Battery X Metals Advances 2025 Critical Metals Exploration Strategy, Initiates NI 43-101 Report for Y Lithium Project, and Strengthens Financial Position

Battery X Metals (OTCQB:BATXF) has announced significant progress in its 2025 critical metals exploration strategy, focusing on its Y Lithium Project in Saskatchewan. The company has completed a high-resolution LiDAR survey costing $56,400 and initiated an NI 43-101 technical report estimated at $7,000.

The Y Lithium Project, spanning 5,856 hectares near Bailey Lake, represents a district-scale opportunity for hard rock lithium mineralization. The company has also finalized its acquisition of the Belanger Project with a final payment of $5,500, securing 100% interest subject to a 3% NSR.

Additionally, Battery X Metals has strengthened its financial position by settling outstanding debt of $544,425.18 through the issuance of units and shares at $0.24 per unit, including warrant coverage at $0.315 for a two-year term.

Battery X Metals (OTCQB:BATXF) ha annunciato importanti progressi nella sua strategia di esplorazione dei metalli critici per il 2025, concentrandosi sul progetto Y Lithium in Saskatchewan. L'azienda ha completato un rilievo LiDAR ad alta risoluzione del valore di 56.400 dollari e ha avviato una relazione tecnica NI 43-101 stimata a 7.000 dollari.

Il progetto Y Lithium, che si estende su 5.856 ettari vicino a Bailey Lake, rappresenta un'opportunità su scala distrettuale per la mineralizzazione del litio in rocce dure. L'azienda ha inoltre finalizzato l'acquisizione del progetto Belanger con un pagamento finale di 5.500 dollari, assicurandosi il 100% degli interessi, soggetto a un NSR del 3%.

In aggiunta, Battery X Metals ha rafforzato la propria posizione finanziaria estinguendo un debito residuo di 544.425,18 dollari tramite l'emissione di unità e azioni a 0,24 dollari per unità, includendo una copertura di warrant a 0,315 dollari con durata biennale.

Battery X Metals (OTCQB:BATXF) ha anunciado avances significativos en su estrategia de exploración de metales críticos para 2025, enfocándose en su Proyecto Y Lithium en Saskatchewan. La compañía ha completado un levantamiento LiDAR de alta resolución con un costo de 56,400 dólares e inició un informe técnico NI 43-101 estimado en 7,000 dólares.

El Proyecto Y Lithium, que abarca 5,856 hectáreas cerca del lago Bailey, representa una oportunidad a escala distrital para la mineralización de litio en roca dura. La compañía también ha finalizado la adquisición del Proyecto Belanger con un pago final de 5,500 dólares, asegurando un interés del 100% sujeto a un NSR del 3%.

Además, Battery X Metals ha fortalecido su posición financiera al saldar una deuda pendiente de 544,425.18 dólares mediante la emisión de unidades y acciones a 0.24 dólares por unidad, incluyendo cobertura de warrants a 0.315 dólares con un plazo de dos años.

Battery X Metals (OTCQB:BATXF)는 2025년 핵심 금속 탐사 전략에서 중요한 진전을 발표했으며, 사스카츄완에 위치한 Y 리튬 프로젝트에 집중하고 있습니다. 회사는 56,400달러 비용의 고해상도 LiDAR 조사를 완료하고, 약 7,000달러로 추산되는 NI 43-101 기술 보고서를 시작했습니다.

Y 리튬 프로젝트는 베일리 호수 인근의 5,856헥타르에 걸쳐 있으며, 경암 리튬 광상에 대한 지역 규모의 기회를 제공합니다. 또한 회사는 3% NSR 조건으로 100% 지분을 확보하는 최종 5,500달러 지불로 벨랑제 프로젝트 인수를 마무리했습니다.

추가로 Battery X Metals는 단위당 0.24달러에 단위 및 주식을 발행하고, 2년 기간의 0.315달러 워런트 보장을 포함하여 544,425.18달러의 미지급 부채를 상환함으로써 재무 상태를 강화했습니다.

Battery X Metals (OTCQB:BATXF) a annoncé des progrès significatifs dans sa stratégie d'exploration des métaux critiques pour 2025, en se concentrant sur son projet Y Lithium en Saskatchewan. La société a réalisé une enquête LiDAR haute résolution d'un coût de 56 400 dollars et a lancé un rapport technique NI 43-101 estimé à 7 000 dollars.

Le projet Y Lithium, couvrant 5 856 hectares près du lac Bailey, représente une opportunité à l'échelle du district pour la minéralisation du lithium en roche dure. La société a également finalisé l'acquisition du projet Belanger avec un paiement final de 5 500 dollars, assurant une participation de 100 % sous réserve d'un NSR de 3 %.

De plus, Battery X Metals a renforcé sa position financière en réglant une dette en souffrance de 544 425,18 dollars par l'émission d'unités et d'actions à 0,24 dollar par unité, incluant une couverture de bons de souscription à 0,315 dollar pour une durée de deux ans.

Battery X Metals (OTCQB:BATXF) hat bedeutende Fortschritte in seiner Strategie zur Erkundung kritischer Metalle für 2025 bekannt gegeben, mit Schwerpunkt auf dem Y Lithium-Projekt in Saskatchewan. Das Unternehmen hat eine hochauflösende LiDAR-Vermessung im Wert von 56.400 US-Dollar abgeschlossen und einen NI 43-101-Technikbericht mit geschätzten Kosten von 7.000 US-Dollar eingeleitet.

Das Y Lithium-Projekt erstreckt sich über 5.856 Hektar in der Nähe des Bailey Lake und stellt eine Chance im Distriktmaßstab für Hartgesteins-Lithiummineralisierung dar. Das Unternehmen hat zudem den Erwerb des Belanger-Projekts mit einer letzten Zahlung von 5.500 US-Dollar abgeschlossen und sich 100 % der Anteile gesichert, vorbehaltlich eines 3 % NSR.

Darüber hinaus hat Battery X Metals seine finanzielle Lage gestärkt, indem es ausstehende Schulden in Höhe von 544.425,18 US-Dollar durch die Ausgabe von Einheiten und Aktien zu je 0,24 US-Dollar pro Einheit beglichen hat, einschließlich einer Optionsabdeckung zu 0,315 US-Dollar für eine Laufzeit von zwei Jahren.

- None.

- Additional costs may be incurred for NI 43-101 report beyond initial $7,000 estimate

- Significant dilution from debt settlement through share issuance

- 3% NSR royalty obligation on Belanger Project

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, BC / ACCESS Newswire / August 1, 2025 / Battery X Metals Inc. (CSE:BATX)(OTCQB:BATXF)(FSE:5YW, WKN:A40X9W)("Battery X Metals" or the "Company") an energy transition resource exploration and technology company, announces that, its wholly-owned subsidiary, YY Resources Inc. ("YY Resources") has completed a high-resolution LiDAR (Light Detection and Ranging) and orthophoto survey program (the "LiDAR Survey") at its Y Lithium Project (the "Y Lithium Project") located in northern Saskatchewan, near Bailey Lake. An assessment report (the "Assessment Report") has been submitted to the Saskatchewan Ministry of Energy and Resources, and the Company has engaged an arm's-length geological consulting firm (the "Geological Consulting Firm") to prepare a National Instrument 43-101 ("NI 43-101") technical report on the Y Lithium Project.

Battery X Metals' Comprehensive 360° Strategy Across the Battery Metals Value Chain

As previously disclosed in the Company's news release dated February 24, 2025, Battery X Metals is advancing a comprehensive 360° strategy across the battery metals sector. This strategy encompasses the exploration of prospective battery metal properties; the development of proprietary recovery technologies pursued through a prior research collaboration with a globally ranked top 20 university to recover battery-grade materials from end-of-life batteries;1 and the development and future commercialization of patent-pending software and hardware technology for the extension of remaining useful lifespan of electric vehicle batteries.

The Company's strategic exploration initiatives during the 2025 season are intended to focus its efforts and reinforce its commitment to innovation across the battery metals value chain.

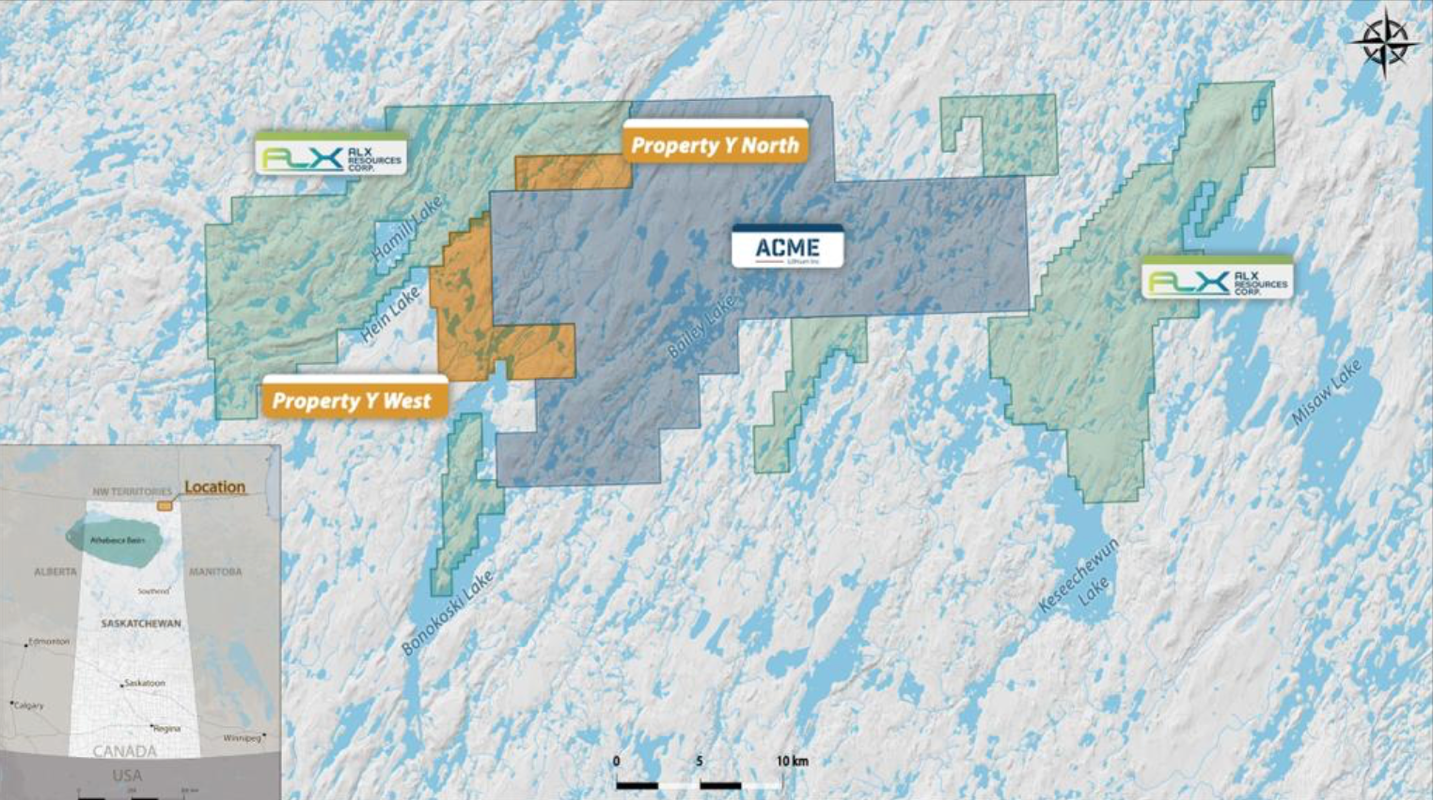

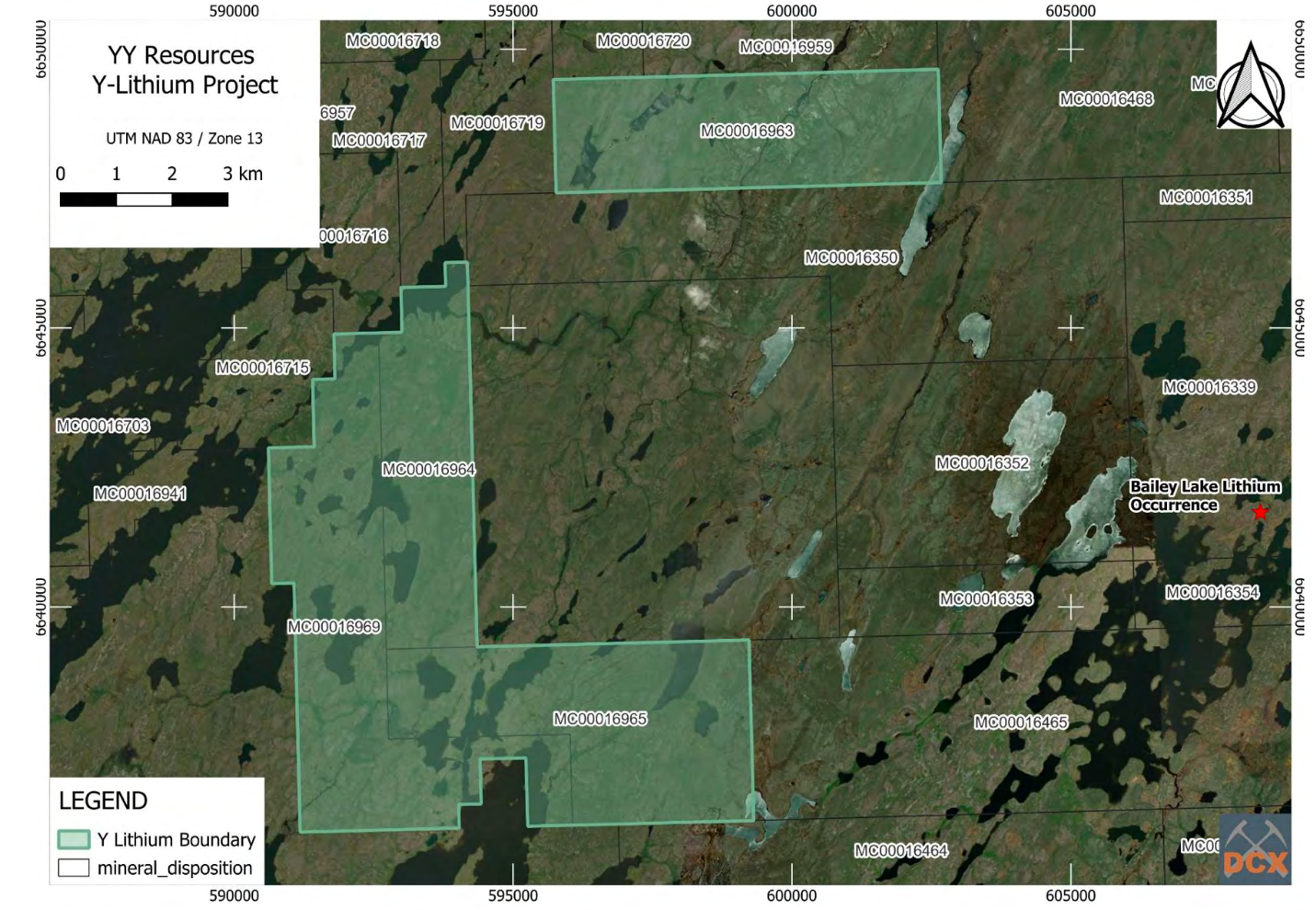

The Y Lithium Project is located in a remote and underexplored region near Bailey Lake, approximately 160 kilometers northeast of Stony Rapids and 10 kilometers south of the Saskatchewan/Northwest Territories border. The project comprises four mineral claims across two distinct blocks, covering a total area of approximately 5,856 hectares. It forms a core part of Battery X Metals' 2025 exploration strategy targeting high-potential lithium-bearing projects in North America. Notably, the Bailey Lake lithium occurrence is situated approximately 10 kilometers east of the Y Lithium Project's central claim area.

To support the evaluation and advancement of the Y Lithium Project's critical battery metal potential, YY Resources has engaged the Geological Consulting Firm to commission a NI 43-101 technical report. The NI 43-101 technical report is expected to provide a formal geological assessment of the property and serve as the foundation for future exploration planning, technical disclosure, and potential development. The estimated cost of the report is approximately

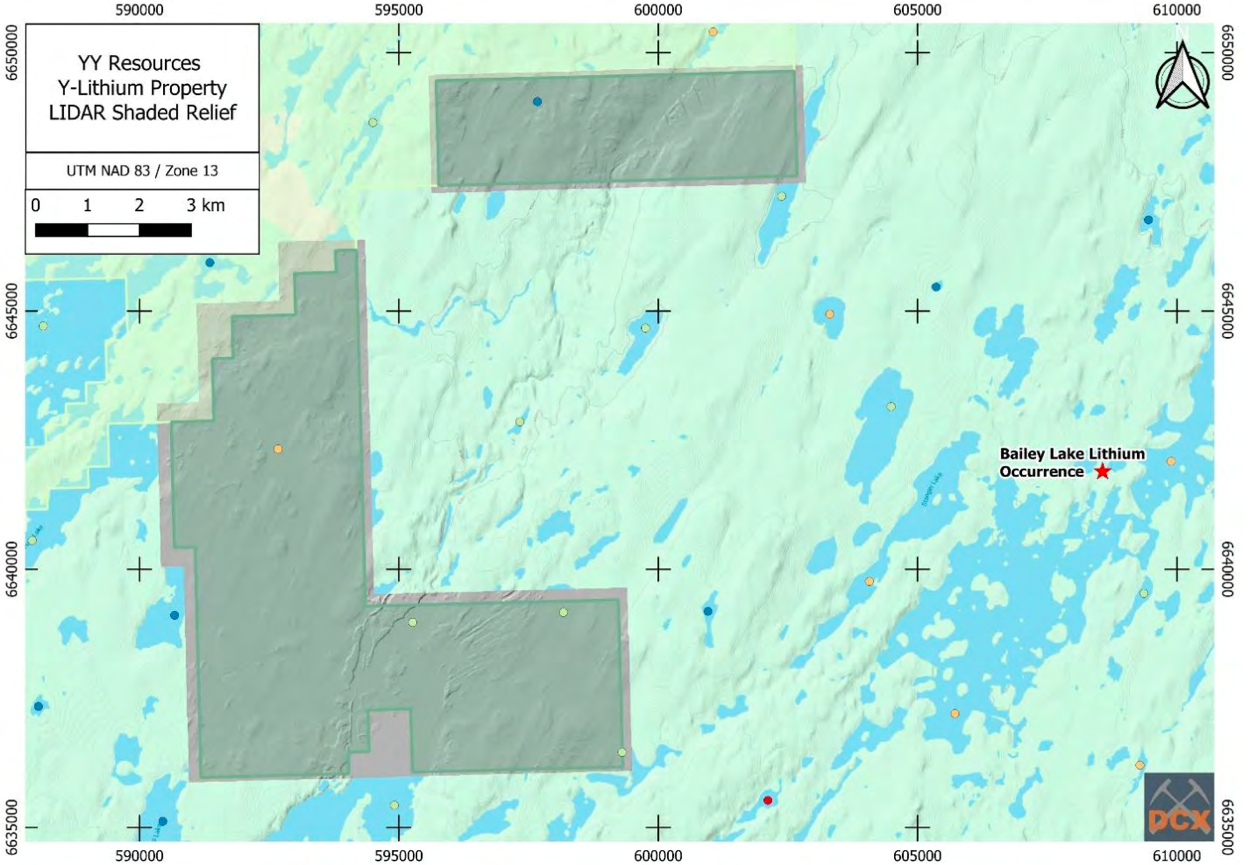

The completion of the LiDAR Survey represents a key milestone in the Company's 2025 exploration program. The total cost of the survey was

Notably, the LiDAR Survey qualifies for a 1.5x exploration expenditure credit under Saskatchewan's mineral exploration incentive program. As a result, YY Resources is able to apply a total of

Interpretation and Recommendations of the LiDAR Survey

The Y Lithium Project is a district-scale property with the potential to host hard rock lithium mineralization. It is situated within the Ennadai Greenstone Belt, which begins in the project area and extends northeast into the Northwest Territories. The recent discovery of spodumene-bearing boulders at Bailey Lake underscores the lithium prospectivity of this underexplored region.

The LiDAR Survey is expected to play a critical role in identifying glacial features, potential outcrop, and boulder trains across the property. When integrated with available government data, the survey is expected to support the delineation of lithological contacts and structural corridors to be targeted in future exploration programs. Additionally, orthophotos generated from the LiDAR Survey are expected to highlight boulder trains and other high-potential features to potentially support a focused Phase I mapping and sampling program.

YY Resources may proceed with a multi-phase exploration approach in the future. If advanced, future exploration work is anticipated to include data compilation and desktop analysis, such as the review of historical till and sediment sampling, geophysical surveys, regional mapping, and glacial ice flow directions. These inputs would be intended to support YY Resources' ongoing efforts to refine exploration targeting and unlock value at the Y Lithium Project.

Belanger Project

The Company also announces that, further to its news releases dated November 29, 2024, in which it disclosed the execution of an addendum agreement (the "Belanger Addendum Agreement") with the optionor of the Belanger Project, Bounty Gold Corp. ("Bounty Gold"), an arm's-length third party, to acquire a

With the completion of the Final Payment, the Company has satisfied all payment obligations under the Belanger Addendum Agreement and has earned a

The Belanger Project, located in Ontario's Birch-Uchi Greenstone Belt near Red Lake, spans 109 unpatented mining claims across Belanger, Bowerman, Knott, and Mitchell townships. Situated within the Uchi Subprovince of the Superior Province of the Canadian Shield, the property lies in a geologically favorable region.

Debt Settlement

The Company also announces that, further to its news release dated July 18, 2025, it has settled outstanding indebtedness in the aggregate amount of

$446,603.75 in consideration for the issuance of an aggregate of 1,860,844 units of the Company (each, a "Debt Settlement Unit") at a deemed price of$0.24 per Debt Settlement Unit. Each Debt Settlement Unit consists of one common share of the Company (each, a "Debt Share") and one transferable common share purchase warrant (each, a "Debt Settlement Warrant"). Each Debt Settlement Warrant is exercisable to acquire one additional common share of the Company (each, a "Debt Settlement Warrant Share") at an exercise price of$0.31 5 per Debt Settlement Warrant Share for a period of two (2) years from August 1, 2025.

$97,821.43 in consideration for the issuance of an aggregate of 407,587 Debt Shares at a deemed price of$0.24 per Debt Share.

The securities issued under the Debt Settlement will be subject to a statutory hold period expiring December 2, 2025.

The Debt Settlements with Massimo Bellini Bressi, Martino Ciambrelli, John Campbell and Howard Blank (together, the "Insider Settlements") are "related party transactions" within the meaning of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Insider Settlements are exempt from the valuation requirement of MI 61-101 by virtue of the exemptions contained in section 5.5(b) of MI 61-101 as the Company's common shares are not listed on a specified market and from the minority shareholder approval requirements of MI 61-101 by virtue of the exemption contained in section 5.7(1)(a) of MI 61-101 in that the fair market value of the Insider Settlements will not exceed

None of the securities acquired in the Debt Settlement will be registered under the United States Securities Act of 1933, as amended (the "1933 Act"), and none of them may be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the 1933 Act. This news release shall not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of the securities in any state where such offer, solicitation, or sale would be unlawful.

Qualified Persons

In accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects, Jason Arnold, P.Geo., President of DCX Geological Consulting and an independent Qualified Person, is the Qualified Person for the Company and has prepared, validated and approved the technical and scientific content of this news release. The Company strictly adheres to CIM Best Practices Guidelines in conducting, documenting, and reporting activities on its projects.

1 The initial research and collaboration agreement concluded on June 30, 2025. the Company is evaluating a new agreement with the globally ranked top 20 university to continue and expand its prior development work.

About Battery X Metals Inc.

Battery X Metals (CSE:BATX)(OTCQB:BATXF)(FSE:5YW, WKN:A40X9W) is an energy transition resource exploration and technology company committed to advancing domestic and critical battery metal resource exploration and developing next-generation proprietary technologies. Taking a diversified, 360° approach to the battery metals industry, the Company focuses on exploration, lifespan extension, and recycling of lithium-ion batteries and battery materials. For more information, visit batteryxmetals.com.

On Behalf of the Board of Directors

Massimo Bellini Bressi, Director

For further information, please contact:

Massimo Bellini Bressi

Chief Executive Officer

Email: mbellini@batteryxmetals.com

Tel: (604) 741-0444

Disclaimer for Forward-Looking Information

This news release contains forward-looking statements within the meaning of applicable securities laws. Forward-looking statements in this release include, but are not limited to, statements regarding the exploration activities of the Company, the anticipated actions of YY Lithium, the exploration of the Y Lithium Project, the results of the LiDAR Survey and the impact of such results within the Company, the future potential exploration efforts and preparation of an NI 43-101 Technical Report for the Y Lithium Project, the Company's research collaborations with third parties, the future rights related to the Net Smelter Returns Royalty on the Belanger Project; any future development or commercial production scenarios relating to the Belanger Project; the anticipated impact of the completed Debt Settlement on the Company's financial position, the participation of related parties, the availability of exemptions under MI 61-101, and other future outcomes related to the transaction. Forward-looking statements reflect management's current beliefs, expectations, and assumptions based on available information as of the date of this release. These statements are subject to known and unknown risks, uncertainties, and other factors that may cause actual results, performance, or achievements to differ materially from those expressed or implied by such forward-looking statements. These risks include, but are not limited to, general economic, market, and regulatory conditions, risks posed by environmental changes, the risk that commercial production at the Belanger Project may never occur, and the risk that the intended benefits of the Debt Settlement may not be realized as expected. Additional risks and uncertainties are discussed in the Company's filings on SEDAR+. The forward-looking statements in this news release are made as of the date hereof, and Battery X Metals disclaims any intention or obligation to update or revise such statements, except as required by law. Investors are cautioned not to place undue reliance on these forward-looking statements.

SOURCE: Battery X Metals

View the original press release on ACCESS Newswire