AmeriTrust Announces 2024 Annual Financial Results

Rhea-AI Summary

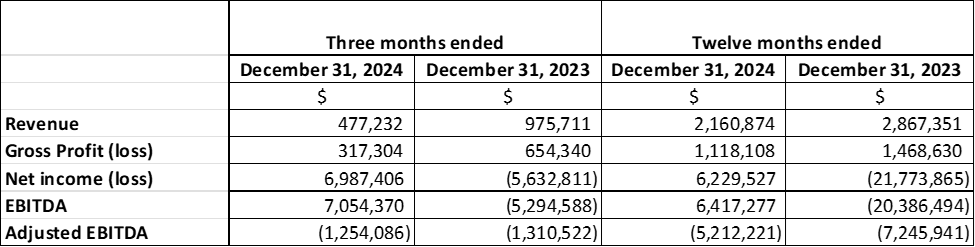

AmeriTrust Financial Technologies (OTCQB:AMTFF) has released its 2024 annual financial results, marking significant improvements in its financial position. Cash holdings increased to $10.2M from $1.9M in 2023, while working capital turned from a $15.9M deficit to a $4.0M surplus.

The company reported Q4 2024 revenue of $477,232, down from $975,711 in Q4 2023. However, AmeriTrust achieved net income of $6.2M for 2024, largely due to the removal of an $11.0M loss provision following portfolio review and credit union confirmation of no claims.

The company successfully raised over $13M through private placements during the year. AmeriTrust has resolved various legal and corporate challenges, improved credit union partnerships, and strengthened its management team. The company is currently in discussions with potential funding providers to support its automotive leasing technology platform.

Positive

- Net income of $6.2M for 2024

- Cash position increased to $10.2M from $1.9M YoY

- Working capital improved to $4.0M surplus from $15.9M deficit

- $13M raised through private placements

- Removal of $11.0M loss provision

Negative

- Q4 2024 revenue declined 51% YoY to $477,232

- Multiple lawsuits required resolution in 2024 and Q1 2025

- Funding arrangements still pending with potential providers

News Market Reaction 1 Alert

On the day this news was published, AMTFF gained 13.80%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

TORONTO, ON / ACCESS Newswire / April 14, 2025 / AmeriTrust Financial Technologies Inc. (TSXV:AMT)(OTCQB:AMTFF)(Frankfurt:1ZVA) ("AmeriTrust", "AMT" or the "Company"), a fintech platform targeting automotive finance, is announcing that it has filed its audited Consolidated Financial Statements and Management's Discussion and Analysis report for the years ended December 31, 2024, and 2023. These documents may be viewed under the Company's profile at www.sedarplus.ca.

Cash on hand at December 31, 2024, was

Revenue for the fourth quarter of 2024 decreased to

AmeriTrust's CEO Jeff Morgan commented: "When I returned to AmeriTrust one year ago the Company was facing many corporate, financial and legal issues that challenged its strategic plans and overall progress.

During the past year AmeriTrust was successful in closing on several private placements and raised over

Our new AmeriTrust Serves team has taken proactive steps to improve servicing, communication and collaboration with our primary credit union partners, working closely with them to resolve the issues that had previously resulted in a provision exceeding

During the past twelve months we were also able to resolve many existing and pending lawsuits, some of which are reflected in the Financial Statements at year end, and others that were resolved or settled in the first quarter of 2025.

With the recapitalization of the Company's Balance Sheet, the removal of the loss provision on lease contracts, the resolution of lawsuits, and the strengthening of our management team throughout the year, AmeriTrust is now in a much stronger corporate and financial position. As I have mentioned in a previous press release, we are currently in discussions with several potential funding providers and are working diligently to finalize funding and will keep all shareholders apprised as to our progress."

About AmeriTrust Financial Technologies Inc.

AmeriTrust Financial Technologies Inc., listed on the TSX Venture Exchange, OTCQB, and Frankfurt markets, is a finance solution and fintech provider disrupting the automotive industry. AmeriTrust's integrated, cloud-based transaction platform facilitates transactions amongst consumers, dealers, and funders. AmeriTrust's platform is being made available across the United States.

For further information, please visit the AmeriTrust website or contact:

Shibu Abraham

Chief Financial Officer and Director

E: info@ameritrust.com

P: 1-800-600-6872

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Non-IFRS Measures:

This news release makes reference to "EBITDA" and "Adjusted EBIDTA" which are non-IFRS financial measures. The Company believes that these measures provide investors with useful supplemental information about the financial performance of its business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating its business. Although management believes these financial measures are important in evaluating the Company's performance, they are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS. These non-IFRS financial measures do not have any standardized meaning and may not be comparable with similar measures used by other companies. For certain non-IFRS financial measures, there are no directly comparable amounts under IFRS. These non-IFRS financial measures should not be viewed as alternatives to measures of financial performance determined in accordance with IFRS. Moreover, presentation of certain of these measures is provided for year-over-year comparison purposes, and investors should be cautioned that the effect of the adjustments there to provided herein have an actual effect on the Company's operating results.

"EBITDA" is defined as Earnings before Interest, Taxation, Depreciation and Amortization. Management believes this is a useful metric in evaluating the ongoing operating performance of the Company.

"Adjusted EBITDA" is defined as Earnings before Interest, Taxation, Depreciation, Amortization, Share Based Compensation expense, Provision for expected credit loss on lease contracts and revision to the provision, foreign exchange loss, and other one-time costs is an additional measure used by management to evaluate cash flows and the Company's ability to service debt. Adjusted EBITDA is a non-IFRS measure and should not be considered an alternative to operating income or net income (loss) in measuring the Company's performance.

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements relating to the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects" and similar expressions. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding future plans and objectives of the Company, the intention to grow the business, operations, and existing and potential activities of the Company, future prospects of the Company, the ability of the Company to execute on its business plan and the anticipated benefits of the Company's business plan, negotiations with potential funding partners and the ability of the Company to secure additional funding, are forward looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements.

The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. As a result, we cannot guarantee that any forward-looking statement will materialize, and the reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated.

Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as at the date of this news release, and the Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by Canadian securities law.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States unless registered under the U.S. Securities Act and applicable state securities laws, unless an exemption from such registration is available.

SOURCE: AmeriTrust Financial Technologies Inc.

View the original press release on ACCESS Newswire