Bitmine Immersion Technologies (BMNR) Announces ETH Holdings Reach 4.144 Million Tokens, and Total Crypto and Total Cash Holdings of $14.2 Billion

Rhea-AI Summary

Bitmine Immersion Technologies (NYSE AMERICAN: BMNR) announced crypto + total cash + "moonshots" holdings of $14.2 billion as of Jan 4, 2026.

Key holdings include 4,143,502 ETH (valued at $3,196 each), representing 3.43% of ETH supply, 192 BTC, a $25 million stake in Eightco Holdings, and $915 million in cash. Total staked ETH is 659,219 (valued at ~$2.1 billion) with MAVAN staking expected to launch in early 2026.

The company acquired 32,977 ETH in the final week of 2025 and will hold its Annual Stockholder Meeting at Wynn Las Vegas on Jan 15, 2026 to vote on increasing authorized shares and other items.

Positive

- Crypto + cash + moonshots totaling $14.2B

- 4,143,502 ETH holdings (3.43% of ETH supply)

- Total cash position of $915M

- Staked ETH 659,219 (~$2.1B) generating staking yield

- Acquired 32,977 ETH in the final week of 2025

- MAVAN staking solution on track for launch in early 2026

Negative

- Proposal to increase authorized shares may result in shareholder dilution

- Only ~15.9% of ETH holdings are currently staked (659,219 of 4,143,502)

News Market Reaction – BMNR

On the day this news was published, BMNR gained 6.93%, reflecting a notable positive market reaction. Argus tracked a peak move of +4.0% during that session. Our momentum scanner triggered 6 alerts that day, indicating moderate trading interest and price volatility. This price movement added approximately $892M to the company's valuation, bringing the market cap to $13.77B at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

BMNR’s 14.88% move outpaced mixed capital markets peers: crypto‑exposed names like IREN (+9.46%) and MARA (+7.83%) rose, while others such as VIRT (-2.69%) and XP (-3.46%) fell, pointing to a BMNR‑specific and crypto‑centric driver.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 22 | Crypto holdings update | Positive | -0.9% | Reported $13.2B holdings and 4.066M ETH, maintaining largest ETH treasury. |

| Dec 19 | Annual meeting notice | Neutral | +10.3% | Detailed Las Vegas annual meeting logistics and proposals including share increase. |

| Dec 08 | Crypto holdings update | Positive | +5.2% | Announced $13.2B holdings and 3.865M ETH with accelerated weekly accumulation. |

| Dec 01 | Crypto holdings update | Positive | -12.6% | Reported $12.1B holdings and 3.726M ETH ahead of Ethereum Fusaka upgrade. |

| Nov 24 | Crypto holdings update | Positive | +19.6% | Disclosed $11.2B holdings and 3.63M ETH, two‑thirds toward 5% ETH target. |

Recent crypto NAV updates have often led to sizable but directionally mixed reactions, with both rallies and pullbacks following broadly positive treasury growth news.

Over the past several months, Bitmine has repeatedly reported rising Ethereum holdings and larger crypto treasuries, moving from 3.63M ETH and $11.2B in holdings on Nov 23, 2025 to 4.066M ETH and $13.2B by Dec 21, 2025. Trading liquidity has remained high, and the company has consistently highlighted its position as the largest ETH treasury and a top global crypto treasury. Today’s update extends that pattern by showing further ETH accumulation, higher total holdings, and progress toward the 5% ETH supply goal and staking initiatives like MAVAN.

Regulatory & Risk Context

The company has an effective S-3ASR shelf registration dated Jul 28, 2025, expiring Jul 28, 2028, with at least two recorded usages via 424B5 filings in Aug and Sep 2025, indicating an established mechanism for raising capital through securities offerings.

Market Pulse Summary

The stock moved +6.9% in the session following this news. A strong positive reaction aligns with Bitmine’s pattern of sizable moves around crypto-treasury updates. Today’s ETH holdings of 4.143M tokens and total crypto plus cash of $14.2B extend a rapid accumulation trend. Past crypto-tagged news showed an average move of 9.67%, so a 14.88% gain fit within its volatile history. Investors monitoring this name have also faced sharp pullbacks after upbeat releases, making capital-raising plans and future ETH-price sensitivity ongoing risks.

Key Terms

staking technical

composite ethereum staking rate technical

validator network technical

stablecoins financial

tokenization financial

proxy regulatory

charter amendment regulatory

AI-generated analysis. Not financial advice.

Bitmine releases Special Chairman's Message related to upcoming Annual Stockholder Meeting

Bitmine staked ETH stands at 659,219 and MAVAN staking solution on track to launch Q1 2026

Bitmine remains the largest 'fresh money' buyer of ETH in the world

Bitmine now owns

Bitmine Crypto + Total Cash Holdings + "Moonshots" total

Bitmine will hold its Annual Stockholder Meeting at the Wynn Las Vegas on January 15, 2026

Bitmine leads crypto treasury peers by both the velocity of raising crypto NAV per share and by the high trading liquidity of BMNR stock

Bitmine is the 44th most traded stock in the US, trading

Bitmine remains supported by a premier group of institutional investors including ARK's Cathie Wood, MOZAYYX, Founders Fund, Bill Miller III, Pantera, Kraken, DCG, Galaxy Digital and personal investor Thomas "Tom" Lee to support Bitmine's goal of acquiring

As of January 4th at 9:00pm ET, the Company's crypto holdings are comprised of 4,143,502 ETH at

"We are excited about the prospects for Ethereum in 2026 given the multiple tailwinds of US government support for crypto, Wall Street embracing stablecoins and tokenization, the rising need for authentication and proof of provenance in an increasingly complex AI world and the rising adoption of crypto among younger generations," said Thomas "Tom" Lee of Fundstrat, Chairman of Bitmine. "Moreover, the surge in commodity and precious metals in 2025 bodes well for crypto prices in 2026, which tend to follow metal price moves."

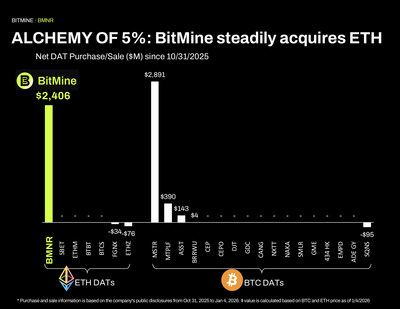

"In the final week of 2025, total equity and crypto activity slowed, and yet we acquired 32,977 ETH in the past week," continued Lee. "Our analysis shows that Bitmine has continued to accumulate ETH at an accelerated pace versus other Ethereum DATs. We remain the largest 'fresh money' buyer of ETH in the world."

Bitmine released a special Chairman's message (link) explaining why Bitmine stockholders should vote to support the amendment to increase authorized shares ahead of the upcoming annual stockholder meeting on January 15, 2026 (the "Annual Meeting"). "BitMine needs the increase in authorized shares primarily to allow the company to selectively issue shares for capital market activities, accommodate future share splits (as ETH moves to our long-term targets) and enable us to consider selective acquisitions," said Tom Lee. "Bitmine sole focus remains creating stockholder value, achieving this by accretively acquiring ETH per share, optimizing yield and income on its ETH holdings, and strategically investing the balance sheet on 'moonshots' and leveraging the company's strong community and market position to generate additional returns."

As of January 4, 2026, Bitmine total staked ETH stands at 659,219 (

"We continue to make progress on our staking solution known as The Made in America Validator Network (MAVAN). This will be the 'best-in-class' solution offering secure staking infrastructure and will be deployed in early calendar 2026," continued Lee.

Bitmine crypto holding reigns as the #1 Ethereum treasury and #2 global treasury, behind Strategy Inc. (MSTR), which owns 672,497 BTC valued at

Bitmine is now one of the most widely traded stocks in the US. According to data from Fundstrat, the stock has traded average daily dollar volume of

Bitmine will hold its Annual Meeting at the Wynn Las Vegas on January 15, 2026. The company encourages stockholders to vote and attend its in-person Annual Meeting. Details and the agenda for the Annual Meeting can be found below:

Bitmine's Annual Meeting:

- Location: Wynn Las Vegas, 3131 Las Vegas Blvd S,

Las Vegas, Nevada 89109 - Timing: 12:00pm-3:00pm PST

- Agenda:

- Elect eight (8) directors for the next year;

- Approve the charter amendment to increase the number of authorized shares of common stock;

- Approve the 2025 Omnibus Incentive Plan; and

- Approve, on a non-binding advisory basis, the special, performance-based compensation arrangement for the executive chairman

- Attending the Annual Meeting: Stockholders wishing to attend the Annual Meeting in person must register in advance at https://web.viewproxy.com/BMNR/2026 and follow the instructions provided. Registration must be completed and submitted no later than January 13, 2026 at 11:59 p.m. Eastern Time.

- On the day of the meeting, please be ready to show your ticket and photo ID at the door for entry. If you have any questions, or need assistance with the registration process please contact Alliance Advisors at LogisticsSupport@allianceadvisors.com.

- Voting: Stockholders can vote either in person at the Annual Meeting or by proxy whether or not you attend the Annual Meeting utilizing one of the following methods:

- By mail: All stockholders of record who received paper copies of the company's proxy materials can vote by marking, signing, dating, and returning their proxy card.

- By telephone: Please call the number listed on your proxy card and follow the recorded instructions. You will need the control number included on your proxy card.

- By internet: Please visit https://AALvote.com/BMNR or, if you received printed copies of your proxy materials, scan the QR code located on your proxy card. You will need the control number included on your proxy card.

- The telephone and internet voting facilities for the stockholders of record of all shares will close at 11:59 p.m., Eastern Time on January 14, 2026.

- If you have any questions or need assistance please contact Alliance Advisors at

- 1-855-206-1722 or BMNR@allianceadvisors.com

- Hours of Operation:

- Monday – Friday: 9am-10pm EST

- Saturday – Sunday: 10am-10pm EST

The Annual Meeting will be livestreamed on Bitmine's X account: https://x.com/bitmnr

The GENIUS Act and SEC's Project Crypto are as transformational to financial services in 2025 as US action on August 15, 1971 ending Bretton Woods and the USD on the gold standard 54 years ago. This 1971 event was the catalyst for the modernization of Wall Street, creating the iconic Wall Street titans and financial and payment rails of today. These proved to be better investments than gold.

The Fiscal Full Year 2025 Earnings presentation and corporate presentation can be found here: https://bitminetech.io/investor-relations/

The Chairman's message can be found here:

https://www.bitminetech.io/chairmans-message

To stay informed, please sign up at: https://bitminetech.io/contact-us/

About Bitmine

Bitmine is a Bitcoin and Ethereum Network Company with a focus on the accumulation of Crypto for long term investment, whether acquired by our Bitcoin mining operations or from the proceeds of capital raising transactions. Company business lines include Bitcoin Mining, synthetic Bitcoin mining through involvement in Bitcoin mining, hashrate as a financial product, offering advisory and mining services to companies interested in earning Bitcoin denominated revenues, and general Bitcoin advisory to public companies. Bitmine's operations are located in low-cost energy regions in

For additional details, follow on X:

https://x.com/bitmnr

https://x.com/fundstrat

https://x.com/bmnrintern

Forward Looking Statements

This press release contains statements that constitute "forward-looking statements." The statements in this press release that are not purely historical are forward-looking statements which involve risks and uncertainties. This document specifically contains forward-looking statements regarding progress and achievement of the Company's goals regarding ETH acquisition and staking, the long-term value of Ethereum, continued growth and advancement of the Company's Ethereum treasury strategy and the applicable benefits to the Company. In evaluating these forward-looking statements, you should consider various factors, including Bitmine's ability to keep pace with new technology and changing market needs; Bitmine's ability to finance its current business, Ethereum treasury operations and proposed future business; the competitive environment of Bitmine's business; and the future value of Bitcoin and Ethereum. Actual future performance outcomes and results may differ materially from those expressed in forward-looking statements. Forward-looking statements are subject to numerous conditions, many of which are beyond Bitmine's control, including those set forth in the Risk Factors section of Bitmine's Form 10-K filed with the Securities and Exchange Commission (the "SEC") on November 21, 2025, as well as all other SEC filings, as amended or updated from time to time. Copies of Bitmine's filings with the SEC are available on the SEC's website at www.sec.gov. Bitmine undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/bitmine-immersion-technologies-bmnr-announces-eth-holdings-reach-4-144-million-tokens-and-total-crypto-and-total-cash-holdings-of-14-2-billion-302652341.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/bitmine-immersion-technologies-bmnr-announces-eth-holdings-reach-4-144-million-tokens-and-total-crypto-and-total-cash-holdings-of-14-2-billion-302652341.html

SOURCE BitMine Immersion Technologies, Inc.