CRML Announces Another Set of Outstanding Rare Earth Elements Results From Its 2024 Drilling Program at Tanbreez. These Elements & Results Include: Niobium Pentoxide of Up to 1,746 ppm, Cerium Dioxide 1711 ppm, Gallium 103 ppm & Hafnium 484 ppm- Mineralisation Has Been Confirmed to Occur Consistently Across All Drilling Locations and at Surface

Rhea-AI Summary

Critical Metals Corp (Nasdaq: CRML) reported final results from its 2024 Tanbreez Fjord drilling program in Greenland on Dec 15, 2025. Drilling (13 holes, 1,149.5 m) returned consistent mineralisation from surface with TREO 0.39%–0.54% (weighted average 0.44%) and a stable HREO share ~25–27%. Notable multi‑commodity values include ZrO2 1.55–1.97%, CeO2 ~1,638 ppm, Nb2O5 ~1,396 ppm, Ga2O5 ~96–103 ppm and HfO2 ~312–484 ppm. A long 203.2 m intersection (K-24) and multiple >40–200 m true widths support lateral and vertical continuity. Results will inform a revised Mineral Resource Estimate once pending 2025 assays are received.

Positive

- Consistent TREO 0.39%–0.54% across holes

- Stable HREO fraction ~25–27% supporting heavy REE value

- Multi‑commodity content: ZrO2 1.74% weighted average

- High niobium: Nb2O5 ~1,396 ppm weighted average

- Long intercept: 203.2m @ 0.48% TREO (K-24)

Negative

- Sample processing and transport issues caused logistical delays and extended assay turnaround

- Assays from the 2025 field season are still pending, delaying an updated Mineral Resource Estimate

News Market Reaction

On the day this news was published, CRML declined 11.00%, reflecting a significant negative market reaction. Argus tracked a trough of -10.4% from its starting point during tracking. Our momentum scanner triggered 25 alerts that day, indicating elevated trading interest and price volatility. This price movement removed approximately $127M from the company's valuation, bringing the market cap to $1.03B at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

CRML fell 2.34% while peers SLI (-4.74%), NEXA (-2.69%), UAMY (-6.98%), SGML (-6.34%) and USAS (-1.87%) also declined, indicating broad basic-materials pressure without confirmed momentum‑scanner sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 11 | Metallurgy update | Positive | +4.1% | Metallurgical tests validated flowsheet and pilot plant plans for Tanbreez concentrates. |

| Dec 09 | JV term sheet | Positive | +6.0% | 50:50 JV term‑sheet with Romania for integrated rare earth processing supply chain. |

| Nov 25 | Regulatory update | Neutral | -1.1% | Court remand on Wolfsberg EIA threshold created regulatory uncertainty but no timing change. |

| Nov 21 | Copper acquisition | Positive | -1.4% | All‑share deal for ultra‑high‑purity copper powder at a premium to market price. |

| Nov 04 | Env. approvals | Positive | +0.5% | EAMRA confirmed required geochemical test work completed for Tanbreez project approvals. |

Recent CRML news has mostly been positive, with three of the last five releases seeing modestly positive price alignment, while one strategic acquisition and one regulatory update saw mild negative divergence.

This announcement adds robust drill results at Tanbreez to a busy period for CRML. Since Nov 4, the company secured key Tanbreez environmental approvals (928956), completed a UHP copper stockpile acquisition (939721), navigated an EIA‑related court ruling at Wolfsberg (940920), and advanced a Romanian refinery JV with a 50:50 structure (945531). Metallurgical test work results on Dec 11 (947029) supported the refinery flowsheet. Today’s drilling data further underpins Tanbreez’s resource confidence and multi‑commodity potential.

Regulatory & Risk Context

An effective resale registration on Form F‑3 covers up to 18,030,303 Ordinary Shares held by a selling securityholder. The company will not receive proceeds from share resales and would only receive cash if PIPE Warrants with exercise prices of $7.00 or $0.0001 are exercised for cash. A related 424B3 prospectus was filed on Nov 10, 2025.

Market Pulse Summary

The stock dropped -11.0% in the session following this news. A negative reaction despite robust drill data would fit a pattern where constructive news, such as JV and metallurgical milestones, has sometimes met muted or mixed responses. The market may be focusing on prior equity issuance, resale registrations, or macro metals sentiment rather than Tanbreez geology. With TREO grades around 0.44% and consistent HREO content, any pullback could still reflect positioning and liquidity rather than a change in project fundamentals.

Key Terms

ppm technical

peralkaline medical

eudialyte medical

jorc code regulatory

AI-generated analysis. Not financial advice.

GREENLAND, TANBREEZ ASSET DRILLING REE HIGHLIGHTS:

- Consistent Rare Earth Grades: TREO grades range from

0.39% to0.54% , with heavy rare earth oxides (HREO) representing approximately ~25–27% TREO. - Strategic Metals: Gallium oxide (~97 ppm), hafnium oxide (~350 ppm), yttrium oxide (~742 ppm), and cerium oxide (~1,630 ppm) are consistently present, alongside zirconium (1.55–

1.97% ), niobium, and tantalum—supporting multi-commodity potential. - Potential: The Fjord area remains open along strike and demonstrates strong vertical grade continuity, indicating significant potential for resource growth.

- Mineralisation is confirmed to occur consistently from surface.

| A1-24 | 40m @ 103ppm Ga2O5, 403ppm HfO2, 1711ppm CeO2, 1513ppm Nb2O5 | |

| A2-24 | 41m @ 96ppm Ga2O5, 393ppm HfO2, 1850ppm CeO2, 1685ppm Nb2O5 | |

| B-24 | 59m @ 100ppm Ga2O5, 396ppm HfO2, 1727ppm CeO2, 1623ppm Nb2O5 | |

| C-24 | 65.3m @ 89ppm Ga2O5, 410ppm HfO2, 1959ppm CeO2, 1727ppm Nb2O5 | |

| D-24 | 63m @ 99ppm Ga2O5, 315ppm HfO2, 1511ppm CeO2, 1336ppm Nb2O5 | |

| E-24 | 62.3m @ 93ppm Ga2O5, 330ppm HfO2, 1407ppm CeO2, 1328ppm Nb2O5 | |

| F-24 | 72m @ 93ppm Ga2O5, 312ppm HfO2, 1462ppm CeO2, 1256ppm Nb2O5 | |

| G-24 | 54.6m @ 97ppm Ga2O5, 360ppm HfO2, 1610ppm CeO2, 1400ppm Nb2O5 | |

| H-24 | 69.6m @ 101ppm Ga2O5, 304ppm HfO2, 1406ppm CeO2, 1218ppm Nb2O5 | |

| K-24 | 203.2m @ 96ppm Ga2O5, 366ppm HfO2, 1700ppm CeO2, 1334ppm Nb2O5 | |

| O-24 | 53.4m @ 98ppm Ga2O5, 319ppm HfO2, 1453ppm CeO2, 1282ppm Nb2O5 | |

| P-24 | 97.8m @ 97ppm Ga2O5, 281ppm HfO2, 1268ppm CeO2, 1140ppm Nb2O5 | |

| X-24 | 63.7m @ 87ppm Ga2O5, 484ppm HfO2, 1955ppm CeO2, 1746ppm Nb2O5 | |

NEW YORK, Dec. 15, 2025 (GLOBE NEWSWIRE) -- Critical Metals Corp. (Nasdaq: CRML) (“Critical Metals Corp” or the “Company”), a leading a critical minerals development company, is pleased to announce that the final results for the 2024 drilling program have now been received at the Fjord area of the Tanbreez Rare Earth Project in Greenland. The drilling campaign was designed to extend known mineralization and refine the geological model of the area. These results will enable the Company to prepare a revised Mineral Resource Estimate and advance subsequent mine planning studies.

Despite logistical challenges related to sample processing and transport, and extended assay turnaround times and quality assurance checks, the results confirm consistent rare earth grades and highlight strategic metals including gallium, hafnium, cerium and yttrium - reinforcing Tanbreez’s position as a world-class critical minerals deposit.

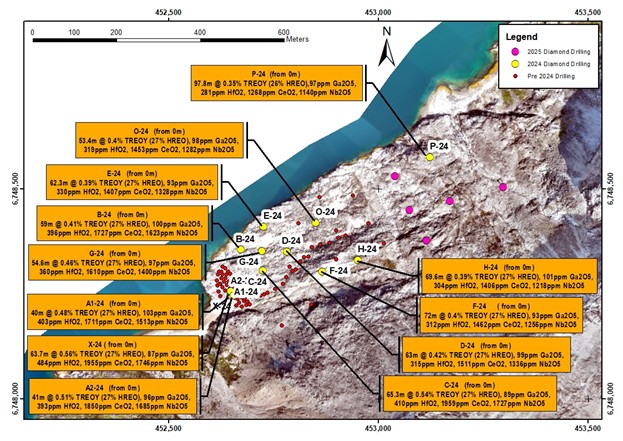

Figure 1. Project Summary Plan (WGS84 zone 23N)

Figure 2. 2024 Diamond Drilling Resource Confirmation (Fjord Area) (WGS84 zone 23N)

The 2024 diamond drilling campaign demonstrates consistent grades and mineralization both vertically and laterally supportive of higher confidence in mineral resource estimates and the potential for significant expansion of the current resource base.

The drilling continues to highlight the projects potential to host significant multi-commodity potential with associated Gallium oxide (~97 ppm), hafnium oxide (~350 ppm), yttrium oxide (~742 ppm), and cerium oxide (~1,630 ppm) present, alongside zirconium (1.55–

Project and Geological Setting

The Tanbreez Project (MIN 2020-54) is situated in southern Greenland, covering an area of approximately 18 km². The regional capital, Qaqortoq, lies 20 km to the south, and a regional airport at Narsarsuaq is in construction approximately 12 km south of the license area.

The Tanbreez deposit is classified as a peralkaline igneous Rare Earth Element (REE)–Zirconium (Zr) deposit and is hosted within the Ilímaussaq Alkaline Complex in South Greenland.

Kakortokite is the dominant host rock for mineralization at Tanbreez. Kakortokite is a rhythmically layered feldspar, arfvedsonite, aegirine, and eudialyte peralkaline cumulate (red/white/black bands) rock.

The primary REE-bearing mineral is eudialyte, which carries both light and heavy REEs, along with zirconium (Zr), cerium (Ce), Hafnium (Hf), niobium (Nb), and tantalum (Ta). Eudialyte has low uranium (U) and thorium (Th), making it attractive for mining.

The unit is laterally persistent, with a surface footprint of approximately 5 × 2.5 km and a thickness of up to 350 m.

Mineralization is integral to the host fabric (eudialyte-dominant). The kakortokite ore is stratiform (primary magmatic layering). It is also lithological constrained (strata bound) but remains genetically magmatic.

The 2024 Drilling program targeted strike extensions of known mineralization and further refinement of the geological and mineralization model of the area. The primary objective of the program was to support an upgrade to the Mineral Resource Estimate at the deposit and to advance subsequent mine planning studies.

A total of 13 holes for 1,149.50 metres were drilled vertically with one angled hole to intersect sub-horizontal layers at true thickness.

The reported 2024 results show narrow TREO variance (~0.39–

- TREO: ~0.39–

0.524% (weighted downhole averages per hole). - HREO fraction: ~25–

27% HREO. - Gallium oxide (~97 ppm), hafnium oxide (~350 ppm), yttrium oxide (~742 ppm), and cerium oxide (~1,630 ppm) are consistently present, alongside zirconium (1.55–

1.97% ), niobium, and tantalum

| Oxide | TREO | HREO | LREO | HREO/TREO | ZrO2 | Ta2O5 | Nb2O5 | Ga2O5 | HfO2 | CeO2 | Y2O3 |

| Unit | % | % | % | % | % | ppm | ppm | ppm | ppm | ppm | ppm |

| Weighted Average Grade | |||||||||||

| 0.44 | 0.12 | 0.33 | 25.44 | 1.74 | 120 | 1,396 | 96 | 355 | 1638 | 708 | |

| Percentile Grade Range | |||||||||||

| 0.39 | 0.10 | 0.29 | 25.6 | 1.55 | 103 | 1,226 | 89 | 306 | 1,406 | 629 | |

| 0.40 | 0.10 | 0.29 | 25.9 | 1.57 | 105 | 1,282 | 93 | 315 | 1,455 | 638 | |

| 0.42 | 0.11 | 0.33 | 26.1 | 1.77 | 115 | 1,336 | 97 | 360 | 1,655 | 759 | |

| 0.48 | 0.13 | 0.36 | 26.5 | 1.96 | 141 | 1,623 | 99 | 396 | 1,785 | 828 | |

| 0.54 | 0.14 | 0.40 | 27.1 | 1.97 | 154 | 1,718 | 100 | 408 | 1,923 | 857 | |

- TREO comprises the sum of La₂O₃, CeO₂, Pr₆O₁₁, Nd₂O₃, Sm₂O₃, Eu₂O₃, Gd₂O₃, Tb₄O₇, Dy₂O₃, Ho₂O₃, Er₂O₃, Tm₂O₃, Yb₂O₃, Lu₂O₃, and Y₂O₃. No economic weighting has been applied (i.e., no NdPr or DyTb separated)

- No grade cut-offs or metal equivalents have been applied; intersections represent true widths. And percentile ranges are based on the 25th and 75th percentiles.

- All drilling and assay results, including both higher and lower grades, are reported to ensure balanced disclosure

Samples from the 2025 drilling field season which targeted the northern extension of the Fjord Deposit are still pending. Once received and interpreted, the Company intends to undertake an updated Mineral Resource Estimate for the Fjord deposit, followed by additional mine planning studies.

Planning for the 2026 Field Season is currently underway.

| HoleID | Easting | Northing | Elevation | Dip | Azimuth | Depth |

| A1-24 | 452648 | 6748255 | 13.0 | -90 | 0 | 40.00 |

| A2-24 | 452648 | 6748256 | 12.9 | -90 | 0 | 41.00 |

| B-24 | 452672 | 6748355 | 6.0 | -90 | 0 | 61.30 |

| C-24 | 452725 | 6748305 | 24.5 | -90 | 0 | 65.25 |

| D-24 | 452782 | 6748350 | 25.3 | -90 | 0 | 85.70 |

| E-24 | 452726 | 6748410 | 7.0 | -90 | 0 | 62.30 |

| F-24 | 452866 | 6748303 | 63.3 | -90 | 0 | 107.45 |

| G-24 | 452722 | 6748352 | 16.0 | -90 | 0 | 65.00 |

| H-24 | 452951 | 6748331 | 72.2 | -90 | 0 | 150.00 |

| K-24 | 453182 | 6747925 | 320.7 | -90 | 0 | 247.70 |

| O-24 | 452851 | 6748419 | 23.4 | -90 | 0 | 57.96 |

| P-24 | 453123 | 6748575 | 36.6 | -90 | 0 | 97.84 |

| X-24 | 452655 | 6748246 | 14.6 | -60 | 56 | 68.00 |

| Total | 1,149.50 |

Coordinates based on WGS1984 zone 23 North grid system

Qualified Person Statement

The information in this announcement that relates to Exploration Results for the Tanbreez Rare Earth Project in Greenland, including the 2024 Fjord Deposit diamond drilling results, is based on and fairly represents information compiled and reviewed by Malcolm Castle, who is a Member of the Australasian Institute of Mining and Metallurgy (AusIMM) and a Competent Person as defined in the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code).

Mr. Castle is an independent Principal Consultant of Agricola Mining Consultants Pty Ltd and has more than sufficient experience that is relevant to the style of mineralization, type of deposit, and activity being undertaken to qualify as a Competent Person under the JORC Code.

Mr. Castle has consented to the inclusion in this announcement of the matter based on his information in the form and context in which they appear.

Reference to Mineral Resources

This announcement refers to the Mineral Resource estimate for the Tanbreez Project first reported on 13 March 2025, which was based on the geological model originally completed in 2016. The Company confirms that it is not aware of any new information or data that materially affects the information included in that Mineral Resource estimate and that all material assumptions and technical parameters underpinning the estimate continue to apply and have not materially changed.

No New Mineral Resource Estimate

The results reported here relate solely to Exploration Results from the 2024 confirmation drilling campaign. This announcement does not report or imply an updated Mineral Resource estimate.

About Critical Metals Corp.

Critical Metals Corp (Nasdaq: CRML) is a leading mining development company focused on critical metals and minerals, and producing strategic products essential to electrification and next generation technologies for Europe and its western world partners. Its flagship Project, Tanbreez, is one of the world's largest, rare-earth deposits and is in Southern Greenland. The deposit is expected to have potential access to key transportation outlets as the area features year-round direct shipping access via deep water fjords that lead directly to the North Atlantic Ocean.

Another key asset is the Wolfsberg Lithium Project located in Carinthia, 270 km south of Vienna, Austria. The Wolfsberg Lithium Project is the first fully permitted mine in Europe and is strategically located with access to established road and rail infrastructure and is expected to be the next major producer of key lithium products to support the European market. Wolfsberg is well positioned with offtake and downstream partners to become a unique and valuable asset in an expanding geostrategic critical metals portfolio.

With this strategic asset portfolio, Critical Metals Corp is positioned to become a reliable and sustainable supplier of critical minerals essential for defense applications, the clean energy transition, and next-generation technologies in the western world.

For more information, please visit https://www.criticalmetalscorp.com/.

Cautionary Note Regarding Forward Looking Statements

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements may include expectations of our business and the plans and objectives of management for future operations. These statements constitute projections, forecasts and forward-looking statements, and do not guarantee performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this news release, forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target,” “designed to” or other similar expressions that predict or indicate future events or trends or that are not statements of historical facts. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements.

Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements for many reasons, including the factors discussed under the “Risk Factors” section in the Company’s Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission. These forward-looking statements are based on information available as of the date of this news release, and expectations, forecasts and assumptions as of that date, involve several judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Critical Metals Corp.

Investor Relations: ir@criticalmetalscorp.com

Media: pr@criticalmetalscorp.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/f83f6e9b-5956-4e97-8317-9749a290d02d

https://www.globenewswire.com/NewsRoom/AttachmentNg/874f3d66-6c37-45fe-ad82-a4e5c5eef852