CreditRiskMonitor.com Recognized by Spend Matters Fall 2025 SolutionMap

Rhea-AI Summary

CreditRiskMonitor.com (OTCQX:CRMZ) announced that its SupplyChainMonitor™ solution was recognized in the Spend Matters Fall 2025 SolutionMap on November 3, 2025. The company introduced its FAST Rating covering 3.5+ million foreign private companies and a new Risk Level classification across 10+ million public and private companies. SupplyChainMonitor™ earned top rank in Supplier Risk Management and above‑benchmark rankings in Supplier Performance Management and Analytics. The platform highlights a 96%-accurate FRISK® Score predicting 12‑month bankruptcy risk and emphasizes AI-driven analytics, dashboards, supplier onboarding, and client services to support supplier continuity.

Positive

- FAST Rating covers 3.5+ million foreign private companies

- Risk Level classifies 10+ million public and private companies

- FRISK® Score cited as 96% accurate for 12‑month bankruptcy prediction

- Top rank in Supplier Risk Management on Spend Matters Fall 2025

Negative

- Company cites a recent and significant increase in vendor bankruptcies

- Macro pressures noted: interest rates, cost inflation, tariffs, high corporate debt

TARRYTOWN, NY / ACCESS Newswire / November 3, 2025 / CreditRiskMonitor.com, Inc. (OTCQX:CRMZ) is pleased to announce that its SupplyChainMonitor™solution has been recognized once again as a top procurement technology - now in the Spend Matters Fall 2025 SolutionMap.

In October, we released our proprietary FAST Rating, which provides financial risk evaluations on 3.5+ million foreign private companies with limited financial data. The FAST Rating is modeled after the collective intelligence of our expert financial analyst team. The approach leverages Reinforcement Learning from Human Feedback (RLHF), a type of machine learning. Additionally, we introduced Risk Level, which provides high, medium, or low risk classifications on 10+ million public and private companies worldwide. Our clients use the Risk Level to easily compare different companies globally, simplify reporting, and accelerate their business decisions.

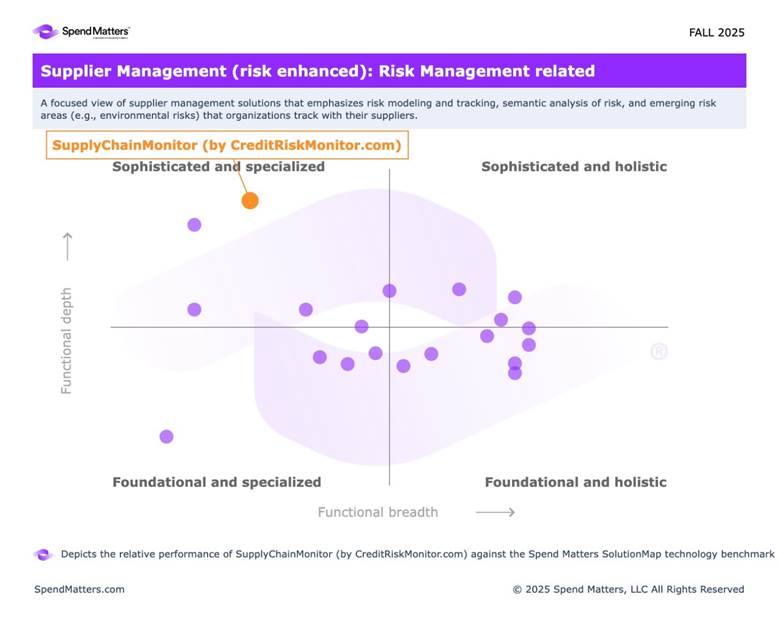

We continue to rank well across Risk Management TPRM/SCRM (third-party risk management and supply chain risk management) category with a focus on financial risk, solidifying SupplyChainMonitor™'s place as a leading point solution for such use cases. We earned a top rank in Supplier Risk Management, in addition to above benchmark rankings in the Supplier Performance Management and Analytics categories. By expanding the businesses covered with our financial risk analytics in 2025, including new ratings on millions of private companies, we're providing clients with the depth and breadth required to easily monitor their suppliers.

Spend Matters' SolutionMap is a trusted industry resource that allows practitioners, consultants and investors to evaluate and compare procurement technology solutions based on feature sets and customer satisfaction metrics. The platform enables businesses to make informed decisions through data-driven comparison of leading solutions.

Commenting on the acknowledgment, Mike Flum, CEO & President of CreditRiskMonitor.com, highlighted his appreciation for this continued recognition:

"We are glad to be recognized again by Spend Matters in Third Party Risk Management with an emphasis on financial risk reporting and analytics. The recent and significant increase in vendor bankruptcies, particularly in the manufacturing sector, has underlined the importance of having an accurate and timely early warning system to monitor business financial risk for our clients. Macro factors including interest rates, cost inflation, tariffs, and generally high corporate debt levels continue to point at increased bankruptcy risk across sectors. We've also seen a swath of adverse events on specific suppliers leading to disruptions. Leading organizations recognize that proactive monitoring of supplier financial risk is critical to maintaining supplier continuity. SupplyChainMonitor™'s AI-driven financial risk models, advanced alerting, and holistic risk management capabilities support early identification of threats, so our clients can implement contingency planning and risk mitigation strategies before operational issues become material."

Key Achievements

CreditRiskMonitor.com's SupplyChainMonitor™platform exceeded competitive benchmarks in SXM (Supplier Risk Management), particularly in managing and mitigating supplier-related risks, while also meeting or nearing the top of industry benchmarks across categories.

The CEO of Spend Matters provided insight into the development of the Fall 2025 SolutionMap:

"As CEO of Spend Matters, I want to express my appreciation for all 115 procurement technology providers who engaged in our Fall 2025 SolutionMap assessment. We recognize that participation is a significant commitment, demanding considerable time and effort from your teams. The process involves submitting data against over 500 detailed functional and capability requirements across 16 source-to-pay categories, conducting mandatory demonstrations, and actively collecting impartial, anonymized customer ratings. This rigorous, data-driven methodology, updated every six months, is what underpins SolutionMap's reputation as the gold standard for evaluating procurement technologies. Your dedication to this comprehensive and transparent assessment allows us to provide unmatched clarity and deep, unbiased insights into a highly dynamic and competitive market, ultimately empowering procurement leaders to make truly informed technology decisions." - Carina Kuhl, CEO, Spend Matters, A Hackett Group Division

SupplyChainMonitor™'s powerful features and latest capabilities include:

Financial Risk Analytics: Our

96% -accurate FRISK® Score predicts financial stress and bankruptcy risk over a 12-month period, which solidifies our leadership in financial risk management within the SXM/Supplier Risk Management category. Our proprietary suite of AI-driven financial risk analytics includes the FRISK® Score, PAYCE® Score, and FAST Rating. Clients use these models to proactively manage supplier financial risk, which can impact supply continuity, product quality, and production capacity. Moreover, these analytics empower continuous monitoring to stay ahead of highly disruptive supplier bankruptcies.Dashboards & Industry Peer Benchmarking: our platform combines our financial risk analytics against client metadata, including supplier spend, criticality, sole source, and other customized data types. These dashboards help supply professionals quickly understand and prioritize their most important suppliers and threats to their operations. Industry Peer Benchmarking enables comparisons across millions of suppliers using our financial risk analytics; primarily to evaluate existing suppliers and supplier alternatives.

Supplier Onboarding & Data Management: we ranked above the benchmark for SXM/Supplier Risk Management, which is partially attributed to supplier list data management including data cleansing and profile management. We are committed to improving our data matching technology and techniques to maximize client-specific business coverage. By mapping suppliers, locations, and spend data, clients can deeply understand their risk exposure and mitigate disruptions before they impact revenue and profitability.

Comprehensive Service Support: Our Platform/Services are directly supported by our Client Success Managers, who provide dedicated onboarding, training, platform customization, and ongoing support. Additionally, our expert financial analysts support inquiries around suppliers, bankruptcies, our proprietary models, adverse news, and other insights available on SupplyChainMonitor™.

About CreditRiskMonitor

CreditRiskMonitor.com, Inc. is a leader in global business intelligence and predictive financial risk analytics. For over 25 years, our Company has been trusted to mitigate business-to-business (B2B) financial risk for thousands of companies worldwide, including nearly

CreditRiskMonitor® empowers credit, finance, treasury, and risk professionals to make more informed decisions in trade credit management and related activities.

SupplyChainMonitor™ empowers supply chain, procurement, vendor management, and finance professionals to make more informed supplier relationship decisions for risk mitigation and resilience strategies.

Learn more about how CreditRiskMonitor.com helps protect your supply chain at www.creditriskmonitor.com.

About Spend Matters

Acquired by The Hackett Group® in 2025, Spend Matters™ started as one of the first blog and social media sites in the procurement and supply chain sector and has since grown into one of the leading sources for data-backed technology and solutions intelligence. Serving private and public sector organizations, consultants, private equity, and services and solution providers, the company drives strategic technology purchasing decisions and superior marketing and sales, product, and investment outcomes for clients. Spend Matters™ is the only tech-enabled, proprietary data platform with exclusive intellectual property that serves the global procurement, finance and supply chain technology ecosystem.

CreditRiskMonitor Contact

Mike Flum

ir@creditriskmonitor.com

(845) 230-3037

Spend Matters Contact

Dina Cutrone

dcutrone@spendmatters.com

SOURCE: CreditRiskMonitor.com, Inc.

View the original press release on ACCESS Newswire