Critical Metals Corp Releases Additional High-Grade REE Results From Diamond Drilling at Tanbreez in Greenland

Rhea-AI Summary

Positive

- High-grade drill results showing consistent 0.43% TREO with 28% HREO plus 1.44% ZrO2

- Potential to double resource estimate from 225MT to 500MT exploration target

- Strong project economics with NPV of US$2.4-3.0B and 180% IRR before tax

- Option to increase ownership stake from 42% to 92.5%

- Multiple revenue streams from eudialyte, feldspar, and arfvedsonite components

Negative

- Current ownership limited to 42% stake

- Project still in exploration phase requiring additional drilling and resource confirmation

- Requires further regulatory approvals from Greenland authorities

- Complex ownership structure with multiple stakeholders

News Market Reaction

On the day this news was published, CRML gained 5.84%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

NEW YORK, June 09, 2025 (GLOBE NEWSWIRE) -- Critical Metals Corp. (Nasdaq: CRML) (“Critical Metals Corp” or the “Company”), a leading critical minerals mining company, is pleased to publish for the first time the assay results of eleven deep diamond drill holes from the Tanbreez Project in Greenland drilled in 2007 and 2013 at the Fjord Deposit.

Commenting on the assay results, Tony Sage, CEO and Executive Chairman of the Company, said:

"I am further encouraged by the deep diamond drill hole results at Tanbreez, revealing exceptional assay results over wider and deeper mineralization. Tanbreez continues to yield consistent high-grade drilling results presenting the Company with a compelling opportunity to significantly increase and double our current Maiden Resource Estimate (MRE) with an exploration target of 500MT of rare earth material up from our previous target of 225MT.”

“This key technical work to uncover and update historical information, strategically positions us to advance our plans for the development strategy as we deepen our understanding of the potential of this world-class asset and the material it contains. Our exploration and in-country field crews are currently on the ground at Tanbreez organizing the forthcoming field season preparing for resource and exploration drilling. After recently announcing the MRE of ~45MT

The Tanbreez Project is operated by Tanbreez Mining Greenland A/S and is currently under the ownership of Critical Metals Corp. (NASDAQ: CRML) (Critical Metals or CRML), which currently holds a

Next Steps

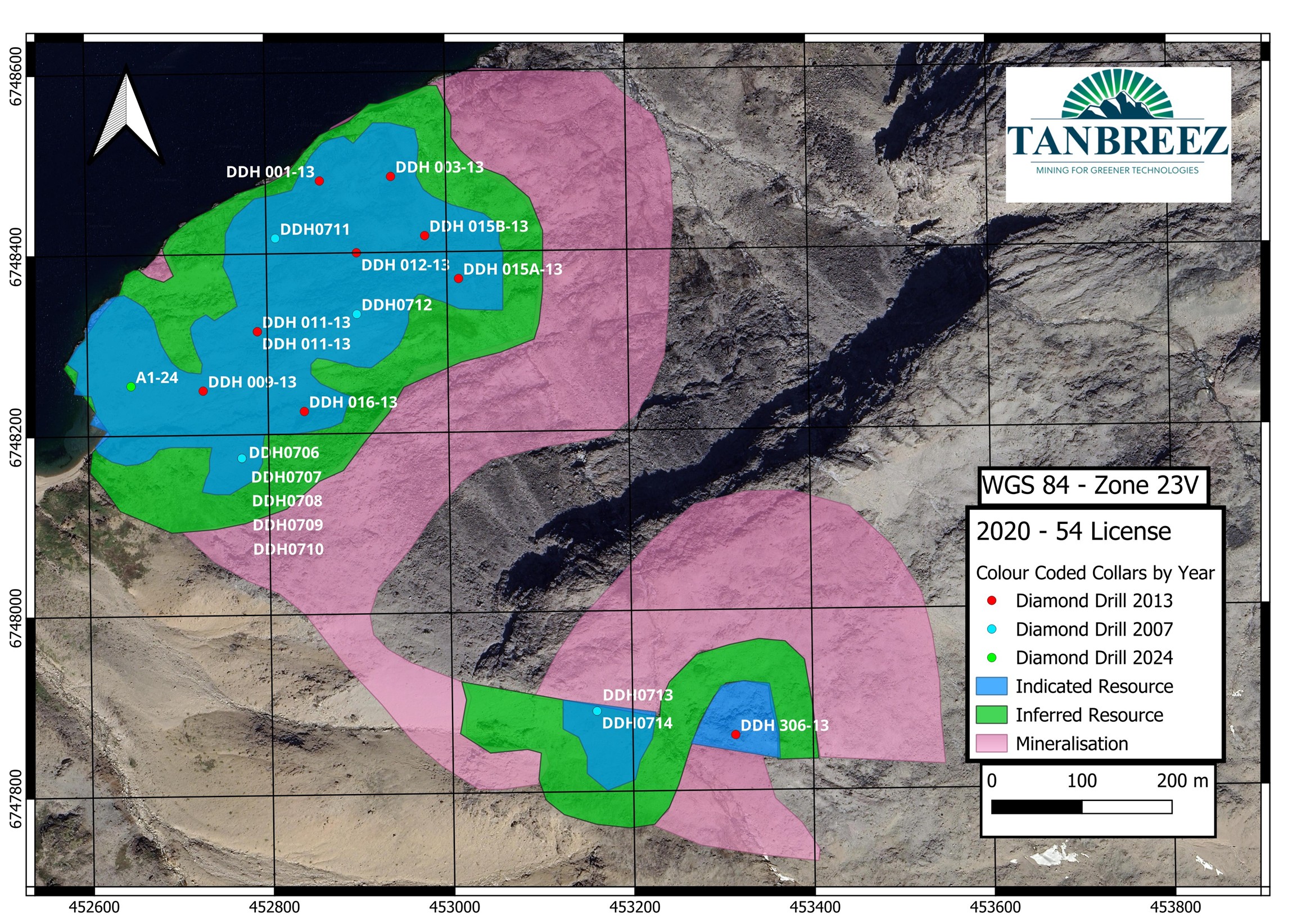

The Company has applied to the Greenland MSLA for a Program of Works for the 2025 resource drilling programs aimed at upgrading the Inferred Resource to Indicated Resource category and extending the size of the Tanbreez Fjord and Hill Zone Deposits (See figure 7).

The applications with Greenland authorities are well-advanced and the Company is preparing for the 2025 field season with drilling and exploration executives visiting the deposit from 30 May.

The Company is currently re-assaying historical pulps stored in Perth and Greenland from some of the existing 2007, 2010, 2013 and 2024 drill, rock chip and bulk sampling for confirmation and check assay reconciliation. The pulp will be analyzed by ALS Metallurgical Laboratory in Perth Western Australia and the results will be published when they become available. Further updated historical assay results are expected soon.

The first stage of the priority resource drilling program will target the Fjord Deposit containing the 23MT MRE footprint by extending drilling further to the north and east of the 16-diamond hole program from 2024.

The average target depth will be 60m – 80m drilling through the mineralized kakortokite bearing REE and metal oxides and 5m into the basal unit sanitizing mineralisation from the uneconomic grade ‘Black Madonna’ unit. Critical Metals Corp will commence its 2025 drilling campaign following satisfactory drill results from the 2024 program with the remaining 15 holes assay. The Company expects to announce the results from the 2024 campaign shortly. .

The second stage of the priority resource drilling program will target the Hill Zone Deposit containing 22.6MT MRE area by infilling drill lines between D306 -13 and DX-01 and DX-02 and DX-01 on the east to west margins over the current MRE footprint.

The target depth will be limited to 150m, targeting continuous mineralisation to defined depth establishing a re-categorization of Inferred to Indicated Resource upgrade.

The Company continues to evaluate all available data from the previous owner’s database and will publish results upon third party and in-house consultation.

Highlights – Newly Released Diamond Drill Hole Results

The weighted average grade1-

_____________________________

1 Weighted average grade estimated: SUM (interval x grade) divided by SUM (interval)

| Diamond Drill Hole | Interval metres Grade (TREO) % | Grade (HREO) % | Grade (ZrO2) |

| DDH-07-06 | 47.65m at | ||

| DDH-07-07 | 99.33m at | ||

| DDH-07-08 | 118.37m at | ||

| DDH-07-09 | 72.96m at | ||

| DDH-07-10 | 133.61m at | ||

| DDH-07-11 | 247.75m at | ||

| DDH-07-12 | 76.50m at | ||

| DDH-07-13 | 79.12m at | ||

| DDH-07-14 | 240.89m at | ||

| DDH 13-011 | 60.50m at | ||

| DDH 13-016 | 38.95m at |

Figure 1 – 30 May 2025 site inspection Fjord deposit drill hole collars DDH-07-06 to DDH-07-10. Mr Greg Barnes (Tanbreez Mining Greenland A/S), & Mr George Karageorge Company Chief Technical Officer.

Highlights – Recently Released Diamond Drill Hole Results

Today’s announcement reports assay results confirming deep and highly mineralized TREO for each drill hole ranging from

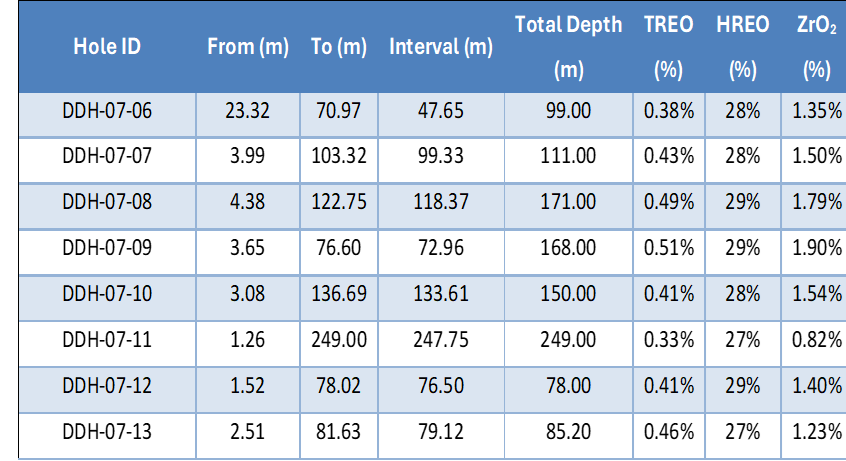

Table 1 - Recent Drill Hole Results (announced 18 March 2025, 28 March 2025, 12 May 2025 and 9 June 2025) – holes DDH-07-06 to DDH-07-10 were drilled from the same collar location

BDL = Below Detection Limit NA = Not Assayed

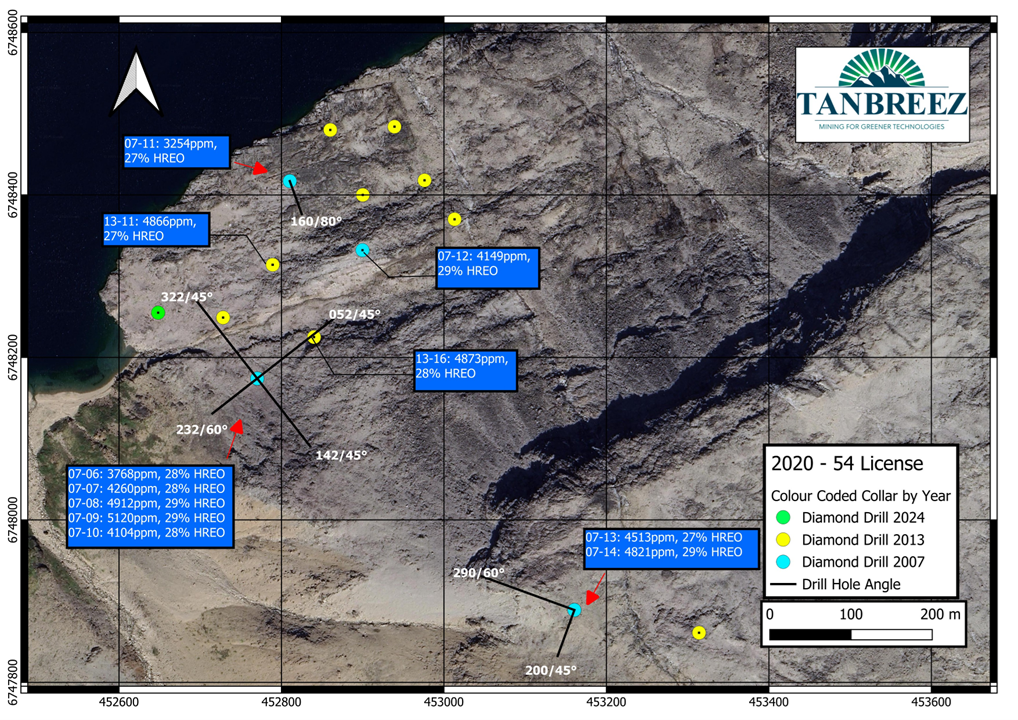

New Drill Hole Results Locations within the Fjord Deposit Area

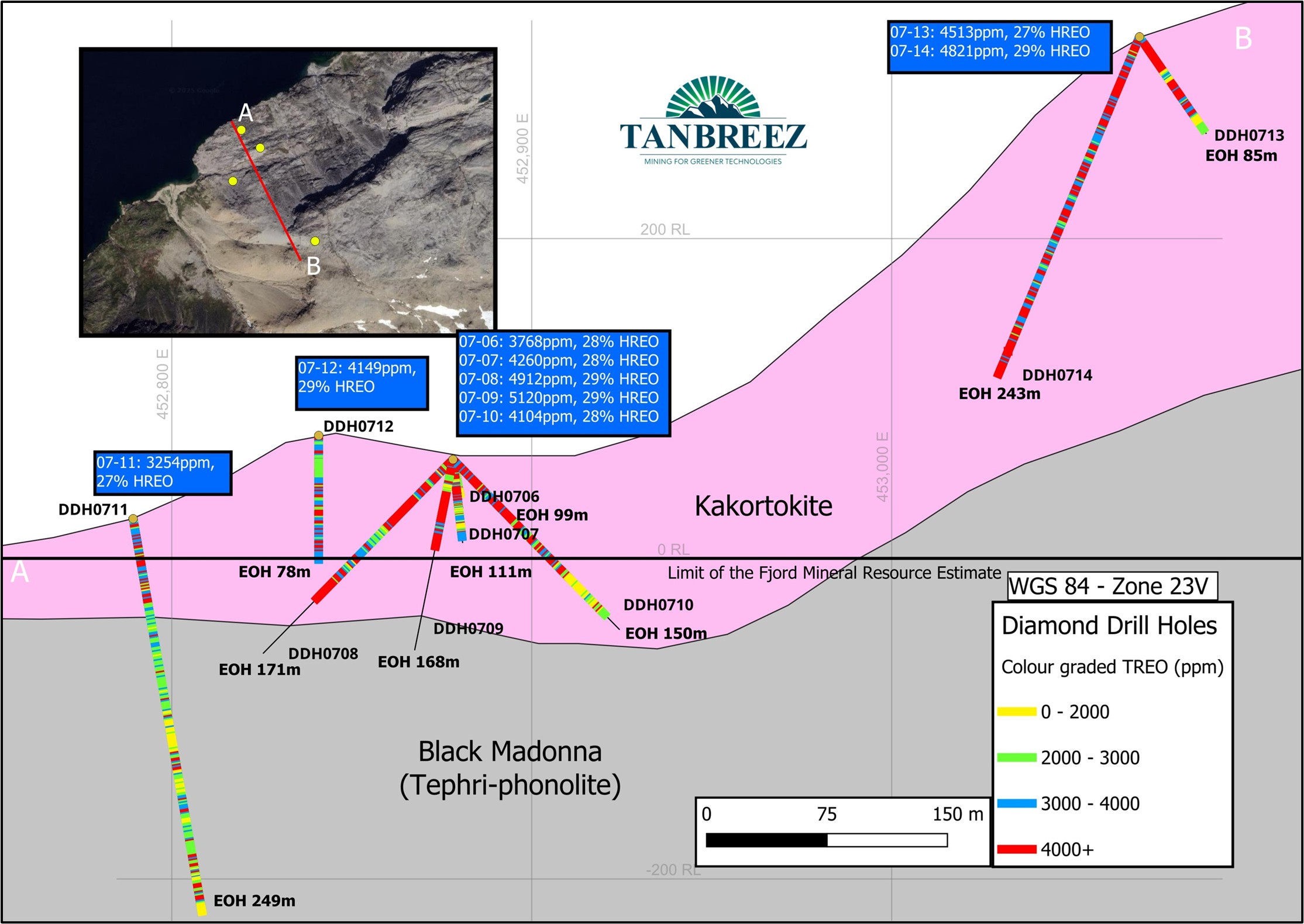

Today’s announcement publishes new results for drill holes drilled through the Fjord deposit and extended below the Mineral Resource Estimate (MRE) for the Fjord deposit (see Nasdaq Press Release 13 March and 29 May 2025). The MRE assessed the eudialyte component of the kakortokite limited to the material above sea level. The deeper drill holes identified rare earth mineralisation at similar grades within the kakortokite unit below and within the MRE.

| Hole ID | Easting | Northing | Elevation | Dip | Azimuth | Total Depth |

| DDH-07-06 | 452770 | 6748174 | 62 | -45 | 232 | 99 |

| DDH-07-07 | 452770 | 6748174 | 62 | -60 | 232 | 111 |

| DDH-07-08 | 452770 | 6748174 | 62 | -45 | 322 | 171 |

| DDH-07-09 | 452770 | 6748174 | 62 | -45 | 52 | 168 |

| DDH-07-10 | 452770 | 6748174 | 62 | -45 | 142 | 150 |

| DDH-07-11 | 452810 | 6748417 | 25 | -80 | 160 | 249 |

| DDH-07-12 | 452899 | 6748332 | 77 | -90 | 0 | 78 |

| DDH-07-13 | 453160 | 6747889 | 326 | -45 | 200 | 85.2 |

| DDH-07-14 | 453160 | 6747889 | 326 | -60 | 290 | 243 |

| DDH 13-011 | 452789 | 6748314 | 41 | -90 | -90 | 62 |

| DDH 13-016 | 452840 | 6748225 | 64 | -90 | -90 | 68 |

Table 2 – New drill hole locations

These drill holes drilled through the Fjord deposit and extended below the Mineral Resource Estimate for the Fjord deposit (see Nasdaq Press Release 17 March, 31 March and 19 May 2025). The MRE assessed the eudialyte component of the kakortokite limited to the material above sea level. The deeper drill holes identified rare earth mineralisation at similar grades within the kakortokite unit below the MRE.

Deep Drill Hole Results

The new deep hole results announced today present a compelling opportunity for the Company to increase the existing MRE over the Tanbreez Fjord Deposit with infill and extension drilling between all historical diamond and RC drill holes (see Nasdaq Press Release 17 March, 31 March and 19 May 2025). The MRE assessed the eudialyte component of the kakortokite limited to the material ).

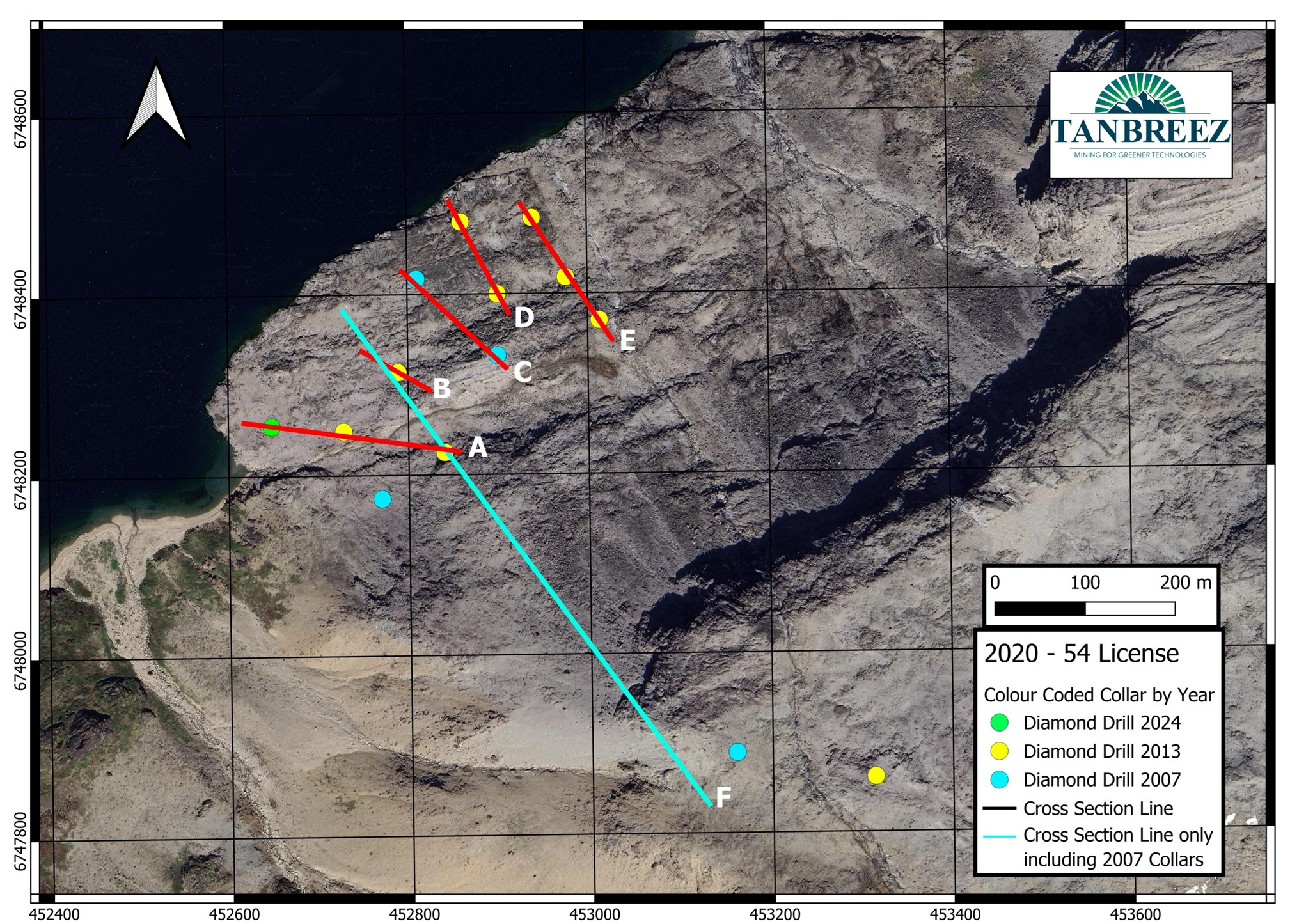

- DDH-007-06, DDH-007-07, DDH-007-08, DDH-007-09, DDH-007-010, were drilled from the same location as a fan of holes into the kakortokite above sea level (except DDH-007-08 and DDH-007-10). DDH-007-12 was drilled between the fan of holes and the fjord coastline down to sea level and DDH-007-11 drilled to 21m below sea level. These holes were included in the MRE.

- DDH-007-08 and DDH-007-011 drilled below sea level. These holes confirmed the extension of the TREO mineralisation below the MRE.

- DDH-007-013 and DDH-007-14 were collared 264 metres above the fan of holes and confirmed extensions to the TREO mineralisation to the south of the MRE.

- DDH-13-011, DDH-13-016 were drilled between the fan of holes and DDH-007-11 and 12.

- Drill hole intervals were assayed for a full suite of rare earth oxides plus zirconium oxide, tantalum oxide, and niobium oxide (See table 3 and figures 4, 5, and 6)

Figure 2 - Drillhole collar positions for the new deep diamond holes in the Fjord Deposit area with the average assay results from surface.

The Fjord rare-earth deposit is contained within a mineralized Kakortokite host unit covering an area of approximately 5km x 2.5km and several hundred metres thick and estimated at 4.7 billion tonnes. two areas have been delineated at Fjord and Hill and subject to detailed exploration and resource estimation.

The host unit has not been fully explored, and the estimate of the mass of the kakortokite host unit does not presume any certainty of hosting economic mineralisation in other areas.

The MRE drilling examined the drill intersections from surface to sea level (0m RL) and prepared a mineral resource estimate based on the TREO and zirconium and niobium oxides within the kakortokite including eudialyte, feldspar and arfvedsonite components.

Drill holes DDH-007-08, DDH-007-09, DDH-007-12, DDH-007-14, DDH-13-011and DDH 13-016 were terminated in kakortokite containing greater than 3000ppm TREO mineralisation at the bottom of the respective drillholes (see figure 2).

Table 3 - Assayed intersections in the 2007 and 2013 drilling announced today.

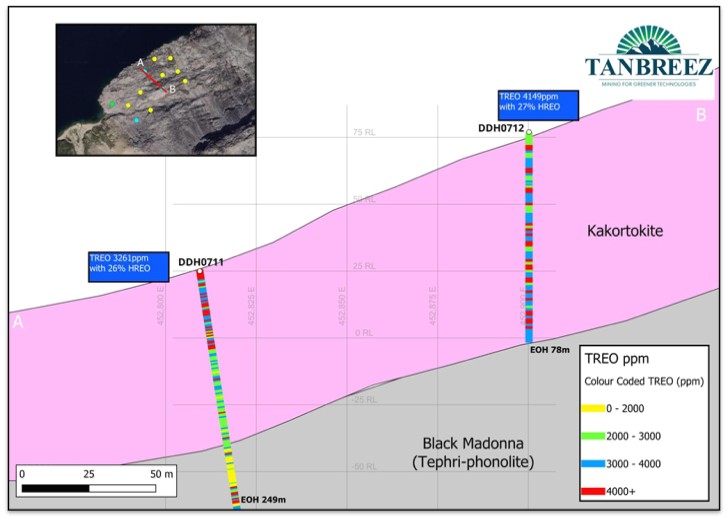

Figure 3 - Deep drilling extending below the Fjord Mineral Resource Estimate with section lines

Figure 4 - Deep drilling extending below the Fjord Mineral Resource Estimate – Section F

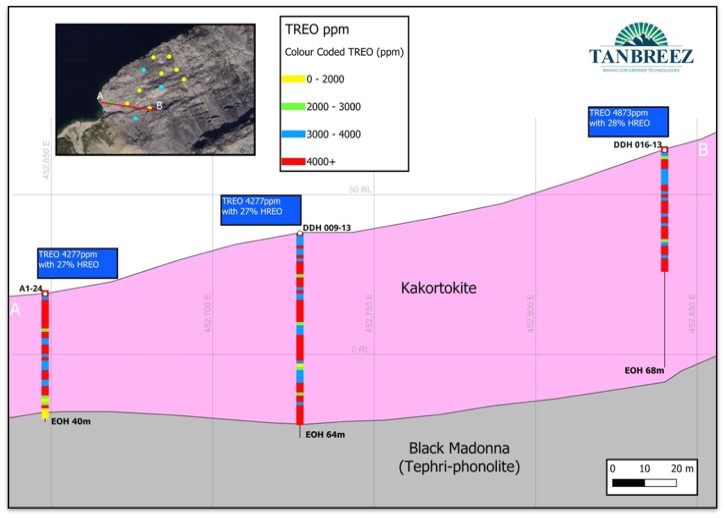

Figure 5 - Deep drilling extending below the Fjord Mineral Resource Estimate – Section C

Figure 6 - Cross section on Fjord Section A

The Mineral Resource Estimate for Tanbreez at the Fjord and Hill Deposits

The Company recently announced its MRE for the Tanbreez Project of 45MT Eudialyte containing

Eudialyte concentrate will be prepared in Greenland and exported to the USA or Europe for further processing. Feldspar and Arfvedsonite from the Tanbreez deposit will be processed in Greenland to form a concentrate for industrial applications and further processing will be required to meet off- take standards.

| TANBREEZ PROJECT | Million | TREO | ZrO2 | Nb2O5 |

| Tonnes | % | % | % | |

| TANBREEZ HILL | ||||

| Eudialyte | ||||

| Indicated Resource | ||||

| Upper | 3.20 | |||

| Lower | 13.46 | |||

| Total | 16.66 | |||

| Inferred Resource | ||||

| Upper | 0.93 | |||

| Lower | 4.72 | |||

| Total | 5.65 | |||

| FJORD DEPOSIT | ||||

| Eudialyte | ||||

| Indicated Resource | 8.76 | |||

| Inferred Resource | 13.80 | |||

| Total | 22.56 | |||

| Eudialyte Total | ||||

| Indicated Resource | 25.42 | |||

| Inferred Resource | 19.45 | |||

| Total | 44.87 | 0.38% | 1.39% | 0.14% |

Table 3 MRE eudialyte component

| TANBREEZ PROJECT | Industrial Mineral Components | |

| TANBREEZ HILL | ||

| Feldspar | ||

| Indicated Resource | 33.00 | Mtonnes |

| Inferred Resource | 11.00 | Mtonnes |

| Arfvedsonite | ||

| Indicated Resource | 33.00 | Mtonnes |

| Inferred Resource | 11.00 | Mtonnes |

| FJORD DEPOSIT | ||

| Feldspar | ||

| Indicated Resource | 18.00 | Mtonnes |

| Inferred Resource | 28.00 | Mtonnes |

| Arfvedsonite | ||

| Indicated Resource | 18.00 | Mtonnes |

| Inferred Resource | 28.00 | Mtonnes |

Table 4 MRE details for feldspar and arfvedsonite

The Company confirms that it is not aware of any new information or data that materially affects the information included in the Company’s previous estimation of the feldspar and arfvedsonite resources in this announcement and that all material assumptions and technical parameters underpinning the estimates continue to apply and have not materially changed.

Figure 7 - Location of drilling in relation to the mineral resource estimate for indicated, inferred drill hole results and outcrop kakortokite at surface.

Figure 8 - The Tanbreez Fjord and the Tanbreez Hill rare-earth mineral sites are hosted within a Kakortokite unit covering an area of approximately 5km x 2.5km, estimated at 4.7 billion tonnes of Kakortokite this does not indicate any certainty of hosting mineralisation

About Critical Metals Corp

Critical Metals Corp (Nasdaq: CRML) is a leading mining development company focused on critical metals and minerals, and producing strategic products essential to electrification and next generation technologies for Europe and its western world partners. Its flagship Project, Tanbreez, is one of the world's largest rare earth deposits and is located in Southern Greenland. The deposit is expected to have access to key transportation outlets as the area features year-round direct shipping access via deep water fjords that lead directly to the North Atlantic Ocean.

Another key asset is the Wolfsberg Lithium Project located in Carinthia, 270 km south of Vienna, Austria. The Wolfsberg Lithium Project is the first fully permitted mine in Europe and is strategically located with access to established road and rail infrastructure and is expected to be the next major producer of key lithium products to support the European market. Wolfsberg is well positioned with offtake and downstream partners to become a unique and valuable asset in an expanding geostrategic critical metals portfolio.

With this strategic asset portfolio, Critical Metals Corp is positioned to become a reliable and sustainable supplier of critical minerals essential for defense applications, clean energy transition, and next-generation technologies in the western world.

For more information, please visit https://www.criticalmetalscorp.com/.

Cautionary Note Regarding Forward Looking Statements

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include, without limitation, statements regarding the net present value, economic viability and prospects of the Tanbreez Project, the expected rare earth metal supply located and recoverable in the Tanbreez Project, the timing and completion of additional studies and operations related to the Tanbreez Project, as well as financial position, financial performance, business strategy, expectations of our business and the plans and objectives of management for future operations. These statements constitute projections, forecasts and forward-looking statements, and are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this news release, forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target,” “designed to” or other similar expressions that predict or indicate future events or trends or that are not statements of historical facts. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements.

Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements for many reasons, including the factors discussed under the “Risk Factors” section in the Company’s Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission. These forward-looking statements are based on information available as of the date of this news release, and expectations, forecasts and assumptions as of that date, involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Critical Metals Corp.

Investor Relations: ir@criticalmetalscorp.com

Media: pr@criticalmetalscorp.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/395cfb9f-5726-4046-b3fc-91f7515e38f8

https://www.globenewswire.com/NewsRoom/AttachmentNg/1e08f7cb-c5c8-4d4e-9905-89d38aadfe14

https://www.globenewswire.com/NewsRoom/AttachmentNg/b63cf541-685b-416d-861d-099c038f387f

https://www.globenewswire.com/NewsRoom/AttachmentNg/5d330348-e551-4ecd-862b-263ce579c2bf

https://www.globenewswire.com/NewsRoom/AttachmentNg/bb3676bc-6690-4cfa-90ce-e8c25b0cf6af

https://www.globenewswire.com/NewsRoom/AttachmentNg/36671b27-0230-4182-92d1-5a1d58ecb5b9

https://www.globenewswire.com/NewsRoom/AttachmentNg/b0642a59-52b1-4771-9b89-7d5978a843dd

https://www.globenewswire.com/NewsRoom/AttachmentNg/63dbd5be-be65-4545-b827-f11616684ff9

https://www.globenewswire.com/NewsRoom/AttachmentNg/4929b697-6830-4c6d-bb20-4a8a73f82c6f

https://www.globenewswire.com/NewsRoom/AttachmentNg/ce96048b-f3e4-4203-a539-51554b718cac