Blackrock Silver Announces Final Assays from Eastern Expansion Drill Program at Tonopah West

Rhea-AI Summary

Blackrock Silver (OTCQX: BKRRF) reported final assays from its Eastern Expansion drill program at Tonopah West on December 2, 2025. The Program drilled 6,798 metres in 24 holes (22 completed) and identified at least three northwest‑oriented mineralized structures over a 1.2 kilometre trend parallel to the Pittsburg‑Monarch fault. Notable intercepts include TXC25‑173: 0.92 m @ 2,122.7 g/t AgEq and TXC25‑178: 0.46 m @ 3,853 g/t AgEq. Results and Northwest Expansion data will be incorporated into an updated mineral resource estimate and preliminary economic assessment targeted for February 2026.

Positive

- High‑grade intercept TXC25‑173: 2,122.7 g/t AgEq

- High‑grade intercept TXC25‑178: 3,853 g/t AgEq (incl.)

- Program drilled 6,798 metres across 24 holes

- Expansion trend extended ~1.2 kilometres east

- PEA/resource update targeted for February 2026

Negative

- Only 22 of 24 drillholes completed for core tails

- Multiple holes below 150 g/t AgEq cut‑off (31–133 g/t AgEq)

- True thickness uncertainty: 75%–85% of interval

News Market Reaction

On the day this news was published, BKRRF gained 0.22%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

While BKRRF slipped -0.88%, peers were mixed: several small declines (GMTLF -1.08%, SDRC -1.45%, SMDRF -1.07%) contrasted with strong gains in SLVTF (15.26%) and OCGSF (14.43%). This points to stock-specific factors rather than a uniform sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 02 | Drill assay update | Positive | +0.2% | Final Eastern Expansion assays confirmed multiple high‑grade mineralized structures. |

| Oct 27 | Drill assay update | Positive | -4.7% | Initial Eastern Expansion assays reported thick, high‑grade AgEq intervals and trend extension. |

| Oct 23 | Project advancement | Positive | +2.5% | Phase 2 hydrology, geotechnical and seismic programs advanced permitting at Tonopah West. |

| Oct 22 | Technical report filing | Positive | +2.5% | NI 43‑101 technical report filed confirming no material differences from prior resource update. |

| Oct 14 | Corporate logistics | Neutral | -0.1% | Disclosure on AGM mailing arrangements due to a postal strike and proxy timing details. |

Recent project and technical updates generally saw aligned positive reactions, with one notable selloff on strong assay results in late October.

Over the last few months, Blackrock Silver has focused on advancing the Tonopah West project through resource definition and technical de-risking. On Oct 22, 2025, it filed an NI 43‑101 technical report supporting a prior mineral resource update with no material changes. Subsequent hydrology and geotechnical work announced on Oct 23, 2025 supported permitting steps. Eastern Expansion drill assays on Oct 27 and final results on Dec 2 highlighted multiple high‑grade silver‑gold intercepts over a 6,798 m program and a ~1,200 m mineralized trend feeding into future economic studies.

Market Pulse Summary

This announcement detailed final assays from the Eastern Expansion program at Tonopah West, confirming at least three northwest‑oriented mineralized structures over a 1.2 kilometre trend and several very high‑grade silver‑gold intercepts. The 6,798 metres drilled across 24 holes will feed into an updated mineral resource estimate and preliminary economic assessment targeted for February 2026. Investors may monitor how these results change tonnage, grade distribution and future technical studies at the project level.

Key Terms

reverse circulation technical

diamond core drilling technical

fire assay fusion technical

Induced Coupled Plasma (ICP) technical

gravimetric finish technical

certified reference material technical

National Instrument 43-101 regulatory

AI-generated analysis. Not financial advice.

The Eastern Expansion Drill Program Identified Several Mineralized Northwest Structures Hosting Shallow Mineralization Encountered Within a 1.2 Kilometre Trend

EASTERN EXPANSION PROGRAM HIGHLIGHTS:

- At least three mineralized northwest oriented structures have been identified within the 1.2 kilometre eastern expansion trend running parallel to the Pittsburg-Monarch fault that suggest a series of footwall fault splays as opposed to a singular east-west structure;

- TXC25-173 cut 0.92 metres of 2,122.7 grams per tonne (g/t) silver equivalent (AgEq) (1,162 g/t silver (Ag) & 8.79 g/t gold (Au)) from 220.9 metres, and a separate zone of 1.04 metres grading 534.8 g/t AgEq (189.8 g/t Ag & 3.16 g/t Au) from 215.5 metres;

- TXC25-178 drilled 6.4 metres of 296.6 g/t AgEq (135.7 g/t Ag & 1.47 g/t Au), including 0.46 metres of 3,853 g/t AgEq (1,771 g/t Ag & 19.06 g/t Au) from 183.8 metres in a north-south oriented structure within the M&I Conversion Area at DPB South; and

- Results from the Company's drill program targeting expansion potential across a one kilometre trend of vein corridor between the DPB and Northwest Step Out resource areas (the "Northwest Expansion Program") and the Eastern Expansion Program will be incorporated into an updated mineral resource estimate and preliminary economic assessment on Tonopah West estimated to be completed in February 2026.

Vancouver, British Columbia--(Newsfile Corp. - December 2, 2025) - Blackrock Silver Corp. (TSXV: BRC) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") announces the final results from its fully-funded eastern expansion drill program (the "Eastern Expansion Program" or the "Program") at its

The Eastern Expansion Program was a follow up to the Company's successful Scout drilling program completed at Tonopah West in February 2025 (see March 31, 2025 news) which shows additional upside for the shallow southern portion of the Denver-Paymaster and Bermuda-Merten vein groups ("DPB South") resource area (the "M&I Conversion Area") to expand the resource area 1,200 metres in an easterly direction (the "Eastern Expansion Zone").

The Company commenced the Eastern Expansion Program in July 2025 within the Eastern Expansion Zone, utilizing reverse circulation (RC) drilling with RC pre-collars to establish initial holes, which were then deepened using diamond core drilling (core tails) for more detailed geological analysis. The Program drilled a total of 6,798 metres (22,896 feet) in twenty-four drillholes, however, only 22 drillholes were completed, as two pre-collar holes were not usable for core tails. Of the 22 completed drillholes, three were core holes completed from surface.

Andrew Pollard, Blackrock's President and CEO, stated, "Whereas we set out to target a single east-west mineralized structure, drilling from our Eastern Expansion Program has defined at least three distinct, parallel mineralized zones oriented northwest. These structures appear to be splays off the Pittsburgh-Monarch fault system. Each of these zones has intersected shallow, high-grade, and thick mineralization, indicating significant potential for further expansion in the area. Additionally, drilling in the M&I Conversion Area at DPB South has successfully connected previously isolated intercepts, confirming the presence of north-south trending structures and suggesting additional tonnage potential. Work on our upcoming mineral resource estimate and preliminary economic assessment is now underway and on track for a targeted completion date in February 2026. These will incorporate data from both our Northwest and Eastern Expansion drill programs."

Table 1 summarizes the final results of the Eastern Expansion Program using a cut-off grade of 150 g/t AgEq.

Table 1: Eastern Expansion Drill Program Significant Results Using a 150 g/t AgEq Cut-off Grade

| Drillhole ID | Program | Area | Hole Type | From (m) | To (m) | Drillhole Interval (m) | Ag g/t | Au g/t | AgEq g/t |

| TXC25-168 | E Expansion | DPB South | RC/Core | 298.03 | 299.86 | 1.83 | 73.7 | 0.754 | 156.1 |

| Including | 298.03 | 298.34 | 0.31 | 353.0 | 3.680 | 754.8 | |||

| TXC25-171 | M&I Conversion | DPB South | RC/Core | 185.99 | 186.69 | 0.70 | 122.0 | 1.100 | 242.1 |

| TXC25-171 | M&I Conversion | DPB South | RC/Core | 247.19 | 249.33 | 2.13 | 85.7 | 0.855 | 179.1 |

| TXC25-173 | E Expansion | DPB South | RC/Core | 215.53 | 216.56 | 1.04 | 189.8 | 3.159 | 534.8 |

| TXC25-173 | E Expansion | DPB South | RC/Core | 220.98 | 221.90 | 0.92 | 1,162.0 | 8.798 | 2,122.7 |

| TXC25-178 | M&I Conversion | DPB South | RC/Core | 161.54 | 162.61 | 1.07 | 158.5 | 2.126 | 390.6 |

| TXC25-178 | M&I Conversion | DPB South | RC/Core | 183.80 | 190.20 | 6.40 | 135.7 | 1.474 | 296.6 |

| Including | 188.37 | 188.82 | 0.46 | 1,771.0 | 19.067 | 3,853.0 | |||

| TXC25-178 | M&I Conversion | DPB South | RC/Core | 270.36 | 271.43 | 1.07 | 108.9 | 1.439 | 266.0 |

| Including | 271.12 | 271.43 | 0.31 | 375.0 | 4.750 | 893.7 | |||

| AgEq = Ag + Au/(Factor); where Factor = (Ag Price/Au Price)*(Ag Recovery/Au Recovery) or Factor=( | |||||||||

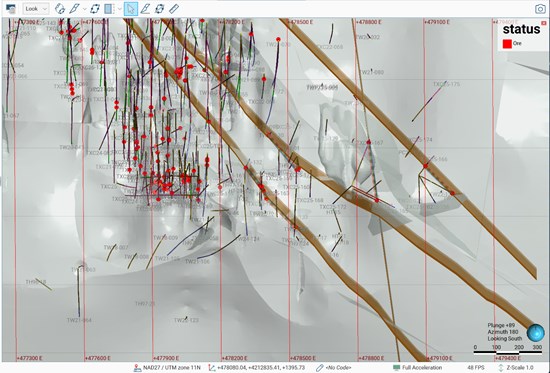

The Eastern Expansion Program encountered at least three northwest oriented structures which appear to be mineralized and offset the southern caldera margin to the northeast. The structures are parallel to the Pittsburg-Monarch fault and suggest a series of footwall fault splays associated with the main Pittsburg-Monarch fault. Figure 1 below shows the approximate location and orientation of the northwest fault system.

Drilling to date shows shallow, high-grade, and thick zones of mineralization in each of these structures and suggest increased expansion potential along this northwest structural corridor. Historically, the Pittsburg-Monarch fault was considered an ore control within the district with the thickest historically mined veins at Victor and Ohio abutting the main fault. The Company's drilling in the Eastern Expansion Zone has returned thick vein intervals of gold and silver along the parallel structures confirming the importance of the Pittsburg-Monarch and its footwall fault splays.

Two drillholes, TXC25-171 and TXC25-178, were drilled in the M&I Conversion Area. These drillholes were directed to the west to understand several north-south structures encountered in the previous drilling. The Program was successful in capturing high-grade drill intervals from the north-south structures and shows there are multiple mineralized structures with similar orientation in the area.

Figure 1: Leapfrog model showing northwest oriented structures in the Eastern Expansion area

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/676/276546_9dcdee45e417e956_001full.jpg

Although below the cut-off grade of 150 g/t AgEq, drillholes TXC25-167, -168, -175, -176, -177 and TXC25-179 were mineralized with silver equivalent values ranging between 31 and 133 g/t AgEq. Table 2 shows the range of gold and silver values encountered along the northwest oriented structures.

Table 2: Mineralized Drillholes from the Eastern Expansion program that are below the 150 g/t AgEq cut-off

| Drillhole ID | Program | Area | Hole Type | From (m) | To (m) | Drillhole Interval (m) | Ag g/t | Au g/t | AgEq g/t |

| TXC25-167 | E Expansion | Ohio | RC/Core | 368.96 | 372.01 | 3.05 | 133.0 | 0.002 | 133.2 |

| TXC25-169 | E Expansion | DPB South | RC/Core | 196.90 | 199.95 | 3.05 | 1.2 | 0.480 | 53.6 |

| TXC25-175 | E Expansion | Ohio | RC/Core | 277.98 | 279.69 | 1.71 | 14.2 | 0.155 | 31.2 |

| TXC25-176 | E Expansion | Ohio | Core | 192.51 | 194.46 | 1.95 | 13.9 | 0.173 | 32.8 |

| TXC25-177 | E Expansion | Ohio | Core | 177.09 | 178.31 | 1.22 | 2.5 | 0.467 | 53.5 |

| TXC25-179 | E Expansion | Ohio | Core | 235.55 | 236.46 | 0.91 | 23.3 | 0.270 | 52.8 |

| TXC25-179 | E Expansion | Ohio | Core | 262.28 | 263.35 | 1.07 | 16.9 | 0.167 | 35.1 |

| AgEq = Ag + Au/(Factor); where Factor = (Ag Price/Au Price)*(Ag Recovery/Au Recovery) or Factor=( | |||||||||

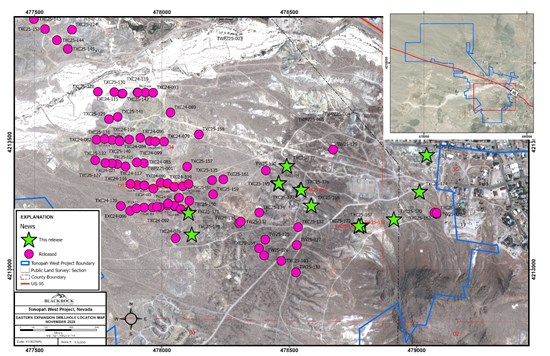

Figure 2: Drillhole location map for the Eastern Expansion drillholes reported in this news release

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/676/276546_9dcdee45e417e956_002full.jpg

Below are all the drillhole intervals above the 150 g/t AgEq cut off from the program showing the upside potential of the Eastern Expansion Zone.

Table 3: Eastern Expansion Program Significant Results Using a 150 g/t AgEq Cut-off Grade (TXC25-156 to TXC25-166 released on October 27, 2025)

| Drillhole ID | Program | Area | Hole Type | From (m) | To (m) | Drillhole Interval (m) | Ag g/t | Au g/t | AgEq g/t |

| TXC25-158 | E Expansion | DPB South | RC/Core | 146.30 | 147.83 | 1.52 | 123.0 | 0.852 | 216.0 |

| TXC25-158 | E Expansion | DPB South | RC/Core | 272.83 | 273.86 | 1.04 | 17.9 | 2.353 | 274.8 |

| Including | 273.56 | 273.86 | 0.30 | 59.8 | 7.970 | 930.1 | |||

| TXC25-158 | E Expansion | DPB South | RC/Core | 340.31 | 341.13 | 0.82 | 56.9 | 0.671 | 130.2 |

| TXC25-159 | E Expansion | DPB South | RC/Core | 234.18 | 242.93 | 8.75 | 90.3 | 0.943 | 193.3 |

| Including | 241.65 | 242.47 | 0.82 | 567.7 | 5.953 | 1,217.8 | |||

| TXC25-160 | E Expansion | DPB South | RC/Core | 146.30 | 147.83 | 1.52 | 79.4 | 6.660 | 806.6 |

| TXC25-164 | E Expansion | DPB South | RC/Core | 180.44 | 186.11 | 5.67 | 3.6 | 2.379 | 263.4 |

| Including | 185.01 | 186.11 | 1.10 | 9.2 | 8.670 | 955.9 | |||

| TXC25-166 | E Expansion | Ohio | RC/Core | 160.17 | 160.78 | 0.61 | 114.9 | 1.658 | 296.0 |

| TXC25-166 | E Expansion | Ohio | RC/Core | 165.20 | 170.23 | 5.03 | 306.8 | 4.062 | 750.3 |

| Including | 166.73 | 168.56 | 1.83 | 724.1 | 8.577 | 1,660.6 | |||

| TXC25-168 | E Expansion | DPB South | RC/Core | 298.03 | 299.86 | 1.83 | 73.7 | 0.754 | 156.1 |

| Including | 298.03 | 298.34 | 0.31 | 353.0 | 3.680 | 754.8 | |||

| TXC25-171 | M&I Conversion | DPB South | RC/Core | 185.99 | 186.69 | 0.70 | 122.0 | 1.100 | 242.1 |

| TXC25-171 | E Expansion | DPB South | RC/Core | 247.19 | 249.33 | 2.13 | 85.7 | 0.855 | 179.1 |

| TXC25-173 | E Expansion | DPB South | RC/Core | 215.53 | 216.56 | 1.04 | 189.8 | 3.159 | 534.8 |

| TXC25-173 | E Expansion | DPB South | RC/Core | 220.98 | 221.90 | 0.92 | 1,162.0 | 8.798 | 2,122.7 |

| TXC25-178 | M&I Conversion | DPB South | RC/Core | 161.54 | 162.61 | 1.07 | 158.5 | 2.126 | 390.6 |

| TXC25-178 | M&I Conversion | DPB South | RC/Core | 183.80 | 190.20 | 6.40 | 135.7 | 1.474 | 296.6 |

| Including | 188.37 | 188.82 | 0.46 | 1,771.0 | 19.067 | 3,853.0 | |||

| TXC25-178 | M&I Conversion | DPB South | RC/Core | 270.36 | 271.43 | 1.07 | 108.9 | 1.439 | 266.0 |

| Including | 271.12 | 271.43 | 0.31 | 375.0 | 4.750 | 893.7 | |||

| AgEq = Ag + Au/(Factor); where Factor = (Ag Price/Au Price)*(Ag Recovery/Au Recovery) or Factor=( | |||||||||

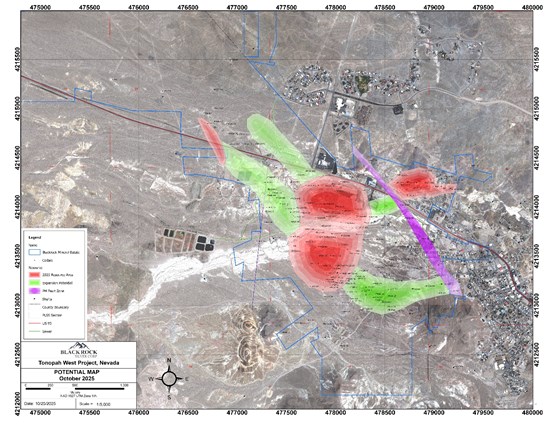

Figure 3: Tonopah West expansion potential

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/676/276546_9dcdee45e417e956_003full.jpg

Figure 4: Tonopah West Drillhole Location Coordinates (based on GPS readings in the field, Datum UTM, NAD 1927, Zone 11)

| Drillhole ID | Area | Program | Type | UTM_NAD27 E | UTM_NAD27 N | Elevation (m) | Depth (ft) | Depth (m) | Azimuth | Dip |

| TXC25-167 | Ohio | E Expansion | RC/Core | 478778.0 | 4213176.0 | 1824.5 | 1302.0 | 396.8 | 25 | -60 |

| TXC25-168 | DPB South | E Expansion | RC/Core | 478600.0 | 4213250.0 | 1800.0 | 1072.0 | 326.7 | 180 | -65 |

| TXC25-169 | DPB South | E Expansion | RC/Core | 478460.0 | 4213340.0 | 1800.0 | 939.0 | 286.2 | 180 | -65 |

| TXC25-170 | Ohio | E Expansion | RC/Core | 478910.0 | 4213200.0 | 1835.0 | 894.0 | 272.5 | 230 | -70 |

| TXC25-171 | DPB South | M&I Conversion | RC/Core | 478105.0 | 4213222.0 | 1789.0 | 1315.0 | 400.8 | 270 | -50 |

| TXC25-172 | Ohio | E Expansion | RC/Core | 478778.0 | 4213176.0 | 1824.5 | 898.5 | 273.9 | 225 | -65 |

| TXC25-173 | DPB South | E Expansion | RC/Core | 478540.0 | 4213310.0 | 1800.0 | 903.0 | 275.2 | 180 | -75 |

| TXC25-174 | Ohio | E Expansion | RC/Core | 479014.0 | 4213300.0 | 1822.0 | 921.0 | 280.7 | 40 | -70 |

| TXC25-175 | Ohio | E Expansion | RC/Core | 479046.0 | 4213457.0 | 1820.0 | 1232.0 | 375.5 | 40 | -50 |

| TXC25-176 | Ohio | E Expansion | Core | 478540.0 | 4213310.0 | 1800.0 | 1060.0 | 323.1 | 210 | -75 |

| TXC25-177 | Ohio | E Expansion | Core | 478495.0 | 4213405.0 | 1791.0 | 732.0 | 223.1 | 0 | -90 |

| TXC25-178 | DPB South | M&I Conversion | RC/Core | 478113.0 | 4213139.0 | 1791.0 | 1728.5 | 526.8 | 270 | -50 |

| TXC25-179 | Ohio | E Expansion | Core | 478460.0 | 4213340.0 | 1800.0 | 922.0 | 281.0 | 0 | -90 |

Quality Assurance/ Quality Control

All sampling is conducted under the supervision of the Company's project geologists, and a strict chain of custody from the project to the sample preparation facility is implemented and monitored. The RC samples are hauled from the project site to a secure and fenced facility in Tonopah, Nevada, where they are loaded on to American Assay Laboratory's (AAL) flat-bed truck and delivered to AAL's facility in Sparks, Nevada. A sample submittal sheet is delivered to AAL personnel who organize and process the sample intervals pursuant to the Company's instructions.

The RC samples are lined out at the lab and logged into AAL's system. The samples are dried, crushed to

Qualified Persons

Blackrock's exploration activities at Tonopah West are conducted and supervised by Mr. William Howald, Executive Chairman of Blackrock. Mr. William Howald, AIPG Certified Professional Geologist #11041, is a Qualified Person as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects. He has reviewed and approved the contents of this news release.

About Blackrock Silver Corp.

Backed by gold and silver ounces in the ground, Blackrock is a junior precious metal focused exploration and development company driven to add shareholder value. Anchored by a seasoned Board of Directors, the Company is focused on its

Additional information on Blackrock Silver Corp. can be found on its website at www.blackrocksilver.com and by reviewing its profile on SEDAR at www.sedarplus.ca.

Cautionary Note Regarding Forward-Looking Statements and Information

This news release contains "forward-looking statements" and "forward-looking information" (collectively, "forward-looking statements") within the meaning of Canadian and United States securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements in this news release relate to, among other things: the Company's strategic plans; the anticipated objectives and results from the Company's drill programs at Tonopah West; the timing of completion of an updated mineral resource estimate and preliminary economic assessment on Tonopah West; the Company's de-risking initiatives at Tonopah West; estimates of mineral resource quantities and qualities; estimates of mineralization from drilling; geological information projected from sampling results; and the potential quantities and grades of the target zones.

These forward-looking statements reflect the Company's current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include, among other things: conditions in general economic and financial markets; accuracy of assay results; geological interpretations from drilling results, timing and amount of capital expenditures; performance of available laboratory and other related services; future operating costs; the historical basis for current estimates of potential quantities and grades of target zones; the availability of skilled labour and no labour related disruptions at any of the Company's operations; no unplanned delays or interruptions in scheduled activities; all necessary permits, licenses and regulatory approvals for operations are received in a timely manner; the ability to secure and maintain title and ownership to properties and the surface rights necessary for operations; and the Company's ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

The Company cautions the reader that forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements contained in this news release and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the timing and content of work programs; results of exploration activities and development of mineral properties; the interpretation and uncertainties of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; project costs overruns or unanticipated costs and expenses; availability of funds; failure to delineate potential quantities and grades of the target zones based on historical data; general market and industry conditions; and those factors identified under the caption "Risks Factors" in the Company's most recent Annual Information Form.

Forward-looking statements are based on the expectations and opinions of the Company's management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For Further Information, Contact:

Andrew Pollard

President and Chief Executive Officer

(604) 817-6044

info@blackrocksilver.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276546