West Point Gold Announces Proceeds of $3.0 Million from Warrant Exercises; Expands Ongoing Drill Program at Gold Chain to 15,000m by Adding a Second Drill Rig

Rhea-AI Summary

West Point Gold (OTCQB: WPGCF; TSXV: WPG) announced C$3.0 million in proceeds from 6,271,071 warrant exercises and a cash balance of C$7.2 million as at December 15, 2025 (up from C$6.4 million at September 30, 2025). The company has drilled 3,229 m since September 2025 with assays pending for 1,594 m.

West Point expanded its Gold Chain drill program from 10,000 m to 15,000 m and will add a second drill rig expected on site in early January 2026 to test multiple targets including Tyro South, Tyro Main Zone at depth, Sheep Trail, Black Dyke, Gold Chain Hill, Union Pass Corridor and Frisco Graben.

Outstanding warrants total 22,951,849 with an aggregate value of $10,548,470 (various expiries and exercise prices), and shares outstanding are 108,072,448.

Positive

- Warrant proceeds of C$3.0M received since Sept 30, 2025

- Cash balance increased to C$7.2M (from C$6.4M on Sept 30, 2025)

- Drill program expanded +50% to 15,000 m with second rig in early Jan 2026

- 3,229 m drilled since Sept 2025 advancing Tyro Main Zone

Negative

- Outstanding 22,951,849 warrants could dilute shareholders if exercised

- Aggregate value of remaining warrants is $10,548,470

- 1,594 m of drilled core with assay results still pending

News Market Reaction – WPGCF

On the day this news was published, WPGCF declined 4.19%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - December 16, 2025) - West Point Gold Corp. (TSXV: WPG) (OTCQB: WPGCF) (FSE: LRA0) ("West Point Gold" or the "Company") is pleased to provide an update on recent warrant exercises and announce the expansion of its drill program to 15,000 metres (m) by adding a second drill rig.

Highlights of this Release:

Since September 30, 2025, a total of 6,271,071 warrants have been exercised for proceeds of C

$3.0 million .As at December 15, 2025, the Company's cash balance is C

$7.2 million , up from C$6.4 million at September 30, 2025.3,229 m have been drilled since drilling resumed in September 2025, results are pending for 1,594 m.

The Company has decided to expand the ongoing drill program to 15,000 m (was 10,000 m).

Second drill rig expected at site in early January 2026.

"The combination of our ongoing drilling success and better-than-expected balance sheet at this point in the program has us well-positioned to drill more aggressively in 2026. Our plan is to test Tyro South, a 1.2 km extension of the 1 km Tyro Main Zone, expand the Tyro Main Zone to depth, and test many of the other high-potential targets at Gold Chain," stated Derek Macpherson, President & CEO. "We would like to thank our many supportive shareholders who have exercised warrants over the last few months, putting us in this strong financial position."

Warrant Exercise Update

Since September 30, 2025, a total of 6,271,071 warrants have been exercised for proceeds of C

Table 1: Outstanding Warrants as at December 15, 2025

| EXPIRATION | EXERCISE PRICE | WARRANTS | VALUE |

| 03-MAY-2026 | 780,500 | ||

| 09-OCT-2026 | 1,909,986 | ||

| 24-OCT-2026 | 5,809,425 | ||

| 15-NOV-2026 | 5,387,652 | ||

| 22-NOV-2026 | 1,220,000 | ||

| 10-JUN-2027 | 213,336 | ||

| 10-JUN-2027 | 7,630,950 | ||

| TOTAL | 22,951,849 |

Expanded Drill Program at Gold Chain

Since September, the Company has completed 3,229 m of drilling at the Tyro Main Zone. Initial drilling focused on infill drilling of the near-surface portion of the deposit (1,178 m) and expanding the high-grade zone at northeast (NE) Tyro (2,051 m). Assays are pending for 1,594 m.

With the addition of a second drill rig, the Company plans to drill an additional 5,000 m in this program for a total of 15,000 m (was 10,000 m). The addition of a second drill and expansion of the drill program are expected to enable the Company to test more step-out targets at Gold Chain and to expand the Tyro Main Zone to depth.

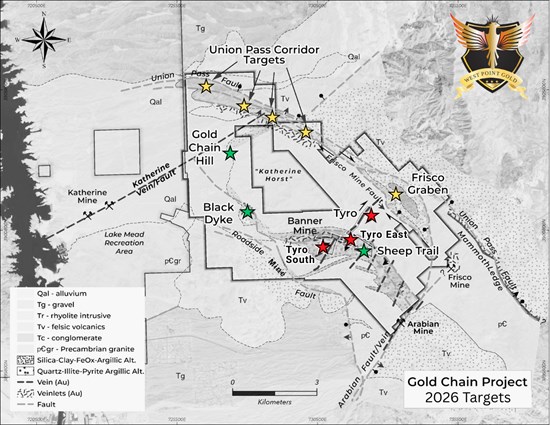

Targets that may be tested include Tyro South, Sheep Trail mine, Black Dyke mine, Gold Chain Hill and Union Pass Corridor targets, along with follow-up drilling at the Frisco Graben (Figure 1). Additional permitting work is underway to test targets, not on the patented claims.

The addition of the second drill rig allows the Company to systematically test these targets while continuing to advance the Tyro Main Zone toward a maiden resource.

Figure 1. Geologic Overview of the Gold Chain Project showing targets for the 2025-2026 drilling campaign.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5717/278167_9aa8ab6c241a1854_002full.jpg

Qualified Person

Robert Johansing, M.Sc. Econ. Geol., P. Geo., the Company's Vice President, Exploration, is a qualified person ("QP") as defined by NI 43-101 and has reviewed and approved the technical content of this press release.

About West Point Gold Corp.

West Point Gold Corp. (formerly Gold79 Mines Ltd.) is focused on gold discovery and development at four prolific Walker Lane Trend projects covering Nevada and Arizona, USA. The Company is advancing a maiden resource at its Gold Chain project in Arizona, while JV partner Kinross is progressing the Jefferson Canyon project in Nevada.

For further information regarding this press release, please contact:

Aaron Paterson, Corporate Communications Manager

Phone: +1 (778) 358-6173

Email: info@westpointgold.com

Stay Connected with Us:

LinkedIn: linkedin.com/company/west-point-gold

X (Twitter): @westpointgoldUS

Facebook: facebook.com/Westpointgold/

Website: westpointgold.com/

FORWARD-LOOKING STATEMENTS:

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the Company's current belief or assumptions as to the outcome and timing of such future events including, among others, assumptions about future prices of gold, silver, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining government approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, availability of drill rigs, and anticipated costs and expenditures. The Company cautions that all forward-looking statements are inherently uncertain, and that actual performance may be affected by a number of material factors, many of which are beyond the Company's control. Such factors include, among other things: risks and uncertainties relating to West Point Gold's ability to complete any payments or expenditures required under the Company's various option agreements for its projects; and other risks and uncertainties relating to the actual results of current exploration activities, the uncertainties related to resources estimates; the uncertainty of estimates and projections in relation to production, costs and expenses; risks relating to grade and continuity of mineral deposits; the uncertainties involved in interpreting drill results and other exploration data; the potential for delays in exploration or development activities; uncertainty related to the geology, grade and continuity of mineral deposits; the possibility that future exploration, development or mining results may vary from those expected; statements about expected results of operations, royalties, cash flows, financial position may not be consistent with the Company's expectations due to accidents, equipment breakdowns, title and permitting matters, labour disputes or other unanticipated difficulties with or interruptions in operations, fluctuating metal prices, unanticipated costs and expenses, uncertainties relating to the availability and costs of financing needed in the future and regulatory restrictions, including environmental regulatory restrictions. The possibility that future exploration, development or mining results will not be consistent with adjacent properties and the Company's expectations; operational risks and hazards inherent with the business of mining (including environmental accidents and hazards, industrial accidents, equipment breakdown, unusual or unexpected geological or structural formations, cave-ins, flooding and severe weather); metal price fluctuations; environmental and regulatory requirements; availability of permits, failure to convert estimated mineral resources to reserves; the inability to complete a feasibility study which recommends a production decision; the preliminary nature of metallurgical test results; fluctuating gold prices; possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, political risks, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks involved in the mineral exploration and development industry, and those risks set out in the filings on SEDAR+ made by the Company with securities regulators. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this corporate press release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, other than as required by applicable securities legislation.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/278167