Benton Resources Acquires Strategic Claims Directly Along Strike from Equinox Gold's Valentine Gold Mine in Central Newfoundland

Rhea-AI Summary

Benton Resources (TSXV: BEX) has expanded its presence in Central Newfoundland through strategic land acquisitions near Equinox Gold's Valentine Gold Mine. The company has staked 108 claim units and executed a purchase agreement with Quest Inc. for an additional 33 claim units, bringing its total Victoria Lake package to 141 claims.

Under the agreement terms, Benton will pay Quest $6,000 cash and issue 200,000 shares for 100% interest, with Quest retaining a 2% Net Smelter Return (NSR). Benton maintains the right to buy back 1% for $1.5 million. Geological data indicates favorable gold structures continuing southwest towards Benton's Victoria West Project, with soil sampling showing gold values up to 169 ppb Au.

Positive

- Strategic acquisition directly along strike from an active gold mine

- Cost-effective land acquisition of 141 total claim units

- Favorable geological indicators with gold values up to 169 ppb Au in nearby soil samples

- Option to reduce NSR exposure by buying back 1% for $1.5 million

Negative

- Initial cash outlay and share dilution required for Quest agreement

- 2% NSR obligation on Quest claims and 0.25% NSR on certain staked claims

- Project is still in early exploration stage with no proven resources

News Market Reaction

On the day this news was published, BNTRF declined NaN%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Thunder Bay, Ontario--(Newsfile Corp. - August 13, 2025) - Benton Resources Inc. (TSXV: BEX) ("Benton" or the "Company") is pleased to announce that it has staked four licences totaling 108 claim units directly along strike from Equinox Gold's Valentine Gold Mine, located in Central Newfoundland, Canada. The Company has also, subject to regulatory approval, executed a purchase agreement (the "Agreement") with Quest Inc. ("Quest"), an arm's-length private company, for two licences encompassing 33 claim units, bringing its total Victoria Lake land package to 141 claims.

In accordance with the Agreement, the Company will pay Quest a one-time cash payment of

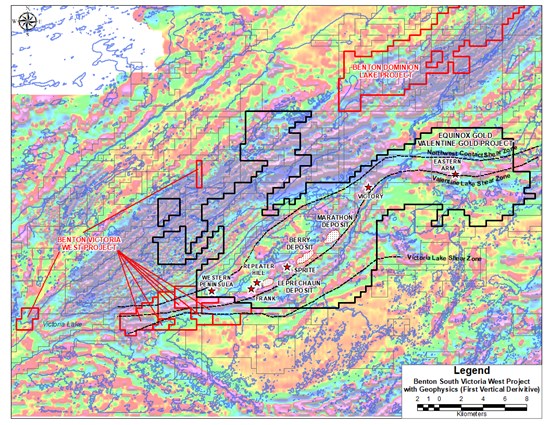

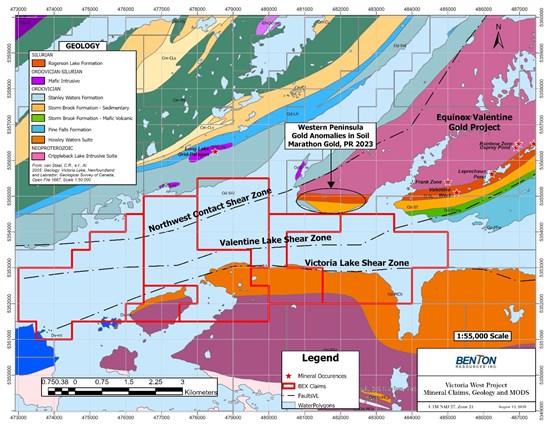

A detailed compilation by Benton, using first-derivative magnetics and historical assessment work filed with the Government of Newfoundland, along with a public press release from Marathon Gold (see Marathon Gold Corporation Press Release dated March 06, 2023) shows that the favourable trend and gold structures continue south west towards Benton's new Victoria West Project (Figure 1). In particular, a soil sampling program completed and released by Marathon Gold highlighted this favourable contact trend with highly anomalous gold values up to 169 ppb Au in soils near the water's edge trending toward Benton's newly acquired claims (Figure 2).

Figure 1: Compilation on the Victoria West Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3657/262304_589c1509e4368bbf_002full.jpg

Figure 2: Western Peninsula Gold in Soils on the Victoria West Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3657/262304_589c1509e4368bbf_003full.jpg

Stephen Stares, Company President and CEO, commented, "This is yet another fantastic opportunity for Benton and its shareholders as it strategically complements our prospective gold and base metal project portfolio in Newfoundland, one of the world's top-ranked mining jurisdictions. We are pleased to have cost-effectively acquired an excellent land position directly along strike from one of Canada's newest and continually growing gold mines. These opportunities are rare and truly hold significant discovery potential. The Company is currently looking at its options for drill targeting on the project."

QP

Stephen House (P.Geo.), Vice President of Exploration for Benton Resources Inc., the 'Qualified Person' under National Instrument 43-101, has approved the scientific and technical disclosure in this news release and prepared or supervised its preparation.

QA/QC Protocols

Core and rock samples, including standards, blanks and duplicates, are submitted to Eastern Analytical Ltd., Springdale, Newfoundland for preparation and analysis. All samples were acquired by saw-cut (channels/drill core) with one-half submitted for assay and one-half retained for reference, or hand (rocks) and delivered, by Benton personnel, in sealed bags, to the Springdale lab of Eastern Analytical, which is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples are analyzed using Eastern's Au (Fire assay) @ 30g + ICP-34 method that delivers a 34-element package utilizing a 200 mg subsample totally dissolved in four acids and analyzed by ICP-OES analytical technique. Overlimits are analysed with Eastern's atomic absorption method, using a 0.200 g to 2.00 g of sample, digested with three acids. All reported assays are uncut. Eastern Analytical Ltd. achieved ISO 17025 accreditation in February 2014 (for more details on the scope of accreditation visit the CALA website). Grab samples are selective in nature and may not represent the average mineralization of a bedrock exposure.

About Benton Resources Inc.

Benton Resources is a well-financed mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Benton has a diversified, highly prospective property portfolio and holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains net smelter return (NSR) royalties with potential long-term cash flow.

Benton is focused on advancing its high-grade Copper-Gold Great Burnt Project in central Newfoundland, which has a Mineral Resource estimate of 667,000 tonnes @

On behalf of the Board of Directors of Benton Resources Inc.,

"Stephen Stares"

Stephen Stares, President

Parties interested in seeking more information about properties available for option can contact Mr. Stares at the number below.

For further information, please contact:

Stephen Stares, President & CEO

Phone: 807-474-9020

Email: sstares@bentonresources.ca

Nick Konkin, Investor Relations

Phone: 647-249-9298 ext. 322

Email: nick@grovecorp.ca

Website: www.bentonresources.ca

Twitter: @BentonResources

Facebook: @BentonResourcesBEX

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements".

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company's expectations or projections.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/262304