CreditRiskMonitor Announces First Quarter Results

Rhea-AI Summary

Positive

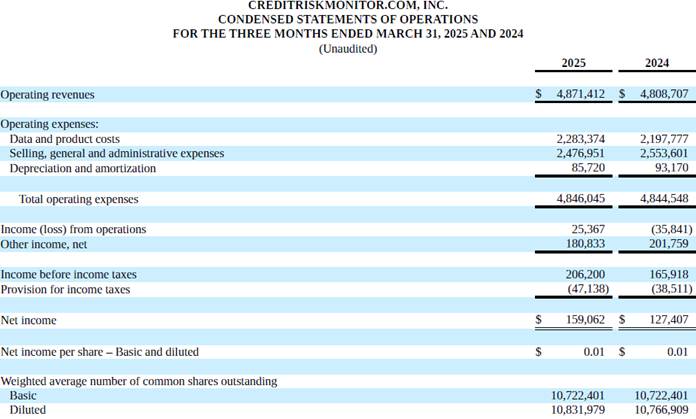

- Revenue increased by 1% to $4.9 million in Q1 2025

- Operating income improved by $61,000 to reach $25,000

- Net income grew 25% to $159,000

- Increased demand for product demonstrations due to market conditions

- Strong client base including 40% of Fortune 1000 companies

Negative

- Deal closures experiencing delays due to market volatility

- Expected increase in short-term expenses for new hires and technology

- Subscribers adopting 'wait & see' strategy affecting sales cycle

- Challenging macroeconomic conditions with highest bankruptcy rates since 2010

News Market Reaction 1 Alert

On the day this news was published, CRMZ gained 2.78%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

VALLEY COTTAGE, NY / ACCESS Newswire / May 8, 2025 / CreditRiskMonitor.com, Inc. (OTCQX:CRMZ) reported revenues of

Mike Flum, CEO, said, "We are progressing our plan to achieve higher team efficiency by pursuing new roles and AI processes to debottleneck some of our revenue and marketing motions while also enhancing our data, product, and development initiatives. We expect to have higher expenses in the short term as we onboard these new people and technologies, but they will provide a great foundation for long-term efficiency gains.

From the macroeconomic perspective, companies are going bankrupt at the fastest rate since 2010 and trade tensions, tariffs, as well as rising nationalist tendencies portend ongoing global trade disruptions. Both conditions have increased demand for demonstrations of our products but are also delaying the closing deals as subscribers and prospects apply a 'wait & see' strategy in this highly volatile economic and political environment. We continue to review and tinker with product improvements and new pricing strategies to combat this slowdown, but we are confident that financial risk solutions will become more necessary as the aforementioned conditions extend and businesses are forced to respond accordingly."

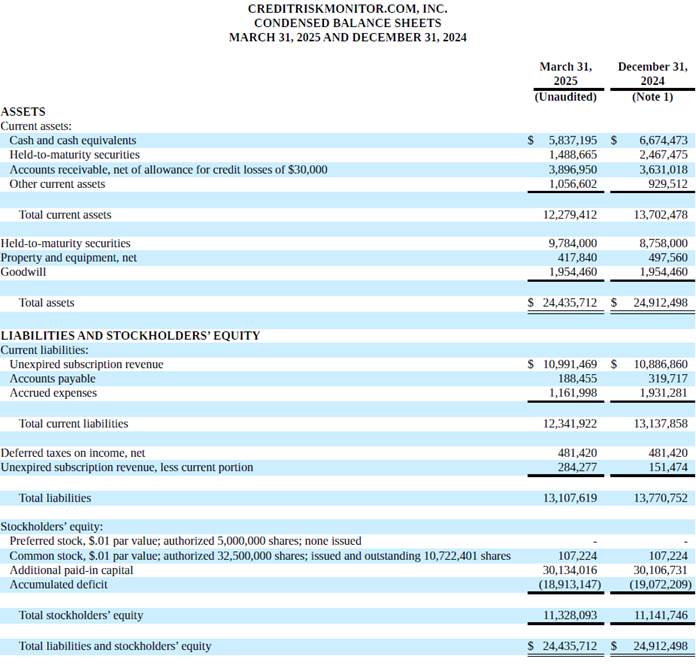

A full copy of the financial statements can be found at https://crmz.ir.edgar-online.com/

Overview

CreditRiskMonitor.com, Inc. (creditriskmonitor.com) sells a suite of web-based, SaaS subscription products providing access to comprehensive commercial credit reports, bankruptcy risk analytics, financial and payment information, and curated news on public and private companies worldwide. Our primary SaaS subscription products for analyzing commercial financial risk are CreditRiskMonitor® and SupplyChainMonitor™. These products help corporate credit and procurement professionals stay ahead of and manage financial risk more quickly, accurately, and cost-effectively. Our subscribers include nearly

To help subscribers prioritize and monitor counterparty financial risk, our SaaS platforms offer the proprietary FRISK® and PAYCE® scores, the well-known Altman Z"-score, agency ratings from key Nationally Recognized Statistical Rating Organizations ("NRSROs"), curated news, and detailed financial spreads & ratios. Our FRISK® and PAYCE® scores are financial distress classification models that measure a business's probability of bankruptcy within a year. The FRISK® score also includes a risk signal based on the aggregate research behaviors of our subscribers, who control counterparty access to trade credit at some of the most sophisticated companies in the world. The inclusion of this risk signal boosts the overall accuracy of this bankruptcy analytic by lowering the false positive rate for the riskiest corporations.

Through its Trade Contributor Program, the Company receives monthly confidential accounts receivables data from hundreds of subscribers and non-subscribers, which it parses, processes, aggregates, and reports to summarize the invoice payment behavior of B2B counterparties without disclosing the specific contributors of this information. The size of the Trade Contributor Program's current annualized trade credit transaction data is approximately

Safe Harbor Statement

Certain statements in this press release, including statements prefaced by the words "anticipates", "estimates", "believes", "expects" or words of similar meaning, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, expectations or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, among others, risks associated with the COVID-19 pandemic and those risks, uncertainties and factors referenced from time to time as "risk factors" or otherwise in the Company's Registration Statements or Securities and Exchange Commission Reports. We disclaim any intention or obligation to revise any forward-looking statements, whether as a result of new information, a future event, or otherwise.

CONTACT:

CreditRiskMonitor.com, Inc.

Mike Flum, Chief Executive Officer

(845) 230-3037

ir@creditriskmonitor.com

SOURCE: CreditRiskMonitor.com, Inc.

View the original press release on ACCESS Newswire