ABQQ Reports FY 2024 Audited Financial Results, Introduces FY 2025 Outlook, Announces to Repurchase $5 Million of Shares by Year-End 2025

Rhea-AI Summary

AB International Group (ABQQ) reported strong FY2024 financial results with revenue increasing 125% to $3.3 million and achieving operational profitability with net income of $542,331, compared to a net loss of $3.57 million in FY2023. Operating expenses decreased to $2.81 million from $5.03 million in the previous year. The company's Total Stockholders' Equity reached $1.46 million, up from $891K in FY2023. During FY2024, ABQQ repurchased 285 million shares for $50,699. The company announced plans to repurchase $5 million of shares by year-end 2025 and projects 150% revenue growth for FY2025 with EPS guidance of $0.001-$0.002.

Positive

- Revenue growth of 125% to $3.3 million in FY2024

- Achieved profitability with net income of $542,331

- Operating expenses reduced by 44% to $2.81 million

- Total Stockholders' Equity increased to $1.46 million

- Announced $5 million share repurchase program

- Projects 150% revenue growth for FY2025

Negative

- Low share repurchase value of $50,699 in FY2024

- Low projected EPS range of $0.001-$0.002 for FY2025

News Market Reaction

On the day this news was published, ABQQ gained 25.00%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

- FY 2024 REVENUE INCREASED

125% TO A RECORD$3.3 MILLION - FY 2024 REACH OPERATIONAL PROFITABILITY NET INCOME TO A RECORD

$0.54 MILLION - GUIDES FY 2025 REVENUE GROWTH OF APPROX.

150% ; EPS RANGE OF$0.00 1 TO$0.00 2 - ANNOUNCES INCREASE TO PREVIOUSLY COMMUNICATED SHARE REPURCHASE GOAL, TO REPURCHASE

$5 MILLION OF SHARES BY YEAR END 2025

NEW YORK, Nov. 26, 2024 (GLOBE NEWSWIRE) -- AB International Group Corp. (OTC: ABQQ), an intellectual property (IP) and movie investment and licensing firm, announces financial and operating results for the year ended August 31, 2024. The audited financial results have been filed in a 10-K with the U.S. Securities and Exchange Commission (the "SEC"). The Company also provided its financial outlook for the fiscal year ending August 31, 2025.

“ABQQ achieved record results during fiscal year 2024, as we delivered revenue growth of

Key Financial Highlights:

Revenues for the year ended August 31, 2024, increased

Operating expenses were

We incurred a net income of

As of August 31, 2024.Total Stockholders’ Equity

During fiscal year 2024, the Company repurchased approximately 285 million shares of its common stock for a total of

Full Fiscal Year 2025 Outlook for the Twelve-Month Period Ending August 31, 2025

The Company's full fiscal year 2025 outlook is forward-looking in nature, reflecting our expectations as of November 26, 2024, and is subject to significant risks and uncertainties that limit our ability to accurately forecast results. This outlook assumes no meaningful changes to the Company's business prospects or risks and uncertainties identified by management that could impact future results, which include but are not limited to changes in economic conditions, including consumer confidence and discretionary spending, inflationary pressures, and foreign currency fluctuation; geopolitical tensions; and supply chain disruptions, constraints and related expenses.

Revenues are expected to increase approximately

Gross margin is expected to be approximately

Diluted earnings per share are expected to be in the range of

About AB International Group Corp.

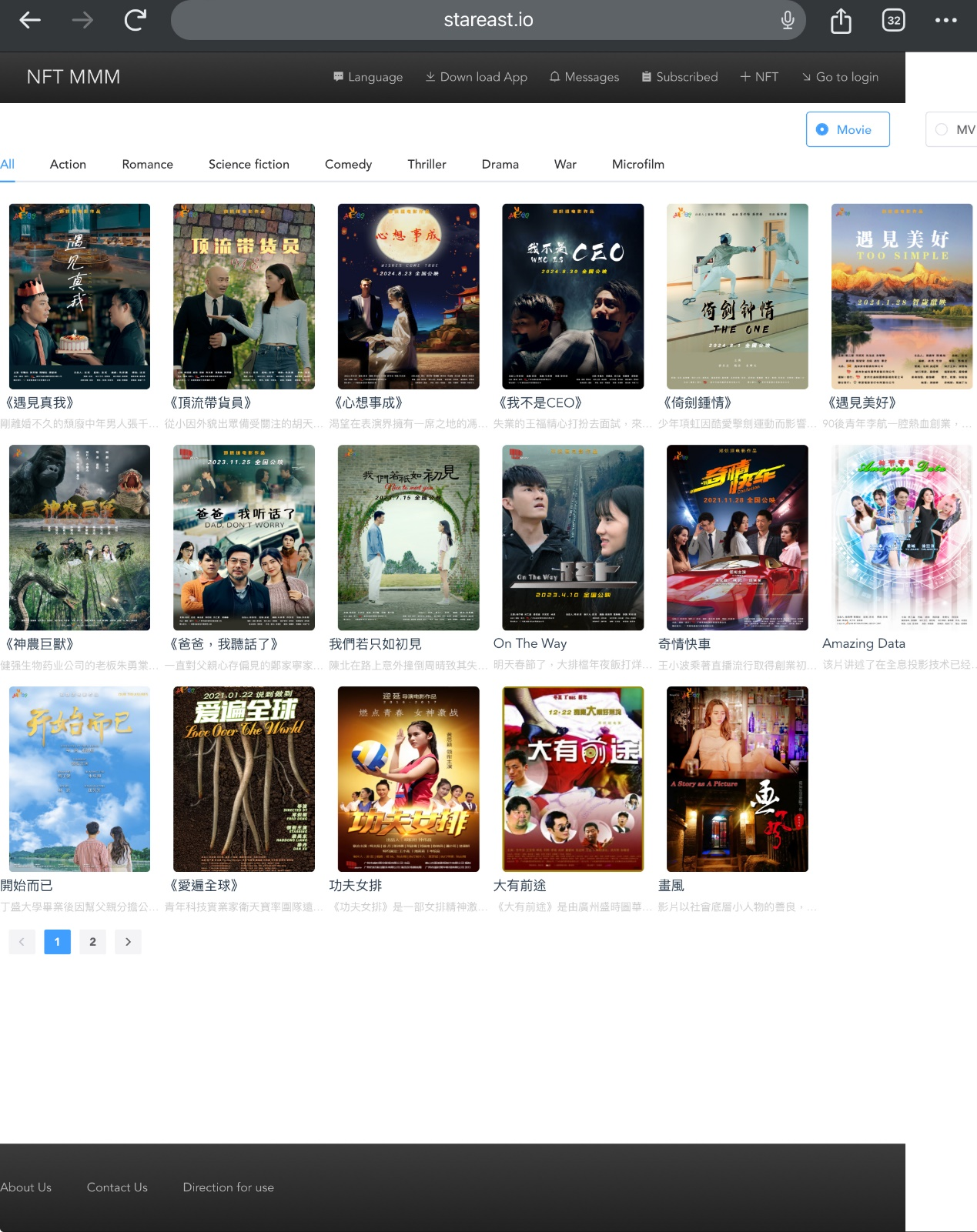

AB International Group Corp. is an intellectual property (IP) and movie investment and licensing firm, focused on acquisitions and development of various intellectual property. We are engaged in acquisition and distribution of movies. The company owns the IP of the NFT movie and music marketplace (NFT MMM) as the unique entertainment industry Non-Fungible Token. The Company operates AB Cinemas, physical movie theaters currently in NY with plans to expand nationwide (www.abcinemasny.com). The company also owns ABQQ.TV which is a movie and TV show online streaming platform. ABQQ TV generates revenue through a hybrid subscription model and advertising model like other online streaming platforms.

For additional information, visit www.abqqs.com, www.abcinemasny.com, https://stareastnet.io/ and www.ABQQ.tv.

Forward-Looking Statements

This press release contains “forward-looking statements” that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements relating to changes to the Company’s management team and statements relating to the Company’s transformation, financial and operational performance including the acceleration of revenue and margins, and the Company’s overall strategy. Because forward-looking statements inherently involve risks and uncertainties, actual future results may differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, the possibility of business disruption, competitive uncertainties, and general economic and business conditions in AB International Group markets as well as the other risks detailed in company filings with the Securities and Exchange Commission. AB International Group undertakes no obligation to update any statements in this press release for changes that happen after the date of this release.

Investor Relations Contact:

Charles Tang

(852) 2622 2891

corp@abqqs.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/8ba28f62-fe9e-45be-89c9-c8c7a2fa9707

https://www.globenewswire.com/NewsRoom/AttachmentNg/d08431cf-b411-4d9f-80d4-ca34f1320c5f