Biodexa Licenses Phase 1 Ready Drug Candidate from Otsuka for Rare Stomach Cancer

Rhea-AI Summary

Biodexa (NASDAQ:BDRX) licensed MTX240, a Phase 1–ready molecular glue for gastrointestinal stromal tumors (GIST), from Otsuka on February 19, 2026.

MTX240 showed dose-dependent preclinical efficacy in TKI-resistant and non-resistant GIST models, is eligible for US/EU Orphan Drug exclusivity, has composition‑of‑matter patents through 2037, and a Phase 1b/2a trial is planned by year-end.

Positive

- Exclusive global rights (ex‑Japan) to MTX240 licensed from Otsuka

- Phase 1b/2a start planned by year‑end to evaluate TKI‑resistant patients

- Orphan Drug eligible with US 7‑year and EU 10‑year exclusivity potential

- Patents through 2037 covering MTX240 composition of matter

- Preclinical efficacy in dose‑dependent shrinking of TKI‑resistant GIST

Negative

- No clinical human data yet; efficacy demonstrated only in preclinical PDX models

- Japan rights retained by Otsuka, limiting Biodexa’s full global commercial upside

- Financial terms include undisclosed upfront fee and royalty/milestone structure

Key Figures

Market Reality Check

Peers on Argus

Biotech peers showed mixed moves, with names like GLTO up 5.9% and DRMA down 3.13%. With 2 peers up and 2 down in momentum scans, activity points to broader small-cap biotech rotations rather than a tightly aligned GIST-specific trade.

Previous Clinical trial Reports

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Feb 04 | GIST asset license | Positive | -11.0% | Exclusive license of Phase 1–ready MTX240 molecular glue for GIST. |

| Dec 01 | Phase 3 enrolment | Positive | +2.2% | First European patients enrolled into pivotal Phase 3 Serenta FAP trial. |

| Nov 24 | EU site activation | Positive | -1.4% | First European site activated for registrational Phase 3 Serenta FAP trial. |

| Nov 03 | CTA approval | Positive | -2.4% | EMA approves CTA for Phase 3 Serenta FAP study across multiple EU countries. |

| Sep 08 | Phase 3 initiation | Positive | -5.8% | Phase 3 eRapa trial for FAP initiated with expanded non-dilutive funding. |

Clinical and pipeline milestones have often seen muted-to-negative price reactions, with an average move of -3.68% across recent clinical-trial-tagged news and only one clearly positive alignment.

Over the last several months, Biodexa has focused on advancing its GI-oncology strategy. It initiated and expanded the pivotal Phase 3 Serenta trial of eRapa for FAP, securing a $20 million grant and multiple European approvals and site activations. More recently, it licensed Otsuka’s OPB-171775, now MTX240, a Phase 1–ready molecular glue for GIST. Those earlier MTX240 license and Serenta progression updates often coincided with flat or negative price moves, framing today’s article as part of an ongoing shift toward rare GI cancers.

Historical Comparison

Clinical-trial news has produced an average move of -3.68% across 5 prior events, indicating that upbeat trial or licensing updates have not consistently driven sustained upside.

Tag-matched history shows Biodexa progressing eRapa from Phase 3 initiation to broad EU activation while layering in MTX240 for GIST, signaling a deepening focus on rare GI oncology indications.

Market Pulse Summary

This announcement details Biodexa’s in-licensed GIST candidate MTX240, a Phase 1–ready molecular glue designed to trigger apoptosis in TKI-resistant tumors, backed by patents to 2037 and potential 7–10 years of Orphan exclusivity. It complements the ongoing Phase 3 eRapa program in FAP, reinforcing a GI-oncology focus. Investors may watch for initiation of the planned Phase 1b/2a trial, regulatory designations, and how the company funds and sequences MTX240 alongside existing late-stage commitments.

Key Terms

gastrointestinal stromal tumors medical

tyrosine kinase inhibitors medical

molecular glue technical

apoptosis medical

Orphan Drug designation regulatory

AI-generated analysis. Not financial advice.

MTX240's mechanistic novelty may give it a long-awaited edge in treatments for gastrointestinal stromal tumors (GIST)

Meg Flippin, Benzinga Staff Writer

CARDIFF, UK / ACCESS Newswire / February 19, 2026 / Biodexa Pharmaceuticals PLC (NASDAQ:BDRX), a clinical-stage biopharmaceutical company developing a pipeline of innovative products for the treatment of rare diseases with an increasing focus on products to treat or prevent gastrointestinal cancers, has added a new Phase 1 ready candidate to its portfolio, this time to target gastrointestinal stromal tumors, or GIST.

Several drugs are available to treat GIST, but all ultimately fail when the tumor develops resistance. When that occurs, median overall survival drops to less than a year. The value and hope of a better drug is at least partially evidenced by the eye-popping

MTX240's unique molecular glue mechanism of action separates it from the current standard of care, notes Stephen Stamp, CEO of Biodexa. "It has the potential to benefit a broader spectrum of GIST patients, including those with TKI-resistant disease, and it strategically aligns with our emerging GI/oncology pipeline which includes our ongoing phase 3 development of eRapa in Familial Adenomatous Polyposis."

What is GIST?

GIST is a hard-to-treat tumor that grows mainly in the stomach wall and is caused by mutations in the so-called Interstitial Cells of Cajal (ICCs) which facilitate gut motility. Mutations in the key tyrosine kinase proteins KIT or PDGFR perturb intra-cellular signaling pathways in ICCs, causing rapid cell proliferation and tumorgenesis. Patients typically undergo resection but, once the GIST becomes unmanageable or the tumors are unresectable, targeted treatments called tyrosine kinase inhibitors (TKIs) are the current standard of care.

Current standard of care

Currently, there are four approved TKI treatments for GIST, generally prescribed in the following order as GIST mutations occur and patients acquire resistance to each of them - (1) imatinib (Gleevec) from Novartis AG (NVS); (2) sunitinib (Sutent) from Pfizer Inc. (PFE); (3) regorafenib (Stivarga) from Bayer AG. (BAYN); and (4) ripretinib (Qinlock) from Deciphera Pharmaceuticals Inc (DCPH).

Once patients have cycled through the available TKIs, having acquired resistance to all of them, median time to tumor progression is 1.2 months and median overall survival is 9.8 months.

As a result of these shortcomings, drug developers, including Biodexa, are jockeying for position in what is currently a

Biodexa's novel drug candidate - MTX240

Enter MTX240, Biodexa's latest developmental treatment, which it recently licensed from Otsuka Pharmaceutical Co., Ltd. MTX240 is a novel molecular glue that works by forcing PDE3A and SLFN12, two proteins expressed in GIST cells to bind together, in turn triggering the tumor cells to self-destruct in a process called apoptosis. Importantly, healthy ICCs do not significantly express either of these proteins and are not therefore affected by MTX240.

Unlike the TKIs that frequently fail once the tumor cells mutate, and render the drug ineffective, MTX240's unique mechanism of action is designed to work whether or not the GIST has acquired secondary mutations.

Early success and promise

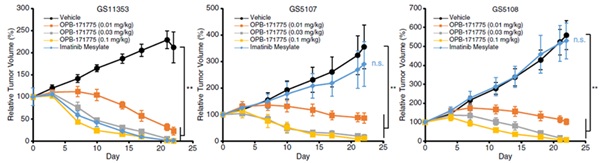

In preclinical PDX models, which use human tumor tissues to mirror real-world genetic complexity, MTX240 demonstrated dose-dependent efficacy in shrinking GIST in both non-resistant (left hand chart) and TKI-resistant tumors (middle and right hand chart) as illustrated below [3]:

Note: MTX240 was coded OPB-171775 by Otsuka in the charts.

If the preclinical results are replicated in clinical trials and MTX240 proves to be lethal to GIST without inducing resistance, it has the potential for co-administration with TKIs and ultimately, to replace the entire class.

MTX240 is eligible for FDA and EU Orphan Drug designation, which means the company is eligible for seven and 10 years of market exclusivity upon approval in the US and EU, respectively. In addition, MTX240 has issued Composition of Matter patents extending through 2037.

Next steps

Next step is to manufacture clinical trial supplies of MTX240 and then initiate a Phase 1b/2a study by year-end. The study is expected to be in two parts: a standard dose escalation part to determine a maximum tolerated dose, followed by an extension part. The extension part is likely to enrol patients with TKI-resistant GIST. By focusing on this high-need population, Biodexa is aiming to rapidly validate MTX240's potential as a way to treat patients who don't respond to the current standards of care.

Deal validation

Biodexa in-licensed exclusive worldwide rights to MTX240 with the exception of Japan rights, which were retained by Otsuka for an undisclosed upfront fee. The deal includes one modest development milestone, low double digit approval milestones and mid single-digit tiered royalties.

Biodexa's entrance into the GIST market with MTX240 puts it in a space that's garnering interest from Big Pharma as well as Wall Street. Take GSK Plc. (GSK) as one example. In January 2025 GSK paid

With Biodexa showing promising initial results with MTX240, this is a treatment investors may want to pay attention to. To learn more about Biodexa and MTX240, click here.

References:

DataBridge Market Research. (2023). Gastrointestinal stromal tumor market size, trends and forecasts (2024-2032). Retrieved from https://www.databridgemarketresearch.com/reports/global-gastrointestinal-stromal-tumor-market

Zhu, H., et al. (2023). Update of epidemiology, survival and initial treatment in gastrointestinal stromal tumor: A population-based analysis. BMJ Open, 13(7), e072945. https://doi.org/10.1136/bmjopen-2023-072945

Takaki, E. O., et al. (2024). A PDE3A-SLFN12 molecular glue exhibits significant antitumor activity in TKI-resistant gastrointestinal stromal tumors. Clinical Cancer Research. https://doi.org/10.1158/1078-0432.CCR-24-0096

GSK. (2025, January 13). GSK enters agreement to acquire IDRx, Inc. https://www.gsk.com/en-gb/media/press-releases/gsk-enters-agreement-to-acquire-idrx-inc

Talk Bio. (2025, November 11). Cogent Biosciences soars on positive Phase 3 PEAK results in gastrointestinal stromal tumors (GIST). Cogent Biosciences Stock Soars

346% in a Year, but One Fund Just Sold Off$4.5 Million Cogent Biosciences, Inc. (2025, November 10). Cogent Biosciences reports positive results from bezuclastinib PEAK Phase 3 trial in gastrointestinal stromal tumors (GIST). https://investors.cogentbio.com/news-releases/news-release-details/cogent-biosciences-reports-positive-results-bezuclastinib-peak

Featured image from Shutterstock.

This post contains sponsored content. This content is for informational purposes only and is not intended to be investing advice. Please see 17(b) disclosure here for more information.

Click here for more information on Biodexa Pharmaceuticals.

Contact:

Stephen Stamp, CEO, CFO

ir@biodexapharma.com

Important notice, please read: Certain statements in this article may constitute "forward-looking statements" within the meaning of legislation in the United Kingdom and/or United States. Such statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and are based on management's belief or interpretation. All statements contained in this article that do not relate to matters of historical fact should be considered forward-looking statements. In certain cases, forward-looking statements can be identified by the use of words such as "plans", "expects" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved." Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of the Company to control or predict, that may cause their actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein.

Reference should be made to those documents that Biodexa shall file from time to time or announcements that may be made by Biodexa in accordance with the rules and regulations promulgated by the SEC, which contain and identify other important factors that could cause actual results to differ materially from those contained in any projections or forward-looking statements. These forward-looking statements speak only as of the date of this article. All subsequent written and oral forward-looking statements by or concerning Biodexa are expressly qualified in their entirety by the cautionary statements above. Except as may be required under relevant laws in the United States, Biodexa does not undertake any obligation to publicly update or revise any forward-looking statements because of new information, future events or events otherwise arising.

SOURCE: Biodexa Pharmaceuticals PLC

View the original press release on ACCESS Newswire