'Stage 1' Resources at Central Gawler Mill Grow to 223koz Au

Barton Gold Holdings (OTCQB:BGDFF) has announced an updated Mineral Resource Estimate (MRE) for its Challenger Gold Project in South Australia. The MRE has grown to 223,000 ounces of gold at a grade of 0.72 g/t Au from 9.56 million tonnes of material, including 81,200 ounces contained in existing high-grade open pit zones.

The company is targeting feasibility studies by the end of 2025 and plans to commence initial 'Stage 1' operations by the end of 2026. A key focus is the potential reprocessing of Tailings Storage Facility 1 (TSF1), which contains higher-grade gold mineralization around its periphery, with drill results showing intervals such as 20m @ 0.70 g/t Au and 21m @ 0.66 g/t Au.

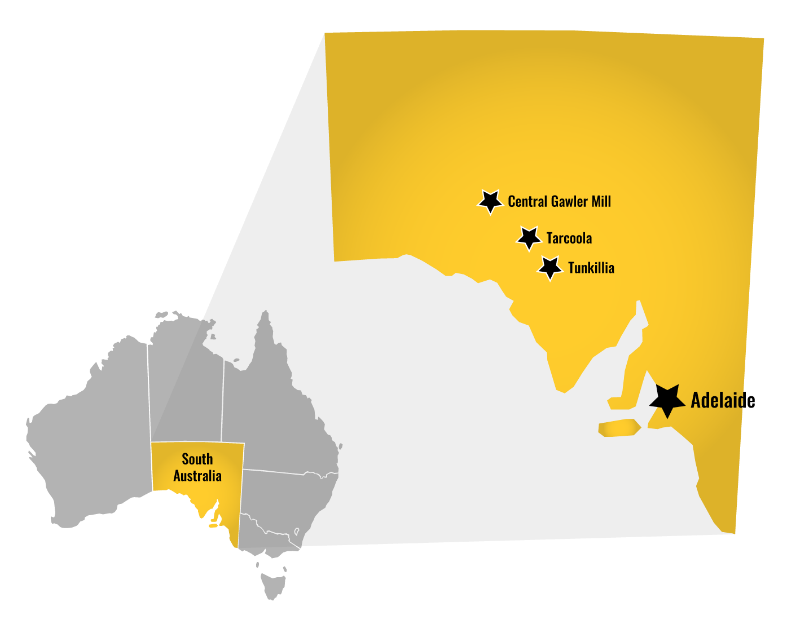

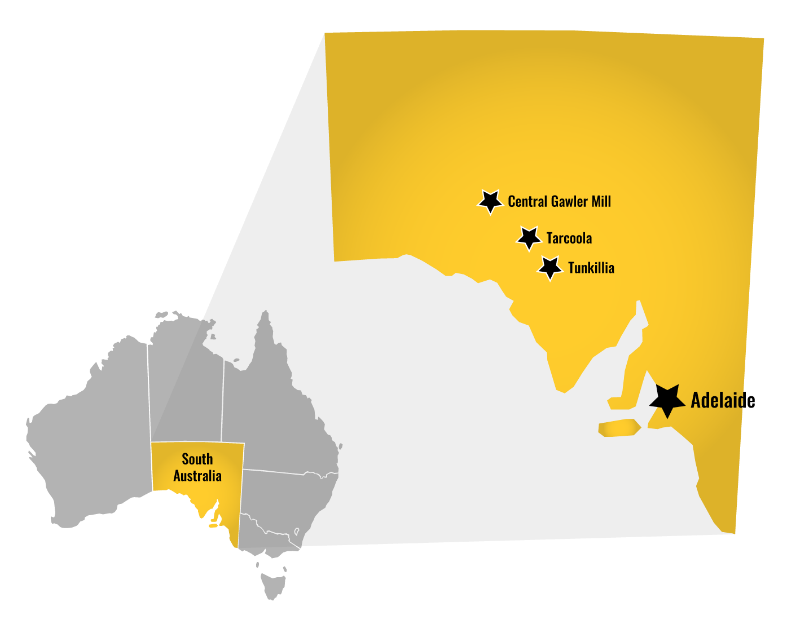

The company's strategy centers on utilizing its fully permitted Central Gawler Mill to process lower-cost and lower-risk mill feed from various sources near the facility.

Barton Gold Holdings (OTCQB:BGDFF) ha annunciato una stima aggiornata delle risorse minerarie (MRE) per il suo progetto Challenger Gold in Australia Meridionale. La MRE è cresciuta fino a 223.000 once d'oro con una gradazione di 0,72 g/t Au da 9,56 milioni di tonnellate di materiale, includendo 81.200 once contenute nelle zone esistenti di cava a cielo aperto ad alta gradazione.

L'azienda punta a completare studi di fattibilità entro la fine del 2025 e prevede di avviare le operazioni iniziali della 'Fase 1' entro la fine del 2026. Un aspetto chiave è il potenziale riprocessamento della struttura di stoccaggio scarti 1 (TSF1), che contiene mineralizzazione aurifera ad alta gradazione lungo il suo perimetro, con risultati di perforazione che mostrano intervalli come 20m @ 0,70 g/t Au e 21m @ 0,66 g/t Au.

La strategia dell'azienda si basa sull'utilizzo del proprio mulino Central Gawler, completamente autorizzato, per trattare alimentazioni di mulino a basso costo e rischio provenienti da diverse fonti nelle vicinanze dell'impianto.

Barton Gold Holdings (OTCQB:BGDFF) ha anunciado una actualización de la Estimación de Recursos Minerales (MRE) para su proyecto Challenger Gold en Australia del Sur. La MRE ha aumentado a 223,000 onzas de oro con una ley de 0,72 g/t Au a partir de 9,56 millones de toneladas de material, incluyendo 81,200 onzas contenidas en las zonas existentes de cantera a cielo abierto de alta ley.

La compañía apunta a estudios de factibilidad para finales de 2025 y planea iniciar las operaciones iniciales de la 'Etapa 1' para finales de 2026. Un foco clave es el potencial reprocesamiento de la Instalación de Almacenamiento de Relaves 1 (TSF1), que contiene mineralización aurífera de mayor ley en su periferia, con resultados de perforación que muestran intervalos como 20m @ 0,70 g/t Au y 21m @ 0,66 g/t Au.

La estrategia de la compañía se centra en utilizar su molino Central Gawler, completamente autorizado, para procesar alimentación de molino de bajo costo y menor riesgo proveniente de varias fuentes cercanas a la instalación.

Barton Gold Holdings (OTCQB:BGDFF)는 남호주에 위치한 챌린저 골드 프로젝트의 업데이트된 광물 자원 추정치(MRE)를 발표했습니다. MRE는 956만 톤의 광석에서 등급 0.72 g/t Au로 223,000 온스의 금으로 증가했으며, 기존 고등급 노천 광구에 포함된 81,200 온스도 포함되어 있습니다.

회사는 2025년 말까지 타당성 조사를 목표로 하며, 2026년 말까지 초기 '1단계' 운영을 시작할 계획입니다. 주요 관심사는 주변부에 더 높은 등급의 금 광물이 포함된 Tailings Storage Facility 1 (TSF1)의 재처리 가능성으로, 시추 결과 20m @ 0.70 g/t Au 및 21m @ 0.66 g/t Au 구간이 나타났습니다.

회사의 전략은 완전 허가를 받은 Central Gawler 밀을 활용하여 시설 인근의 다양한 출처로부터 저비용·저위험의 밀 공급원을 처리하는 데 중점을 두고 있습니다.

Barton Gold Holdings (OTCQB:BGDFF) a annoncé une mise à jour de son estimation des ressources minérales (MRE) pour son projet Challenger Gold en Australie-Méridionale. La MRE a augmenté pour atteindre 223 000 onces d'or à une teneur de 0,72 g/t Au à partir de 9,56 millions de tonnes de matériau, incluant 81 200 onces contenues dans les zones de carrière à ciel ouvert à haute teneur existantes.

L'entreprise vise des études de faisabilité d'ici la fin 2025 et prévoit de commencer les opérations initiales de la 'Phase 1' d'ici la fin 2026. Un point clé est le potentiel de retraitement du dépôt de résidus Tailings Storage Facility 1 (TSF1), qui contient une minéralisation aurifère à plus haute teneur sur sa périphérie, avec des résultats de forage montrant des intervalles tels que 20m @ 0,70 g/t Au et 21m @ 0,66 g/t Au.

La stratégie de l'entreprise repose sur l'utilisation de son moulin Central Gawler entièrement autorisé pour traiter des matières premières à moindre coût et à moindre risque provenant de différentes sources proches de l'installation.

Barton Gold Holdings (OTCQB:BGDFF) hat eine aktualisierte Schätzung der Mineralressourcen (MRE) für sein Challenger Gold Projekt in Südaustralien bekannt gegeben. Die MRE ist auf 223.000 Unzen Gold mit einem Gehalt von 0,72 g/t Au aus 9,56 Millionen Tonnen Material angewachsen, einschließlich 81.200 Unzen, die in bestehenden hochgradigen Tagebauzonen enthalten sind.

Das Unternehmen strebt Machbarkeitsstudien bis Ende 2025 an und plant, die ersten 'Phase 1'-Operationen bis Ende 2026 zu starten. Ein Schwerpunkt liegt auf der möglichen Wiederaufbereitung der Tailings Storage Facility 1 (TSF1), die eine höhergradige Goldmineralisierung an ihrem Rand enthält, wobei Bohrergebnisse Intervalle wie 20m @ 0,70 g/t Au und 21m @ 0,66 g/t Au zeigen.

Die Strategie des Unternehmens konzentriert sich darauf, die voll genehmigte Central Gawler Mühle zu nutzen, um kostengünstiges und risikoarmes Mahlgut aus verschiedenen Quellen in der Nähe der Anlage zu verarbeiten.

- Updated MRE shows significant resource of 223,000 ounces of gold

- Company owns fully permitted Central Gawler Mill, reducing development costs

- Higher-grade gold mineralization identified in TSF1 for potential reprocessing

- Clear timeline for feasibility studies (end of 2025) and operations (end of 2026)

- Relatively low overall gold grade of 0.72 g/t Au

Priority focus on higher-grade tailings and open pit materials

ADELAIDE, AUSTRALIA / ACCESS Newswire / June 29, 2025 / Barton Gold Holdings Limited (ASX:BGD)(FRA:BGD3)(OTCQB:BGDFF) (Barton or Company) is pleased to announce an updated MRE for its South Australian Challenger Gold Project (Challenger).

Challenger JORC (2012) Mineral Resources Estimate (MRE) grow to 223koz gold (9.56Mt @ 0.72 g/t Au), including 81,200oz Au contained in the existing high-grade open pit zones.

Barton has identified several potential sources of economically viable gold mineralisation adjacent to the Central Gawler Mill for use as lower-cost and lower-risk 'Stage 1' mill feed, and is targeting feasibility studies by the end of 2025, with initial 'Stage 1' operations by the end of 2026.

Barton is also evaluating the potential to reprocess (in particular) Tailings Storage Facility (TSF) 1 to extract gold as a part of Stage 1 operations. TSF1 was constructed in 2002 and decommissioned during 2009, during which time it serviced open pit mining operations from Challenger Main and the highest-grade portion of the historical U/G mine. This highest-grade mineralisation was processed last during the operation of TSF1, resulting in a higher-grade ring of mineralisation located around the periphery of TSF1 where discharge spigots were located. Examples of the consolidation of higher-grade mineralisation around the periphery of TSF1 include:

Hole ID | Interval | Including: |

CHB0044 | 20m @ 0.70 g/t Au from 2 metres | 1m @ 1.29 g/t Au from 11 metres |

CHB0047 | 21m @ 0.66 g/t Au from 2 metres | 10m @ 0.88 g/t Au from 3 metres |

CHB0056 | 19m @ 0.66 g/t Au from 2 metres | 4m @ 1.05 g/t Au from 5 metres |

CHB0084 | 19m @ 0.75g/t Au from 2 metres | 3m @ 1.06 g/t Au from 10 metres |

Table - Select Challenger TSF1 higher-grade intervals from 2023 and 2025 validation drilling

Commenting on the JORC Mineral Resources update, Barton MD Alexander Scanlon said:

"As indicated to the market for the past ~24 months, we have been analysing the potential for JORC Mineral Resources in the immediate vicinity of our fully permitted Central Gawler Mill. This infrastructure is a significant leverage point for BGD's investors, and provides the option for a shorter, lower-cost, and lower-risk pathway to operations and the re-rating of BGD to 'producer' status. There is significant arbitrage value in this 'real option'.

"With the sustained upward move in gold prices, we will now look to exercise that option. During the balance of 2025 we will complete feasibility analyses to determine the preferred development pathway, with the objective to commence our initial 'Stage 1' operations before the end of 2026."

Full details are contained in the complete announcement, which can be accessed on the ASX website, the investor section of Barton's website, or directly by clicking here.

Authorised by the Managing Director of Barton Gold Holdings Limited.

For further information, please contact:

Alexander Scanlon | Jade Cook |

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000ozpa with 1.9Moz Au & 3.1Moz Ag JORC Mineral Resources (73.0Mt @ 0.79 g/t Au), brownfield mines, and

Tarcoola Gold Project

Tunkillia Gold Project

Challenger Gold Project

|  |

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 (JORC).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company's website at www.bartongold.com.au or on the ASX website www.asx.com.au. The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets, continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

*Refer to Barton Prospectus dated 14 May 2021 and ASX announcement dated 30 June 2025. Total Barton JORC (2012) Mineral Resources include 1,031koz Au (39.3Mt @ 0.82 g/t Au) in Indicated category and 834koz Au (33.8Mt @ 0.77 g/t Au) in Inferred category, and 3,070koz Ag (34.5Mt @ 2.80 g/t Ag) in Inferred category as a subset of Tunkillia gold JORC (2012) Mineral Resources.

SOURCE: Barton Gold Holdings Limited

View the original press release on ACCESS Newswire