AB InBev Reports Third Quarter 2024 Results

Diversified global footprint and consistent execution of our strategy delivered an EBITDA increase of

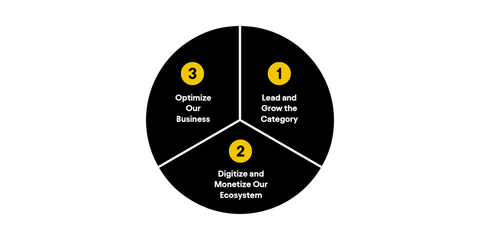

AB InBev Strategic Priorities (Graphic: Business Wire)

Regulated and inside information1

“Beer is a passion point for consumers. Consumer demand for our megabrands and the execution of our mega platforms delivered another quarter of top- and bottom-line growth with margin expansion. Our teams and partners continue to execute our strategy and we are confident in our ability to deliver on our raised FY24 EBITDA growth outlook of 6

– Michel Doukeris, CEO, AB InBev

Total Revenue

+

Revenue increased by

Approximately

Total Volume

-

In 3Q24, total volumes declined by

In 9M24, total volumes declined by

|

Normalized EBITDA

+

In 3Q24, normalized EBITDA increased by

In 9M24, normalized EBITDA increased by

Underlying Profit

1

Underlying profit (profit attributable to equity holders of AB InBev excluding non-underlying items and the impact of hyperinflation) was 1

Underlying EPS

Underlying EPS was |

Capital Allocation

The AB InBev Board of Directors has approved a |

|

1The enclosed information constitutes inside information as defined in Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse, and regulated information as defined in the Belgian Royal Decree of 14 November 2007 regarding the duties of issuers of financial instruments which have been admitted for trading on a regulated market. For important disclaimers and notes on the basis of preparation, please refer to page 15. |

Management comments

Diversified global footprint and consistent execution of our strategy delivered an EBITDA increase of

Top-line increased by

Progressing our strategic priorities

We continue to execute on and invest in three key strategic pillars to deliver consistent growth and long-term value creation.

(1) Lead and grow the category:

We estimate we gained or maintained market share in

(2) Digitize and monetize our ecosystem:

BEES captured

(3) Optimize our business:

Underlying EPS increased by

(1) Lead and grow the category

We are executing on our five replicable levers to drive category expansion. Our performance across each of the levers was led by our megabrands which delivered a

- Category Participation: Through our focus on brand, pack and liquid innovations, the percentage of beer consumers purchasing our brands increased in a majority of our markets in 3Q24, according to our estimates. Participation increases were led by improvements with all consumer groups in the US.

-

Core Superiority: Our mainstream portfolio delivered a low-single digit revenue increase in 3Q24, driven by double-digit growth in

South Korea and theDominican Republic . - Occasions Development: Our global no-alcohol beer portfolio delivered mid-thirties revenue growth this quarter. Corona Cero, the official beer partner of the Olympic Games, delivered triple-digit volume growth and Budweiser Zero grew volume in the low twenties.

-

Premiumization: In 3Q24, the Corona brand grew revenue by

10.2% globally, outside ofMexico . Our overall above core beer portfolio delivered a low-single digit revenue increase, with growth constrained by a soft industry inChina . -

Beyond Beer: Our global Beyond Beer business contributed approximately

365 million USD of revenue in 3Q24, a low-single digit decrease versus 3Q23, as growth in key brands such as Brutal Fruit, Cutwater, Nutrl and Beats was primarily offset by soft malt-based seltzer performance inNorth America .

(2) Digitize and monetize our ecosystem

-

Digitizing our relationships with more than 6 million customers globally: As of 30 September 2024, BEES is now live in 28 markets with

72% of our revenues captured through B2B digital platforms. In 3Q24, BEES had 3.9 million monthly active users and captured12.1 billion USD in gross merchandise value (GMV), both growing14% versus 3Q23.

BEES Marketplace generated 9.5 million orders and captured630 million USD in GMV from sales of third-party products in 3Q24, growth of31% and51% versus 3Q23 respectively. -

Leading the way in DTC solutions: Our omnichannel DTC ecosystem of digital and physical products generated revenue of approximately

350 million USD in 3Q24. Our DTC megabrands, Zé Delivery, TaDa Delivery and PerfectDraft, are available in 21 markets, generated 18.6 million e-commerce orders and delivered approximately140 million USD in revenue this quarter, representing11% growth versus 3Q23.

(3) Optimize our business

-

Maximizing value creation: Our Underlying EPS was

0.98 USD this quarter, a14% increase versus 3Q23, driven primarily by nominal EBIT growth and optimization of our net finance costs. As a result of our continued global momentum and strong free cash flow generation, the AB InBev Board of Directors has approved a2 billion USD share buyback program to be executed within the next 12 months. -

Advancing our sustainability priorities: In Climate Action, our Scopes 1 and 2 emissions per hectoliter of production were 4.48 kgCO2e/hl in 9M24, an improvement of

46% versus our 2017 baseline. In Water Stewardship, our water use efficiency ratio improved to 2.47 hl per hl in 9M24 versus 2.53 hl per hl in 9M23, as we continue working towards our ambition to reach 2.50 hl per hl on an annual basis by 2025.

Creating a future with more cheers

Our business delivered another quarter of profitable growth with an EBITDA increase of

2024 Outlook

-

Overall Performance: We expect our FY24 EBITDA to grow between 6

-8% . The outlook for FY24 reflects our current assessment of inflation and other macroeconomic conditions. -

Net Finance Costs: Net pension interest expenses and accretion expenses are expected to be in the range of 220 to

250 million USD per quarter, depending on currency and interest rate fluctuations. We expect the average gross debt coupon in FY24 to be approximately4% . -

Effective Tax Rates (ETR): We expect the normalized ETR in FY24 to be in the range of

27% to29% . The ETR outlook does not consider the impact of potential future changes in legislation. -

Net Capital Expenditure: We expect net capital expenditure of between 4.0 and

4.5 billion USD in FY24.

Figure 1. Consolidated performance (million USD) |

||||||

3Q23 |

3Q24 |

Organic |

||||

growth |

||||||

Total Volumes (thousand hls) |

151 891 |

148 039 |

- |

|||

AB InBev own beer |

132 325 |

128 124 |

- |

|||

Non-beer volumes |

18 589 |

18 691 |

|

|||

Third party products |

977 |

1 223 |

|

|||

Revenue |

15 574 |

15 046 |

|

|||

Gross profit |

8 394 |

8 366 |

|

|||

Gross margin |

|

|

183bps |

|||

Normalized EBITDA |

5 431 |

5 424 |

|

|||

Normalized EBITDA margin |

|

|

169bps |

|||

Normalized EBIT |

4 027 |

4 091 |

|

|||

Normalized EBIT margin |

|

|

171bps |

|||

|

||||||

Profit attributable to equity holders of AB InBev |

1 472 |

2 071 |

||||

Underlying profit attributable to equity holders of AB InBev |

1 735 |

1 971 |

||||

|

||||||

Earnings per share (USD) |

0.73 |

1.03 |

||||

Underlying earnings per share (USD) |

0.86 |

0.98 |

|

|||

9M23 |

9M24 |

Organic |

||||

growth |

||||||

Total Volumes (thousand hls) |

440 021 |

433 877 |

- |

|||

AB InBev own beer |

382 135 |

374 438 |

- |

|||

Non-beer volumes |

54 812 |

56 157 |

|

|||

Third party products |

3 075 |

3 282 |

|

|||

Revenue |

44 907 |

44 927 |

|

|||

Gross profit |

24 190 |

24 827 |

|

|||

Gross margin |

|

|

140bps |

|||

Normalized EBITDA |

15 099 |

15 712 |

|

|||

Normalized EBITDA margin |

|

|

166bps |

|||

Normalized EBIT |

11 099 |

11 638 |

|

|||

Normalized EBIT margin |

|

|

147bps |

|||

|

||||||

Profit attributable to equity holders of AB InBev |

3 450 |

4 635 |

||||

Underlying profit attributable to equity holders of AB InBev |

4 497 |

5 291 |

||||

|

||||||

Earnings per share (USD) |

1.71 |

2.31 |

||||

Underlying earnings per share (USD) |

2.23 |

2.64 |

|

Figure 2. Volumes (thousand hls) |

||||||||||||

3Q23 |

Scope |

Organic |

3Q24 |

Organic growth |

||||||||

growth |

Total |

Own beer |

||||||||||

|

23 007 |

-159 |

-83 |

22 764 |

- |

|

||||||

Middle |

37 931 |

-4 |

- 819 |

37 107 |

- |

- |

||||||

|

39 733 |

- |

- 231 |

39 502 |

- |

- |

||||||

EMEA |

23 407 |

- |

632 |

24 039 |

|

|

||||||

|

27 672 |

- |

-3 158 |

24 514 |

- |

- |

||||||

Global Export and Holding Companies |

141 |

- |

-29 |

112 |

- |

- |

||||||

AB InBev Worldwide |

151 891 |

- 163 |

-3 688 |

148 039 |

- |

- |

||||||

9M23 |

Scope |

Organic |

9M24 |

Organic growth |

||||||||

growth |

Total |

Own beer |

||||||||||

|

70 401 |

-470 |

-3 175 |

66 756 |

- |

- |

||||||

Middle |

110 095 |

-13 |

1 097 |

111 179 |

|

|

||||||

|

115 756 |

- |

61 |

115 818 |

|

- |

||||||

EMEA |

66 249 |

- |

2 672 |

68 921 |

|

|

||||||

|

77 261 |

- |

-6 303 |

70 958 |

- |

- |

||||||

Global Export and Holding Companies |

259 |

- |

-14 |

244 |

- |

|

||||||

AB InBev Worldwide |

440 021 |

- 484 |

-5 661 |

433 877 |

- |

- |

||||||

-

Operating performance:

-

3Q24: Revenue increased by

1.8% with revenue per hl increasing by2.0% driven by revenue management initiatives. Sales-to-wholesalers (STWs) declined by0.2% , supported by one additional selling-day in the quarter. Sales-to-retailers (STRs) were down by3.0% on a selling-day adjusted basis, outperforming the industry according to our estimates. EBITDA grew by13.7% with a margin improvement of approximately 375bps, driven by productivity initiatives and SG&A efficiencies. -

9M24: Revenue declined by

2.8% , with revenue per hl increasing by1.8% . Our STWs declined by4.5% and STRs were down by6.8% . EBITDA increased by2.9% .

-

3Q24: Revenue increased by

- Commercial highlights: The beer industry remained resilient in 3Q24, improving in both volume and revenue trends quarter over quarter according to Circana, supported by the phasing of key holidays. Our beer portfolio is estimated to have gained market share this quarter, driven by Michelob Ultra and Busch Light, which were two of the top three volume share gainers in the industry. In Beyond Beer, our spirits-based ready-to-drink portfolio delivered volume growth in the mid-teens, outperforming the industry.

-

Operating performance:

- 3Q24: Revenue was flattish, with low-single digit revenue per hl growth driven by revenue management initiatives. Volumes declined by low-single digits, outperforming the industry which was negatively impacted by adverse weather and a soft consumer environment. EBITDA grew by mid-single digits with continued margin expansion.

- 9M24: Revenue grew by mid-single digits with revenue per hl growth of low-single digits. Volumes increased by low-single digits, outperforming the industry. EBITDA grew by high-single digits with margin expansion.

-

Commercial highlights: Our above core portfolio outperformed, delivering continued volume growth this quarter, led by the performance of Modelo and Pacifico. We continued to progress our digital initiatives, with BEES Marketplace growing GMV by

14% versus 3Q23, and our digital DTC platform, TaDa Delivery, generating approximately 1.1 million orders, a36% increase versus 3Q23.

-

Operating performance:

- 3Q24: Revenue increased by high-single digits with high-single digit revenue per hl growth, driven by pricing actions and other revenue management initiatives. Beer volumes were flattish while total volumes declined by low-single digits, as industry service levels were impacted by a week-long national trucking strike in September. EBITDA grew by low twenties with margin expansion.

- 9M24: Revenue grew by low-teens with high-single digit revenue per hl growth. Volumes increased by low-single digits. EBITDA grew by high-teens with margin expansion.

- Commercial highlights: The beer category remained resilient this quarter with our portfolio continuing to gain share of total alcohol. Our performance was driven by our premium and super premium brands which delivered high-teens volume growth, led by Corona and Stella Artois. Our core beer portfolio continued to grow, delivering a low-single digit revenue increase.

-

Operating performance:

-

3Q24: Revenue grew by

5.2% with revenue per hl growth of3.8% driven by premiumization and revenue management initiatives. Total volumes grew by1.3% , with beer volumes increasing by0.6% . Non-beer volumes increased by3.4% . EBITDA increased by10.9% with margin expansion of 174bps. -

9M24: Total volumes grew by

3.2% with beer volumes up by2.3% and non-beer volumes up by5.8% . Revenue grew by6.3% with a revenue per hl increase of2.9% . EBITDA grew by17.6% with 309bps of margin expansion.

-

3Q24: Revenue grew by

-

Commercial highlights: Our premium and super premium beer brands continued to lead our growth this quarter, delivering low twenties volume growth, led by Corona, Spaten and Original. Within the core beer segment, Brahma’s momentum continued, delivering a high-single digit volume increase. Non-beer performance was led by our low- and no-sugar portfolio, which grew volumes in the low twenties. We continued to progress our digital initiatives, with BEES Marketplace growing GMV by

43% versus 3Q23, and our digital DTC platform, Zé Delivery, generating over 16 million orders in 3Q24, an8% increase versus 3Q23.

-

Operating performance:

- 3Q24: Revenue was flattish with slight revenue per hl growth driven by continued premiumization. Volume declined by low-single digits, outperforming a soft industry in a majority of our key markets according to our estimates. EBITDA grew by low-single digits with margin recovery.

- 9M24: Volume grew by low-single digits, outperforming the industry in a majority of our key markets according to our estimates. Both revenue and revenue per hl increased by low-single digits. EBITDA grew by low-teens with margin recovery driven by top-line growth and cost efficiencies.

-

Commercial highlights: We continued to premiumize our portfolio in

Europe , with our premium and super premium portfolio making up approximately57% of our revenue in 3Q24. Our performance this quarter was driven by our megabrands, led by Corona which delivered another quarter of double-digit volume growth. In the no-alcohol beer segment, Corona Cero, the official beer partner of the Olympic Games, delivered triple digit volume growth.

-

Operating performance:

- 3Q24: Revenue increased by low-teens, with low-single digit volume growth and a revenue per hl increase of high-single digits, driven by revenue management initiatives and continued premiumization. EBITDA grew by mid-teens with margin expansion.

- 9M24: Revenue grew by low-teens with high-single digit revenue per hl growth and a mid-single digit increase in volume, estimated to have outperformed the industry in both beer and Beyond Beer. EBITDA increased by low twenties with margin expansion.

- Commercial highlights: The momentum of our business continued with both our premium beer and Beyond Beer portfolios estimated to have gained share of their respective segments. Our performance was led by our above core beer brands, which grew volumes by high-teens driven by Corona and Stella Artois. In Beyond Beer, our portfolio grew volumes by high-single digits driven by Flying Fish.

-

Operating performance:

-

3Q24: Top-line performance was impacted by a soft industry, particularly from continued weakness in the on-premise channel. Revenue declined by

16.1% with volumes declining by14.2% and revenue per hl decreasing by2.2% . EBITDA declined by20.1% with margin contraction of approximately 175bps. -

9M24: Revenue declined by

11.7% with revenue per hl declining by1.2% and volumes decreasing by10.6% . EBITDA declined by12.2% with margin contraction of 26bps.

-

3Q24: Top-line performance was impacted by a soft industry, particularly from continued weakness in the on-premise channel. Revenue declined by

-

Commercial highlights: We continued to invest behind our commercial strategy, focused on premiumization, channel and geographic expansion, and digital transformation, even in the context of a soft industry. We believe we are well positioned to lead the premiumization of the beer category with our premium and super premium portfolio contributing approximately two-thirds of our revenue in 9M24. The brand power of our portfolio combined with the long-term growth potential from geographic expansion and industry premiumization remains a compelling value creation opportunity. The roll out and adoption of the BEES platform continued, as of September 2024, BEES is present in 306 cities with approximately

70% of our revenue generated through digital channels.

Highlights from our other markets

-

Canada : Revenue was flattish this quarter with revenue per hl growth of low-single digits, driven by revenue management initiatives and continued premiumization. Volumes declined by low-single digits, with beer volumes estimated to be in-line with the industry. Our portfolio has momentum, with four of our beer brands in the top five fastest growing in the country this quarter, led by Michelob Ultra which was number one. -

Peru : Revenue grew by low-single digits this quarter with revenue per hl growth of high-single digits, driven by revenue management initiatives. Volumes declined by mid-single digits, outperforming a soft industry according to our estimates, which was negatively impacted by adverse weather. -

Ecuador : Revenue decreased by high-single digits in 3Q24 with volumes declining by high-single digits, estimated to be in line with a soft industry, which was negatively impacted by rolling blackouts and lower consumer confidence. -

Argentina : Volumes declined by mid-teens in 3Q24 as overall consumer demand was impacted by inflationary pressures. For FY24, the definition of organic revenue growth inArgentina has been amended to cap the price growth to a maximum of2% per month. Revenue grew by high-single digits on this basis. -

Africa excludingSouth Africa : InNigeria , our total volumes grew by high-single digits this quarter, cycling a soft industry in 3Q23. Revenue grew by strong double-digits, driven by revenue management initiatives in a highly inflationary environment. In our other markets inAfrica , we grew volume in aggregate by high-single digits in 3Q24, driven byTanzania ,Mozambique ,Zambia andGhana . -

South Korea : Revenue increased by high-teens in 3Q24 with revenue per hl growth of low-teens, driven by revenue management initiatives and positive brand and packaging mix. Volumes grew by mid-single digits, outperforming the industry in both the on-premise and in-home channels, with performance led by our megabrand Cass.

Consolidated Income Statement

Figure 3. Consolidated income statement (million USD) |

||||||

3Q23 |

3Q24 |

Organic |

||||

growth |

||||||

Revenue |

15 574 |

15 046 |

|

|||

Cost of sales |

-7 180 |

-6 680 |

|

|||

Gross profit |

8 394 |

8 366 |

|

|||

SG&A |

-4 583 |

-4 490 |

- |

|||

Other operating income/(expenses) |

217 |

215 |

|

|||

Normalized profit from operations (normalized EBIT) |

4 027 |

4 091 |

|

|||

Non-underlying items above EBIT (incl. impairment losses) |

-352 |

-125 |

||||

Net finance income/(cost) |

-1 223 |

-1 043 |

||||

Non-underlying net finance income/(cost) |

84 |

236 |

||||

Share of results of associates |

95 |

89 |

||||

Income tax expense |

-666 |

-758 |

||||

Profit |

1 966 |

2 489 |

||||

Profit attributable to non-controlling interest |

494 |

418 |

||||

Profit attributable to equity holders of AB InBev |

1 472 |

2 071 |

||||

|

||||||

Normalized EBITDA |

5 431 |

5 424 |

|

|||

Underlying profit attributable to equity holders of AB InBev |

1 735 |

1 971 |

||||

. |

||||||

9M23 |

9M24 |

Organic |

||||

growth |

||||||

Revenue |

44 907 |

44 927 |

|

|||

Cost of sales |

-20 717 |

-20 100 |

|

|||

Gross profit |

24 190 |

24 827 |

|

|||

SG&A |

-13 635 |

-13 738 |

- |

|||

Other operating income/(expenses) |

544 |

548 |

|

|||

Normalized profit from operations (normalized EBIT) |

11 099 |

11 638 |

|

|||

Non-underlying items above EBIT (incl. impairment losses) |

-458 |

-244 |

||||

Net finance income/(cost) |

-3 743 |

-3 400 |

||||

Non-underlying net finance income/(cost) |

-619 |

-294 |

||||

Share of results of associates |

201 |

226 |

||||

Non-underlying share of results of associates |

- |

104 |

||||

Income tax expense |

-1 858 |

-2 304 |

||||

Profit |

4 621 |

5 725 |

||||

Profit attributable to non-controlling interest |

1 171 |

1 090 |

||||

Profit attributable to equity holders of AB InBev |

3 450 |

4 635 |

||||

|

||||||

Normalized EBITDA |

15 099 |

15 712 |

|

|||

Underlying profit attributable to equity holders of AB InBev |

4 497 |

5 291 |

||||

Non-underlying items above EBIT & Non-underlying share of results of associates

Figure 4. Non-underlying items above EBIT & Non-underlying share of results of associates (million USD) |

||||||||

3Q23 |

3Q24 |

9M23 |

9M24 |

|||||

Restructuring |

-28 |

-38 |

-78 |

-97 |

||||

Business and asset disposal (incl. impairment losses) |

-324 |

-87 |

-361 |

-147 |

||||

Claims and legal costs |

- |

- |

-19 |

- |

||||

Non-underlying items in EBIT |

-352 |

-125 |

-458 |

-244 |

||||

Non-underlying share of results of associates |

- |

- |

- |

104 |

||||

Non-underlying share of results from associates of 9M24 includes the impact from our associate Anadolu Efes’ adoption of IAS 29 hyperinflation accounting on their 2023 results.

Net finance income/(cost)

Figure 5. Net finance income/(cost) (million USD) |

||||||||

3Q23 |

3Q24 |

9M23 |

9M24 |

|||||

Net interest expense |

-789 |

-719 |

-2 419 |

-2 179 |

||||

Net interest on net defined benefit liabilities |

-22 |

-22 |

-64 |

-67 |

||||

Accretion expense |

-194 |

-163 |

-579 |

-545 |

||||

Net interest income on Brazilian tax credits |

29 |

34 |

107 |

95 |

||||

Other financial results |

-247 |

-173 |

-787 |

-704 |

||||

Net finance income/(cost) |

-1 223 |

-1 043 |

-3 743 |

-3 400 |

||||

Non-underlying net finance income/(cost)

Figure 6. Non-underlying net finance income/(cost) (million USD) |

||||||||

3Q23 |

3Q24 |

9M23 |

9M24 |

|||||

Mark-to-market |

84 |

236 |

-619 |

-271 |

||||

Gain/(loss) on bond redemption and other |

- |

- |

- |

-23 |

||||

Non-underlying net finance income/(cost) |

84 |

236 |

-619 |

-294 |

||||

Non-underlying net finance cost in 9M24 includes mark-to-market losses on derivative instruments entered into in order to hedge our share-based payment programs and shares issued in relation to the combination with Grupo Modelo and SAB.

The number of shares covered by the hedging of our share-based payment program, the deferred share instrument and the restricted shares are shown in figure 7, together with the opening and closing share prices.

Figure 7. Non-underlying equity derivative instruments |

||||||||

3Q23 |

3Q24 |

9M23 |

9M24 |

|||||

Share price at the start of the period (Euro) |

51.83 |

54.12 |

56.27 |

58.42 |

||||

Share price at the end of the period (Euro) |

52.51 |

59.38 |

52.51 |

59.38 |

||||

Number of equity derivative instruments at the end of the period (millions) |

100.5 |

100.5 |

100.5 |

100.5 |

||||

Income tax expense

Figure 8. Income tax expense (million USD) |

||||||||

3Q23 |

3Q24 |

9M23 |

9M24 |

|||||

Income tax expense |

666 |

758 |

1 858 |

2 304 |

||||

Effective tax rate |

|

|

|

|

||||

Normalized effective tax rate |

|

|

|

|

||||

The 3Q23 and 3Q24 effective tax rates were positively impacted by non-taxable gains from derivatives related to the hedging of share-based payment programs and of the shares issued in a transaction related to the combination with Grupo Modelo and SAB.

Furthermore, the 9M24 effective tax rate includes

Figure 9. Underlying Profit attributable to equity holders of AB InBev (million USD) |

||||||||

3Q23 |

3Q24 |

9M23 |

9M24 |

|||||

Profit attributable to equity holders of AB InBev |

1 472 |

2 071 |

3 450 |

4 635 |

||||

Net impact of non-underlying items on profit |

224 |

-133 |

973 |

542 |

||||

Hyperinflation impacts in underlying profit |

39 |

33 |

74 |

114 |

||||

Underlying profit attributable to equity holders of AB InBev |

1 735 |

1 971 |

4 497 |

5 291 |

||||

Basic and underlying EPS

Figure 10. Earnings per share (USD) |

||||||||

3Q23 |

3Q24 |

9M23 |

9M24 |

|||||

Basic EPS |

0.73 |

1.03 |

1.71 |

2.31 |

||||

Net impact of non-underlying items on profit |

0.11 |

-0.07 |

0.48 |

0.27 |

||||

Hyperinflation impacts in EPS |

0.02 |

0.02 |

0.04 |

0.06 |

||||

Underlying EPS |

0.86 |

0.98 |

2.23 |

2.64 |

||||

Weighted average number of ordinary and restricted shares (million) |

2 016 |

2 004 |

2 016 |

2 004 |

||||

Figure 11. Key components - Underlying EPS in USD |

||||||||

3Q23 |

3Q24 |

9M23 |

9M24 |

|||||

Normalized EBIT before hyperinflation |

2.02 |

2.06 |

5.56 |

5.84 |

||||

Hyperinflation impacts in normalized EBIT |

-0.03 |

-0.02 |

-0.06 |

-0.04 |

||||

Normalized EBIT |

2.00 |

2.04 |

5.51 |

5.81 |

||||

Net finance cost |

-0.61 |

-0.52 |

-1.86 |

-1.70 |

||||

Income tax expense |

-0.35 |

-0.39 |

-0.97 |

-1.09 |

||||

Associates & non-controlling interest |

-0.20 |

-0.17 |

-0.49 |

-0.43 |

||||

Hyperinflation impacts in EPS |

0.02 |

0.02 |

0.04 |

0.06 |

||||

Underlying EPS |

0.86 |

0.98 |

2.23 |

2.64 |

||||

Weighted average number of ordinary and restricted shares (million) |

2 016 |

2 004 |

2 016 |

2 004 |

||||

Reconciliation between normalized EBITDA and profit attributable to equity holders

Figure 12. Reconciliation of normalized EBITDA to profit attributable to equity holders of AB InBev (million USD) |

||||||||

3Q23 |

3Q24 |

9M23 |

9M24 |

|||||

Profit attributable to equity holders of AB InBev |

1 472 |

2 071 |

3 450 |

4 635 |

||||

Non-controlling interests |

494 |

418 |

1 171 |

1 090 |

||||

Profit |

1 966 |

2 489 |

4 621 |

5 725 |

||||

Income tax expense |

666 |

758 |

1 858 |

2 304 |

||||

Share of result of associates |

-95 |

-89 |

-201 |

-226 |

||||

Non-underlying share of results of associates |

- |

- |

- |

- 104 |

||||

Net finance (income)/cost |

1 223 |

1 043 |

3 743 |

3 400 |

||||

Non-underlying net finance (income)/cost |

-84 |

-236 |

619 |

294 |

||||

Non-underlying items above EBIT (incl. impairment losses) |

352 |

125 |

458 |

244 |

||||

Normalized EBIT |

4 027 |

4 091 |

11 099 |

11 638 |

||||

Depreciation, amortization and impairment |

1 403 |

1 333 |

3 999 |

4 074 |

||||

Normalized EBITDA |

5 431 |

5 424 |

15 099 |

15 712 |

||||

Normalized EBITDA and normalized EBIT are measures utilized by AB InBev to demonstrate the company’s underlying performance.

Normalized EBITDA is calculated excluding the following effects from profit attributable to equity holders of AB InBev: (i) non-controlling interest; (ii) income tax expense; (iii) share of results of associates; (iv) non-underlying share of results of associates; (v) net finance income or cost; (vi) non-underlying net finance income or cost; (vii) non-underlying items above EBIT; and (viii) depreciation, amortization and impairment.

Normalized EBITDA and normalized EBIT are not accounting measures under IFRS and should not be considered as an alternative to profit attributable to equity holders as a measure of operational performance, or an alternative to cash flow as a measure of liquidity. Normalized EBITDA and normalized EBIT do not have a standard calculation method and AB InBev’s definition of normalized EBITDA and normalized EBIT may not be comparable to that of other companies.

Recent Events

Announcement of

On 30 October 2024, the AB InBev Board of Directors approved a

Notes

To facilitate the understanding of AB InBev’s underlying performance, the analyses of growth, including all comments in this press release, unless otherwise indicated, are based on organic growth and normalized numbers. In other words, financials are analyzed eliminating the impact of changes in currencies on translation of foreign operations, and scope changes. For FY24, the definition of organic revenue growth has been amended to cap the price growth in

Legal disclaimer

This release contains “forward-looking statements”. These statements are based on the current expectations and views of future events and developments of the management of AB InBev and are naturally subject to uncertainty and changes in circumstances. The forward-looking statements contained in this release include statements other than historical facts and include statements typically containing words such as “will”, “may”, “should”, “believe”, “intends”, “expects”, “anticipates”, “targets”, “estimates”, “likely”, “foresees” and words of similar import. All statements other than statements of historical facts are forward-looking statements. You should not place undue reliance on these forward-looking statements, which reflect the current views of the management of AB InBev, are subject to numerous risks and uncertainties about AB InBev and are dependent on many factors, some of which are outside of AB InBev’s control. There are important factors, risks and uncertainties that could cause actual outcomes and results to be materially different, including, but not limited to the risks and uncertainties relating to AB InBev that are described under Item 3.D of AB InBev’s Annual Report on Form 20-F filed with the SEC on 11 March 2024. Many of these risks and uncertainties are, and will be, exacerbated by any further worsening of the global business and economic environment, including as a result of the ongoing conflict in

Conference call and webcast

Investor Conference call and webcast on Thursday, 31 October 2024:

2.00pm

Registration details:

Webcast (listen-only mode):

AB InBev 3Q24 Results Webcast

To join by phone, please use one of the following two phone numbers:

Toll-Free: +1-877-407-8029

Toll: +1-201-689-8029

About AB InBev

Anheuser-Busch InBev (AB InBev) is a publicly traded company (Euronext: ABI) based in Leuven,

Annex 1: Segment reporting (3Q)

AB InBev Worldwide |

3Q23 |

Scope |

Currency Translation |

Organic Growth |

3Q24 |

Organic Growth |

||||||

Total volumes (thousand hls) |

151 891 |

-163 |

- |

-3 688 |

148 039 |

- |

||||||

of which AB InBev own beer |

132 325 |

-159 |

- |

-4 041 |

128 124 |

- |

||||||

Revenue |

15 574 |

76 |

-931 |

327 |

15 046 |

|

||||||

Cost of sales |

-7 180 |

-171 |

531 |

139 |

-6 680 |

|

||||||

Gross profit |

8 394 |

-95 |

-399 |

467 |

8 366 |

|

||||||

SG&A |

-4 583 |

-45 |

262 |

-123 |

-4 490 |

- |

||||||

Other operating income/(expenses) |

217 |

10 |

-23 |

11 |

215 |

|

||||||

Normalized EBIT |

4 027 |

-131 |

-161 |

355 |

4 091 |

|

||||||

Normalized EBITDA |

5 431 |

-135 |

-254 |

382 |

5 424 |

|

||||||

Normalized EBITDA margin |

|

|

169bps |

|||||||||

|

||||||||||||

|

3Q23 |

Scope |

Currency Translation |

Organic Growth |

3Q24 |

Organic Growth |

||||||

Total volumes (thousand hls) |

23 007 |

-159 |

- |

-83 |

22 764 |

- |

||||||

Revenue |

3 863 |

-40 |

-13 |

58 |

3 867 |

|

||||||

Cost of sales |

-1 656 |

23 |

5 |

26 |

-1 602 |

|

||||||

Gross profit |

2 207 |

-17 |

-9 |

84 |

2 265 |

|

||||||

SG&A |

-1 168 |

-10 |

5 |

79 |

-1 094 |

|

||||||

Other operating income/(expenses) |

-2 |

- |

- |

9 |

8 |

- |

||||||

Normalized EBIT |

1 038 |

-27 |

-4 |

172 |

1 179 |

|

||||||

Normalized EBITDA |

1 231 |

-28 |

-4 |

160 |

1 358 |

|

||||||

Normalized EBITDA margin |

|

|

363bps |

|||||||||

|

||||||||||||

Middle |

3Q23 |

Scope |

Currency Translation |

Organic Growth |

3Q24 |

Organic Growth |

||||||

Total volumes (thousand hls) |

37 931 |

-4 |

- |

- 819 |

37 107 |

- |

||||||

Revenue |

4 338 |

-31 |

-287 |

83 |

4 103 |

|

||||||

Cost of sales |

-1 722 |

13 |

104 |

142 |

-1 462 |

|

||||||

Gross profit |

2 617 |

-18 |

-183 |

226 |

2 641 |

|

||||||

SG&A |

-995 |

12 |

74 |

-27 |

-937 |

- |

||||||

Other operating income/(expenses) |

16 |

-13 |

-1 |

1 |

3 |

- |

||||||

Normalized EBIT |

1 637 |

-19 |

-110 |

199 |

1 707 |

|

||||||

Normalized EBITDA |

2 051 |

-35 |

-139 |

190 |

2 068 |

|

||||||

Normalized EBITDA margin |

|

|

343bps |

|||||||||

|

||||||||||||

|

3Q23 |

Scope |

Currency Translation |

Organic Growth |

3Q24 |

Organic Growth |

||||||

Total volumes (thousand hls) |

39 733 |

- |

- |

- 231 |

39 502 |

- |

||||||

Revenue |

3 106 |

167 |

-516 |

175 |

2 932 |

|

||||||

Cost of sales |

-1 586 |

-213 |

346 |

-49 |

-1 502 |

- |

||||||

Gross profit |

1 521 |

-46 |

-170 |

126 |

1 430 |

|

||||||

SG&A |

-882 |

-116 |

157 |

-30 |

-870 |

- |

||||||

Other operating income/(expenses) |

105 |

20 |

-23 |

2 |

104 |

|

||||||

Normalized EBIT |

744 |

-142 |

-36 |

98 |

664 |

|

||||||

Normalized EBITDA |

1 013 |

-127 |

-86 |

108 |

908 |

|

||||||

Normalized EBITDA margin |

|

|

156bps |

EMEA |

3Q23 |

Scope |

Currency Translation |

Organic Growth |

3Q24 |

Organic Growth |

||||||

Total volumes (thousand hls) |

23 407 |

- |

- |

632 |

24 039 |

|

||||||

Revenue |

2 266 |

4 |

-106 |

187 |

2 351 |

|

||||||

Cost of sales |

-1 181 |

-3 |

74 |

-77 |

-1 188 |

- |

||||||

Gross profit |

1 085 |

- |

-32 |

110 |

1 163 |

|

||||||

SG&A |

-652 |

-27 |

18 |

-28 |

-689 |

- |

||||||

Other operating income/(expenses) |

62 |

1 |

-1 |

-15 |

47 |

- |

||||||

Normalized EBIT |

496 |

-26 |

-15 |

67 |

521 |

|

||||||

Normalized EBITDA |

752 |

-26 |

-28 |

82 |

780 |

|

||||||

Normalized EBITDA margin |

|

|

80bps |

|||||||||

|

||||||||||||

|

3Q23 |

Scope |

Currency Translation |

Organic Growth |

3Q24 |

Organic Growth |

||||||

Total volumes (thousand hls) |

27 672 |

- |

- |

-3 158 |

24 514 |

- |

||||||

Revenue |

1 878 |

-1 |

-8 |

-178 |

1 691 |

- |

||||||

Cost of sales |

-886 |

-7 |

3 |

93 |

-797 |

|

||||||

Gross profit |

993 |

-8 |

-5 |

-86 |

894 |

- |

||||||

SG&A |

-567 |

-18 |

5 |

- |

-580 |

- |

||||||

Other operating income/(expenses) |

34 |

1 |

- |

-9 |

27 |

- |

||||||

Normalized EBIT |

460 |

-25 |

1 |

-96 |

340 |

- |

||||||

Normalized EBITDA |

625 |

-27 |

1 |

-95 |

503 |

- |

||||||

Normalized EBITDA margin |

|

|

-213bps |

|||||||||

|

||||||||||||

Global Export and Holding Companies |

3Q23 |

Scope |

Currency Translation |

Organic Growth |

3Q24 |

Organic Growth |

||||||

Total volumes (thousand hls) |

141 |

- |

- |

-29 |

112 |

- |

||||||

Revenue |

122 |

-22 |

-1 |

2 |

102 |

|

||||||

Cost of sales |

-151 |

16 |

- |

5 |

-129 |

|

||||||

Gross profit |

-28 |

-6 |

-1 |

8 |

-27 |

|

||||||

SG&A |

-320 |

114 |

3 |

-117 |

-320 |

- |

||||||

Other operating income/(expenses) |

1 |

- |

1 |

24 |

26 |

- |

||||||

Normalized EBIT |

-347 |

108 |

3 |

-85 |

-321 |

- |

||||||

Normalized EBITDA |

-240 |

107 |

3 |

-63 |

-194 |

- |

Annex 2: Segment reporting (9M)

AB InBev Worldwide |

9M23 |

Scope |

Currency Translation |

Organic Growth |

9M24 |

Organic Growth |

||||||

Total volumes (thousand hls) |

440 021 |

- 484 |

- |

-5 661 |

433 877 |

- |

||||||

of which AB InBev own beer |

382 135 |

- 463 |

- |

-7 233 |

374 438 |

- |

||||||

Revenue |

44 907 |

1 807 |

-2 900 |

1 113 |

44 927 |

|

||||||

Cost of sales |

-20 717 |

-1 190 |

1 679 |

128 |

-20 100 |

|

||||||

Gross profit |

24 190 |

617 |

-1 221 |

1 241 |

24 827 |

|

||||||

SG&A |

-13 635 |

- 717 |

908 |

- 293 |

-13 738 |

- |

||||||

Other operating income/(expenses) |

544 |

20 |

-18 |

2 |

548 |

|

||||||

Normalized EBIT |

11 099 |

- 80 |

- 331 |

950 |

11 638 |

|

||||||

Normalized EBITDA |

15 099 |

83 |

- 606 |

1 136 |

15 712 |

|

||||||

Normalized EBITDA margin |

|

|

166bps |

|||||||||

|

||||||||||||

|

9M23 |

Scope |

Currency Translation |

Organic Growth |

9M24 |

Organic Growth |

||||||

Total volumes (thousand hls) |

70 401 |

- 470 |

- |

-3 175 |

66 756 |

- |

||||||

Revenue |

11 789 |

- 115 |

- 12 |

- 338 |

11 324 |

- |

||||||

Cost of sales |

-5 076 |

66 |

4 |

254 |

-4 752 |

|

||||||

Gross profit |

6 713 |

- 49 |

- 8 |

- 85 |

6 572 |

- |

||||||

SG&A |

-3 521 |

11 |

4 |

226 |

-3 280 |

|

||||||

Other operating income/(expenses) |

16 |

- |

- |

-17 |

-1 |

- |

||||||

Normalized EBIT |

3 209 |

- 38 |

- 3 |

124 |

3 291 |

|

||||||

Normalized EBITDA |

3 769 |

- 42 |

- 4 |

98 |

3 822 |

|

||||||

Normalized EBITDA margin |

|

|

183bps |

|||||||||

Middle |

9M23 |

Scope |

Currency Translation |

Organic Growth |

9M24 |

Organic Growth |

||||||

Total volumes (thousand hls) |

110 095 |

- 13 |

- |

1 097 |

111 179 |

|

||||||

Revenue |

11 911 |

- 43 |

206 |

602 |

12 677 |

|

||||||

Cost of sales |

-4 648 |

- |

- 78 |

84 |

-4 641 |

|

||||||

Gross profit |

7 263 |

- 42 |

129 |

686 |

8 036 |

|

||||||

SG&A |

-2 858 |

16 |

- 48 |

- 111 |

-3 002 |

- |

||||||

Other operating income/(expenses) |

24 |

- |

1 |

1 |

26 |

- |

||||||

Normalized EBIT |

4 429 |

- 27 |

82 |

576 |

5 060 |

|

||||||

Normalized EBITDA |

5 545 |

- 34 |

97 |

564 |

6 172 |

|

||||||

Normalized EBITDA margin |

|

|

227bps |

|||||||||

|

||||||||||||

|

9M23 |

Scope |

Currency Translation |

Organic Growth |

9M24 |

Organic Growth |

||||||

Total volumes (thousand hls) |

115 756 |

- |

- |

61 |

115 818 |

|

||||||

Revenue |

8 956 |

1 979 |

-2 487 |

502 |

8 950 |

|

||||||

Cost of sales |

-4 535 |

-1 244 |

1 372 |

- 109 |

-4 515 |

- |

||||||

Gross profit |

4 421 |

736 |

-1 115 |

393 |

4 435 |

|

||||||

SG&A |

-2 686 |

- 836 |

820 |

- 85 |

-2 787 |

- |

||||||

Other operating income/(expenses) |

276 |

16 |

-14 |

42 |

319 |

|

||||||

Normalized EBIT |

2 011 |

- 85 |

- 309 |

350 |

1 967 |

|

||||||

Normalized EBITDA |

2 779 |

93 |

- 535 |

406 |

2 742 |

|

||||||

Normalized EBITDA margin |

|

|

267bps |

EMEA |

9M23 |

Scope |

Currency Translation |

Organic Growth |

9M24 |

Organic Growth |

||||||

Total volumes (thousand hls) |

66 249 |

- |

- |

2 672 |

68 921 |

|

||||||

Revenue |

6 337 |

10 |

- 478 |

710 |

6 579 |

|

||||||

Cost of sales |

-3 392 |

- 9 |

323 |

- 324 |

-3 403 |

- |

||||||

Gross profit |

2 945 |

1 |

- 155 |

386 |

3 176 |

|

||||||

SG&A |

-1 959 |

- 34 |

88 |

- 89 |

-1 994 |

- |

||||||

Other operating income/(expenses) |

145 |

2 |

-4 |

-18 |

126 |

- |

||||||

Normalized EBIT |

1 131 |

-31 |

-71 |

279 |

1 308 |

|

||||||

Normalized EBITDA |

1 894 |

- 31 |

- 123 |

330 |

2 070 |

|

||||||

Normalized EBITDA margin |

|

|

167bps |

|||||||||

|

||||||||||||

|

9M23 |

Scope |

Currency Translation |

Organic Growth |

9M24 |

Organic Growth |

||||||

Total volumes (thousand hls) |

77 261 |

- |

- |

-6 303 |

70 958 |

- |

||||||

Revenue |

5 557 |

-2 |

-131 |

-349 |

5 074 |

- |

||||||

Cost of sales |

-2 635 |

-20 |

58 |

216 |

-2 381 |

|

||||||

Gross profit |

2 921 |

-22 |

-73 |

-133 |

2 694 |

- |

||||||

SG&A |

-1 600 |

-26 |

40 |

12 |

-1 575 |

|

||||||

Other operating income/(expenses) |

87 |

2 |

-2 |

-5 |

82 |

- |

||||||

Normalized EBIT |

1 408 |

-45 |

-35 |

-126 |

1 202 |

- |

||||||

Normalized EBITDA |

1 897 |

-49 |

-47 |

-113 |

1 689 |

- |

||||||

Normalized EBITDA margin |

|

|

9bps |

|||||||||

|

||||||||||||

Global Export and Holding Companies |

9M23 |

Scope |

Currency Translation |

Organic Growth |

9M24 |

Organic Growth |

||||||

Total volumes (thousand hls) |

259 |

- |

- |

-14 |

244 |

- |

||||||

Revenue |

358 |

-22 |

1 |

-14 |

323 |

- |

||||||

Cost of sales |

-431 |

16 |

- |

7 |

-408 |

|

||||||

Gross profit |

-73 |

-6 |

- |

-7 |

-86 |

- |

||||||

SG&A |

-1 012 |

152 |

5 |

-246 |

-1 101 |

- |

||||||

Other operating income/(expenses) |

-4 |

- |

- |

-1 |

-5 |

- |

||||||

Normalized EBIT |

-1 089 |

146 |

5 |

-253 |

-1 191 |

- |

||||||

Normalized EBITDA |

-786 |

145 |

5 |

-148 |

-784 |

- |

View source version on businesswire.com: https://www.businesswire.com/news/home/20241030139581/en/

Investors

Shaun Fullalove

E-mail: shaun.fullalove@ab-inbev.com

Ekaterina Baillie

E-mail: ekaterina.baillie@ab-inbev.com

Cyrus Nentin

E-mail: cyrus.nentin@ab-inbev.com

Media

Media Relations

E-mail: media.relations@ab-inbev.com

Source: Anheuser-Busch InBev