Spetz Announces Results for the Three and Six Months Ended June 30 2024

Rhea-AI Summary

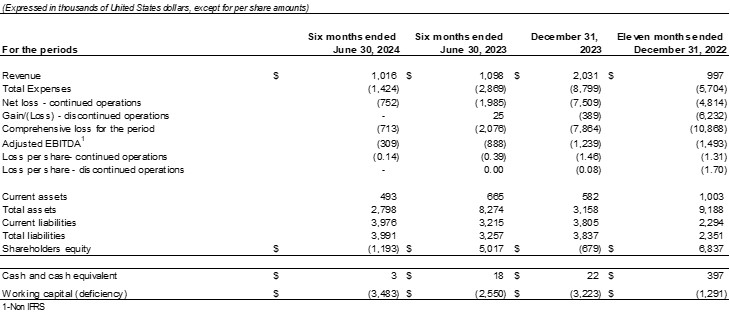

Spetz Inc. (CSE:SPTZ)(OTC PINK:DBKSF) reported financial results for Q2 2024, showing a strategic shift towards the Israeli market. Key highlights include:

- Revenue of US$1,016K for H1 2024, down 7.47% year-over-year

- Total expenses decreased by 50.37% to US$1,424K

- Net loss reduced by 61.63% to US$752K

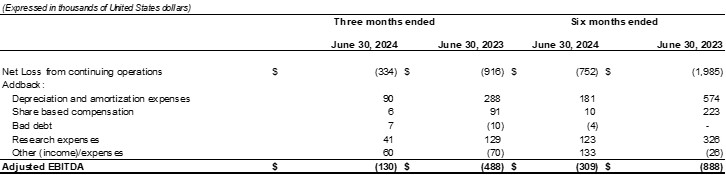

- Adjusted EBITDA loss decreased by 65.2% to US$309K

CEO Yossi Nevo emphasized the company's focus on efficiency and cost reduction, aiming for positive cash flow. Spetz is seeking additional investments in its Israeli subsidiary and offering debt-to-equity conversion opportunities to support profitability.

Positive

- Total expenses decreased by 50.37% to US$1,424K for H1 2024

- Net loss reduced by 61.63% to US$752K for H1 2024

- Adjusted EBITDA loss decreased by 65.2% to US$309K for H1 2024

- Strategic focus on the Israeli market to improve efficiency

- Seeking additional investments and offering debt-to-equity conversions to support profitability

Negative

- Revenue decreased by 7.47% to US$1,016K for H1 2024

- Scaling back investments in regions outside Israel

News Market Reaction

On the day this news was published, DBKSF declined NaN%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

TORONTO, ON / ACCESSWIRE / July 29, 2024 / SPETZ INC. (the "Company" or "Spetz") (CSE:SPTZ)(OTC PINK:DBKSF) today reported its financial results for the three and six months ended June 30, 2024. All figures are in US Dollars.

Highlights:

For the six months ending June 30, 2024, revenue was US

$1,016 K, a decrease of7.47% from US$1,098 K in the same period the previous year. This revenue, generated from referral service fees, reflects a strategic shift towards focusing on the Israeli market while scaling back investments in other regions. This strategic realignment has contributed to a reduction in the company's net loss as part of its ongoing efficiency initiatives.Total expenses decreased by

50.37% to US$1,424 K for the six months ended June 30, 2024, compared to US$2,869 K for the six months ended June 30, 2023Net Loss for the period decreased by

61.63% to US$752 K for the six months ended June 30, 2024, compared to US$1,960 K for the six months ended June 30, 2023.Adjusted EBITDA loss, as defined in the management discussion and analysis, decreased by

65.2% to US$309 K for the six months ended June 30, 2024, compared to US$888 K for the six months ended June 30, 2023.

"We are pleased to present our financial results for Q2 2024, which highlight our ongoing commitment to efficiency and improvement," said Yossi Nevo, CEO of Spetz Inc. "Our strategic efficiency plan has led to a substantial reduction in expenses, with an impressive decrease of approximately

For full financial information, notes, and management commentary, please refer to the Company's Management's Discussion and Analysis (MD&A) and the Consolidated Financial Statements as of June 30, 2024, posted on the Company's website and available on SEDAR. All financial information is provided in U.S. dollars unless otherwise indicated. In addition, all financial information provided herein is unaudited unless otherwise stated.

About Spetz Inc.

Spetz Inc. is a multinational technology company that operates Spetz, a global online, AI-powered marketplace platform that dynamically connects consumers to nearby top-rated service providers in around 30 seconds. Spetz is available in the USA, United Kingdom, Australia, and Israel. The Spetz vision is to reinvent how people around the world connect to services in their moment of need. Connecting them immediately with the top-matched service provider for any need, anytime, anywhere.

Spetz Website: www.spetz.app

Spetz Investor information: https://investor.spetz.app/

Company Contacts:

Ofir Friedman | Investor Relations |

|

|

|

|

NEITHER THE CANADIAN SECURITIES EXCHANGE, NOR THEIR REGULATION SERVICES PROVIDERS HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Cautionary Note Regarding Forward-looking Statements

Certain information in this press release constitutes forward-looking statements under applicable securities laws. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements and are based on expectations, estimates and projections as at the date of this press release. Forward-looking statements are often identified by terms such as "may", "should", "anticipate", "plans" "expect", "potential", "believe", "intend" or negatives of these terms and similar expressions. In this press release, forward-looking statements relate, among other things, to: the ability of Spetz to achieve cash-flow positivity and growth on a go-forward basis.

Forward-looking statements are based on certain assumptions. While the Company considers these assumptions to be reasonable based on information currently available, they are inherently subject to significant business, economic and competitive uncertainties and contingencies and they may prove to be incorrect. In this press release, such assumptions include, but are note limited to: the ability of Spetz to maintain its current growth trajectory.

Forward-looking statements also necessarily involve known and unknown risks, including without limitation: risks associated with general economic conditions; the inability of Spetz to achieve growth; and increased competition in the mobile application and home-services market.

Readers are cautioned that the foregoing is not exhaustive. Readers are further cautioned not to place undue reliance on forward-looking statements as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ from those anticipated. Forward-looking statements are not guarantees of future performance. The purpose of forward-looking information is to provide the reader with a description of management's expectations, and such forward-looking information may not be appropriate for any other purpose. Except as required by law, the Company disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise. Forward-looking statements contained in this news release are made as to the date hereof and are expressly qualified by this cautionary statement. Except as required by law, the Company assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change.

SOURCE: Spetz Inc.

View the original press release on accesswire.com