Solitario Adds Bright Angel Gold - Copper Project, Further Diversifying Its Property Portfolio

Rhea-AI Summary

Solitario (NYSE American: XPL) acquired the Bright Angel copper-gold project in Colorado, earning 100% of the minerals from a private party (rights acquired Sept 2025). Surface reconnaissance (27 grab samples across ~750m x 600m) returned strongly anomalous gold and copper including high-grade select rock assays (examples: 8.45% Cu, 3.97% Cu, 3.30% Cu). Solitario has submitted a Notice of Intent to the U.S. Forest Service and is working on a Plan of Operations to obtain drilling permits, targeting possible drilling in late‑2026.

The company noted historic drilling by Anaconda but cannot verify historic assays; a drone magnetic survey and possible IP survey are planned. Cash and marketable securities are approximately US$7.6 million and Newmont holds 9.3% of shares.

Positive

- Acquired Bright Angel mineral rights to earn 100% (Sept 2025)

- Surface sampling confirmed widespread gold and copper across 750m x 600m

- Select rock assays include highs up to 8.45% Cu and multiple >3% Cu samples

- Submitted Notice of Intent to U.S. Forest Service; drilling permit process underway

- Company cash and marketable securities of ~US$7.6M

Negative

- Reported assays are select grab samples, not representative of a resource

- Historic drill assays from late 1960s/Anaconda are unverified by Solitario

- No NI 43-101 mineral resource or reserve reported; drilling required to confirm grades

- Drilling is permit-dependent; Plan of Operations not yet submitted

News Market Reaction

On the day this news was published, XPL gained 4.40%, reflecting a moderate positive market reaction. Our momentum scanner triggered 2 alerts that day, indicating moderate trading interest and price volatility. This price movement added approximately $3M to the company's valuation, bringing the market cap to $73M at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

While XPL was down 1.89%, momentum-screened peers OMEX and USGO were up 6.13% and 7.94% respectively, suggesting a stock-specific setup rather than a broad sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 08 | Portfolio overview | Positive | -1.6% | CEO webcast outlining diversified portfolio and key company metrics. |

| Oct 21 | Project addition | Positive | -4.7% | Cat Creek drilling permits and critical metals project update. |

| Sep 15 | Drilling results | Positive | -8.6% | Golden Crest Phase 1 drill results with high-grade silver intercept. |

| Sep 12 | Conference appearance | Neutral | -0.2% | Denver Gold Group presentation on strategy and drilling program. |

| Sep 04 | Conference appearance | Neutral | +4.2% | HC Wainwright conference presentation and investor meetings. |

Recent positive exploration and portfolio updates have often been followed by negative price reactions, while conference appearances have produced mixed but generally modest moves.

Over the last six months, Solitario has highlighted portfolio depth and exploration progress, including Golden Crest drilling results, the Cat Creek critical metals project, and early-stage Bright Angel positioning. Multiple conference presentations in September 2025 showcased strategy and drilling updates. Despite these generally constructive updates and portfolio expansion, share reactions after news on 09/15, 10/21, and 12/08 were negative, indicating a pattern of weak immediate price follow-through on positive announcements.

Market Pulse Summary

This announcement adds the Bright Angel gold-copper project in Colorado to Solitario’s portfolio, supported by encouraging surface assays and ongoing drill permitting efforts. It complements existing assets such as Golden Crest, Cat Creek, Lik, and Florida Canyon, where over $110 million has been spent historically. With approximately US$7.6 million in cash and securities and 90.9 million shares outstanding, key items to watch include permitting progress, initial Bright Angel drill results, and execution of the 2026 Golden Crest drilling campaign.

Key Terms

porphyry technical

skarn technical

fire assay technical

icp-ms technical

iso 17025:2017 technical

ni 43-101 regulatory

AI-generated analysis. Not financial advice.

DENVER, CO / ACCESS Newswire / January 22, 2026 / Solitario Resources Corp. ("Solitario" or the "Company") (NYSE American:XPL)(TSX:SLR) is pleased to announce that it has acquired the Bright Angel copper-gold project in Colorado. At Bright Angel, mineralized porphyry stockwork contains significant values of gold and copper, with minor silver values. Mineralization has been traced over an area approximately 750 meters long and up to 600 meters wide. Both gold and copper are trading at all-time highs, with copper being designated as a critical metal by the U.S. government.

Bright Angel was originally discovered and drilled in the late 1960's by a private party. Anaconda Copper leased the property in 1970 and drilled eleven core holes, maintaining the lease for ten years. The property has sat idle for the past 50 years until Solitario acquired the rights to earn

To date, Solitario has completed a surface reconnaissance rock sampling program and has initiated drill hole permitting. Results of the surface sampling program have been highly encouraging with consistently anomalous to strong values of gold and copper (see table below and sample map here). Solitario has submitted a Notice of Intent to the U.S. Forest Service to commence an exploration drilling program at Bright Angel and is currently working on submitting a Plan of Operations.

Chris Herald, President and CEO of Solitario, stated: "With gold and copper prices at all-time highs, we are extremely excited about the potential of our newly acquired Bright Angel gold-copper property. Our geologic evaluation of Bright Angel is that it is an alkaline pipe-like porphyry system characterized by potentially high grades for both gold and copper with deep roots. We are focused on obtaining a drilling permit and testing this exceptional target, hopefully in late-2026.

The importance of this type of gold-copper deposit is now well-known, in large part due to Newcrest Mining's (now Newmont) world-class Cadia - Ridgeway copper-gold pipe-like porphyry deposits discovered in the mid-1990's. The Cadia - Ridgeway gold/copper endowment is estimated to be in excess of 20 million ounces of gold and 10 billion pounds of copper. The lateral footprint of alkaline copper/gold pipe-like porphyry systems are rather small, generally limited to several hundred meters in diameter, but often extending to depths greater than 1,000 meters. Another important attribute is that these deposits often occur in clusters."

Chris Herald, President and CEO, will present at the 2026 Metals Investor Forum in Vancouver, British Columbia, Canada on January 23 at 5:20 pm PST. The in-person live presentation will not be webcast. Mr. Herald plans to present an overview of Solitario's exploration plans for the Golden Crest gold project - Ponderosa area, Cat Creek molybdenum-rhenium project, Bright Angel copper-gold property, and its Florida Canyon and Lik zinc projects. |

History of Project

Drilling at Bright Angel began in the late-1960's when its initial owner completed 186 very shallow (~16 meters) and widely spaced drill holes. Twelve of the more mineralized holes were deepened to depths of up to 200 meters. Two of the holes reportedly intersected significant grades of gold and copper but are not reported here as Solitario is unable to verify the historic drill hole assay results. However, Solitario's surface rock sampling (see table below and sample map here) produced gold/copper grades consistent with the grades in the upper 20 meters of the reported historic drill holes. Drilling will be required to confirm drill hole grades reported in the historic files.

Anaconda Copper, formerly one of the largest mining companies in the world, leased the property in 1970 and drilled 11 widely spaced core holes ranging in depth from 270 to 783 meters. Anaconda's exploration program focused upon testing for a classic large-scale mushroom-shaped, calc-alkaline copper porphyry system common in the Arizona and Chilean copper belts. Calc-alkaline copper systems tend to be laterally extensive, often well over 1,000 meters in diameter. These copper systems are generally gold poor.

Anaconda intersected thick sections of

Solitario Surface Sampling

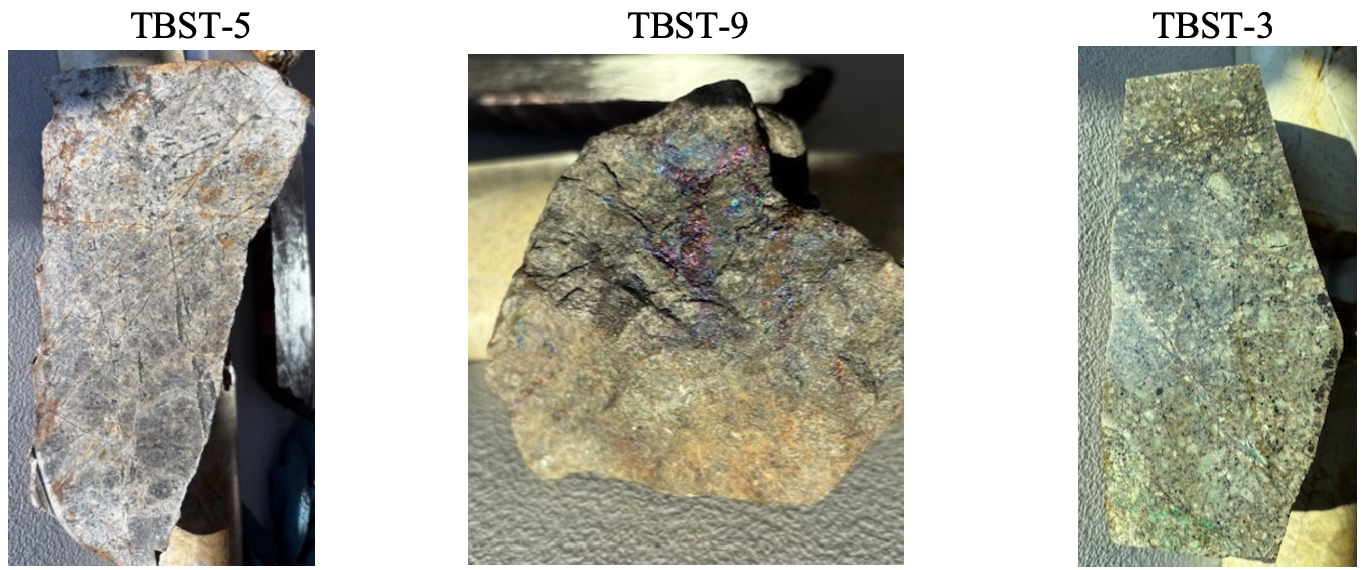

During late-fall, Solitario collected 27 select surface grab samples from an area approximately 750 meters x 600 meters. Results are presented in the Table below. This work confirmed widespread gold and copper mineralization in both porphyry intrusive rocks and skarn.

Surface Rock Assays | ||||||||

Sample # | Cu % | Au ppm | Ag ppm | Sample # | Cu % | Au ppm | Ag ppm | |

TBST-1 | 0.38 | 1.16 | 2.17 | 5942 | 0.43 | 0.07 | 0.47 | |

TBST-2 | 0.044 | 0.04 | 0.3 | 5943 | 0.09 | 0.08 | 1.49 | |

TBST-3 | 0.57 | 0.14 | 0.96 | 5944 | 0.73 | 0.35 | 4.95 | |

TBST-4 | 0.85 | 0.74 | 1.35 | 5945 | 0.53 | 0.13 | 3.59 | |

TBST-5 | 1.12 | 2.15 | 1.56 | 5946 | 0.15 | 0.31 | 1.47 | |

TBST-6 | 1.17 | 0.37 | 3.04 | 5947 | 0.06 | 0.15 | 1.01 | |

TBST-7 | 3.22 | 0.29 | 15 | 5948 | 3.30 | 0.37 | 27.00 | |

TBST-8 | 8.45 | 0.67 | 38.8 | 5949 | 0.26 | 0.31 | 1.50 | |

TBST-9 | 3.97 | 0.16 | 38 | 5950 | 0.57 | 0.10 | 0.62 | |

5937 | 0.03 | 0.27 | 1.27 | 5951 | 0.02 | 0.02 | 0.24 | |

5938 | 0.19 | 0.03 | 0.18 | 5952 | 0.34 | 0.09 | 1.08 | |

5939 | 0.22 | 0.09 | 0.67 | 5953 | 1.00 | 0.12 | 8.88 | |

5940 | 0.43 | 0.12 | 0.56 | 4747 | 0.00 | 0.03 | 0.17 | |

5941 | 0.49 | 0.09 | 0.58 | |||||

Plans are also underway to conduct a drone magnetic survey and possibly an Induced Polarization geophysical survey in the upcoming field season.

Sample Type, Sampling Methodology, Chain of Custody, Quality Control and Assurance

The reported Bright Angel rock assays are all select surface rock grab/float samples and were generally not collected from a bedrock source. However, these samples are thought to be derived from the underlying bedrock in the immediate area. Rock samples are reconnaissance select grab samples that display alteration, usually with silicification and silica-filled fractures +/- sulfide and copper mineralization. The significance of these results is limited to determining whether copper, gold, or trace elements usually associated with copper and gold, are present within the sampled rocks. These assay results should not be considered as representative of, nor verify economically mineable mineralization.

Samples were analyzed by ALS Laboratories in Reno, Nevada, a laboratory accredited in accordance with the standards of ISO 17025:2017. ALS is independent from Solitario. The samples were collected by Solitario geologists and submitted directly to ALS through secure chain of custody protocols or an independent sample preparation laboratory prior to being shipped to ALS. All activities prior to shipment were directly supervised by Solitario geologists. The samples were crushed and pulverized, and sample pulps were analyzed using industry standard fire assay and Inductively Coupled Plasma - Mass Spectrometry (ICP-MS) analytical methods.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Walter Hunt, a qualified person as defined by Canadian instrument NI 43-101, Standards of Disclosure for Mineral Projects.

About Solitario

Solitario is a natural resource exploration company focused on high-quality Tier-1 gold, copper, zinc and critical metals (molybdenum and rhenium) projects. Solitario's

In addition to its Bright Angel and Golden Crest projects, Solitario holds a

The Company is traded on the NYSE American ("XPL") and on the Toronto Stock Exchange ("SLR"). Solitario's Management and Directors hold approximately

Solitario has a long history of committed Environmental, Social and Responsible Governance ("ESG") of its business. We realize ESG issues are also important to investors, employees, and all stakeholders, including communities in which we work. We are committed to conducting our business in a manner that supports positive environmental and social initiatives and responsible corporate governance. Importantly, we work with joint venture partners that not only value the importance of ESG issues in the conduct of their business on our joint venture projects but are leaders in the industry in this important segment of our business.

For More Information Please Contact:

Christopher Herald, President and CEO | 303-534-1030 Ext. 1 |

Cautionary Statement Regarding Forward Looking Information

This press release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933 and the U.S. Securities Exchange Act of 1934, and as defined in the United States Private Securities Litigation Reform Act of 1995 (and the equivalent under Canadian securities laws), that are intended to be covered by the safe harbor created by such sections. Forward-looking statements are statements that are not historical facts. They are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and address activities, events or developments that Solitario expects or anticipates will or may occur in the future, and are based on current expectations and assumptions. Technical data from the Bright Angel project was derived primarily from historic Anaconda files thought to be accurate, but have not verified by QAQC quality controls as defined by NI 43-101, Standards of Disclosure for Mineral Projects. Forward-looking statements involve numerous risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Such forward-looking statements include, without limitation, statements regarding the Company's expectation of the projected timing and outcome of engineering studies; expectations regarding the receipt of all necessary permits and approvals to implement a mining plan, if any, at any of its mineral properties. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, among others, risks relating to risks that Solitario's and its joint venture partners' exploration and property advancement efforts will not be successful; risks relating to fluctuations in the price of gold, silver, copper, zinc, lead, and molybdenum; the inherently hazardous nature of mining-related activities; uncertainties concerning reserve and resource estimates; availability of outside contractors, and other activities; uncertainties relating to obtaining approvals and permits from governmental regulatory authorities; the possibility that environmental laws and regulations will change over time and become even more restrictive; and availability and timing of capital for financing the Company's exploration and development activities, including uncertainty of being able to raise capital on favorable terms or at all; as well as those factors discussed in Solitario's filings and reports with the U.S. Securities and Exchange Commission (the "SEC"), including Solitario's latest Annual Report on Form 10-K and its other SEC filings (and Canadian filings) including, without limitation, its latest Quarterly Report on Form 10-Q. The Company does not intend to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities laws.

SOURCE: Solitario Resources Corp.

View the original press release on ACCESS Newswire