 1.30%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Headwinds such as extreme weather, inflation and line-specific pressures continue to challenge long-term underwriting profitability

JERSEY CITY, N.J., Sept. 03, 2025 (GLOBE NEWSWIRE) -- Verisk (Nasdaq: VRSK), a leading strategic data analytics and technology partner to the global insurance industry, and The American Property Casualty Insurance Association (APCIA), the primary national trade association for home, auto and business insurers, today reported half-year underwriting gains for the insurance industry, which are estimated to be

According to key financial indicators for private U.S. property/casualty insurers, the first half of 2025 experienced losses in line with the escalated levels seen in recent years. First-quarter losses, driven largely by the Palisades and Eaton wildfires, outpaced historical averages but did not carry over at the same magnitude in the second quarter. Surplus levels remained historically high at

“Net written premiums growth slowed to 1.9 percent. The lack of any significant natural catastrophes in the second quarter helped offset the record-breaking catastrophe losses related to the California wildfires and severe convective storms impacting Texas and Georgia earlier in the year,” said Robert Gordon, senior vice president, policy, research and international at APCIA. “However, the U.S. is now entering the height of hurricane and wildfire season, so time will tell if the industry is able to maintain underwriting gains through year-end.”

- Premiums written: Insurers wrote

$472 billion in premiums during the first half of this year, compared to$464 billion during the same period in 2024. Similarly, earned premiums grew 3.9 percent to$453 billion in the first half of 2025.

- Underwriting gain: The estimated U.S. insurance industry net underwriting gain of

$11.5 billion is an improvement over the$3.8 billion net underwriting gain through mid-year 2024. - Incurred losses and loss adjustment expenses: Mid-year 2025, incurred losses and loss adjustment expenses increased by 2.1 percent, compared to the 2.4 percent increase at mid-year 2024. The combined ratio, a crucial measure of profitability for insurers, improved to 96.4 percent in the first half of 2025 versus 97.6 percent for the same period in 2024.

- Surplus: In the first half of 2025, the policyholders’ surplus increased slightly to

$1.08 trillion from$1.07 trillion at mid-year 2024. - Realized Capital Gains: Realized capital gains declined sharply to

$6.8 billion in the first half of 2025, compared to$58.1 billion during the same period in 2024. Adjusting for the capital gains realized by one insurer in 2024, overall investment gains were stable during this period.

“Insurers are navigating a new era of risk, where extreme weather events are no longer anomalies and frequency perils are now persistent stressors on underwriting performance, as discussed in Verisk’s 2025 Global Modeled Catastrophe Losses report,” said Saurabh Khemka, co-president of Underwriting Solutions at Verisk.

About the first half of the year results, Khemka added: “While some lines are showing signs of improvement, the broader industry continues to walk a fine line. Combined ratio has edged down slightly from this time last year, reflecting underwriting discipline, but escalating catastrophe losses— most notably January’s unprecedented California wildfires—underscore the volatility ahead. Predictive analytics, granular data and adaptive pricing strategies can help insurers respond to a rapidly evolving risk landscape.”

Note: The results above are based on annual statements filed with insurance regulators by private property/casualty insurers domiciled in the United States, including reinsurers, excess and surplus insurers, and domestic insurers owned by foreign parents, and excluding state funds for workers' compensation and other residual market insurers, the National Flood Insurance Program, and foreign insurers. The figures are consolidated estimates based on reports accounting for about 97 percent of all business written by U.S. property/casualty insurers. All figures are net of reinsurance unless otherwise noted and occasionally may not balance due to rounding.

Verisk’s Underwriting & Rating Solutions helps global insurers, reinsurers and other stakeholders modernize their processes, reduce operating costs and underwrite risks quickly and precisely. These solutions support (re)insurers across multiple lines of business, including personal & commercial property, personal & commercial auto, small commercial and general liability programming to streamline forms, rules, loss costs and rating-related information.

About Verisk

Verisk (Nasdaq: VRSK) is a leading strategic data analytics and technology partner to the global insurance industry. It empowers clients to strengthen operating efficiency, improve underwriting and claims outcomes, combat fraud and make informed decisions about global risks, including climate change, extreme events, sustainability and political issues. Through advanced data analytics, software, scientific research and deep industry knowledge, Verisk helps build global resilience for individuals, communities and businesses. With teams across more than 20 countries, Verisk consistently earns certification by Great Place to Work and fosters an inclusive culture where all team members feel they belong. For more, visit Verisk.com and the Verisk Newsroom.

About APCIA

The American Property Casualty Insurance Association (APCIA) is the primary national trade association for home, auto, and business insurers. APCIA promotes and protects the viability of private competition for the benefit of consumers and insurers, with a legacy dating back 150 years. APCIA members represent all sizes, structures, and regions-protecting families, communities, and businesses in the U.S. and across the globe.

Morgan Hurley Verisk 551-655-7858 morgan.hurley@verisk.com