Xos launches 2026 Electric Class 6 Chassis, starting at just $99,000

Rhea-AI Summary

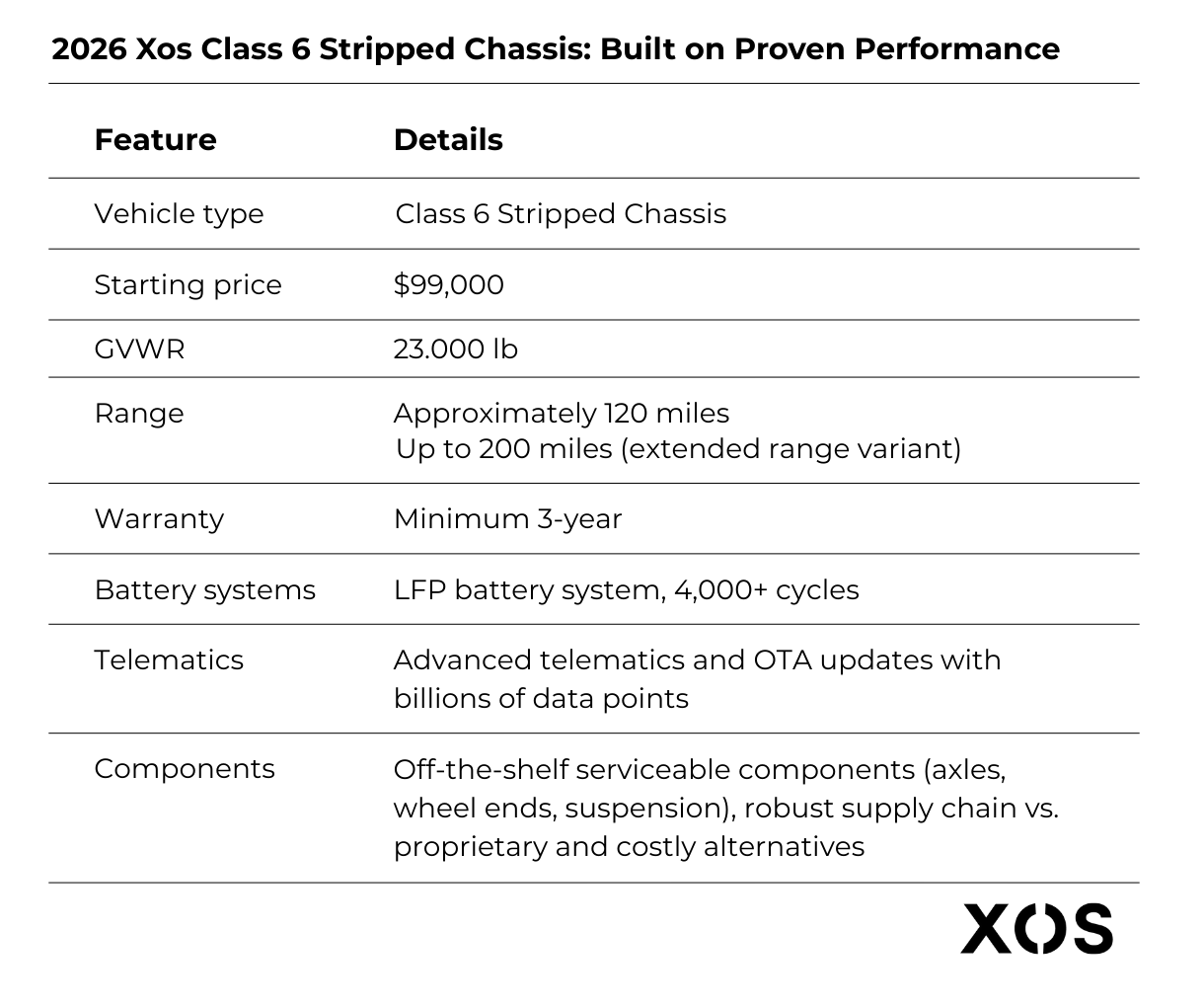

Xos (NASDAQ: XOS) unveiled the 2026 Class 6 stripped chassis with a starting price of $99,000, positioned as the industrys most competitive entry for commercial fleet electrification. The platform targets return-to-base duty cycles with ~120 miles range (up to 200 miles extended).

Key specs include an LFP battery engineered for 4,000+ cycles, advanced telematics with 3+ years of operational data and OTA updates, serviceable commercial components, a minimum 3-year warranty, and over 1,000 US-deployed vehicles.

Positive

- Starting price of $99,000 for 2026 Class 6 stripped chassis

- Standard range ~120 miles; extended variant up to 200 miles

- LFP battery engineered for 4,000+ cycle durability

- Over 1,000 vehicles and powertrains deployed from Tennessee factory

- Established blue-chip customers including UPS, FedEx, Cintas, Loomis

Negative

- Standard ~120-mile range limits suitability to return-to-base duty cycles

- Price applies to stripped chassis; upfit and body costs are not included

Key Figures

Market Reality Check

Peers on Argus

XOS fell 11.65% while peers were mixed: UGRO appeared in momentum scans up 9.52%, HCAI in scans down 4.39%, and GP down 3.85%. With only one peer moving strongly higher and another lower, the move in XOS looks more company-specific than sector-driven.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Jan 26 | Product expansion | Positive | +27.2% | Expanded Xos Hub mobile energy lineup with new capacities and pricing. |

| Nov 13 | Earnings report | Positive | +1.2% | Strong Q3 2025 results with revenue growth and positive free cash flow. |

| Oct 27 | Earnings call notice | Neutral | +0.0% | Announcement of Q3 2025 earnings release date and conference call. |

| Sep 10 | Policy incentive | Positive | +0.0% | Details on California HVIP incentives for Class 6 electric vehicles. |

| Sep 4 | Strategic partnership | Positive | -5.0% | Partnership with Windrose to pair Class 8 trucks with Xos Hub charging. |

Positive operational and product news has often led to favorable or muted reactions, with some instances of divergence on partnerships and incentive-related updates.

Over the last several months, Xos reported multiple operational milestones, including the Xos Hub lineup expansion with capacities up to 630 kWh and strong Q3 2025 results with $16.5M revenue and positive free cash flow. Regulatory incentives (HVIP) and a charging partnership with Windrose also featured. Today’s Class 6 chassis launch continues this theme of expanding electrification offerings and builds on earlier product and charging ecosystem announcements.

Market Pulse Summary

This announcement highlights a 2026 Class 6 chassis starting at $99,000, with up to 200 miles of range and an LFP battery targeting 4,000+ cycles. It builds on more than 1,000 deployed units and expanded charging offerings. In context of recent filings noting going-concern risks and funding needs, investors may watch how this platform translates into orders, margins, and cash flow in upcoming results.

Key Terms

gvwr technical

telematics technical

over-the-air update technical

lfp battery technical

predictive maintenance technical

duty cycles technical

mobile charging solutions technical

AI-generated analysis. Not financial advice.

- Performance proven market leader delivers electric platform with more deployed vehicles, more real-world miles, and more blue-chip fleet customers in the US than any competitor.

- The Xos stripped chassis now starts at the most competitive price in the industry.

LOS ANGELES, Feb. 03, 2026 (GLOBE NEWSWIRE) -- Xos, Inc. (NASDAQ: XOS) ("Xos" or the "Company"), a leader in electric commercial vehicles and mobile charging solutions, today unveiled the 2026 model year Xos Class 6 strip chassis at a starting price of

Xos has more US-deployed vehicles than any competitor in its segment. With blue-chip customers including UPS, FedEx, Cintas, and Loomis, and over 1,000 vehicles and powertrains on the road that were manufactured in its Tennessee factory, Xos brings proven market leadership to the 2026 model year launch.

2026 Class 6 Strip chassis specifications:

- Class 6 Platform: 23,000 lb GVWR purpose-built for commercial fleet operations

- Optimized Range: Approximately 120 miles engineered for return-to-base duty cycles and up to 200 miles on the extended range variant.

- Advanced Telematics: Enhanced platform with 3+ years of operational data, billions of data points monitored, and over-the-air update capability for continuous performance improvements

- Commercial-Grade Battery: LFP battery system designed for 4,000+ cycle durability, prioritizing reliability and total cost of ownership

- Serviceable Architecture: Industry-standard axles, wheel ends, and suspension systems for nationwide service capability and supply chain resilience

- Comprehensive Warranty: Minimum 3-year coverage backed by Xos's proven service network

- Industry-Leading Price: Starting at

$99,000 , a sustainable price point achieved through manufacturing scale and supplier partnerships, not promotional discounting

"The 2026 launch represents everything we've built at Xos over nearly 10 years of engineering innovation, supply chain partnerships, and manufacturing scale," said Dakota Semler, Chief Executive Officer of Xos. "We're not the newest entrant making promises, we're a proven leader delivering results today. Our customers see it in the reliability of our vehicles, the sophistication of our telematics, and the strength of our manufacturing. At a

The 2026 model year introduces enhanced over-the-air update capabilities that enable continuous performance improvements, optimized charging strategies, and predictive maintenance, all delivered remotely without vehicle downtime. Combined with industry-standard serviceable components, this approach delivers uptime and flexibility that proprietary closed systems cannot match.

Xos's LFP battery system prioritizes reliability, safety, and total cost of ownership over theoretical performance claims. Engineered for 4,000+ cycle durability and commercial duty cycles, the platform delivers predictable economics that fleet operators trust for mission-critical operations.

With the broadest deployment footprint and most accumulated real-world mileage in the US, and through partnerships with some of the nation's largest fleet operators, Xos has established itself as the proven choice for commercial electrification. The 2026 model year launch reinforces this leadership while making the transition to electric more accessible than ever.

Fleet operators interested in securing 2026 delivery should contact Xos directly at www.xostrucks.com.

About Xos

Xos, Inc. (NASDAQ: XOS) is a leading technology company, electric truck manufacturer, and fleet services provider for battery-electric fleets. Xos vehicles and fleet management software are purpose-built for medium- and heavy-duty commercial vehicles that travel on last-mile, back-to-base routes. The Company leverages its proprietary technologies to provide commercial fleets with battery-electric vehicles that are easier to maintain and more cost-efficient on a total cost of ownership basis than their internal combustion engine counterparts. For more information, visit www.xostrucks.com.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements regarding projected financial and performance information; expectations and timing related to product deliveries and customer demand; sufficiency of existing cash reserves; customer acquisition and order metrics; ability to access additional capital and Xos’s long-term strategy and future growth. These forward-looking statements may be identified by the words “anticipate,” “believe,” “continue,” “likely,” “plan,” “possible,” “potential,” “predict,” “project,” “seem,” “seek,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “might,” “could,” “should,” “will,” “would,” and similar expressions and any other statements that predict or indicate future events or trends or that are not statements of historical matters, although not all forward-looking statements contain such identifying words. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: (i) Xos’s liquidity and access to capital when needed, including its ability to service its indebtedness; (ii) cost increases and delays in production due to supply chain shortages in the components needed for the production of Xos's vehicle chassis and battery system; (iii) the ability of products and/or components to perform as designed or expected; (iv) Xos's ability to implement its business plan or meet or exceed its financial projections; (v) Xos's ability to retain key personnel and hire additional personnel, particularly in light of current and potential labor shortages; (vi) the risk of downturns and a changing regulatory landscape in the highly competitive electric vehicle industry; and (vii) macroeconomic and political conditions. All forward-looking statements included in this press release are expressly qualified in their entirety by, and you should carefully consider, the foregoing factors and the other risks and uncertainties described under the heading “Risk Factors” included in Xos's Annual Report on Form 10-K for the year ended December 31, 2024 filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 31, 2025 and Xos's other filings with the SEC, copies of which may be obtained by visiting Xos's Investors Relations website at https://www.xostrucks.com/sec-filings or the SEC's website at www.sec.gov. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Xos assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Xos does not give any assurance that it will achieve its expectations.

Media Contact:

Marketing@xostrucks.com

Investor Contact:

Xos Investor Relations

ir@xostrucks.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/14c3ffa7-f69d-4227-a914-0559197fc59c

https://www.globenewswire.com/NewsRoom/AttachmentNg/caaf36a6-a1a6-47bf-859e-e4a4abb88f8e