SunPower Reports Q1’25: $80.2M Revenue, $1.3M Profit¹

SunPower reported its Q1 2025 financial results, marking its first profitable quarter in four years with revenue of $80.2 million and an operating profit of $1.3 million. This milestone comes after the company's rebranding from Complete Solaria on April 21, 2025, following the SunPower asset purchase in September 2024.

Key achievements include:

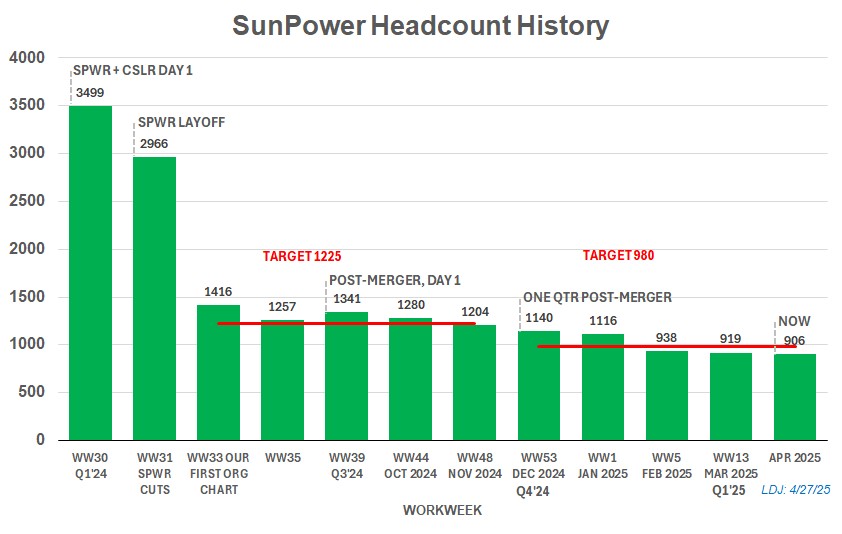

- Successful headcount reduction from 3,499 to 906 employees

- Cash balance increase to $14.0 million from $13.3 million in Q4 2024

- Strategic partnership with Sunder for growth expansion

- Board strengthening with three new public-company ex-CEO directors

The company maintains a positive outlook, forecasting steady revenue and continued profitability for the next quarter. With an annualized revenue of $300 million-plus, SunPower has positioned itself for sustainable growth in the solar technology and installation sector.

SunPower ha annunciato i risultati finanziari del primo trimestre 2025, segnando il primo trimestre in utile dopo quattro anni, con ricavi di 80,2 milioni di dollari e un utile operativo di 1,3 milioni di dollari. Questo traguardo arriva dopo il rebranding dell'azienda da Complete Solaria il 21 aprile 2025, a seguito dell'acquisto degli asset di SunPower nel settembre 2024.

Principali risultati raggiunti:

- Riduzione efficace del personale da 3.499 a 906 dipendenti

- Aumento della liquidità a 14,0 milioni di dollari dai 13,3 milioni del quarto trimestre 2024

- Partnership strategica con Sunder per l'espansione della crescita

- Rafforzamento del consiglio di amministrazione con tre nuovi ex-CEO di società quotate

L'azienda mantiene una prospettiva positiva, prevedendo ricavi stabili e continuità nella redditività per il prossimo trimestre. Con ricavi annualizzati superiori a 300 milioni di dollari, SunPower si è posizionata per una crescita sostenibile nel settore della tecnologia e installazione solare.

SunPower presentó sus resultados financieros del primer trimestre de 2025, marcando su primer trimestre rentable en cuatro años con ingresos de 80,2 millones de dólares y una ganancia operativa de 1,3 millones de dólares. Este hito llega tras el cambio de nombre de la empresa de Complete Solaria el 21 de abril de 2025, luego de la compra de activos de SunPower en septiembre de 2024.

Logros clave incluyen:

- Reducción exitosa de personal de 3,499 a 906 empleados

- Aumento del saldo de efectivo a 14,0 millones de dólares desde 13,3 millones en el cuarto trimestre de 2024

- Alianza estratégica con Sunder para expansión del crecimiento

- Fortalecimiento del consejo con tres nuevos directores ex-CEO de empresas públicas

La compañía mantiene una perspectiva positiva, pronosticando ingresos estables y rentabilidad continua para el próximo trimestre. Con ingresos anualizados superiores a 300 millones de dólares, SunPower se ha posicionado para un crecimiento sostenible en el sector de tecnología e instalación solar.

SunPower는 2025년 1분기 재무 실적을 발표하며 4년 만에 첫 흑자 분기를 기록했습니다. 매출은 8,020만 달러, 영업 이익은 130만 달러였습니다. 이 성과는 2024년 9월 SunPower 자산 인수 후 2025년 4월 21일 Complete Solaria에서 SunPower로 사명 변경한 이후 이루어진 것입니다.

주요 성과는 다음과 같습니다:

- 직원 수 3,499명에서 906명으로 성공적인 감축

- 현금 잔고가 2024년 4분기 1,330만 달러에서 1,400만 달러로 증가

- 성장 확장을 위한 Sunder와의 전략적 파트너십 체결

- 상장사 출신 전 CEO 3명을 영입하여 이사회 강화

회사는 긍정적인 전망을 유지하며 다음 분기에도 안정적인 매출과 지속적인 수익성을 예상하고 있습니다. 연간 매출 3억 달러 이상을 기록하며, SunPower는 태양광 기술 및 설치 분야에서 지속 가능한 성장을 위한 입지를 확고히 했습니다.

SunPower a publié ses résultats financiers du premier trimestre 2025, marquant son premier trimestre bénéficiaire depuis quatre ans avec un chiffre d'affaires de 80,2 millions de dollars et un bénéfice opérationnel de 1,3 million de dollars. Cette étape intervient après le changement de nom de l'entreprise, de Complete Solaria à SunPower, le 21 avril 2025, suite à l'acquisition des actifs de SunPower en septembre 2024.

Principales réalisations :

- Réduction réussie des effectifs de 3 499 à 906 employés

- Augmentation de la trésorerie à 14,0 millions de dollars contre 13,3 millions au T4 2024

- Partenariat stratégique avec Sunder pour l'expansion de la croissance

- Renforcement du conseil d'administration avec trois nouveaux directeurs anciens PDG d'entreprises cotées

L'entreprise maintient une perspective positive, prévoyant des revenus stables et une rentabilité continue pour le trimestre suivant. Avec un chiffre d'affaires annualisé supérieur à 300 millions de dollars, SunPower s'est positionnée pour une croissance durable dans le secteur des technologies solaires et de l'installation.

SunPower meldete seine Finanzergebnisse für das erste Quartal 2025 und verzeichnete damit das erste profitable Quartal seit vier Jahren mit einem Umsatz von 80,2 Millionen US-Dollar und einem operativen Gewinn von 1,3 Millionen US-Dollar. Dieser Meilenstein folgt auf die Umbenennung des Unternehmens von Complete Solaria am 21. April 2025, nach dem Erwerb der SunPower-Assets im September 2024.

Wesentliche Erfolge umfassen:

- Erfolgreiche Reduzierung der Mitarbeiterzahl von 3.499 auf 906

- Erhöhung des Kassenbestands auf 14,0 Millionen US-Dollar von 13,3 Millionen im vierten Quartal 2024

- Strategische Partnerschaft mit Sunder zur Wachstumserweiterung

- Stärkung des Vorstands mit drei neuen ehemaligen CEOs börsennotierter Unternehmen

Das Unternehmen bleibt optimistisch und prognostiziert für das nächste Quartal stabile Umsätze und anhaltende Profitabilität. Mit einem annualisierten Umsatz von über 300 Millionen US-Dollar hat sich SunPower für nachhaltiges Wachstum im Bereich Solartechnologie und Installation positioniert.

- First profitable quarter in 4 years with $1.3M operating profit in Q1'25

- Revenue maintained at $80.2M in traditionally difficult winter quarter

- Cash balance increased from $13.3M to $14.0M quarter-over-quarter

- Successful headcount reduction by 3x to 906 employees, ahead of 980 target

- Strategic partnership with Sunder expected to drive growth from Q3'25

- Board strengthened with three experienced public-company ex-CEO directors

- Key industry hires including SunPower founder Dr. Richard Swanson and former Enphase Battery CTO

- Quarter-over-quarter revenue decline from $88.7M in Q4'24 to $80.2M in Q1'25

- Gross margin decreased from 47% in Q4'24 to 36% in Q1'25

- Low cash balance of $14M for a public company

- Significant workforce reduction from 3,499 to 906 employees indicates major restructuring

Insights

SunPower achieves first profitability in four years through dramatic operational restructuring, signaling potential turnaround in challenging solar market.

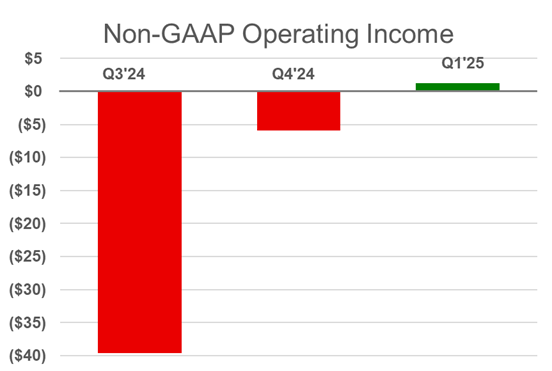

SunPower's Q1'25 results mark a significant milestone with the company achieving its first profitable quarter in four years. The non-GAAP operating profit of

The dramatic operational transformation is evident in the company's headcount reduction from 3,499 employees to 906 - a

Cash stability has been achieved with a slight improvement in the balance from

The successful rebranding from Complete Solaria to SunPower, strategic partnership with Sunder, and board strengthening with experienced public-company directors all indicate a company transitioning from restructuring to stability. Management's forecast of continued positive operating income for Q2'25 suggests this profitability milestone may represent the beginning of a sustained turnaround rather than a one-time event.

First Profitable Quarter In Four Years

OREM, Utah, April 30, 2025 (GLOBE NEWSWIRE) -- SunPower, formerly d/b/a Complete Solaria, Inc. (“SunPower” or the “Company”) (Nasdaq: SPWR), a solar technology, services, and installation company, will present its 2024 and Q1’25 results via webcast at 1:00pm ET on Wednesday, April 30. Interested parties may access the webcast by registering here or by visiting the Events page within the IR section of the company website: https://investors.sunpower.com/news-events/events.

Please see our SunPower rebranding announcement on the back page of the April 29 print version of the Wall Street Journal or on the mobile app for the WSJ print version, where it will reside for the next week.

SunPower chairman and CEO, T.J. Rodgers commented, “This is the Company’s second quarterly report after the SunPower asset purchase on September 30, 2024, and our first report as SunPower, after rebranding with that name on April 21, 2025. The rebranding also fortuitously coincides with SunPower’s first profitable quarter in four years.”

| SunPower Revenue & Operating Income | |||||||||||

| Our First Two Quarters as SunPower | |||||||||||

| GAAP2 | NON-GAAP | ||||||||||

| ( | Q1 2025 | Q4 2024 | Q1 20253 | Q4 2024 | |||||||

| Revenue | 80,174 | 88,674 | 80,174 | 88,674 | 4 | ||||||

| Gross Margin | 36 | % | 47 | % | 36 | % | 47 | %4 | |||

| Operating Expenses | 27,366 | 62,769 | 27,366 | 62,769 | |||||||

| Operating Expenses | 12,270 | 49,870 | 12,270 | 49,870 | |||||||

| Less Commission | |||||||||||

| Operating Income/(Loss) | (8,876 | ) | (21,501 | ) | 1,274 | (5,940 | ) | ||||

| Cash Balance5 | 13,995 | 13,308 | 13,995 | 13,308 | |||||||

_____________________________________

1 Operating profit based on the non-GAAP results posted on our website [us.sunpower.com].

2 To see our audited 2024 GAAP financial statements, go to the SEC 10K filing on our website [us.sunpower.com].

3 Our non-GAAP financials are used to run the company and differ from the official GAAP report in three ways: 1) no non-cash amortization of intangibles, no employee stock compensation charges (already reflected in share count by dilution) and no one-time events, including favorable and unfavorable events. (See note 4.)

4 The Q4’24 revenue and gross margin reported in our unaudited January 21, 2025 shareholder letter were lower,

5 Cash balance is exclusive of restricted cash.

Fellow Shareholders:

Our Q1’25 revenue, earnings and cashflow are given above. They feature identical GAAP and non-GAAP results for the quarter, except for GAAP operating income, which contains charges from depreciation and amortization of intangible assets, stock-based compensation charges, and non-recurring events, mostly from the asset purchase.

Rodgers added, “I congratulate our team for breaking the profit barrier just 180 days after launch, despite enduring layoffs and some hard times in the solar industry. The rest of this report will focus on our other important first-quarter accomplishments.”

Summary of SunPower Q1’25 Accomplishments

- Our

$80.2 million Q1’25 revenue was in line with expectations, and it was achieved in the traditionally difficult winter quarter. (For example, Blue Raven operates in the Midwest and often has to remove snow from customers’ roofs during winter.) - SunPower is now properly and leanly staffed. The new SunPower was launched with the combined headcounts of Complete Solar, SunPower and Blue Raven Solar – 3,499 employees – on October 1, 2024. We reduced the staffing by 3x, to 1,140 one quarter later, as graphed below. Our final headcount target for the combined company was first set at 1,225 and then lowered to 980. We are currently ahead of that plan with 906 employees. We are at the right headcount to be profitable at

$300 million in annualized revenue.

- Key new employees. We are now able to recycle a fraction of the salaries saved from headcount reductions to bring in key industry players. For example, we hired Dr. Richard Swanson, the Stanford technical genius and founder of SunPower, to advise us on technology, as well as our new CTO, Dr. Mehran Sedigh, a storage expert who ran the Enphase Battery business unit and ramped it to its current

$500 million in revenue. - Our headcount and cost reductions led to

$1.3 million operating income in Q1’25. Our continuous cost-cutting measures have improved our operating income over the last three quarters from a$39.6 million loss in Q3’24 (unofficial sum of losses for three companies), to a loss of$5.9 million in Q4’24 (audited), to an operating profit of$1.3 million in Q1’25.

- Our cash balance grew (slightly). We finished Q1’25 with

$14.0 million in cash versus$13.3 million in Q4’24.

Outlook

We forecast steady revenue and positive operating income again next quarter. We will provide a more detailed forecast and growth plan during our May annual meeting.

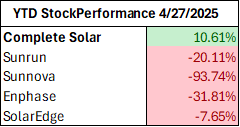

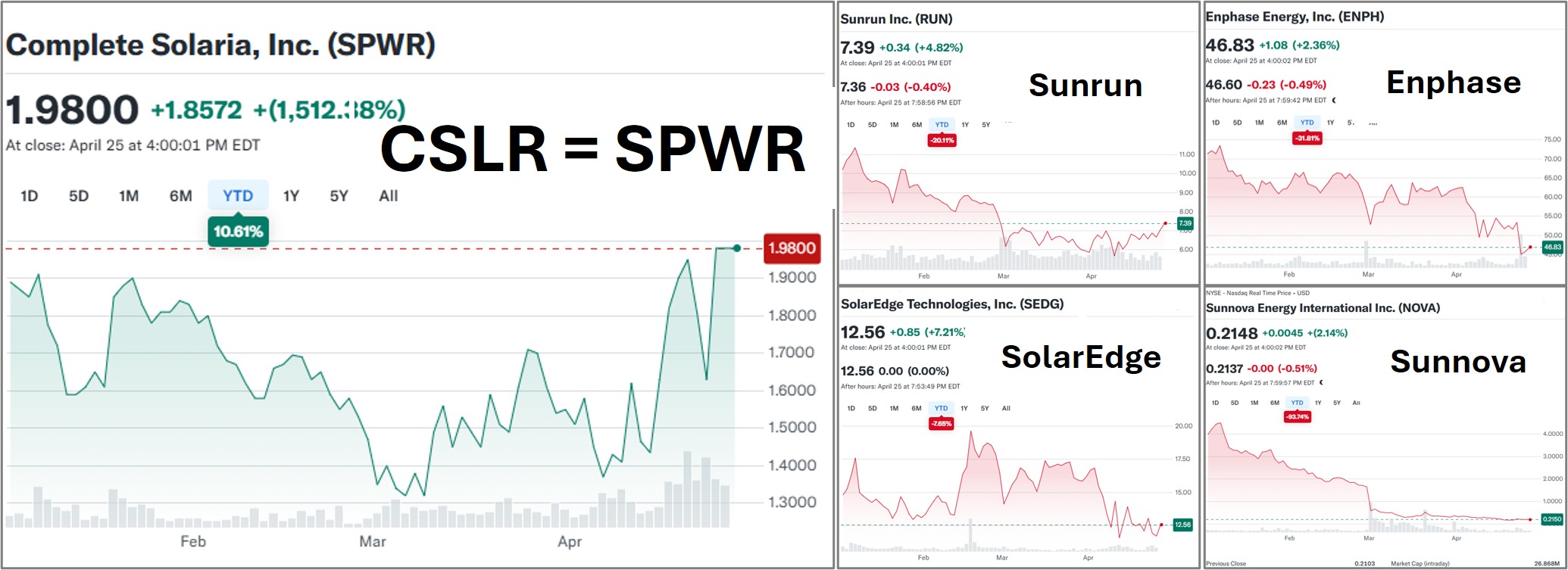

Subsequent Events

We are now SunPower (Nasdaq: SPWR). On April 21, the Company announced it has rebranded as SunPower, a tradename we own. The company’s ticker symbols have been changed from “CSLR” and “CSLRW” to “SPWR” and “SPWRW”, respectively, effective April 22, 2025.

Strategic partnership with Sunder. We have partnered with Sunder, a large, highly regarded Salt-Lake area solar sales firm. They are now supporting our growth, which should start to show up on the top line in Q3’25.

We strengthened our board with three pubic-company ex-CEO directors: Lothar Maier, former CEO of Linear Technology, a

We have a fully independent board. A current independent director, Ron Pasek, now has been named the Lead Director for the corporation and Dan McCranie has been named as the Compensation Committee Chairman serving respectively for T.J. Rodgers (Chairman) and Tony Alvarez (Compensation Committee Chair) who are not independent directors because they worked for the company or a predecessor company in the last five years.

| SunPower Board (4/30/25) | ||||

| DIRECTOR | STATUS | PRIOR | DEGREE/UNIVERSITY | SOLAR VETERAN (Bolded) |

| Tony Alvarez | CEO | BEE Georgia Tech, MSEE Georgia Tech | Complete Solar, SunEdison, ChipMOS, Cypress* | |

| Will Anderson | CEO | BS Mgmt Science MIT, MBA Stanford | Same Day Solar, Complete Solar | |

| Adam Gishen | I | VPIR | BS Int'l Studies Univ. of Leeds | Credit Suisse, Ondra, Lehman Bros. |

| *Jamie Haenggi | I | CEO | BS Int'l Relations Univ. of Minnesota | ADT Solar, Vonage |

| Chris Lundell | CEO | BS Finance, MBA Finance BYU | Vivint, DOMO, Novell | |

| *Lothar Maier | I | CEO | BS Chemical Eng UC Berkley | Linear Tech, Cypress |

| *Dan McCranie | I | CEO | BS EE Virginia Tech | ENVX, Cypress Semi, SEEQ, AMD |

| Ron Pasek | I | CFO | BS Finance SJSU, MBA Santa Clara | NetApp, Alterra, Sun Micro |

| T.J Rodgers | CEO | BA Dartmouth, MA/PhD EE Stanford | SunPower, Complete Solar, Enphase, Cypress | |

| Tidjane Thiam | I | CEO | BS Ecole Polytechnique, MBA INSEAD | Credit Suisse, Prudential, Aviva, McKinsey & Co. |

| Devin Whatley | I | VC | BA East Asian Studies UCLA, MBA Penn | Ecosystem Integrity Fund, Zep Solar, Pegasus |

| * New (3) | Independent ( | *Cypress Semiconductor Corporation | ||

Rodgers concluded, “Our successive

About SunPower

SunPower has become a leading residential solar services provider in North America. SunPower’s digital platform and installation services support energy needs for customers wishing to make the transition to a more energy-efficient lifestyle. For more information visit www.sunpower.com.

Non-GAAP Financial Measures

In addition to providing financial measurements based on generally accepted accounting principles in the United States of America ("GAAP"), SunPower provides an additional financial metrics in this press release that are not prepared in accordance with GAAP ("non-GAAP"). Management believes the non-GAAP financial measures, in addition to GAAP financial measures, are useful measures of operating performance because the non-GAAP financial measure does not include the impact of items that management does not consider indicative of SunPower’s operating performance, such as amortization of goodwill and expensing employee stock options in addition to accounting for their dilutive effect, which facilitates the analysis of the company’s core operating results across reporting periods. The non-GAAP financial measures do not replace the presentation of SunPower’s GAAP financial results and should only be used as a supplement to, not as a substitute for, SunPower’s financial results presented in accordance with GAAP. Descriptions of and reconciliations of the non-GAAP financial measures used in this press release are included in the financial table above and related footnotes. We encourage investors to carefully consider our preliminary results under GAAP, as well as our preliminary non-GAAP information and the reconciliations between these presentations, to more fully understand our business. Non-GAAP financial measures are reported in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, about us and our industry that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “will,” “goal,” “prioritize,” “plan,” “target,” “expect,” “focus,” “forecast,” “look forward,” “opportunity,” “believe,” “estimate,” “continue,” “anticipate,” and “pursue” or the negative of these terms or similar expressions. Forward-looking statements in this press release include, without limitation, our Q1’25 revenue projection, our expectations regarding our Q1’25 and fiscal 2025 financial performance, including with respect to our Q1’25 and fiscal 2025 combined revenues and profit before tax loss, expectations and plans relating to further headcount reduction, cost control efforts, and our expectations with respect to when we achieve breakeven operating income and positive operating income, including our forecast to be operating income breakeven in Q2’25. Actual results could differ materially from these forward-looking statements as a result of certain risks and uncertainties, including, without limitation, our ability to implement further headcount reductions and cost controls, our ability to integrate and operate the combined business with the SunPower assets, our ability to achieve the anticipated benefits of the SunPower acquisition, global market conditions, any adjustments, changes or revisions to our financial results arising from our financial closing procedures, the completion of our audit and financial statements for Q1’25 and fiscal 2025, and other risks and uncertainties applicable to our business. For additional information on these risks and uncertainties and other potential factors that could affect our business and financial results or cause actual results to differ from the results predicted, readers should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of our annual report on Form 10-K to be filed with the SEC on April 30, 2025, our quarterly reports on Form 10-Q filed with the SEC and other documents that we have filed with, or will file with, the SEC. Such filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements in this press release speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and SunPower assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Preliminary Unaudited Financial Results

The selected unaudited financial results for the Q1’25 are preliminary and subject to our quarter and year-end accounting procedures and external audit by our independent registered accounting firm. As a result, the financial results presented in this press release may change in connection with the finalization of our closing and reporting processes and financial statements for Q1’25 and fiscal 2025 and may not represent the actual financial results for such quarter and full year. In addition, the information in this press release is not a comprehensive statement of our financial results for Q1’25 or the 2025 fiscal year, should not be viewed as a substitute for full, audited financial statements prepared in accordance with generally accepted accounting principles, and are not necessarily indicative of our results for any future period.

Company Contacts:

| Dan Foley CFO daniel.foley@SunPower.com (858) 212-9594 | Sioban Hickie VP Investor Relations & Marketing IR@SunPower.com (801) 477-5847 |

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (PRELIMINARY) | |||||||||||

| (In Thousands) | |||||||||||

| COMPLETE SOLARIA, INC. - AS REPORTED | SPWR - Unaudited | ||||||||||

| 13 weeks ended | 13 weeks ended | 13 weeks ended | *13 weeks ended | *13 weeks ended | |||||||

| March 31, 2024 | June 30, 2024 | 29-Sep-24 | 29-Dec-24 | 30-Mar-24 | |||||||

| GAAP operating loss from continuing operations | (7,544) | (9,494) | (29,770) | (21,501) | (8,876) | ||||||

| Note | |||||||||||

| Depreciation and amortization | A | 357 | 329 | 305 | 1,745 | 1,146 | |||||

| Stock based compensation | B | 1,341 | 1,229 | 1,516 | (1,019) | 5,756 | |||||

| Restructuring charges | C | 406 | 2,603 | 21,072 | 14,835 | 3,248 | |||||

| Total of Non-GAAP adjustments | 2,104 | 4,161 | 22,893 | 15,561 | 10,150 | ||||||

| Non-GAAP net loss | (5,440) | (5,333) | (6,877) | (5,940) | 1,274 | ||||||

| Notes: | |||||||||||

| (A) Depreciation and amortization: Depreciation and amortization related to capital expenditures. | |||||||||||

| (B) Stock-based compensation: Stock-based compensation relates to our equity incentive awards and for services paid in warrants. Stock-based compensation is a non-cash expense. | |||||||||||

| (C) Acquisition Costs: Costs primarily related to acquisition, headcount reductions (i.e. severance), legal, professional services (i.e. historical carveout audits) and due diligence. | |||||||||||

| *Reflects the acquisition of the SunPower Assets which Complete Solaria acquired on 9/30/24. | |||||||||||

Source: SunPower

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/2ac50cb4-e2ec-4521-b6a3-7c8998a1e039

https://www.globenewswire.com/NewsRoom/AttachmentNg/567b6c1e-0669-48f2-a82e-fd31476f2ffe

https://www.globenewswire.com/NewsRoom/AttachmentNg/1baa11af-22b3-414f-8dbb-f9ad3c75808a

https://www.globenewswire.com/NewsRoom/AttachmentNg/9ceb6148-b2e7-41bf-873e-4ed60af1abd0