Amex More than Doubles Land Position to Control 500 km2 in the Abitibi Region

Rhea-AI Summary

Amex Exploration (OTCQX: AMXEF) agreed to acquire the Abbotsford and Hepburn projects and staked adjoining ground, boosting its Abitibi footprint from 19,972 ha to 50,108 ha (501.08 km2) and controlling approximately 70 km of Normétal-Burntbush strike. Consideration includes $150,000 cash, 600,000 shares escrowed over 36 months, a 0.5% gross overriding royalty, and contingent cash milestones of $1,000,000 and $500,000. The properties will be subject to an existing 1.5% NSR (assumed on closing), and closing remains subject to TSX Venture approval and standard conditions.

The package adjoins Perron (2.3 Moz resource) and Agnico ground and is positioned for an initial exploration program with potential synergies to the Perron PEA infrastructure.

Positive

- Land position increased to 50,108 ha (501.08 km2)

- Controls approximately 70 km of Normétal-Burntbush strike

- Adjoins Perron 2.3 Moz resource and Agnico ground

- Potential synergy with Perron PEA mine infrastructure

Negative

- Properties subject to aggregate 1.5% NSR plus 0.5% GORR

- Contingent milestone payments total $1.5M in cash

- Issuance of 600,000 shares subject to 36-month escrow (dilution)

News Market Reaction

On the day this news was published, AMXEF gained 4.01%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

While AMXEF was down 2.68% pre-news, key gold peers like SRBIF (+7.43%) and WRLGF (+5.57%) were up, suggesting stock-specific factors rather than a sector-wide move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 04 | Community engagement | Positive | -1.9% | Expanded community team, opened local offices, launched Perron community website. |

| Dec 01 | Land acquisition | Positive | +4.0% | Doubled land to 50,108 ha and secured 70 km of belt strike. |

| Nov 21 | Equity incentives | Neutral | +1.7% | Granted 3.25M stock options and 2.026M RSUs under incentive plan. |

| Nov 03 | Drilling program | Positive | +0.9% | Announced fully budgeted 2026 drilling up to 100,000m at Perron projects. |

| Oct 31 | Award and PEA | Positive | +3.3% | Won Discovery of the Year and shared high-IRR, high-NPV PEA metrics. |

Recent positive operational and recognition news often aligned with modest share price gains, though governance and community-related updates have occasionally seen negative or muted reactions.

Over the last few months, Amex reported multiple positive developments: a major land expansion to 50,108 ha on Dec 1, 2025, drilling plans of up to 100,000m, and a prestigious Discovery of the Year award with a robust PEA outlining an IRR 148.7% and C$3.2B NPV (5%). The company also advanced community engagement and granted equity incentives. Historically, operational growth and value-building milestones tended to coincide with upward price reactions, while corporate or community updates showed more mixed alignment.

Market Pulse Summary

This announcement highlighted Amex’s transformation into a major landholder in the Abitibi, expanding from 19,972 ha to 50,108 ha and securing about 70 km of greenstone belt strike. The transaction adds both exploration upside and additional royalty layers, with contingent payments tied to 1M+ oz resources and economic studies. Investors may watch for initial exploration programs, follow-up drilling results, and how these properties integrate with the existing Perron development plans.

Key Terms

gross overriding royalty financial

net smelter returns royalty financial

preliminary economic assessment technical

pre-feasibility study technical

feasibility study technical

National Instrument 43-101 regulatory

mineral resource technical

mineral reserve technical

AI-generated analysis. Not financial advice.

Becomes one of the largest land holders in the Abitibi region - holds 70 km along strike of Normétal-Burntbush greenstone belt

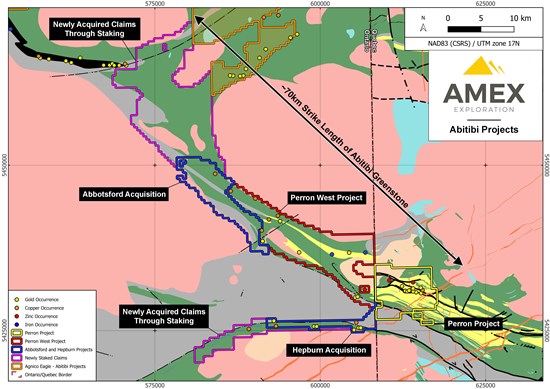

Montreal, Quebec--(Newsfile Corp. - December 1, 2025) - Amex Exploration Inc. (TSXV: AMX) (FSE: MX0) (OTCQX: AMXEF) ("Amex" or "the Company") is pleased to announce that it has entered into an asset purchase agreement (the "APA") with an arm's length vendor to acquire two projects immediately adjacent to the existing Amex land package, individually named the Abbotsford Project and the Hepburn Project (the "Transaction"). In addition to these acquisitions, the Company has acquired, through claim staking, the continuation of these greenstone belts, and now controls approximately 70 km of strike length of the prolific Abitibi greenstone belt (see Figure 1). When combined with the existing land holdings of Perron and Perron West, the Company will increase its footprint from 19,972 hectares (199.72 km2) to 50,108 hectares (501.08 km2).

Amex has extended its holdings to the northwest along the Normétal-Burntbush greenstone belt, which hosts Perron's 2.3 million ounce resource (see press release dated May 21, 2025).

Details of the acquisitions and claim staking are as follows:

- The Abbotsford Project consists of 242 claims for a total of 6,253.47 hectares;

- The Hepburn Project consists of 82 claims for a total of 2,139.45 hectares;

- 890 claims acquired though staking for the continuation of the Abbotsford project for a total of 18,753.17 hectares; and

- 141 claims acquired through claim staking for the continuation of the Hepburn project, for a total of 2,990.16 hectares.

Victor Cantore, President & CEO of Amex Exploration commented, "Based on our extensive exploration of the Perron property, we see the Normétal-Burntbush greenstone belt, which adjoins the Casa Berardi deformation zone to the northwest, as being extremely prospective for future gold and VMS discoveries. With these acquisitions, we have constructed a truly district scale land package which is controlled by one company, rarely seen in the Abitibi region. The Normétal-Burntbush greenstone belt remains heavily underexplored for gold, while holding several historical showings that never had substantial follow-up work. It is also exciting to now hold land adjoining the Casa Berardi break, which also contains important fertile structures that warrant further work."

The Amex land package now neighbours Agnico Eagle's Abitibi properties along the Casa Berardi break in Ontario. As can be seen in Figure 1, Agnico's project holds several gold showings along a NE-SW strike, of which any potential continuation of mineralization would be trending towards the new Amex claims. The Company looks forward to designing an initial exploration program on this underexplored package.

In addition to the continuation of the Normétal-Burntbush greenstone belt, the Company also acquired the Hepburn Project, and staked claims further to the west. The Hepburn Project contains mafic to intermediate metavolcanic rocks that hold numerous gold and copper showings which warrant further exploration work (See Figure 1).

Amex envisages that any future discoveries made on the new land package would have synergies with the proposed mine infrastructure on the Perron Project in Quebec (see updated PEA press release dated September 4, 2025 for more information).

Figure 1: Geological map of the Normétal-Burntbush greenstone belt adjoining the Casa Berardi deformation zone, showing the Perron and Perron West Projects as well as Amex's newly acquired and staked ground.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2667/276418_c998576cf43ee822_002full.jpg

Transaction Details

The Company, as purchaser, entered into the APA with an arm's length vendor to acquire the Abbotsford Project and the Hepburn Project (collectively, the "Properties"). Pursuant to the APA, the Company will:

(i) pay to the vendor aggregate cash consideration of

(ii) issue to the vendor a total of 600,000 common shares (each, a "Share") in capital of the Company, subject to certain contractual resale restrictions providing for a staggered release of the Shares from escrow over a 36-month period;

(iii) grant to the vendor a

(iv) make the following additional milestone payments to the vendor:

(a) a further

(b) a further

The Properties are currently subject to an existing

The Transaction remains subject to a number of closing conditions and post-closing obligations, including, the execution of the Royalty Agreement and certain deeds and instruments of conveyance, the approval of the TSX Venture Exchange, and standard closing conditions for transactions of this nature.

Qualified Persons and QAQC

The technical information in this news release has been reviewed and approved by Aaron Stone, P. Geo. (OGQ 2170 and PGO 3708) for the properties in Ontario and Jérôme Augustin P.Geo. Ph.D., (OGQ 2134) for the Perron Project in Quebec (collectively, the "Qualified Persons").

The potential grades of exploration targets discussed in this news release are conceptual in nature. The Qualified Persons have not completed sufficient work to verify historical information on the Properties and it is uncertain if further exploration will result in any targets being delineated as a mineral resource. The Company has not independently verified and cannot guarantee the accuracy or completeness of any third-party data discussed in this news release and investors should use caution in placing reliance on such information. The information provides an indication of the exploration potential of the Properties but may not be representative of expected results.

About Amex

Amex Exploration Inc. has made significant high-grade gold discoveries, along with copper-rich volcanogenic massive sulphide (VMS) zones, at its

When combined with the adjacent and contiguous Perron West Project in Ontario, which includes 35 claims (33 multi-cell and 2 single cell claims) for 134.55 km², the consolidated land package spans a district-scale 200.30 km². This extensive property lies within highly prospective geology favourable for both high-grade gold and VMS mineralization.

The Project benefits from excellent infrastructure: it is accessible by a year-round road, located just 30 minutes from an airport, and approximately 6.5 km from the Town of Normétal. It is also in close proximity to several process plants owned by major gold producers.

For further information please contact:

Victor Cantore

President and Chief Executive Officer

Amex Exploration: +1-514-866-8209

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements

This news release contains forward-looking statements. All statements, other than of historical facts, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future including, without limitation, planned exploration programs, the expected positive exploration results, the extension of mineralized zones, the ability of the Company to continue with exploration programs, the availability of the required funds to continue with the exploration, the Company's plans for further drilling and exploration, the Company's ability to obtain all required approvals to complete the Transaction, and potential mineralization or potential mineral resources are forward-looking statements. Forward-looking statements are generally identifiable by use of the words "will", "should", "continue", "expect", "anticipate", "estimate", "believe", "intend", "to earn", "to have', "plan" or "project" or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company's ability to control or predict, that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements. Factors that could cause actual results or events to differ materially from current expectations include, among other things, the historical estimates may turn out to be inaccurate; additional drilling and exploration may lead to a determination that there is no potentially viable mine plan for the Property; general business, economic, competitive, political and social uncertainties; delay or failure to receive board, shareholder or regulatory approvals, the possibility that future exploration results will not be consistent with the Company's expectations, general business and economic conditions, changes in world gold markets, sufficient labour and equipment being available, changes in laws and permitting requirements, unanticipated weather changes, title disputes and claims, environmental risks as well as those risks identified in the Company's annual Management's Discussion and Analysis. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described and accordingly, readers should not place undue reliance on forward-looking statements. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements except as otherwise required by applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276418